Uniswap (UNI) ripped greater on Tuesday after Uniswap Labs founder Hayden Adams unveiled “UNIfication,” a sweeping governance proposal that may activate protocol charges and route them into coordinated token burns. The structural shift—mixed with a pointy change in how Uniswap’s groups are organized, igniting a particularly bullish sentiment, with CryptoQuant CEO Ki Younger Ju arguing that an actual provide shock may very well be incoming.

Uniswap (UNI) Provide Shock Incoming?

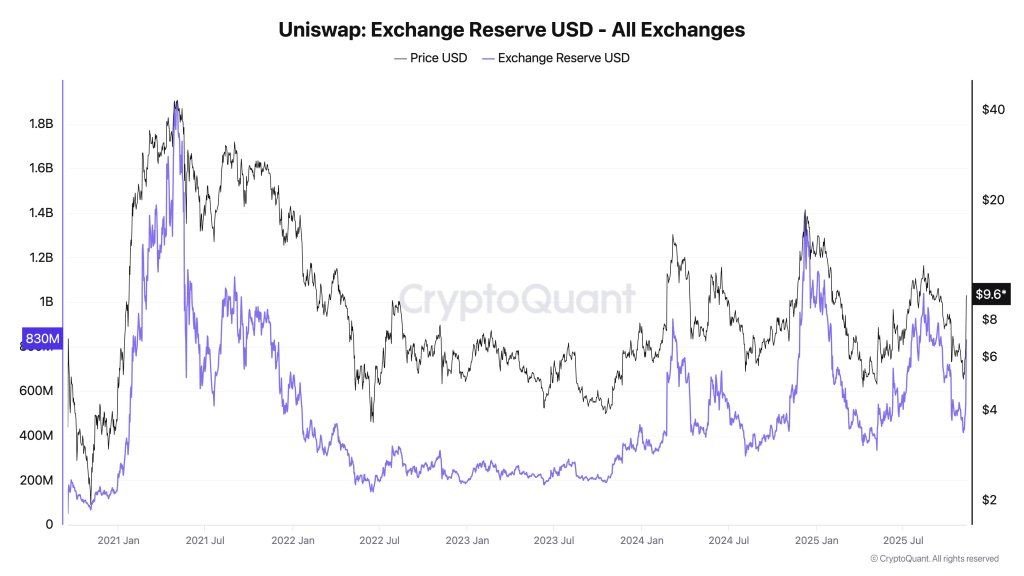

“Uniswap may go parabolic if the price swap is activated. Even simply counting v2 and v3, with $1T in YTD quantity, that’s about $500M in annual burns if quantity holds. Exchanges maintain $830M, so even with unlocks, a provide shock appears inevitable. Appropriate me if I’m incorrect,” Ki Younger Ju wrote.

In a thread posted early Tuesday, Adams stated he was “extremely excited to make my first proposal to Uniswap governance,” describing a framework that “activates protocol charges and aligns incentives throughout the Uniswap ecosystem.” He framed the transfer because the fruits of years of authorized wrangling that had constrained Labs’ position: “UNI launched in 2020, however for the previous 5 years Labs has been unable to meaningfully take part in Uniswap governance […] That ends right now,” he wrote, including that “the regulatory atmosphere has shifted.”

Associated Studying

The on-chain economics he outlined are unambiguous. Protocol utilization would start burning UNI; Unichain sequencer income can be directed to the identical burn sink; and the treasury would instantly destroy 100 million UNI to account for charges that “may have been burned if charges have been turned on at token launch.”

Adams additionally described new “protocol price low cost auctions” to enhance LP outcomes and internalize MEV, and an “aggregator hooks” structure in v4 that may let the protocol seize charges sourced from exterior liquidity.

In parallel, Uniswap Labs would cease charging charges on its interface, pockets, and API to push distribution and adoption, whereas Uniswap Basis employees transfer to Labs underneath a development mandate funded by the treasury. The online impact is a consolidation: Uniswap’s improvement, development and price coverage can be operated underneath a single, explicitly token-aligned construction, with governance retaining management.

Value motion mirrored Ki Younger Ju’s remark. UNI spiked to multi-week highs as protection unfold. In early European buying and selling hours, UNI confirmed a one-day acquire close to 30% whereas many majors treaded water, underscoring UNI’s idiosyncratic governance-driven rally.

Past headline burns, the crux is whether or not the financial flywheel will be sustained with out degrading liquidity supplier economics. Traditionally, Uniswap governance has wrestled with “price swap” design trade-offs and the danger of disintermediating LPs or pushing order stream elsewhere.

Associated Studying

Adams argued this blueprint is totally different as a result of price proceeds usually are not distributed as passive yield however are as a substitute destroyed to pay attention worth into the remaining float, whereas low cost auctions and MEV internalization are supposed to maintain LPs aggressive on internet execution. The total rationale and parameterization—price charges, break up between swimming pools, cadence for auctions, and the precise mechanics of the burn—are specified by the governance put up now in “Requests for Remark,” with implementation topic to the standard discussion board evaluation and on-chain governance course of.

Adams solid the proposal as an existential scaling step: “I consider Uniswap protocol will be the first place tokens are traded. This proposal units the stage for the following decade of its development […] Uniswap will ship relentlessly over the approaching years and supercharge the ecosystem of builders, LPs, and merchants,” he wrote.

In response to estimates by MegaETH Labs member BREAD, if Uniswap have been to change its commonplace 0.3% buying and selling price in order that 0.25% is allotted to liquidity suppliers and 0.05% directed towards UNI buybacks, the protocol may channel roughly $38 million into month-to-month repurchases. This projection relies on an annualized price income of roughly $2.8 billion and would place Uniswap’s buyback capability barely above PUMP’s $35 million tempo, but nonetheless under HYPE’s $95 million benchmark.

At press time, UNI traded at $8.609.

Featured picture created with DALL.E, chart from TradingView.com