See how each the Massive 4 and smaller corporations are using AI of their workflows.

In right this moment’s fast-paced enterprise world, ignoring AI know-how will not be an possibility, and the sphere of accounting isn’t any exception.

Synthetic Intelligence (AI) has develop into a game-changer, serving to accounting corporations streamline processes, enhance accuracy, and ship extra worth to their purchasers. Agency homeowners are shifting their perspective. The 2025 Generative AI in Skilled Providers Report from Thomson Reuters Institute discovered that 68% of tax and accounting professionals are excited and/or hopeful about the way forward for GenAI within the {industry}.

“Present and rising generations of GenAI instruments could possibly be transformative,” stated one US director of tax. “For instance, deep analysis capabilities, software program software improvement, and utilizing GenAI to assist with enterprise storytelling would have important impacts on the way forward for skilled work.”

How are industry-leading corporations actively implementing GenAI know-how? This text explores how completely different accounting corporations use AI of their operations to drive effectivity and excellence of their providers.

Bounce to:

2025 GenAI in Skilled Providers Report

Discover how GenAI will influence the way forward for authorized, tax, accounting, audit, authorities, and threat & fraud professionals work

What number of accounting corporations use AI?

In line with survey respondents, 21% of tax corporations recognized as already utilizing GenAI know-how, with 53% both planning to make use of the know-how or contemplating it. 1 / 4 of corporations (25%) nonetheless don’t have any present plans to make use of GenAI, however this share is down from 49% in 2024. The AI commerce winds are altering.

The adoption of AI within the accounting {industry} in recent times has been on the rise. Accounting corporations of all sizes, from international giants to native boutiques, are more and more turning to AI options to reinforce their providers. This shift is pushed by the belief that AI can automate mundane duties, scale back errors, and release accountants to deal with higher-value advisory work.

Apparently, accountants appear to be implementing GenAI tech by means of private, open-source instruments for his or her work over industry-specific instruments. 52% of tax agency survey respondents who already use a GenAI software are utilizing open-source know-how, reminiscent of ChatGPT; solely 17% are utilizing an industry-specific software.

This development may quickly shift as extra industry-specific know-how suppliers introduce their very own GenAI options inside the coming years.

How do the Massive 4 use synthetic intelligence?

The “Massive 4” accounting corporations—Deloitte, Ernst & Younger (EY), PwC, and KPMG—have led the way in which with AI adoption. They’ve closely invested in AI-powered instruments and options to supply purchasers with extra superior and insightful providers. Right here’s a glimpse of how they use AI:

- Shopper options: KPMG’s Trusted AI framework helps their member corporations’ purchasers design, construct, deploy, and use AI tech options in a accountable and moral method, constructing loyalty and partnerships.

How do smaller accounting corporations use AI?

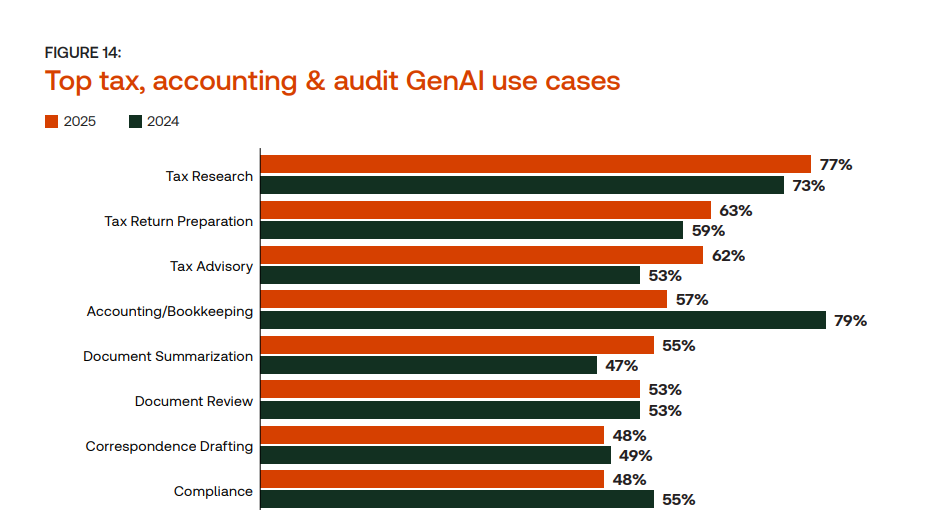

Smaller accounting corporations may not have the identical sources because the Massive 4, however they’re additionally embracing AI to remain aggressive and supply higher providers. In line with the GenAI report, the highest 5 use instances for tax corporations utilizing or planning to make use of GenAI have been:

- Tax analysis: Corporations use AI-powered algorithms in tax analysis instruments to return knowledge from human-edited, tax-specific content material. This gives authoritative solutions from trusted sources rapidly and precisely.

- Tax return preparation: Corporations are utilizing AI to automate the extraction and evaluation of information from numerous monetary paperwork, considerably decreasing the effort and time required to arrange correct tax returns. GenAI additionally assists in figuring out relevant deductions and credit tailor-made to particular person or company monetary eventualities, making certain compliance and optimization of tax liabilities.

- Tax advisory: Corporations are utilizing AI instruments to generate predictive insights, serving to purchasers plan for future tax implications primarily based on their monetary choices. This gives a extra strategic position for tax professionals, permitting them to supply value-added providers.

- Accounting/bookkeeping automation: Corporations are utilizing AI-powered software program to robotically categorize bills, reconcile accounts, and generate monetary stories. This protects time and reduces the chance of handbook errors for corporations.

- Doc summarization: Corporations use AI to summarize key factors from contracts, invoices, and receipts and may rapidly establish anomalies that require additional investigation. This functionality not solely accelerates the evaluate course of but additionally enhances the accuracy and reliability of monetary audits and compliance checks.

Among the many corporations actively utilizing or planning to make use of GenAI, 44% stated they use the know-how every day, if not a number of occasions a day. An extra 29% stated they’re utilizing it weekly.

Approaching AI with curiosity

Within the accounting world, AI will not be a menace however a chance. It may well empower corporations of all sizes to supply higher providers, enhance effectivity, and thrive in an ever-changing {industry}. As AI continues to advance, those that method it with curiosity and a willingness to embrace new know-how will doubtless keep forward of this development.

If you’re trying to discover the world of AI in accounting, be part of the AI @ Thomson Reuters neighborhood. Right here, you may join with consultants, study concerning the newest AI developments, and unlock the total potential of AI in your accounting follow. For subsequent steps on methods to incorporate AI instruments in your agency, learn our white paper: “Harnessing AI and automation: Tips on how to elevate your tech stack.”