In November of 2015, Rob Regulation and I based DailyPay in my basement. On a second hand whiteboard propped up towards a wall, Rob, Andrew Yoo (Developer 1), my canine Jack, and I derived the important thing formulation we would have liked in an effort to transfer cash earlier than payday, and importantly, the code for methods to receives a commission again. We started with a easy drawback to unravel – staff want entry to the pay they’ve earned earlier than payday as a result of it’s their cash. Each single enterprise determination, product determination, engineering determination, advertising and marketing determination, and regulatory determination we ever made discovered its North Star on this foundational precept: It’s your cash and you must have full management over it.

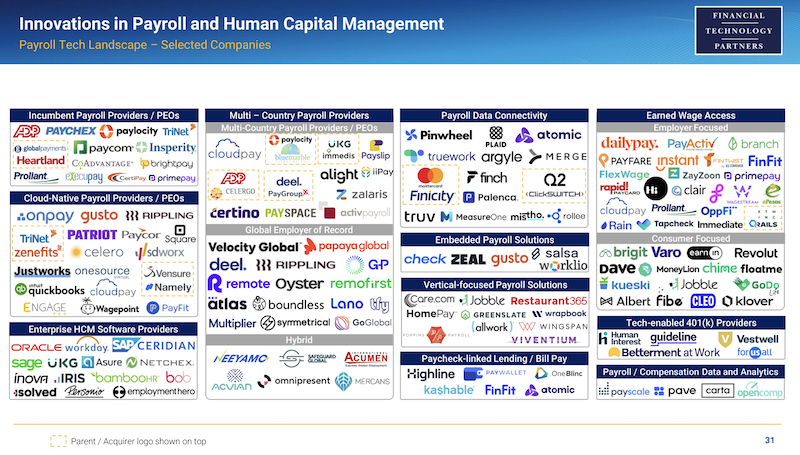

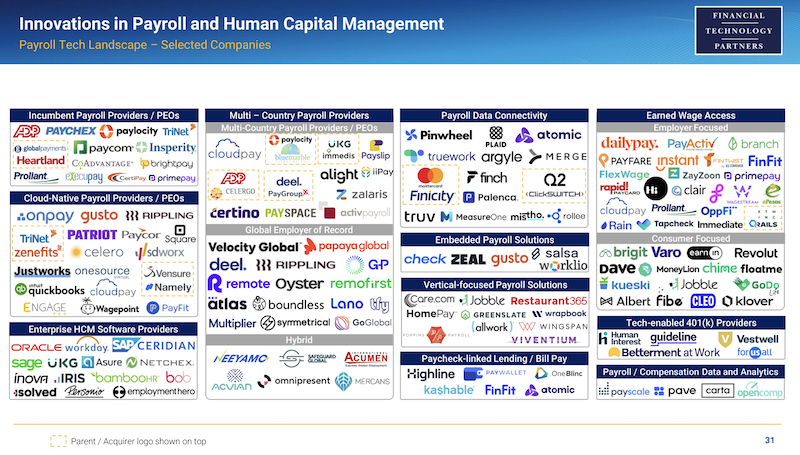

Eight years later, on demand pay and earned wage entry is its personal {industry}. In keeping with FT Companions, there are 35 firms in america providing on demand pay as a standalone providing. It’s now turn into its personal class inside monetary expertise and human capital administration.

Supply: FT Companions

On-demand pay has been adopted by main payroll firms and HCM suppliers like ADP and Ceridian. By depend, 10 out of the highest 10 HCM firms have some sort of providing and/or partnership with one of many answer suppliers. It has even prolonged to main monetary establishments akin to JPMorgan, Residents Financial institution, PNC, U.S. Financial institution, and others, who’ve acknowledged the importance of on-demand pay and have included it into their suite of choices. Just a few months in the past, I collaborated with Professor Marshall Lux of Harvard College on the state of the on-demand pay market. The staff at Harvard concluded that 4 out of 10 low earnings staff now have entry to some sort of on-demand pay supplier. Really astounding.

At present, I consider the on-demand pay {industry} is at a crucial inflection level. On one hand, earlier than the vacations, I used to be having espresso with the President of a Fortune 100 firm who started providing on-demand pay two years in the past. He glibly noticed “On-demand pay is desk stakes at this level. Each employer is providing it.” On the similar time, regulators and lawmakers have begun to articulate positions that providing on-demand pay is a type of unlicensed lending exercise, which if codified, would impede the expansion of a crucial service for low earnings staff.

We’re in an necessary second proper now. It’s a second to pause, take inventory, and to chart the course for the way forward for this necessary {industry}. Right here’s the place I see the {industry} headed:

- Regulators will see that earned wages are simply your cash

Any industry-transforming enterprise change usually requires a serious technological breakthrough. In any other case, that innovation would have occurred already. On-demand pay isn’t any completely different.

It’s a profound false impression that the novelty or breakthrough on this {industry} is the act of a client getting cash earlier than payday. Regardless of the title “on demand pay” or “earned wage entry,” this {industry} is not about customers getting cash. Let me clarify with a extra acquainted analogy: Once you go to an ATM machine and withdraw $100 out of your checking account, do you marvel at the truth that you at the moment are holding $100 in money? In fact you don’t. Getting your individual cash out of your individual checking account is a trivial, mundane, and anticipated proper. It’s inherent to a checking account. The factor that’s extra attention-grabbing is how the cash bought into your checking account within the first place. Now, shifting again to our context, the true “product” behind on-demand pay is not the act of receiving cash. It’s slightly how did the patron even understand how a lot her accessible earned wages had been within the first place. That is the product. That is the innovation.

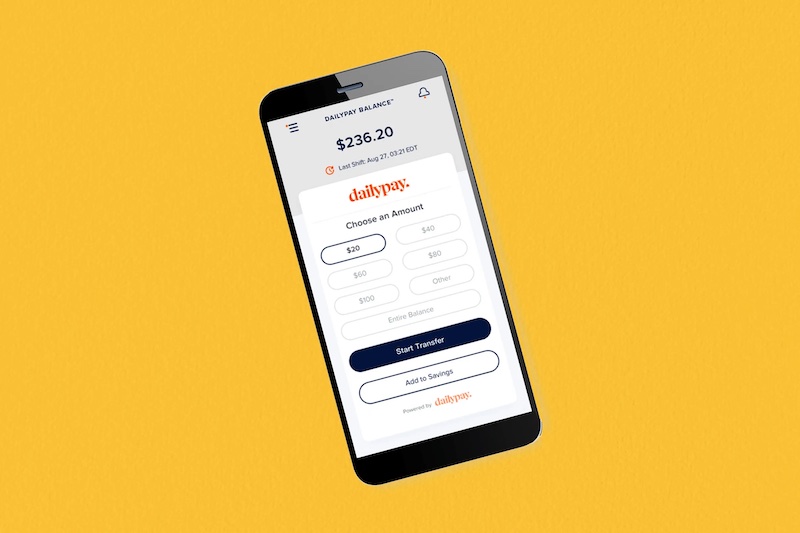

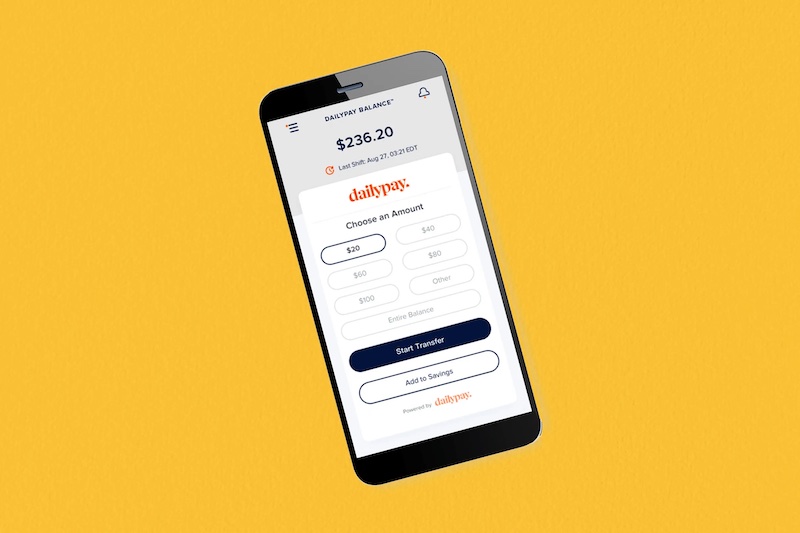

At DailyPay, we known as this technological breakthrough the Pay Steadiness, a completely new account stability we created. For the primary time ever, we might use expertise and monetary engineering to precisely replicate the quantity of web pay an worker had earned. Previous to this, that data solely existed in unconstructed information throughout a number of HR techniques of an employer. The canonical expertise and techniques drawback at an employer is that an employer makes use of one vendor for Time & Attendance and a unique vendor for Payroll or the system of file. Moreover, that information was unaudited and unverified in the course of the precise pay interval, previous to the payroll processing interval at which level the corporate’s Payroll Division would want to juggle between a number of techniques and confirm/audit the underlying information in an effort to run the ultimate payroll for that week.

So as to create an correct and absolutely provisioned stability {that a} employee might depend on as “cash within the financial institution,” one has to determine methods to overcome this information non-interoperability drawback after which underwrite the chance that these computations are correct, whereas additionally securing contingent funding to again that Pay Steadiness. This was a particularly laborious drawback to unravel however fortunately, I labored with sensible individuals like Konstantin Getmanchuk (Head of Product) in an effort to clear up it and create a whole {industry}. It’s why the Pay Steadiness was named certainly one of Time’s Greatest Innovations in 2021.

The Pay Steadiness (Supply: DailyPay)

All of that historical past is supposed to supply background to the next truism: the Pay Steadiness is the patron’s cash, and so any withdrawal from that Pay Steadiness is analogous to that client taking cash out of her personal checking account. For example: let’s say an worker has reported she labored eight hours at present and is paid $21 per hour. That worker lives in Oregon, has two garnishments for again taxes and little one help, and likewise has a behavior of forgetting to clock out for unpaid lunch. So as to set up what her “true” or “web” earnings are for that day, one has to keep in mind all of these components on an actual time foundation. After which in an effort to make that cash obtainable 24/7, one has to underwrite and fund that calculation. That’s actually laborious to do. However by means of the leveraging of complicated monetary expertise, one can “create a stability” out of unconstructed information that in any other case doesn’t exist at present.

One has to first perceive the Pay Steadiness as a product in an effort to perceive that then accessing a portion of that stability shouldn’t be a mortgage. Not at all would any of you take into account taking cash out of your individual checking account to be a mortgage. I imply, why would you. It’s your cash. To be intellectually sincere, it’s truly the alternative of taking out a mortgage. Taking cash out of your checking account is a defeasement of a mortgage that you have truly made to the financial institution. Once you deposit $1,000 into your checking account, you’re technically loaning $1,000 to the financial institution. You might be technically a creditor of the financial institution. The quantity you see displayed in your checking account stability is technically the cash that the financial institution owes you. And in case you withdraw $100 out of your checking account, you’ve got lowered the quantity that’s owed to you to $900.

Now let’s transfer to at least one’s earned wages. That is cash that’s owed to you. Sound acquainted? As a employee, you’re technically a creditor of the employer. You have already got a “pay stability.” It simply sits unfunded on the employer within the type of unconstructed information. The technological breakthrough was codifying and consolidating that quantity right into a digital stability, right into a digital asset. Then and solely then, can the stability be accessed. And similar to taking cash out of your paycheck is mundane and trivial, taking cash out of your Pay Steadiness is equally mundane and by no means a lending transaction.

Because the Pay Steadiness is already the patron’s cash, it’s most akin to a checking account stability. As such, funds from the Pay Steadiness are like a client withdrawing cash from her personal checking account, not a mortgage. Regulatory acceptance of this truth is essential to proceed to broaden this a lot wanted profit to customers all over the place.

- On demand pay will ultimately be provided to 7.8 billion individuals

Whereas worldwide markets have markedly completely different payroll regimes, real-time entry to pay will more and more turn into desk stakes throughout the globe. The growth of on demand pay into a world providing unsurprisingly began with international firms who provided it to their US workers who need it throughout their complete international workforce. However it has now expanded to over 100 on-demand pay suppliers throughout the globe providing on-demand pay of their respective areas.

I’ve a entrance row seat to the growth of on-demand pay throughout the globe by means of my position as advisor to every of the most important on-demand pay firms within the three main areas world wide. In Asia the place there are excessive charges of unbanked/underbanked, Paywatch has signed up a whole bunch of employers (and counting) throughout the area, together with in Malaysia, Philippines, Korea, and many others. In Europe the place month-to-month payroll is usually the norm, Rosaly’s digital providing helps the 6 out of 10 staff who stay paycheck to paycheck. And in Latin America, Payflow is rising exponentially because it indicators up the biggest employers within the area like Telefonica and Mango. As crucial as on-demand pay is in america, it’s much more important internationally the place payroll cycles, poverty charges, predatory mortgage charges and banking entry are usually worse. It’s thrilling to drive on-demand pay from its infancy on every of those continents and to look at these superb firms fulfill their imaginative and prescient in serving essentially the most weak of their areas.

- The {industry} will – and should – broaden past entry to at least one’s pay into long-term wealth creation

At DailyPay, we created the Pay Steadiness to be a life altering asset for staff. Probably the most precious property of the Pay Steadiness is its liquidity. As an asset, what provides the Pay Steadiness its energy is that you would be able to entry and spend it immediately such as you would cash out of your checking account. It’s why tens of millions of individuals can now cease counting on overdraft and payday loans to pay on a regular basis payments, saving over $600 per yr on common. That is the facility of leveraging monetary expertise to create and distribute a brand new asset.

At my subsequent firm Salt Labs, we’ve created an asset to allow staff to maneuver past their paying payments. If the Pay Steadiness is the hourly employee’s Checking Account, her Salt Steadiness is her Financial savings Account. At Salt Labs, our expertise produces an asset whose best property is its non-fungiblity, or its non-transferabilty. The distinction in names of the merchandise – Pay Steadiness versus Salt Steadiness – absolutely captures that distinction. Your pay is one thing you must be capable of entry instantly. Your Salt shouldn’t be. Your Salt allows financial savings as a result of its very nature is that it’s not spendable on Day 1, however slightly preserves your work for the longer term.

The Salt Steadiness

There’s an escalating financial savings disaster for low and reasonable earnings staff, which impacts households, communities and workplaces. One can observe this at each stage of the financial savings spectrum. Employees can’t save for the brief time period: Employees making lower than $60k have a median financial savings charge of destructive 2%, leaving nothing (or destructive quantities) for surprising bills or a discretionary buy like a gift for a relative’s birthday. Within the medium time period, a staggering 81% of American households report being worse off than 12 months in the past. In the long run, the median retirement account worth of the 65+ age bracket is zero (due to the highest quartile, the common is $176k; in any other case it will be destructive). Regardless of 4 many years of increasing 401(ok) entry, two-thirds of low and reasonable earnings staff can’t afford the upfront contributions due to the shortcoming to scale back one’s paycheck at present for the longer term.

The way forward for on-demand pay is in leveraging one of the best of its providing – entry, immediate, transparency, and ease – and to use these product properties to the subsequent cease within the worker’s journey – financial savings and wealth creation. An worker’s monetary targets – and by extension, the expertise made obtainable to them – should take the worker to get past the paying of payments. Whereas critically necessary, the subsequent a part of the worker’s journey is constructing financial savings, monetary well being, and undertaking medium to long-term targets.

As a monetary expertise {industry}, now we have a chance – a accountability even – to radically impression the long-term monetary well being of a whole technology of staff. I take that calling extraordinarily critically.

Who’s with me.