CryptoQuant’s analysis head has identified how demand to soak up Bitcoin at greater costs has been low lately, doubtlessly explaining the asset’s decline.

Bitcoin Obvious Demand Metric Has Turned Purple Lately

In a brand new put up on X, Julio Moreno, head of analysis at on-chain analytics agency CryptoQuant, has checked out latest BTC market dynamics from a special angle. “As an alternative of Bitcoin long-term holder distribution/spending, I like to take a look at the opposite aspect of the commerce,” famous Moreno.

Lengthy-term holders right here discuss with the BTC buyers who’ve been holding onto their cash for a interval longer than 155 days. This cohort is taken into account to incorporate the high-conviction “HODLers” of the market, so distribution from them is usually one thing on-chain analysts be careful for.

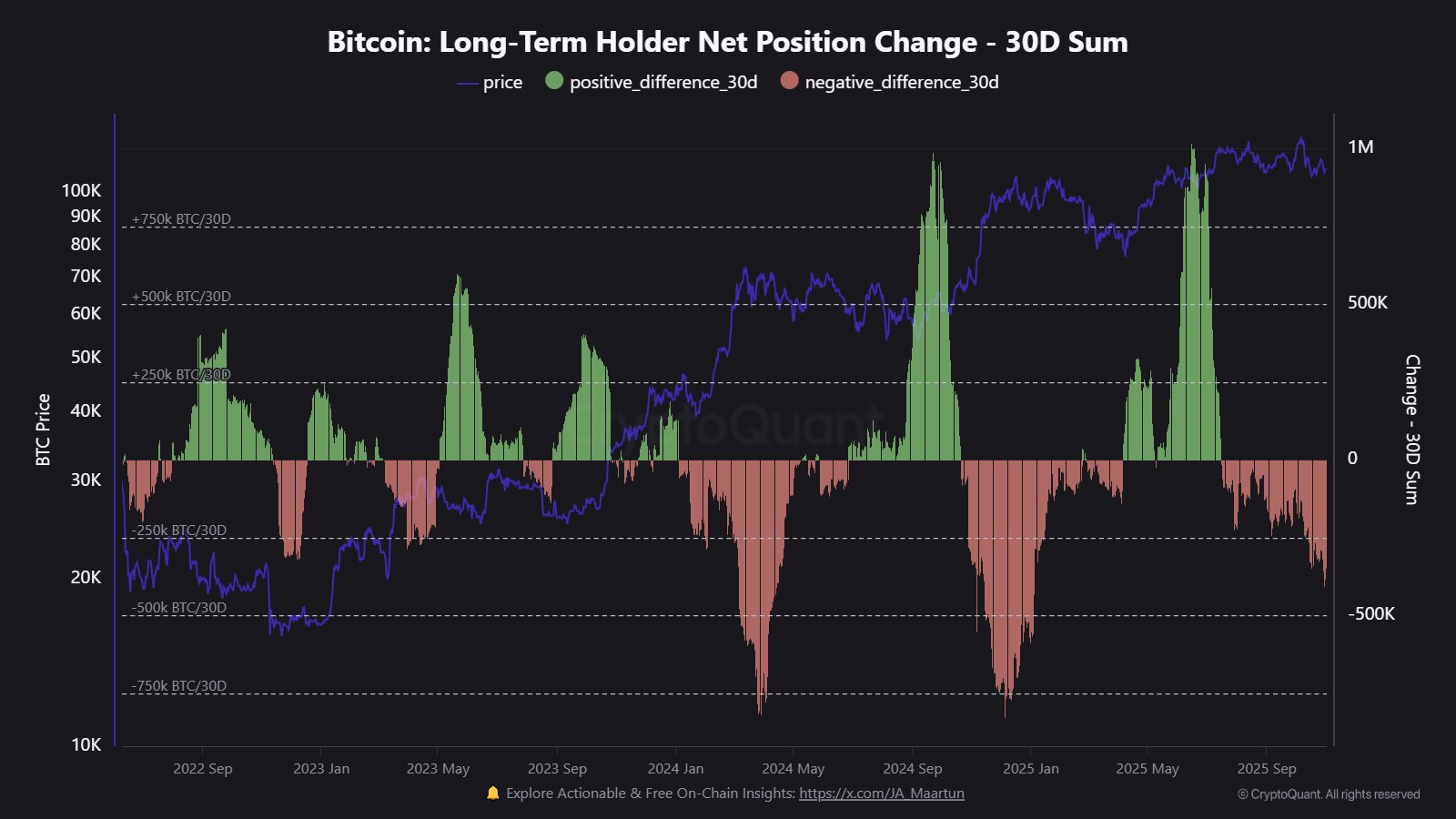

As CryptoQuant neighborhood analyst Maartunn has highlighted in a separate X put up, Bitcoin long-term holders have participated in a major quantity of promoting in the course of the previous month.

This isn’t the sign Moreno focuses on, nevertheless. As an alternative, the CryptoQuant head checks for whether or not there’s sufficient demand coming in to soak up the provision that the long-term holders are promoting at greater costs.

An indicator that may be helpful for monitoring that is the Obvious Demand, which compares the distinction between BTC’s manufacturing and modifications in its long-term stock. “Manufacturing” is the quantity that miners are issuing on the community every single day, whereas the “stock” is the provision that has been inactive for over a 12 months.

Now, right here is the chart shared by Moreno that reveals the development within the 30-day and 1-year variations of the Bitcoin Obvious Demand over the previous few years:

As displayed within the above graph, the Bitcoin Obvious Demand has been crimson on the 30-day throughout the previous few weeks, implying a detrimental short-term demand for the cryptocurrency. “Is there sufficient demand to soak up the provision at greater costs?” requested the analyst. “Since a number of weeks in the past the reply isn’t any, and that’s the reason we see costs declining.”

The story is a bit completely different in the case of the 1-year Obvious Demand, which has really seen some progress lately, however the tempo of its rise has been gradual, and its worth continues to be under the 90-day easy transferring common (SMA).

The final time Bitcoin noticed an prolonged part of detrimental 30-day Obvious Demand was in the course of the bearish part within the first half of the 12 months. It now stays to be seen whether or not one thing related will comply with this time as properly, or if demand will bounce again.

BTC Worth

On the time of writing, Bitcoin is floating round $103,900, down 9% over the past seven days.