The latest approval of a number of spot Bitcoin exchange-traded funds (ETFs) by the SEC was anticipated to usher in an period of mainstream adoption and sky-high costs for the flagship Cryptocurrency. As an alternative, Bitcoin has crashed over 20% from its 2024 excessive of $49,000 to only beneath $39,000 on the time of writing.

The place is the underside of this crash? Is that this a purchase the dip alternative? And most significantly, is that this sharp correction the top of the bull market in Crypto? We discover the elements behind the selloff, and why this might finally result in extra bullish worth motion within the prime Cryptocurrency by market cap.

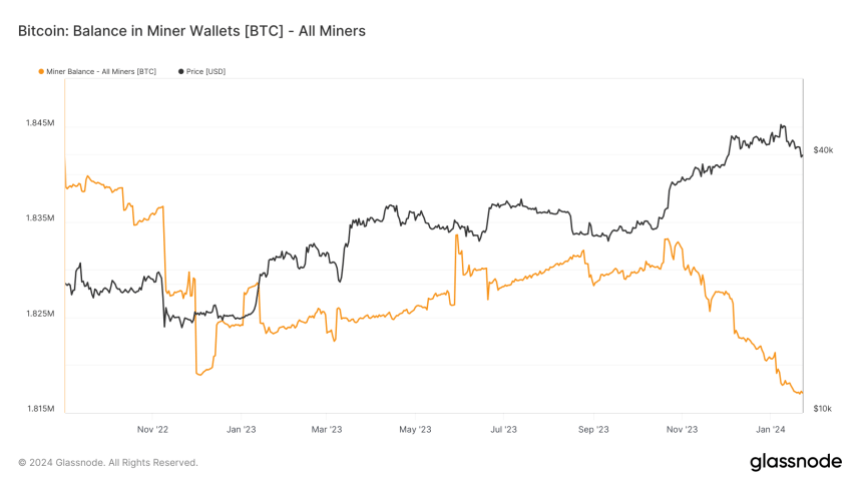

Miners promoting Bitcoin on the identical time

One main issue driving the decline is miners offloading their Bitcoin onto exchanges at a tempo not seen for the reason that FTX collapse in November 2022. The quantity of BTC held by miners has plunged, indicating they’re promoting their newly minted cash as an alternative of the everyday technique of accumulating them as a long-term funding. This surge of promote strain from miners has overwhelmed shopping for demand, at the same time as main ETF suppliers snap up Bitcoin to again their newly launched funds.

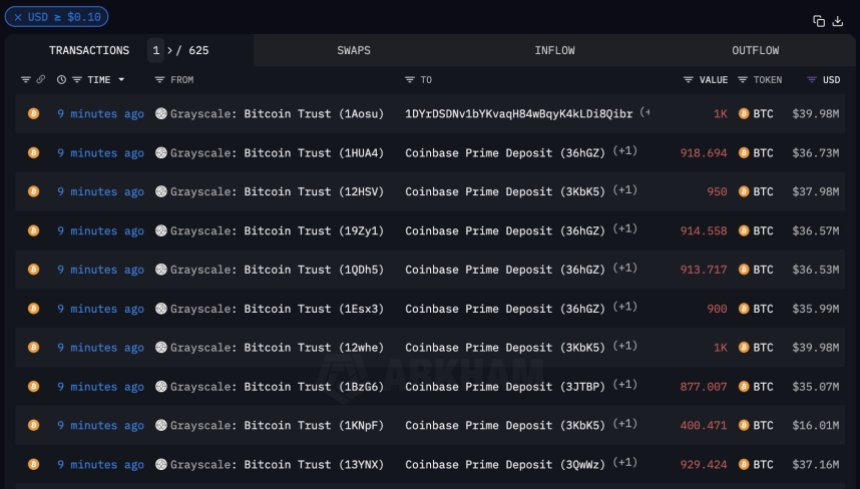

Grayscale outflows including gas to the hearth

Grayscale Bitcoin Belief has been sending billions in BTC to Coinbase. Grayscale is without doubt one of the world’s largest holders of BTC, inflicting the substantial outflows to have a notable affect on worth motion. GBTC outflows are being pushed by significantly excessive 1.5% expense charges in comparison with different spot ETF alternate options within the US. The state of affairs was made worse when FTX’s property redeemed practically $1 billion in GBTC. When GTBC holders money out their shares, a corresponding BTC sale is made.

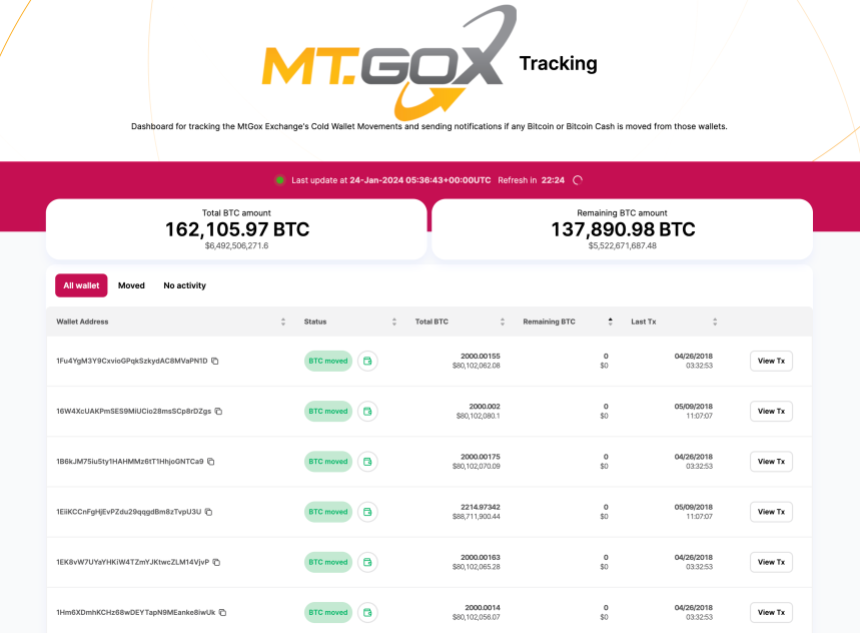

Looming Mt. Gox payouts spooking traders

Additionally contributing to the skittish sentiment is the long-running Mt. Gox reimbursement plan nearing its conclusion. The defunct trade is getting ready to distribute 137,000 BTC to holders as restitution for funds misplaced in its notorious 2014 hack. Many recipients are anticipated to money out instantly and will flood the market with promote orders. This impending overhang has traders worrying about whether or not Bitcoin has sufficient demand to soak up the additional provide.

Ongoing macroeconomic headwinds

Bitcoin’s ties to dangerous asset lessons imply it has suffered collateral injury from the Federal Reserve’s relentless rate of interest hikes and the sturdy US greenback squeezing different belongings. Till inflation reveals clear indicators of slowing down, traders are unlikely to search out refuge in Crypto. The Fed’s actions have dashed hopes that loosening financial coverage may stoke Bitcoin’s subsequent bull run.

There could also be mild on the finish of the tunnel

However there are causes to be optimistic about Bitcoin’s future. For one, miner balances have fallen so dramatically that they’re now decrease than throughout final November’s FTX-induced meltdown. This indicators that a lot of the surplus promoting strain has already been expended.

As for the Mt. Gox payouts, collectors have held Bitcoin for practically a decade and should decide to proceed holding now that the Crypto winter appears to be thawing, slightly than money out at depressed costs under $40k.

ETFs now account for 0.5% of BTC provide

Most significantly, every newly authorised ETF has greedily snapped up the Bitcoin bought into the market over the previous weeks, evidenced by their substantial and quickly rising holdings.

BlackRock’s spot Bitcoin ETF took in a staggering 44,000 BTC price $1.75 billion inside two weeks of launch. At Constancy’s present tempo, its ETF holds 30,000 BTC. With one other over 30,000 BTC already beneath administration throughout the remaining SEC-approved ETFs, these funds mixed now maintain over 100,000 BTC and counting.

Contemplating Bitcoin’s max provide is simply 21 million, over 0.5% of all Bitcoin in existence is now locked up in only a handful of funding automobiles catering to institutional traders. And the urge for food for Bitcoin publicity is simply set to develop as extra mega-asset managers file for spot ETFs to fulfill rising demand.

The looming Bitcoin halving may upend the established order

With miners offloading cash forward of the Bitcoin halving, and validation rewards about to be minimize 50% from 6.25 Bitcoin per block to three.125 Bitcoin per block this April, Bitcoin’s already reducing issuance price is about to drop drastically decrease. This quadrennial occasion has traditionally choked the inflow of recent Bitcoins, as solely half the variety of cash enter circulation post-halving.

But regardless of the turmoil in Crypto markets presently, institutional intrigue in Bitcoin is constant to scale up. Main asset managers have lastly secured SEC approval for spot Bitcoin ETFs to fulfill surging demand from institutional traders searching for Crypto publicity.

Retail curiosity additionally stays resilient. The stage is being set for a critical supply-demand imbalance to play out over 2024. This, in flip, may act as rocket gas to propel costs increased, as liquid cash develop into more and more scarce relative to the swell of recent institutional and retail entrants.

If historical past is any indicator, Bitcoin’s earlier halving occasions triggered spectacular bull runs that noticed costs recognize multiples increased over the next 12-18 months. Investor euphoria reached a fever pitch as mainstream media protection pulled in waves of recent consumers blissful to buy Bitcoin at ever-loftier costs.

The run-up to April’s halving may see an analogous sample emerge. The kind of provide shock which will unfold as Bitcoin’s issuance falls off a cliff this spring, whereas curiosity continues rising unabated, has the potential to ignite the asset’s subsequent parabolic ascent to new all-time highs.

Turbulence creates alternative for daring merchants

Using out this era of volatility would require nerves of metal, however for seasoned merchants, the swirling uncertainty presents a chance. Platforms like PrimeXBT enable merchants to profit from Bitcoin’s wild worth swings in both path by way of devices like Crypto Futures contracts and adjustable leverage. Superior danger administration instruments are additionally at merchants’ disposal to customize publicity based mostly on private danger tolerance.

As Bitcoin emerges from its post-halving cocoon over the mid-2020s, this era could also be seemed again upon as a ultimate cleaning plunge earlier than ascending to new heights on the again of hyper-scarcity and institutional adoption. These daring sufficient to take calculated dangers may reap outsized returns if religion in Bitcoin’s enduring worth proposition holds agency.

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual danger.