We’re joined by two tax professionals to debate staffing points, expertise adoption, and strategic planning forward of the subsequent busy season.

Highlights:

|

Tax season challenges have existed ever for the reason that April 15 deadline was established. However the varieties of challenges that tax professionals face are all the time evolving. We needed to forecast what varieties of tax trade traits will outline 2026 and the way professionals can put together. So, we gathered a panel of specialists to share their views:

- Bob LeMay, Principal and President, LeMay & Firm

Listed below are some highlights from our prolonged dialogue on tax trade traits, preparation for 2026, and the advantages and challenges of implementing expertise in This autumn.

Leap to ↓

What varieties of modifications have you ever seen over the previous yr? How do you count on them to influence this upcoming tax season?

Bob: Definitely we’ve seen regulation modifications, and that uncertainty has brought about some anxiousness with our shoppers. That places extra stress on us to information them via the mire of what we’re seeing within the tax world. Persons are pondering extra long run. Not simply what right now’s return is wanting like.

Keestan: Clearly AI is on the forefront of everybody’s thoughts. However I feel one different factor that’s stood out to us is simply expertise. These previous couple years, it’s been tougher and tougher for us to rent individuals. Much less persons are going into accounting and we’re simply making an attempt to determine the way it will go shifting ahead.

I feel seasonal assist is very tougher to seek out. We used to rent 3-4 seasonal interns and in previous years we’ve had only a few candidates. This final tax season was our first the place we didn’t have to rent seasonal assist. We centered extra on software program and automation.

As tax season approaches, what steps ought to professionals take to arrange?

Keestan: For us, that is the time of yr that we have a look at our software program, our processes. We’re really making some software program modifications and dealing to implement these. We have now a bit of little bit of downtime since November-December are sometimes a few of our slower months.

Bob: We do a whole analysis of our programs, and we ask: “How we are able to do that higher?” Which features a huge analysis of our software program. You don’t need to be making an attempt to implement one thing in January. It’s too late.

What’s your agency doing to set itself up for fulfillment subsequent yr?

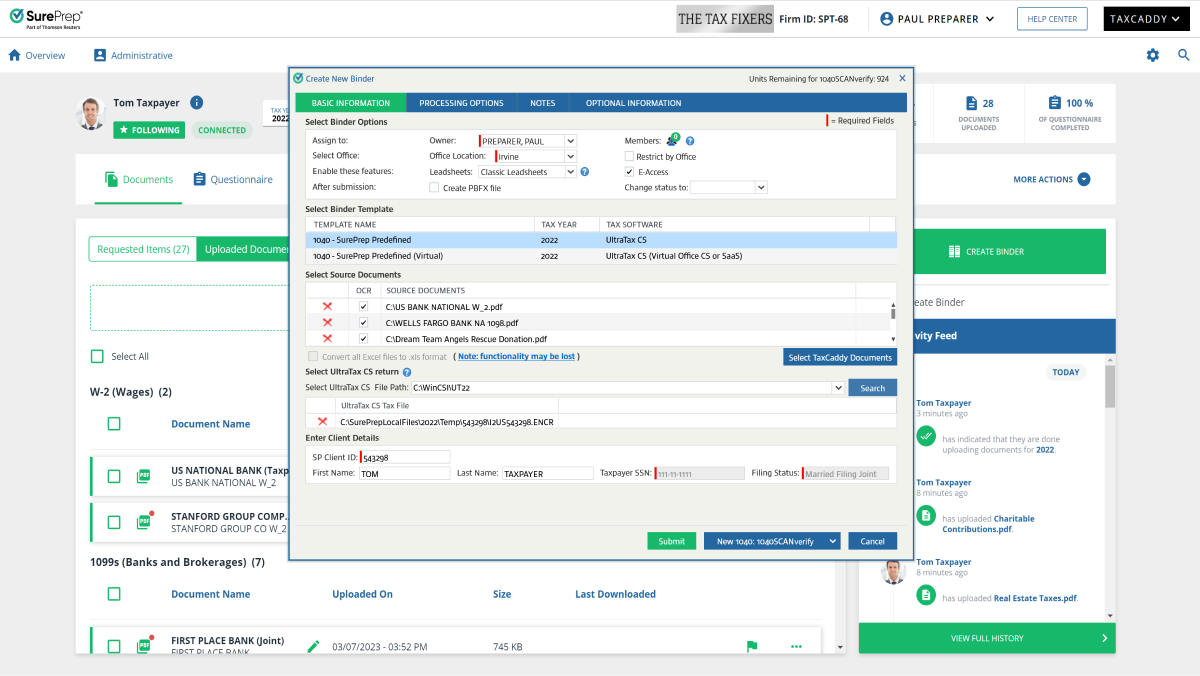

Bob: We’ve introduced on lots of software program in partnering with [Thomson Reuters], from SurePrep to SafeSend. We will now do extra with much less employees, and the work we’re doing is increased worth work. Once we began shifting on this path, certainly one of my employees members was like, “Wow, I can really begin doing what I actually take pleasure in as a substitute of this handbook stuff.”

Keestan: We’re adopting the Collect AI portion of SafeSend. I feel it’s all the time good to check out new software program throughout extension season when you may have much less quantity, that approach you recognize what hiccups are going to return.

When ought to a agency begin enthusiastic about switching software program? Are there any telltale indicators?

Bob: I’m an enormous believer in sooner reasonably than later … Normally fall is a very good time. You need to do it when you may have a possibility to judge. If you speak about telltale indicators, you need to have a look at your workflow. What are the bottlenecks? Discuss to your buddy within the workplace. What are their struggles? Is there a greater approach of doing that?

Keestan: Previous to the 2021 tax yr, we modified our tax software program, our doc software program, and our signing software program multi function tax yr and it was a tough tax season … Now we all the time check issues out in extension season … Your workforce has to get used to it. You might need to vary your course of. There is likely to be lots of questions. The extra time you give your self earlier than you get to busy season, the higher.

Amanda: You don’t have to modify the whole lot . There’s help there for you. As a Thomson Reuters Gross sales Govt, that’s what our jobs are … We’ll make it easier to develop that recreation plan and say: “Right here’s the place we suggest which options to implement at which stage.”

How does Thomson Reuters help your agency out and in of tax season?

Bob: I lean on the Gross sales workforce to actually consider the place we’re as a agency … The principle cause I made the swap was the customer support. It’s not a vendor. It’s actually a partnership. I really feel that [Thomson Reuters] is invested in me as a lot as I’m invested in my enterprise.

Keestan: I feel one factor that’s actually nice in regards to the Thomson Reuters reps is you can have open, trustworthy conversations. We’ll do a demo on a software program and I’ll lay out: “These are all of the ache factors I see in my course of with this software program. How is that this going to suit for us?” They usually get me solutions. They’ll sort of go to the top of the earth to get you all the data it is advisable make these choices.

What these tax trade traits imply on your workforce

Like Bob and Keestan found, staffing challenges and workflow hurdles don’t need to be constants at your agency. With the correct expertise companion guiding the way in which, your apply can create a multi-year roadmap towards end-to-end automation. And with extra regulatory challenges on the horizon, it’s by no means been extra essential to reduce preparation burdens so your workforce has the capability to maximise its experience.

Wish to hear extra from this dialog? Watch a recording of the complete webinar for added tax trade traits and implementation suggestions that may set your agency up for fulfillment in 2026 and past.