As bitcoin , ether , , and different tokens look to stabilize after current weak point, market focus shifts to impending essential occasions and information releases, together with Nvidia’s earnings report, the Federal Reserve’s October assembly minutes, and the pivotal however delayed September U.S. jobs report.

These key information factors and occasions might set the tone for the subsequent market strikes throughout each shares and cryptocurrencies. Let’s take a more in-depth take a look at what to anticipate.

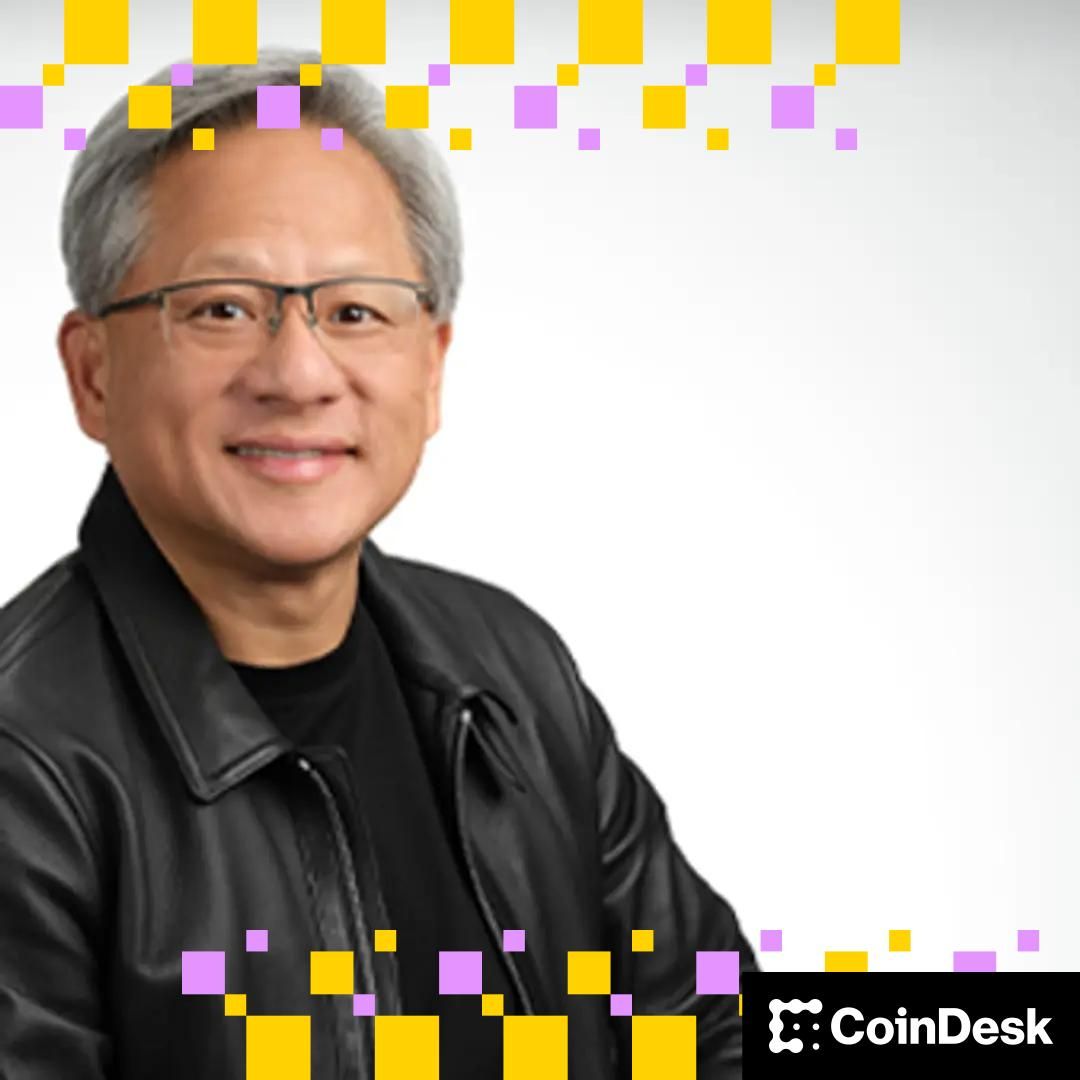

NVDA issues

Nasdaq-listed chip maker Nvidia (NVDA) is scheduled to report its third quarter earnings throughout Wednesday’s after market hours. In response to Market Pulse, Wall Avenue expects Q3 income of $54.8 billion and non-GAAP EPS of $1.25. The AI chipmaker is at present valued at about $4.42 trillion.

Bulls will intently look ahead to cues on deliveries of latest GPU structure Blackwell, publicity to China and steerage for the fourth quarter, hoping that the AI bullish theme stays intact into the year-end.

Usually, company earnings experiences have restricted affect on the crypto market, however Nvidia is a distinct story as its the world’s largest publicly listed agency by market worth and is bellwether for all issues synthetic intelligence (AI).

It is GPUs play a pivotal position in AI coaching in addition to blockchain expertise, which makes it central to the AI-led bull run in shares and crypto since 2023. It is current partnership with Anthropic features a $30 billion compute cope with Microsoft that can run on NVIDIA’s latest Grace Blackwell and Vera Rubin methods, underscoring NVIDIA’s continued dominance in AI infrastructure.

Sturdy earnings by NVDA might revive the uptrend in all issues AI, doubtlessly recharging crypto bulls’ engines.

Notice that AI-related shares, together with NVDA, and cryptocurrencies have lately skilled correction.

NVIDIA shares have been up nearly 50% for the yr on the finish of October, briefly pushing the corporate above a $5 trillion market worth, the primary in historical past to take action. The inventory is now up 31% yr thus far at $181 per share. Market jitters have emerged since late October, with the Nasdaq 100 down over 6% from its late October all-time excessive.

BTC has dropped by over 25% to $90,000 since peaking above $126,000 on Oct. 8, CoinDesk information present. The mixture of a scarcity of financial information, coverage uncertainty and the federal government shutdown weighed on bitcoin in current weeks.

FOMC Minutes

Minutes of the Federal Reserve’s October Fed assembly, the place the central financial institution minimize charges by 25 foundation factors to the three.75% to 4.00%, are due at 19:00 GMT Wednesday.

Market members might be in search of clues on the diploma of divide on the central financial institution over the necessity for extra easing within the coming months and chance of one other minimize in December.

Just lately, odds of a 25 foundation level minimize in December have dropped sharply to nearluy coin toss ranges. As of writing, Polymarket and the CME FedWatch software indicate {that a} maintain is just barely forward of a 25 foundation level minimize.

The October assembly passed off throughout the longest U.S. authorities shutdown on document, which delayed key information releases, including to coverage uncertainty. The federal government, nonetheless, has reopened operations, which makes the approaching Dec. 9-10 assembly pivotal. This assembly will embody recent Abstract of Financial Projections and a brand new rate of interest “dot plot”.

Key Jobs Information

On Thursday, the September nonfarm payrolls report, delayed by the federal government shutdown, will hit the wires, providing cues on the labor market well being.

Nonfarm payrolls for September 2025 are forecasted to point out a rise of about 50,000 jobs, marking a slight enchancment from the 22,000 jobs added in August, in keeping with FactSet. The unemployment price is predicted to stay regular at 4.3%. Whereas the September achieve could be higher than August, it nonetheless falls wanting the roughly 100,000 jobs monthly tempo noticed at first of the yr.

A weak information might revive Fed price minimize bets, inviting a bounce in threat belongings, together with BTC.