The crypto market confronted a violent downturn, with Ethereum breaking beneath the $3,100 degree whereas Bitcoin misplaced the crucial $100,000 mark, triggering widespread liquidation and fear-driven promoting. Panic shortly rippled throughout the market, and sentiment flipped sharply bearish as merchants rushed to scale back publicity, value targets vanished from social media, and danger property noticed a cascade of exits. In moments like these, feelings usually outweigh fundamentals — and this week was a transparent reminder of that dynamic.

Associated Studying

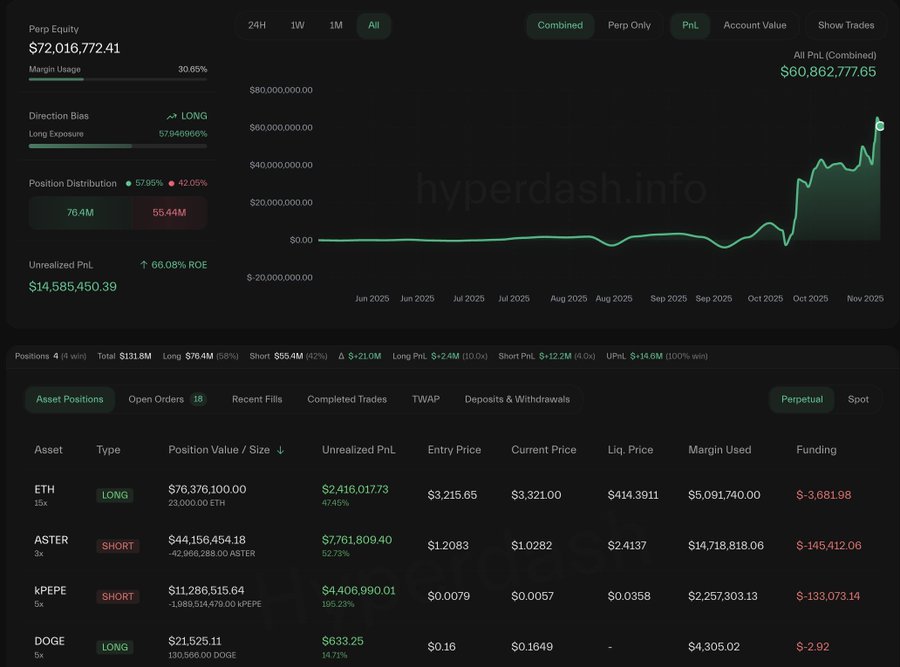

Nevertheless, even in durations of sharp concern, not all market individuals behave the identical. Some notable gamers have begun shifting their stance, hinting that strategic positioning could already be underway beneath the panic. Amongst them is the well-known Anti-CZ Whale — a dealer who gained consideration after aggressively shorting ASTER instantly following Changpeng Zhao’s public submit saying he purchased ASTER. That commerce paid off massively as ASTER surged briefly after which retraced sharply, delivering this whale tens of hundreds of thousands in unrealized revenue.

Now, in a notable shift, this dealer has flipped from shorting Ethereum to going lengthy, signaling renewed conviction regardless of the market’s emotional breakdown. As concern peaks, subtle gamers could already be getting ready for the following section — elevating the query: is that this capitulation… or alternative?

Whale Rotates Into ETH Lengthy as Market Panic Peaks

In line with Lookonchain, the well-known Anti-CZ Whale has executed a notable portfolio shift, flipping from shorting Ethereum to taking an extended place value 32,802 ETH (~$109 million). Now, the whale is sustaining a 58.27M ASTER quick (~$59.7M), signaling conviction that ASTER’s weak spot could proceed regardless of current volatility.

Alongside this, the whale holds a 1.99B kPEPE quick (~$11.3M), a wager in opposition to speculative memecoin flows throughout uncertainty. In the meantime, a small 130,566 DOGE lengthy (~$21.5K) seems extra symbolic than directional, possible serving as a hedge or sentiment gauge relatively than a significant conviction play.

The standout transfer is clearly the ETH lengthy, signaling the whale views Ethereum’s drop beneath $3,100 as oversold relatively than structurally bearish. Taking such a place throughout peak concern suggests an expectation of restoration as soon as compelled liquidations cool and liquidity stabilizes. Whereas broader sentiment stays fragile, this shift implies subtle capital could already be positioning for an eventual rebound — reinforcing ETH’s position as a core asset even amid aggressive market stress.

Associated Studying

ETH Value Technical Outlook: Testing Key Help as Panic Promoting Eases

Ethereum is trying to stabilize after a steep breakdown beneath the $3,500 area, with value now reacting across the $3,300 zone. This degree aligns intently with the 200-day transferring common (purple line), making it a crucial assist space for bulls to defend. The current candle construction exhibits heavy volatility and excessive sell-side quantity, confirming panic-driven liquidations as the first power behind the transfer — relatively than a basic shift in pattern.

The aggressive flush adopted a sequence of decrease highs all through October, signaling weakening momentum earlier than the breakdown. The 50-day and 100-day transferring averages (blue and inexperienced) are trending down and presently overhead, including strain and reinforcing the short-term bearish construction. A restoration above the 50-day MA can be an early signal of energy, however Ethereum should reclaim the $3,500 zone to regain bullish management.

Associated Studying

Quantity has spiked dramatically, suggesting capitulation habits — usually close to cycle pivot factors. The wick close to $3,150 hints that consumers stepped in aggressively at lows, in line with accumulation dynamics noticed amongst subtle merchants. If ETH holds above the 200-day MA and builds a base right here, it might arrange a reduction rally. A sustained break beneath $3,150, nonetheless, dangers additional draw back towards $2,900 as liquidity pockets stay skinny beneath present ranges.

Featured picture from ChatGPT, chart from TradingView.com