Hut 8’s (HUT) Tuesday third quarter earnings report confirmed report income and stable profitability, however the inventory tumbled almost 13% after traders had been let down by the shortage of an AI hyperscaler tenant announcement at its River Bend web site in Louisiana, Wall Road dealer Benchmark stated in a report on Wednesday.

The selloff was “short-sighted and unwarranted,” wrote analyst Mark Palmer, who argued it’s not a matter of if a deal occurs, however when. He maintained his purchase ranking and $78 value goal.

Tuesday’s plunge in Hut 8 did not happen in a vacuum, in fact. Crypto markets generally suffered considered one of their worst declines of the yr and conventional markets offered off as nicely, with the Nasdaq shedding 2%. HUT shares, nonetheless, had been the worst performers within the bitcoin mining/ AI infrastructure area.

HUT is increased by 4% early Wednesday to $50 alongside a modest bounce in markets generally.

Turning again to outcomes and the outlook, Hut 8 CEO Asher Genoot reaffirmed that the 300 megawatt (MW) information heart in West Feliciana Parish, which may finally scale towards 1 gigawatt (GW), stays on schedule for late 2026, according to what Palmer referred to as the corporate’s “methodical” method.

Palmer stated merchants chasing a fast pop missed the larger story. Hut 8 is positioning itself for long-term worth moderately than dashing right into a suboptimal deal.

With hyperscalers and cloud suppliers scrambling for energy capability amid the AI growth, Palmer expects River Bend to discover a tenant in due time.

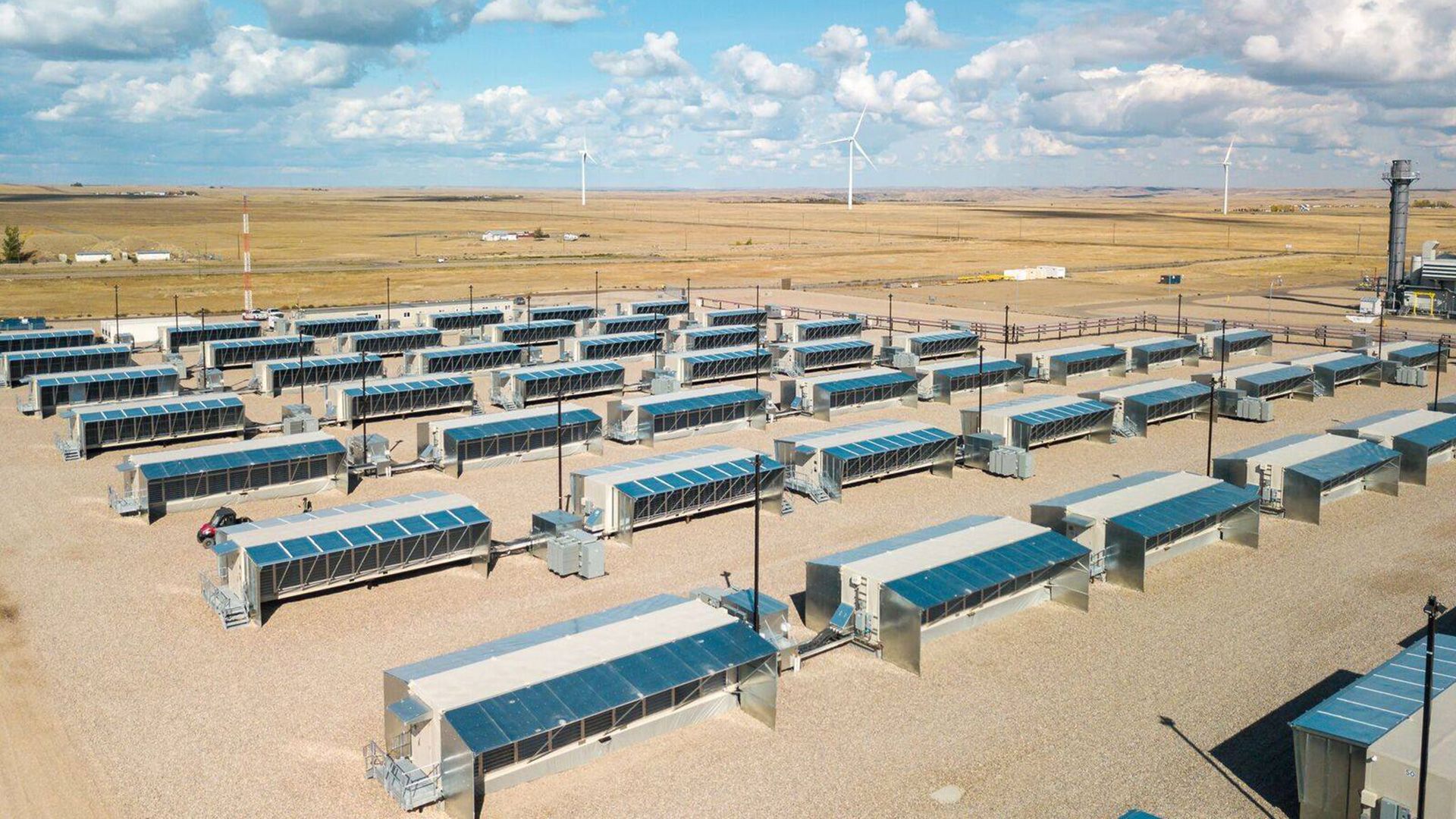

Genoot’s feedback on the decision underscored a management crew centered on strategic positioning for the following decade, with Hut 8’s websites in Texas, Alberta, and Louisiana forming an built-in platform that may shift between AI, high-performance computing, and bitcoin mining as economics dictate.

Palmer additionally famous that Genoot addressed the market’s low cost on Hut 8’s 1,530 MW energy pipeline, saying traders might want to see execution earlier than awarding increased valuations.

Palmer’s purchase ranking and $78 value goal is predicated on a sum-of-the-parts evaluation factoring in that improvement pipeline, Hut 8’s 64% stake in American Bitcoin (ABTC), and the ten,278 bitcoin held as of Sept. 30.

The valuation doesn’t but embody the extra 1,255 MW beneath exclusivity or 5,865 MW beneath diligence, leaving additional upside potential, the report added.

Learn extra: Benchmark Sees Hut 8 as Hybrid AI–Bitcoin Energy Play, Value Goal Doubled to $78