CryptoQuant CEO Ki Younger Ju has put a transparent reference stage on the present Bitcoin correction – however is adamant it shouldn’t be mistaken for a prediction.

“Many individuals appear to be misunderstanding this, so let me make clear,” he wrote. “I’m not saying $56K is the underside. I’m saying the realized value is 56K. In case you observe the cycle idea, that stage could be the underside. However I believe the cycle idea is damaged, and the worth might flip at any time relying on macro circumstances and market sentiment.”

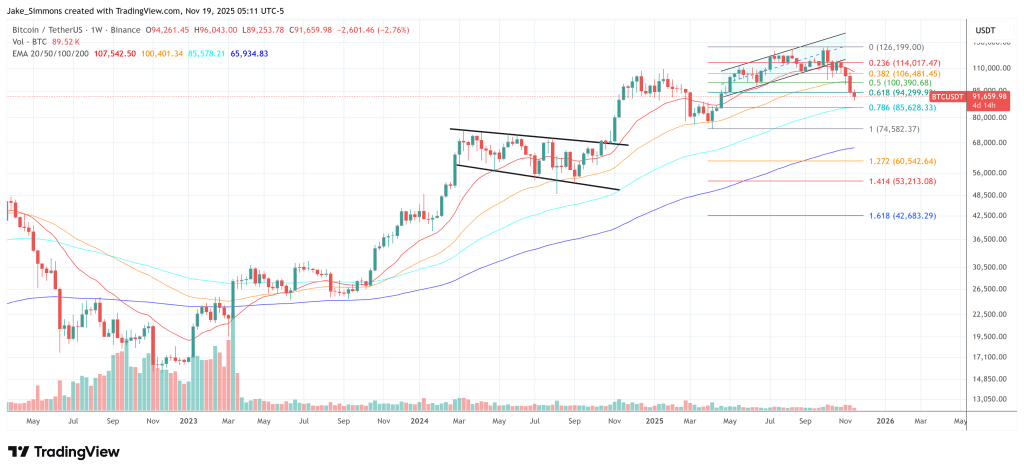

Bitcoin Realized Value Sits at $56,000

His newest knowledge briefing breaks the market into three layers: futures, spot, and on-chain.

Within the futures market, Ju says the typical order measurement reveals that futures whales have left and retail now dominates. Inner movement profile (IFP) knowledge signifies BTC inflows from spot to futures exchanges have collapsed, ending the part when massive gamers have been posting BTC as collateral to go lengthy.

Associated Studying

On the similar time, the Estimated Leverage Ratio stays excessive, and Binance deposit price foundation sits round $57,000, which “means merchants already captured massive good points from ETF and institutional flows.” Open curiosity remains to be above final yr’s ranges, whereas the aggregated funding price is impartial, not fearful, suggesting leverage stays elevated however and not using a traditional capitulation reset.

Spot knowledge factors to fading institutional aggression. Ju notes the Coinbase Premium is at a nine-month low, which he attributes to ETF-driven institutional promoting. Spot Bitcoin ETFs have seen web unfavourable weekly flows for 3 straight weeks, and Technique mNAV at 1.23 implies that “near-term capital elevating appears tough,” as many structured methods are already sitting on substantial good points.

On-chain metrics present the context for the much-discussed $56,000 stage. Ju observes that realized cap development has stalled for 3 days, whereas market cap is rising extra slowly than realized cap, a configuration he interprets as robust promoting strain as worthwhile cash transfer.

CryptoQuant’s PnL Index flipped brief on November 8, which Ju summarizes as whales taking revenue. “If the cycle idea holds, the cycle backside could be round $56K (realized value),” he says – and instantly distances himself from treating that as a tough rule in a structurally altering market.

CryptoQuant CEO Rejects Traditional Cycle Backside Idea

In a separate prediction phase, Ju turns to macro circumstances. “Quick-term circumstances are weak: greenback liquidity is gradual, funding markets are tight, and Bitcoin inflows have cooled,” he writes. Nonetheless, he provides, “I don’t count on Bitcoin inflows to cease or flip into sustained outflows over the following six months.”

Associated Studying

In his view, a shift within the coverage narrative might quickly invert sentiment: “If price cuts or any easy-money narrative seems, sentiment might flip and liquidity would rush again into ETFs.”

Ju additionally sketches a longer-term structural thesis. He argues that stablecoin adoption and a wave of reverse ICOs by public corporations might push conventional property onto DEXs, enabling on-chain lengthy and brief buying and selling in names like Tesla. In that world, on-chain evaluation might evolve into labeling wallets like “Elon Musk’s ETH deal with to trace Tesla coin onchain inflows and outflows.”

He believes Bitcoin would profit essentially the most, whereas altcoins with weak narratives or no actual efficiency would possible lose liquidity as capital concentrates in property with clear utility or narrative power.

“I gave up predicting Bitcoin value,” Ju reminds followers, “however I haven’t given up analyzing knowledge.” His $56,000 reference is finest understood in that spirit: a data-driven anchor derived from realized value and cycle idea, not a promise that this drawdown will finish neatly at that line.

At press time, BTC traded at $91,659.

Featured picture created with DALL.E, chart from TradingView.com