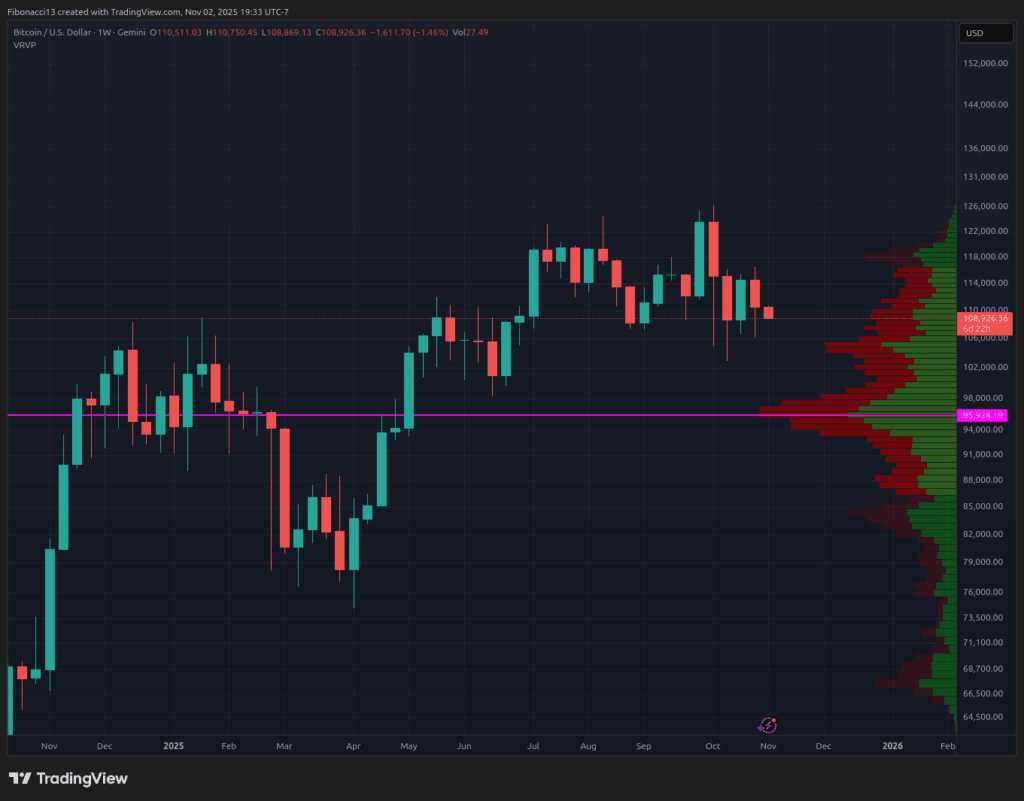

It was a really disappointing week for bitcoin value motion final week. Monday noticed a pleasant transfer up into resistance, however that momentum rapidly pale as bitcoin retraced the bullish transfer to finish up proper again down on the lows by Thursday. The market was a combined bag because the Federal Reserve’s 25 foundation level reduce was anticipated, however Chairman Powell put a damper on expectations going ahead, stating that there have been no plans to proceed with one other rate of interest reduce in December’s FOMC assembly, which the market had been anticipating. Bitcoin closed the week out at $110,591, which wasn’t totally bearish, however was not confidence-inspiring for the bulls both.

Key Assist and Resistance Ranges Now

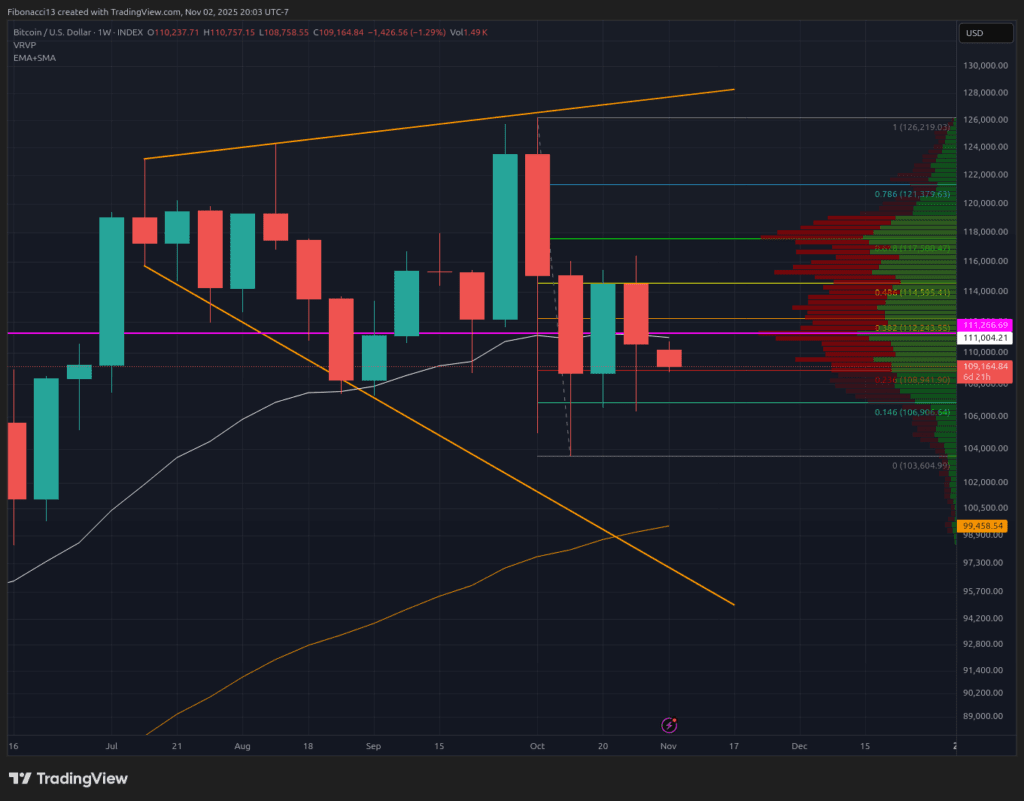

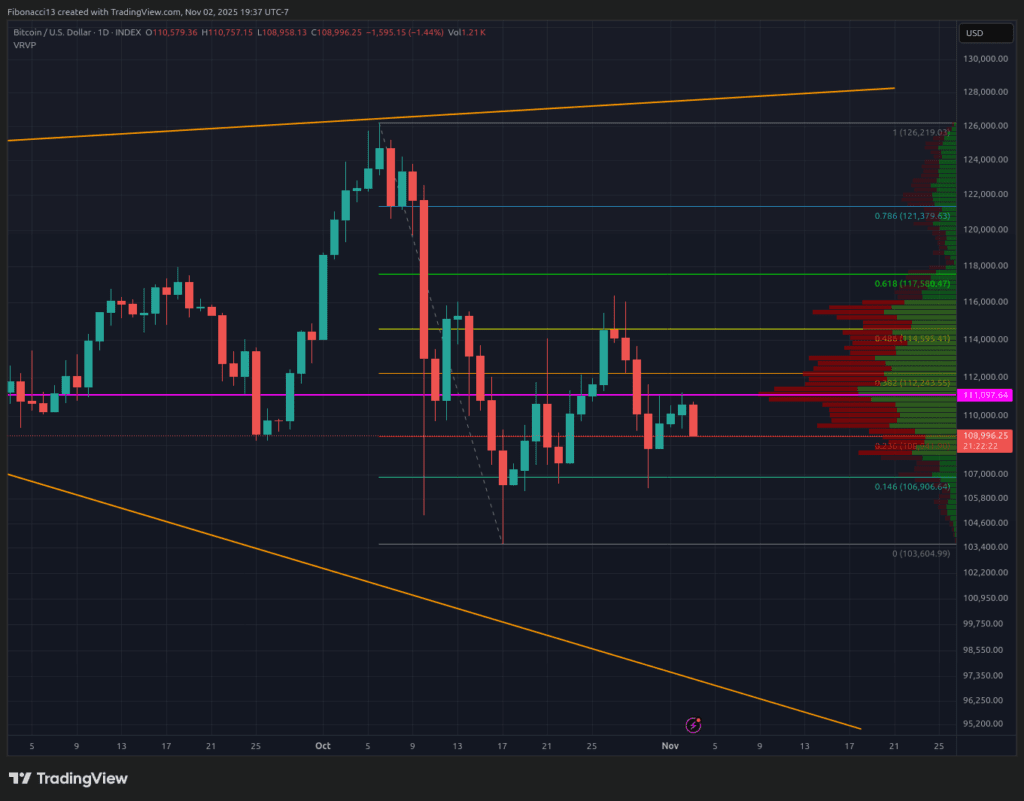

The $106,900 assist stage held once more final week on the 0.146 Fibonacci Retracement, offering a pleasant bounce for the bulls on Thursday into the weekly shut on Sunday. Bulls don’t need this stage to be examined once more going ahead, as it might be extra prone to fail on the following check. Shedding this stage may be very prone to result in dropping $100,000 and a check of long-term assist at $96,000. We do have potential assist at $104,000 earlier than there, however this stage has been examined twice already, so it might be an enormous ask for this stage to carry as assist as soon as once more.

The bearish value motion final week has solely created further resistance ranges for the bulls to beat right here. Worth closed final week beneath the 21-EMA, which sits proper round $111,000 coming into this week. The amount profile can be displaying us some extent of management (POC) at $111,000 as effectively. If value manages to climb above $111,000, we’ll look to $114,600 as the following resistance stage. Closing above $114,600 opens up $122,000 as the ultimate hurdle to beat for the bulls to take again management of the motion.

Outlook For This Week

Bitcoin is prone to break assist to the draw back this week until consumers can step up in an enormous method, with sturdy shopping for quantity. Search for $106,900 assist to be misplaced if the worth begins closing beneath $108,000. $104,000 ought to present a bounce beneath there, however the $96,000 assist is prone to be examined if $104,000 doesn’t maintain for lengthy. Bulls will probably want some form of macro catalyst this week to save lots of themselves from decrease costs, because the each day chart is wanting very bearish heading into this week. As of Monday morning, it seems bitcoin is dropping the $106,900 stage and can check $104,000 or decrease.

Market temper: Bearish – The bulls’ hopes had been overwhelmed again this week when the worth failed to carry above the $115,500 resistance stage. The onus continues to be on the bulls to take out some higher resistance ranges to attempt to swing bias again of their favor.

The following few weeks

Bitcoin is prone to take a backseat to the Nasdaq value motion going ahead. It will likely be very troublesome to maintain any sort of upward motion if the Nasdaq continues to appropriate decrease over the approaching weeks. So, bitcoin bulls shall be hoping for the Nasdaq to renew its uptrend to assist them out. Bulls will even be looking for the Client Worth Index, because of be launched on November 13, for an enchancment from final month’s lukewarm inflation numbers. Cooler inflation information ought to tilt the chances in favor of one other rate of interest reduce within the Federal Reserve’s December assembly. Until the bulls get a number of assist right here, the bears ought to stay in management for the foreseeable future.

Terminology Information:

Bulls/Bullish: Patrons or traders anticipating the worth to go greater.

Bears/Bearish: Sellers or traders anticipating the worth to go decrease.

Assist or assist stage: A stage at which the worth ought to maintain for the asset, a minimum of initially. The extra touches on assist, the weaker it will get and the extra probably it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of assist. The extent that’s prone to reject the worth, a minimum of initially. The extra touches at resistance, the weaker it will get and the extra probably it’s to fail to carry again the worth.

EMA: Exponential Shifting Common. A transferring common that applies extra weight to latest costs than earlier costs, lowering the lag of the transferring common.

Fibonacci Retracements and Extensions: Ratios based mostly on what is called the golden ratio, a common ratio pertaining to progress and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Quantity Profile: An indicator that shows the full quantity of buys and sells at particular value ranges. The purpose of management (or POC) is a horizontal line on this indicator that reveals us the worth stage at which the very best quantity of transactions occurred.