Key Takeaways

- Bitcoin whales have switched to purchasing regardless of the continuing BTC value drop, with BTC surging as little as $89,368 on Tuesday.

- Analysts declare that giant holders and institutional buyers are profiting from this value drop when panic promoting rises among the many retail merchants and short-term sellers.

- Newest market knowledge from a number of sources confirms that BTC whales have been accumulating since late October, persevering with their exercise amid the broader market downturn.

- Institutional pullback and macro sentiment, like uncertainty within the Fed Charge insurance policies, are fueling BTC’s bearish momentum. Bitcoin’s drop beneath the $93K Fibonacci 78.6% retracement stage can also be a depreciating issue.

- Bitcoin presently trades at $91,384.47, displaying a market downtrend of 4.3% in comparison with the final 24 hours.

In keeping with the most recent on-chain knowledge, the variety of Bitcoin whale wallets has surged as the value of Bitcoin has dropped this week, plunging as little as $89,368 on Tuesday. Bitcoin, together with the opposite main cryptocurrencies, has struggled and skilled important volatility this week. Nevertheless, the BTC downtrend didn’t have an effect on whales, and an fascinating pattern of elevated whale accumulation has occurred amid this lively market turbulence.

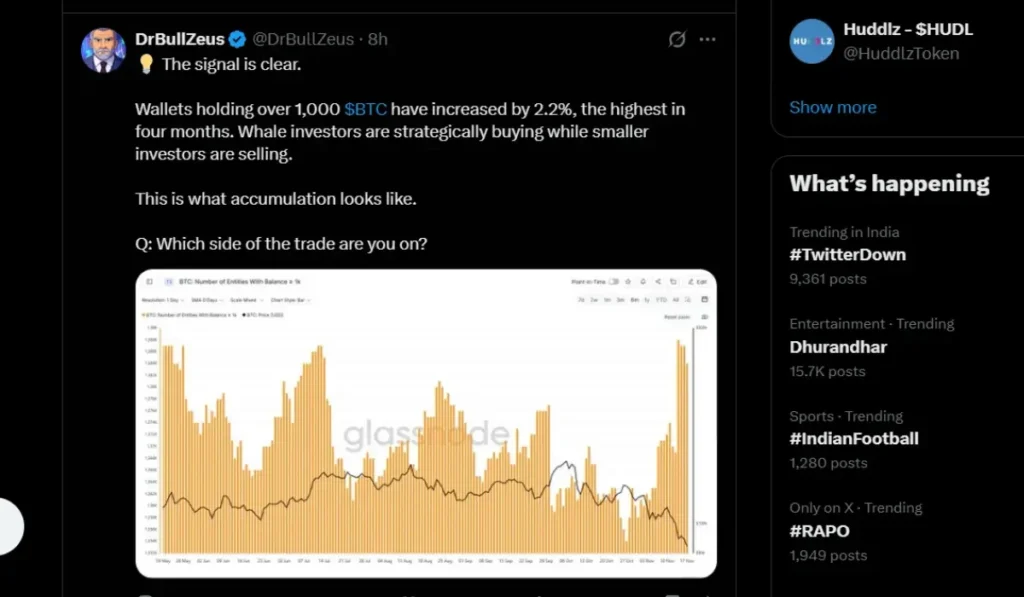

Distinguished crypto analytics platform Glassnode confirmed that whales have been accumulating BTC since late October and continued their exercise regardless of the broader market fall. In keeping with Glassnode, a big spike in November whale exercise has been noticed, with the variety of whale wallets holding above 1,000 BTC ranging from the earlier Friday. Knowledgeable evaluation derived from Glassnode knowledge confirmed that whale wallets’ numbers had fallen to a yearly low of 1,354 on October 27 when BTC was buying and selling at round $114,000, however as of Monday, the quantity had spiked 2.2% to regular at 1,384, indicating ranges not seen in 4 months.

In addition they talked about that Glassnode knowledge exhibits that the small holders with a small variety of BTC holdings have been feeling the stress of the continuing value drop. In keeping with their knowledge monitoring on November 17, the full variety of small wallets has decreased from 980,577(October 27) to 977,420(November 17), reaching a yearly low. The knowledgeable evaluation concludes that the BTC downtrend impacted smaller buyers and made them promote panicly, whereas the whales stayed alert and amassed at decrease costs. Veteran and knowledgeable dealer DrBullZeus posted on X that the sign was clear. He talked about that wallets holding over 1,000 $BTC had elevated by 2.2%, the very best in 4 months, and famous that whale buyers have been strategically shopping for whereas smaller buyers have been promoting.

Bitcoin Rebounded and Hit $91,000 At this time: A Doable Comeback to $100K Loading?

Bitcoin, the biggest cryptocurrency by market capitalization, hit $91,000 at the moment after a pointy correction began earlier this month. In keeping with the most recent evaluation, 91K will likely be essential and act as a key psychological and technical stage. Specialists expect consumers may step up after BTC broke above $91,000 and revive BTC from this ongoing downturn. In keeping with market consultants, BTC’s present value motion might be the potential base for a renewed push towards the $100K with ETF inflows and macroeconomic components fueling it.

Company treasury specialist Technique Inc. accomplished the acquisition of 8,178 BTC for $836 million lately, and the President of El Salvador had purchased one other 100 million in Bitcoin, making it some of the in-demand cryptocurrencies, with its distressed value rally. Bitcoin is hovering between $88-$92K; consultants imagine that $95K–$96K is the resistance BTC wants for a possible breakout above $100K. Presently, the $100K is the main hurdle as a result of BTC failed to carry above this stage for a protracted time period and tried to interrupt above the value level a number of instances.

Grok AI predicted and posted on X that, primarily based on historic post-halving patterns, ongoing ETF inflows, and potential regulatory tailwinds, Bitcoin might climb towards $120,000–$150,000 within the coming months, assuming there have been no main financial downturns. He said that volatility remained excessive, so a pullback to $80,000 was not out of the query, and added that $220,000 appeared overly optimistic with out huge catalysts.

Additionally Learn: Crypto Market Crash: Why is Crypto Down At this time?