What’s Exponential Shifting Common (EMA)

An Exponential shifting common is a technical indicator that measures pattern route over a time frame. EMA is much like the Easy Shifting Common (SMA), which is a technical indicator that tracks the common closing value of belongings over specified time intervals, whereas EMA focuses on making use of weight to knowledge that’s extra present. An exponential shifting common smooths out the worth knowledge by giving precedence to more moderen costs, making it extra conscious of the most recent market exercise in comparison with a easy shifting common.

How Does the Exponential Shifting Common Work?

The Exponential shifting common (EMA) is a sort of shifting common that locations larger significance on latest value actions of a inventory or cryptocurrency. In contrast to the Easy shifting common, which assigns equal weight to all knowledge in a interval, EMA reacts extra shortly to cost modifications as a result of its weighting mechanisms.

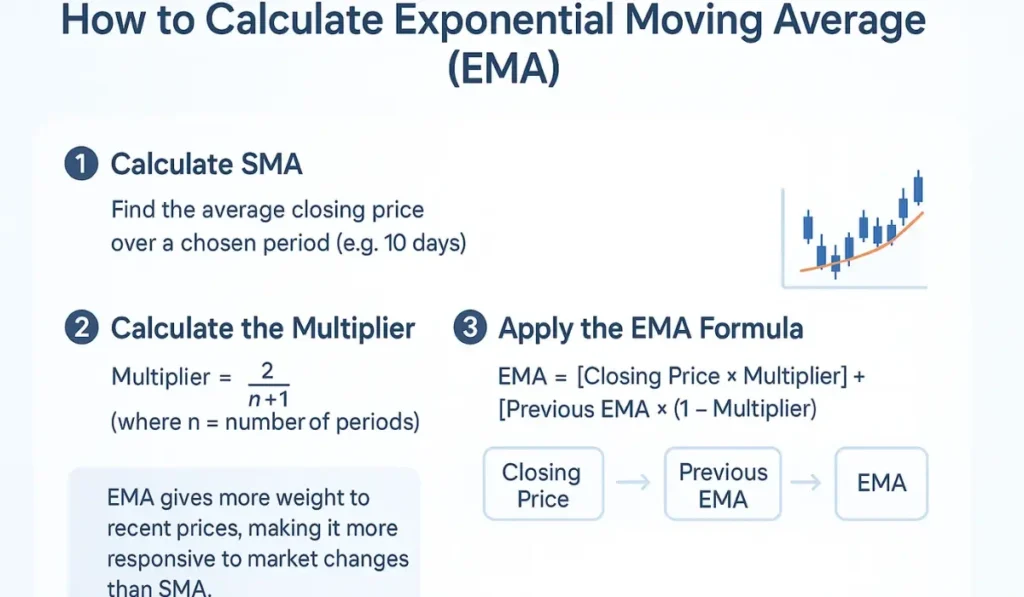

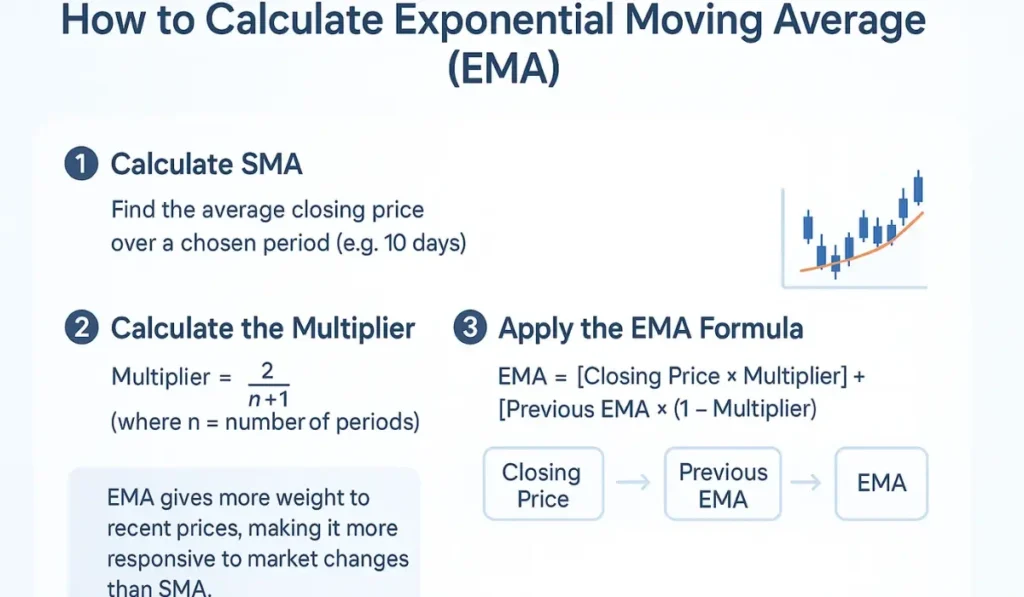

The calculation of EMA includes three key steps:

- Calculate the straightforward shifting common (SMA) by discovering the common closing value throughout a specified interval (eg, 10 days).

- Calculate the multiplier that determines how a lot weight is utilized to the most recent value. It’s calculated as:

Multiplier = 2 ÷ (n + 1)

The place n is the variety of intervals.

- Apply the EMA method:

EMA = [closing price of the stock x The multiplier] + [Previous day EMA x (1 – the multiplier)]

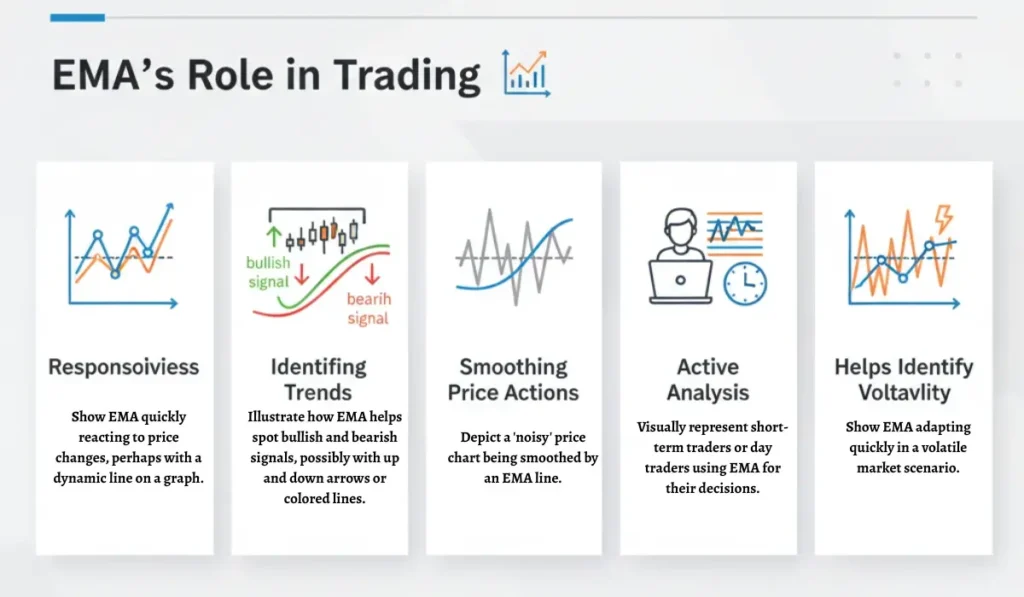

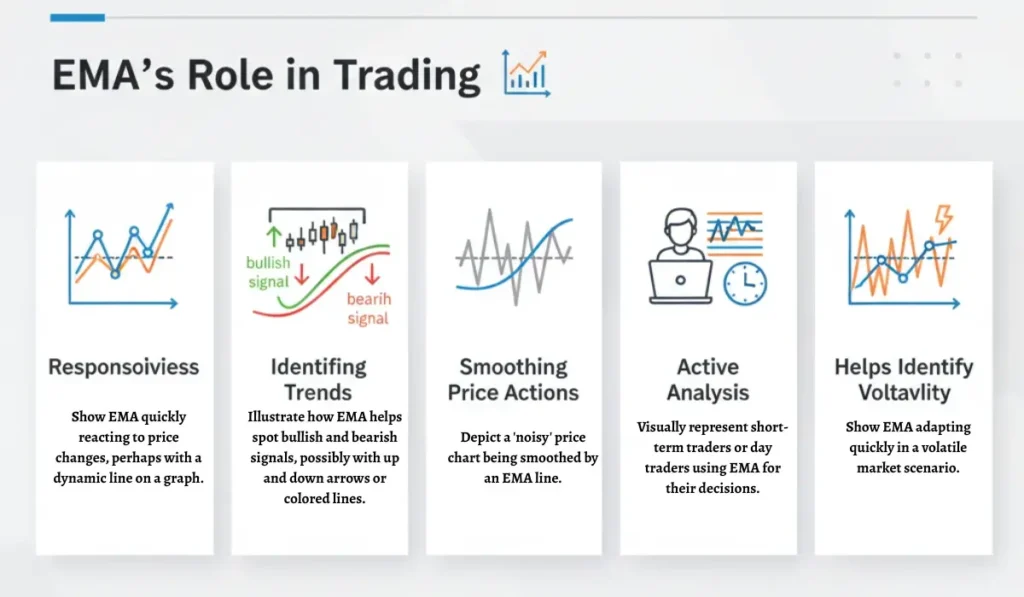

Exponential Shifting Common’s Function in Buying and selling

EMA is especially used for its means to detect short-term tendencies precisely. Some key benefits embrace:

- Responsiveness: EMA reacts quicker to market value modifications, making it extra appropriate for markets with excessive volatility.

- Figuring out tendencies: Bullish and bearish indicators may be recognized early utilizing EMA indicators, which assist mark entry and exit factors precisely.

- Smoothing value actions: EMA smooths out the worth actions, offering a cleaner pattern evaluation.

- Lively evaluation: The EMA is a popular software for short-term merchants and day merchants, who depend upon minor fluctuations out there costs.

- Helps establish volatility: In fast-moving or unstable markets, the flexibility of the EMA to shortly adapt to the worth modifications makes it a robust analytical software.

Limitations of Exponential Shifting Common

Whereas EMA has its plus factors in buying and selling, it isn’t with out drawbacks:

- Lagging Indicator: EMA is extra responsive in comparison with SMA, but it surely nonetheless reacts to cost modifications which have already occurred, and this results in lag throughout pattern reversal.

- False Alerts: Crypto markets are extremely unstable, EMA indicators usually are not 100% correct, and will generally produce false indicators, resulting in potential losses.

- Time Body Dependency: It is rather necessary to pick the correct timeframe, as it will probably have an effect on the accuracy of indicators.

Closing Ideas on Exponential Shifting Common

The exponential shifting common is a dynamic software that permits merchants to raised perceive tendencies and make knowledgeable selections. Its means to assign extra weight to the latest value knowledge helps traders to grasp market value momentum extra exactly. In the event you mix the EMA with different indicators, it will probably strengthen market evaluation, establish tendencies, mark entry and exit ranges, and considerably enhance timing.

Mastering EMA ideas and functions will present an enormous benefit to anybody trying to excel in monetary buying and selling and funding.

FAQs

The 50-day and 200-day EMAs are hottest and utilized by long-term traders.

EMA reacts faster to the present market costs; because of this, merchants desire utilizing EMA as a substitute of SMA.

Choosing the fallacious EMA intervals and never altering them when the market value modifications.

When the worth always exceeds the EMA, then it’s a bullish sign. If it falls beneath the EMA, it’s a bearish sign.

EMA is common amongst merchants for figuring out short-term tendencies utilizing intervals reminiscent of 12- and 26-day EMAs or for long-term tendencies with 50- and 200-day EMAs.

Additionally Learn: What’s the Relative Power Index? (RSI) How does it work?