Bitcoin is sitting on a technical ledge that might resolve whether or not value makes a brand new all-time excessive or unwinds sharply into the $80,000s, in accordance with veteran dealer Josh Olszewicz (CarpeNoctom). “BTC advanced iHS brewing within the megaphone,” he posted on October 30, 2025, including in a follow-up: “Additionally this brewing, not nice.”

The Bullish Case For Bitcoin

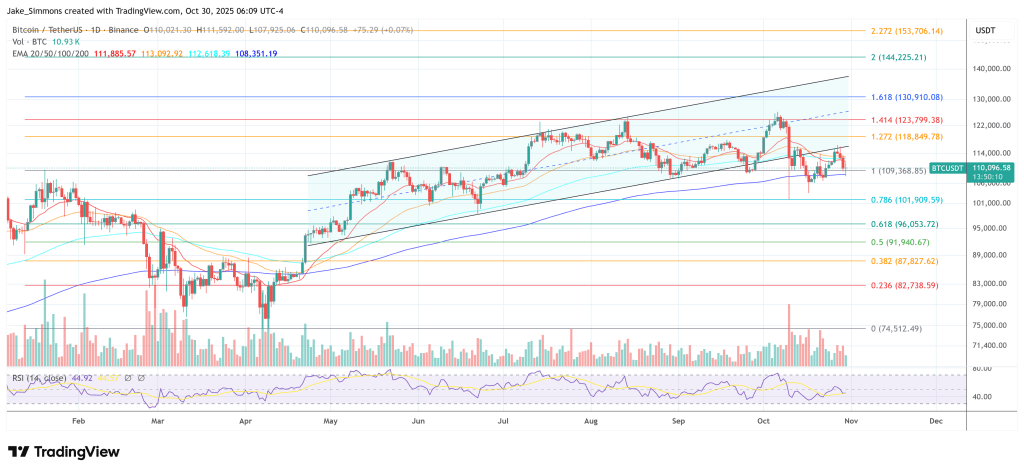

Olszewicz is monitoring two constructions. The primary, on the 6-hour timeframe, reveals BTC buying and selling inside a broadening “megaphone” sample that has contained value since July. The megaphone is outlined by rising dotted resistance strains above and falling dotted help strains under. The higher boundary extends by means of roughly $126,000 to $128,000. The decrease boundary widens down towards $105,400 and $103,800.

Inside that vary, Bitcoin put in a pointy spike above $126,000 in early October, then offered off violently, dropping under $106,000s with a wick towards roughly $102,000. That bounce did not get well the prior vary. As a substitute, value stalled beneath a horizontal resistance shelf round $116,000–$117,000. Olszewicz sketches a yellow projected path that means a short-term bounce from just below $111,000 again in the direction of $116,000. That path suggests tried reduction, not confirmed bullish continuation.

Associated Studying

Provided that Bitcoin can reclaim the $116,000–$117,000 zone does a transfer towards the higher resistance band come again into play. In that state of affairs, value may prolong towards $128,000, print a brand new all-time excessive, and probably restart a broader restoration section.

The Bearish Case For Bitcoin

The second chart is the place the draw back threat accelerates. On the 1-day timeframe, Olszewicz maps a head-and-shoulders prime with a rising neckline. The left shoulder topped within the $118,000 space, the top reached roughly $126,200, and the fitting shoulder once more failed close to $116,000. The neckline is drawn as an ascending dotted help line that now sits within the $105,000–$106,000 zone. He highlights $107,316.81 as the important thing breakdown degree.

If that neckline breaks decisively, the chart applies an ordinary measured transfer. The space from the top all the way down to the neckline is projected decrease. Olszewicz plots that extension right into a teal goal zone and marks intermediate and full targets at $93,963.81 (the 1.618 extension) and $87,652.27 (the two.0 extension). In different phrases, a clear every day breakdown by means of $107,316 opens a path first towards the mid-$90,000s after which towards roughly $87,600.

Associated Studying

Above spot, resistance stays layered. The 0.5 retracement of the prior impulse is labeled at $115,486, and the 1.0 retracement — successfully the earlier swing excessive — is marked at $124,477.

Structurally, Bitcoin is now boxed between provide within the $116,000 area and that neckline helps round $105,000–$106,000. Olszewicz’s message is that bulls should be attempting to kind a “advanced inverse head-and-shoulders within the megaphone,” however the lively every day head-and-shoulders prime is “not nice.” A decisive lack of the neckline may affirm the bearish construction and put $93,963.81 and $87,652.27 on the desk.

At press time, BTC traded at $110,096.

Featured picture created with DALL.E, chart from TradingView.com