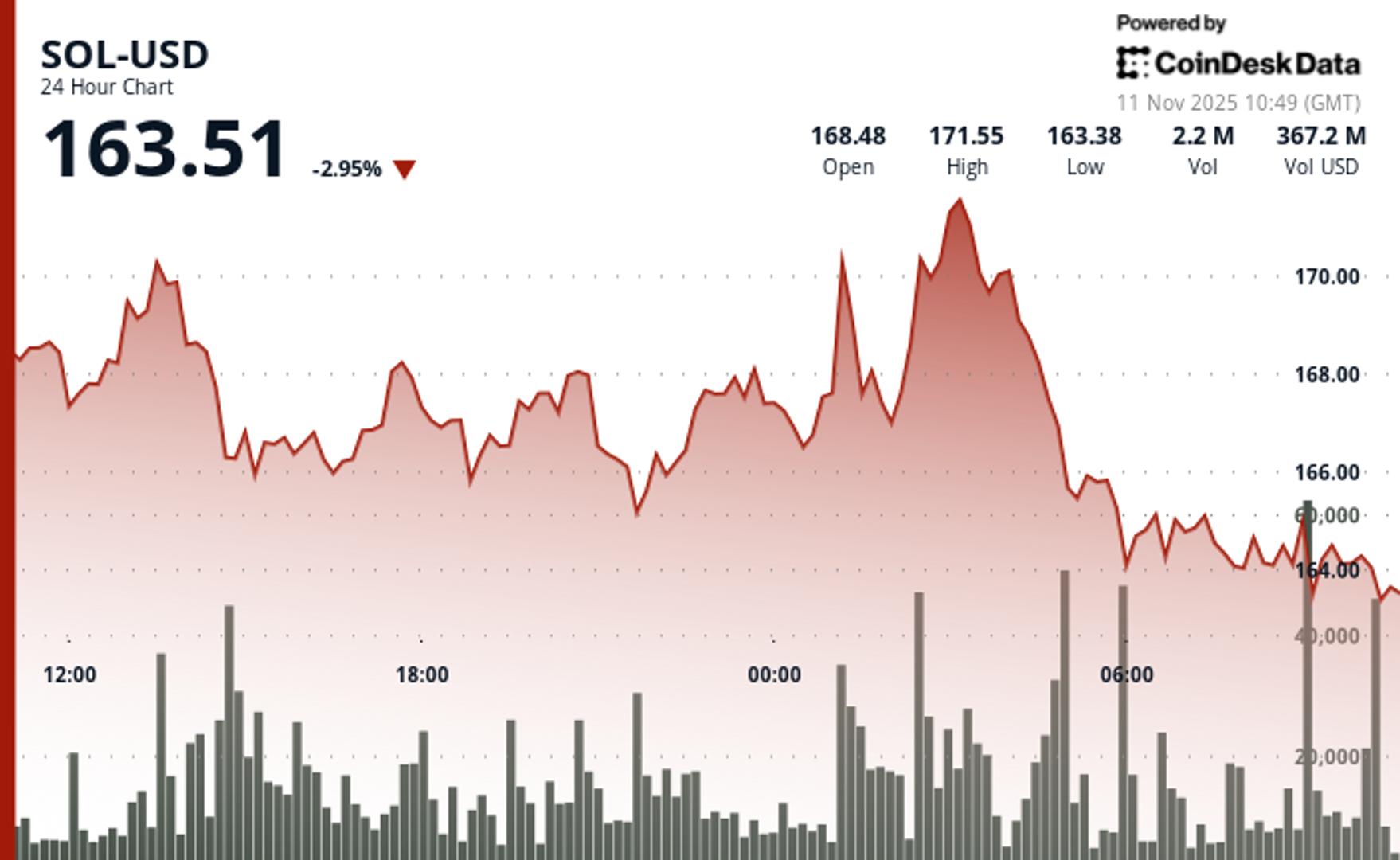

In response to CoinDesk Analysis’s technical evaluation information mannequin, solana dropped 3.1% to $164.30 throughout Tuesday’s session because the token broke by crucial technical help ranges.

SOL declined from $169.54 to $164.26 over the 24-hour interval ending November 11 at 09:00 UTC, establishing a transparent downtrend construction with a number of rejection factors above $170.

The selloff accelerated throughout Asian buying and selling hours with vital quantity accumulation. Buying and selling exercise surged 58% above the day by day common as SOL examined the essential $163.85 help zone. The session’s $8.06 vary represented 4.9% volatility, with essentially the most vital quantity spike occurring at 06:00 UTC with 1.47 million shares traded.

SOL underperformed the broader crypto market by 1.42% relative to the CoinDesk 5 Index (CD5), signaling focused promoting strain on the token. Current 60-minute evaluation confirmed an aggressive upside reversal that shortly collapsed, with SOL spiking from $164.07 to $164.97 earlier than surrendering good points in a pointy selloff to $163.46. This whipsaw motion highlighted the fragility of any bullish momentum inside the established downtrend.

The technical breakdown occurred with out clear elementary catalysts, suggesting profit-taking and momentum-driven promoting dominated worth motion. Institutional flows remained combined as in a single day accumulation patterns conflicted with daytime distribution exercise.

Technical breakdown vs help protection

With SOL having breached the $165 psychological degree whereas quantity patterns confirmed elevated promoting curiosity, near-term worth motion facilities on whether or not the $163.50 zone can maintain as demand emerges. The downtrend construction stays intact with decrease highs at $170.48 and $171.92 offering overhead resistance.

Momentum indicators deteriorated by the session as every rally try weakened. Quantity evaluation revealed promoting strain intensified on retests of highs whereas bounces attracted minimal shopping for curiosity, confirming the bearish bias within the close to time period.

Key technical ranges sign vulnerability for SOL

Assist/Resistance: Important help now checks at $163.50 after the break of $165, whereas sturdy resistance stays at $170.50 with a number of failed breakout makes an attempt.

Quantity Evaluation: Important quantity spike occurred with 1.47 million shares (58% above 24-hour common) in the course of the help breakdown, with promoting strain peaking at 66,399 shares in the course of the 09:16 UTC decline.

Chart Patterns: Established downtrend construction with decrease highs at $170.48 and $171.92, adopted by technical help failure and momentum deterioration.

Threat/Reward: The $163.50 degree represents the subsequent crucial take a look at for bulls, with technical indicators suggesting continued draw back strain towards the $160 psychological help zone.

CD5 market evaluation: institutional rotation amid range-bound motion

CD5 dropped 1.63% from $1851.31 to $1821.19 in the course of the 24-hour interval, experiencing elevated volatility with a $52.78 intraday vary between $1868.63 and $1816.85, whereas institutional shopping for emerged throughout in a single day periods supporting restoration from $1817 technical help.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.