Whereas some may suppose that taxes are an inconvenience, they really serve many good makes use of, together with funding well being applications, meals stamps, incapacity advantages, and protection applications.

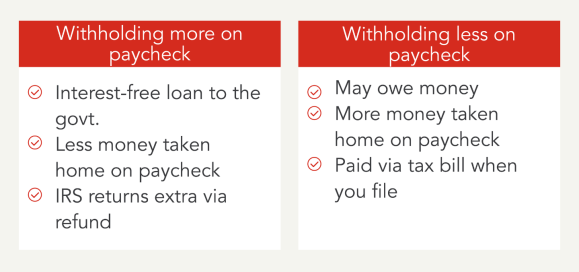

If you pay an excessive amount of in taxes, nonetheless, it creates an interest-free mortgage to the federal government that’s greater than your justifiable share. This causes you to take dwelling much less cash per paycheck and primarily has the federal government holding onto your hard-earned cash till tax season.

Whether or not you need extra money in your paycheck and fewer taxes withheld or an even bigger tax refund at tax time and extra money withheld out of your paychecks is a desire. For a lot of, the tax refund is the largest verify they obtain all 12 months, they usually favor to obtain a tax refund at tax time, as a result of if they’ve the extra cash of their paycheck they could spend it.

TurboTax has instruments that will help you estimate your withholding, whether or not you favor a tax refund or need extra money in your paycheck. Right here is extra of what it’s worthwhile to find out about withholding and overpaid taxes.

How do I do know if I overpaid my taxes?

Should you’ve overpaid your taxes, you’ll find yourself getting an IRS refund when you’ve filed your taxes. That is the clearest signal that you simply’ve overpaid, as the explanation you’re getting a refund again within the first place is that you simply’ve paid an excessive amount of in taxes all year long.

How can I keep away from overpayment on my taxes?

Within the case of a main life occasion, reminiscent of marriage or divorce, the beginning of a kid, change in employment, or acquiring a second job, you may not have had time to completely regulate your withholding standing by way of a Type W-4.

On this case, it’s cheap to anticipate a tax refund for that 12 months. Adjusting your withholdings promptly can make sure that you’re not paying greater than essential to the IRS, placing extra money in your pocket all year long. You may regulate your withholding primarily based in your desire, whether or not you need extra money in your paycheck or an even bigger refund at tax time.

If you’re eligible for refundable credit like Earned Revenue Tax Credit score as much as $7,430 for 3 or extra youngsters in 2023 , you may additionally see a lift in your refund since refundable credit provide the extra quantity of credit score past taxes you owe, not like non-refundable credit.

In response to the newest IRS statistics, as of December 2023, the typical refund was over $3,100, and the entire quantity of refunds was $334.861 billion. For a lot of, that’s the largest paycheck of the 12 months.

You may converse to a tax knowledgeable to determine how one can correctly regulate your withholdings so that you simply’re receiving probably the most out of your paycheck and you’re estimating your withholdings appropriately whether or not you desire a refund at tax time or extra in your paycheck.

What occurs if I overpaid my taxes?

Should you’ve overpaid your taxes, the IRS will concern you a refund while you file your taxes for the 12 months. That is the simplest approach to know that you simply’ve paid extra into taxes than essential.

What ought to I do within the case of a tax overpayment?

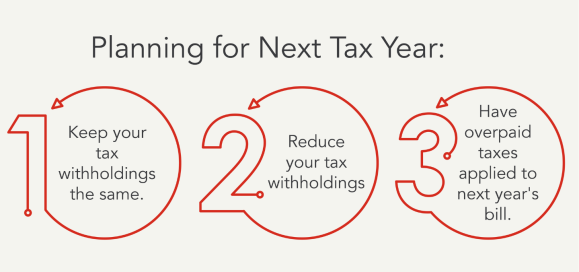

Don’t fear for those who made a mistake in your tax return; tax overpayment isn’t usually an issue. Should you overpaid your taxes, you may have the choice of receiving a refund or having the refund quantity utilized to subsequent 12 months’s taxes.

Within the sections beneath, we’ll speak about what occurs for those who overpay taxes and how one can reply.

Have your refund utilized to subsequent 12 months’s taxes

Should you favor as a substitute to get forward on the subsequent 12 months’s taxes, you possibly can decide to have the refund utilized to your taxes for subsequent 12 months.

This might be an important possibility for those who’re anticipating a life change, like beginning your individual enterprise, the place you may be not sure in regards to the tax implications.

Modify tax withholdings

Should you’re incessantly receiving a tax refund, it’s possible you’ll need to regulate your tax withholdings so you find yourself receiving extra per paycheck out of your employer and fewer of a refund throughout tax time for those who favor— holding in thoughts that the aim of tax time is to have a internet of zero, the place you don’t owe.

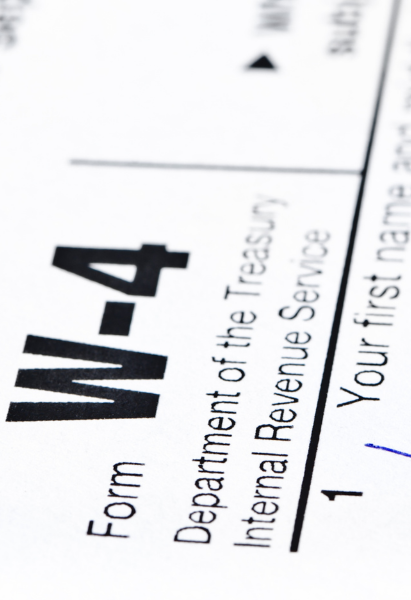

To regulate your withholdings, you’ll want to finish a Type W-4. This kind could be discovered on the IRS web site or out of your employer’s HR division.

Full this manner per the directions and return again to your employer; their payroll division will be capable to make the required adjustments to your withholdings so that you’re paying the suitable quantity for taxes.

Recalculate estimated taxes

Self-employed taxpayers have the choice to pay estimated quarterly taxes, making it simpler to allocate cash for annual taxes. Should you’re calculating your estimated quarterly taxes incorrectly, it’s possible you’ll be overpaying every quarter.

Should you obtain a tax overpayment refund or a discover from the IRS about overpaying your estimated quarterly taxes, it’s best to recalculate to be sure you’re not paying greater than it’s best to.

Use our self-employed tax calculators, or you possibly can fill out Type 1040-ES to determine how a lot you owe in quarterly taxes.

Assembly quarterly tax deadlines is essential, so be sure you recalculate your taxes earlier than the subsequent deadline arrives There could also be different conditions, like promoting inventory at a acquire, the place you may think about paying estimated taxes.

Is it higher to underpay or overpay taxes?

Usually talking, it’s higher to overpay your taxes moderately than underpay. A tax overpayment will end in a refund on the finish of the 12 months, which suggests your taxes are paid in full, and also you obtain the distinction as a refund.

The issue with underpaying your taxes is that you simply’ll nonetheless owe taxes on the finish of the 12 months. You might solely owe a small portion of your tax legal responsibility, nevertheless it’s simpler to ensure your taxes are paid upfront, so that you don’t have to fret about arising with extra cash when taxes are due.

How do I contact the IRS about tax overpayment?

Should you overpaid your taxes, you possibly can sometimes anticipate to obtain a refund a number of weeks after submitting your taxes. Typically, the IRS will be sure you obtain a tax overpayment refund for those who overpay in your taxes.

There are a number of choices if it’s worthwhile to contact the IRS about your tax overpayment. You may name the toll-free phone service at 1-800-829-1040 for solutions to federal tax questions. You can too mail tax returns and inquiries to the IRS, though correspondence by mail is often slower than different strategies.

What if I make a mistake on my taxes?

It’s potential that you simply discover a missed deduction or credit score after submitting your taxes that might have resulted in a tax refund. Don’t fear about lacking deductions and credit when submitting with TurboTax.

It doesn’t matter what strikes you made final 12 months, TurboTax will make them depend in your taxes. Whether or not you need to do your taxes your self or have a TurboTax knowledgeable file for you, we’ll be sure you get each greenback you deserve and your greatest potential refund – assured.