Institutional flows accelerated Tuesday as XRP broke from broader crypto weak point, posting regular beneficial properties amid bettering regulatory readability and managed accumulation throughout key assist zones.

Information Background

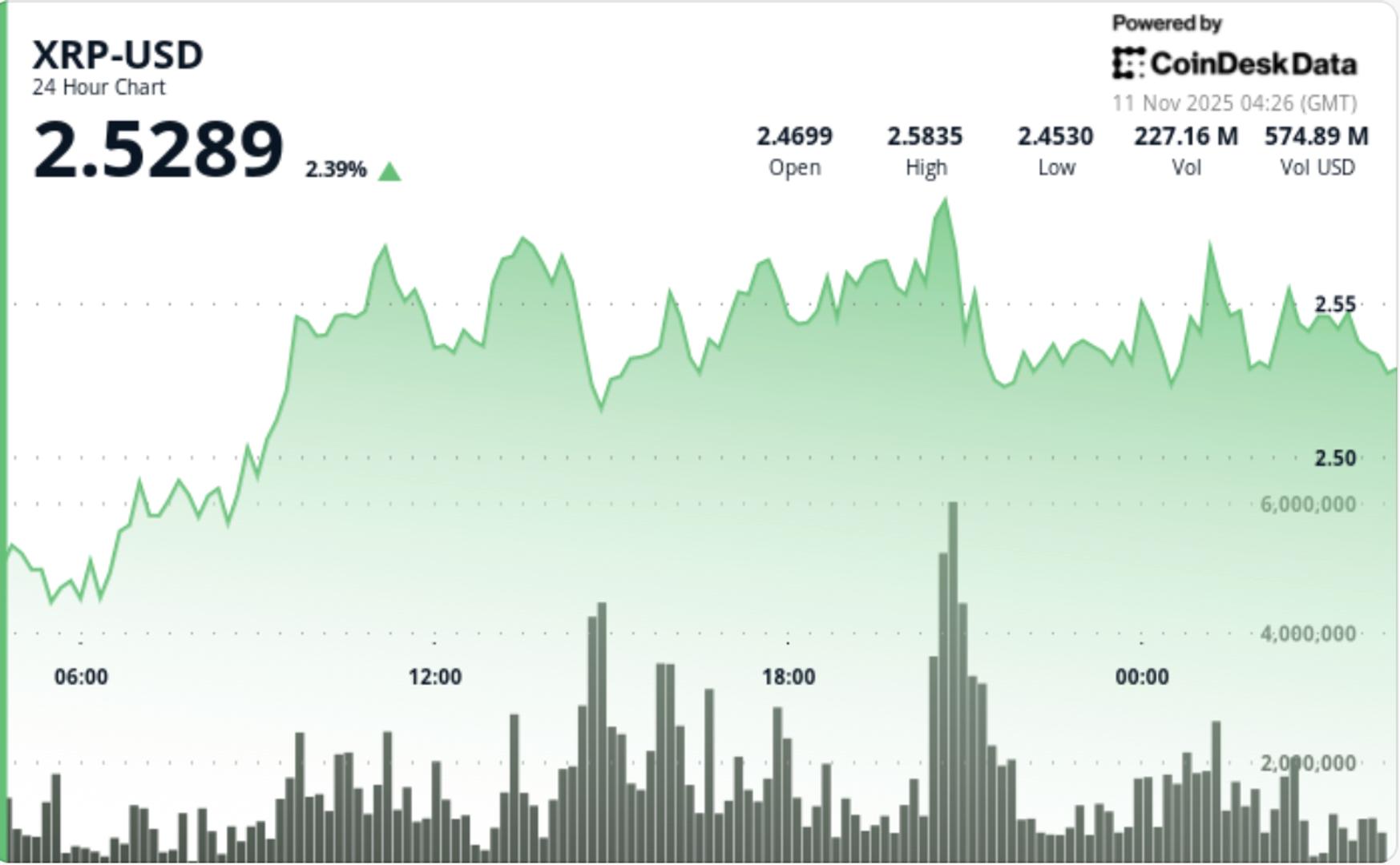

- XRP climbed 1.55% to $2.53 in Tuesday’s session, outperforming the broader crypto market by 2.33 share factors. The advance got here as traders continued constructing positions on renewed optimism round regulatory progress and ETF developments, whereas broader digital property traded combined.

- Canary Capital, Bitwise, Franklin Templeton, and 21Shares filed amended S-1 registration statements for spot XRP exchange-traded funds, introducing standardized itemizing language designed to streamline SEC overview underneath current 8(a) procedures.

- The 5 spot XRP ETFs have been listed on DTCC forward of a possible US launch this month.

- Buying and selling quantity surged 20.71% above the seven-day common, confirming institutional participation. Market information confirmed 140.2 million tokens altering fingers in the course of the peak of the session—86% above the 24-hour shifting common—underscoring sustained skilled flows at larger worth ranges.

- XRP’s transfer contrasts with sector underperformance, highlighting the token’s decoupling as regulated publicity expands globally and on-chain information factors to managed accumulation amongst giant holders.

Value Motion Abstract

- XRP traded inside a $0.13 intraday vary, advancing from $2.47 to $2.54 whereas forming larger lows at $2.45, $2.50, and $2.52.

- The breakout try at $2.57 met resistance as profit-taking emerged, although patrons held agency above the $2.52-$2.53 zone to substantiate short-term assist.

- Quantity distribution confirmed disciplined accumulation quite than speculative spikes, with shopping for concentrated round mid-range ranges—according to institutional scaling conduct.

- Late-session buying and selling printed sustained bid exercise above $2.52 as volatility normalized from early-session highs.

Technical Evaluation

- XRP maintains its ascending construction on the 4-hour chart, with RSI at 58 supporting additional upside potential. MACD stays optimistic with a widening histogram, indicating strengthening short-term momentum.

- The token’s failure to interrupt above $2.57 resistance highlights near-term consolidation danger, although the broader uptrend stays intact so long as worth holds above $2.50.

- Quantity patterns reinforce constructive positioning: the 21% improve above common coincided with steady volatility bands, suggesting managed accumulation.

- Order guide depth throughout main exchanges reveals constant buy-side layering between $2.48 and $2.52—an early sign of institutional protection forward of macro catalysts.

What Merchants Ought to Know

- XRP’s capability to carry above $2.50-$2.52 stays key to sustaining bullish momentum.

- A each day shut above $2.57 would affirm breakout continuation focusing on $2.65-$2.70, whereas failure to defend assist may set off a corrective transfer towards $2.45-$2.47.

- Analysts be aware that ETF progress and Ripple’s rising institutional partnerships proceed to underpin long-term confidence, although short-term overextension dangers warrant warning forward of main information releases later within the week.