On-chain information reveals the Bitcoin Stablecoin Provide Ratio has declined into the purchase territory. Right here’s what adopted this sign up to now.

Bitcoin SSR RSI Is Giving A Purchase Sign

In a brand new submit on X, CryptoQuant neighborhood analyst Maartunn has talked concerning the newest pattern within the Stablecoin Provide Ratio (SSR) for Bitcoin. The SSR is an indicator that measures how the market cap of BTC compares towards the entire provide of the stablecoins.

Stablecoins discuss with cryptocurrencies which are pegged to a fiat foreign money. Traders usually park their capital within the type of these property after they wish to keep away from the volatility related to BTC and different property.

Such holders additionally often ultimately make investments again into Bitcoin and firm, nonetheless, exchanging away their stablecoins in favor of them as soon as they really feel the time is correct. Due to this cause, the stablecoin provide is usually checked out as a form of “obtainable purchase provide” within the cryptocurrency sector.

When the worth of SSR is excessive, it means BTC’s worth is excessive in comparison with the stablecoin provide. Such a pattern suggests the market stablecoin shopping for energy is low, which could possibly be a bearish signal.

Alternatively, the indicator being low implies the sector could have a excessive quantity of dry powder obtainable relative to the Bitcoin market cap, which might naturally be bullish.

Now, right here is the chart for the BTC SSR shared by the analyst that reveals the pattern in its Relative Power Index (RSI) over the past couple of years:

As is seen within the above graph, the Bitcoin SSR RSI has witnessed a decline just lately because the BTC spot worth has crashed. This implies that there could also be a excessive quantity of stablecoin shopping for energy obtainable available in the market now.

The indicator’s drop has been so steep that it has entered right into a zone that Maartunn has flagged as pertaining to a purchase sign. From the chart, it’s obvious that previous cases of this sign have typically coincided with some form of backside or led right into a worth surge.

In loads of the cases, nonetheless, the sign has solely resulted in a short lived reversal. It now stays to be seen whether or not any bullish shift will comply with the most recent sign, and if one does, whether or not it is going to be lasting.

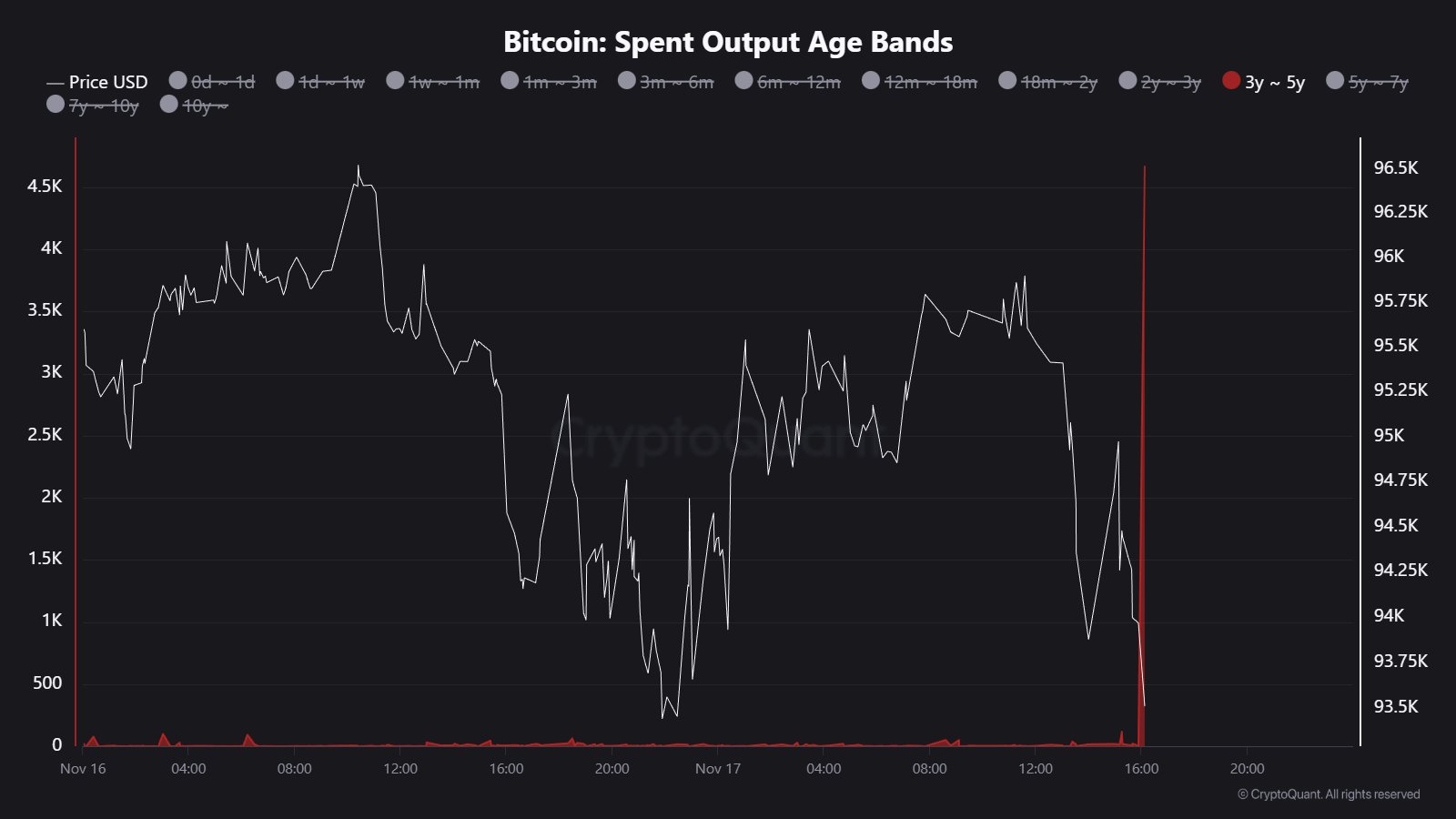

In another information, a big motion involving dormant tokens has simply occurred on the Bitcoin community, as Maartunn has identified in one other X submit.

“4,668 $BTC aged 3–5 years have been simply spent — a transparent spike in dormant provide activation,” famous the analyst. Motion from dormant palms is usually an indication of promoting.

BTC Worth

Bearish momentum hasn’t proven any indicators of stopping for Bitcoin as its worth has now dropped to the $92,500 degree.