If I needed to choose one single inventory to kind the core of my portfolio, it could be Enbridge (TSX:ENB). For Canadian traders looking for reliable passive earnings, Enbridge has confirmed to be a dependable cash-flow machine, churning out juicy dividends to traders by each possible financial cycle. It’s a primary candidate for a long-term “buy-and-hold” funding technique, particularly in a retirement account. Its historical past exhibits precisely why it has nearly by no means upset loyal, income-oriented traders.

Enbridge inventory: A dividend historical past you possibly can financial institution on

Enbridge boasts an expansive asset base comprised principally of pipelines that proceed to circulation all through all financial seasons. It’s greater than only a dependable dividend payer; it’s a constant dividend grower. The corporate has proudly paid dividends to its shareholders for over 70 years. Much more impressively, it has elevated its payout for 29 consecutive years.

Simply take into consideration that: this payout has survived the previous eight financial recessions. Whereas different firms have been chopping or suspending their dividends in periods of market panic, Enbridge inventory’s 29-year dividend progress spree continued proper by the three most up-to-date downturns.

Enbridge’s dividend stability and dependability present constant portfolio money circulation and dependable passive earnings, which is strictly what so many people want – extra so throughout robust financial instances. This unmatched monitor report alone makes it a prime Canadian dividend inventory to purchase now.

Extra than simply earnings: ENB inventory a complete return powerhouse

Whereas Enbridge’s present 5.7% dividend yield is the primary attraction for earnings seekers, early traders have additionally been handsomely rewarded with capital positive factors. The actual magic occurs if you mix the 2.

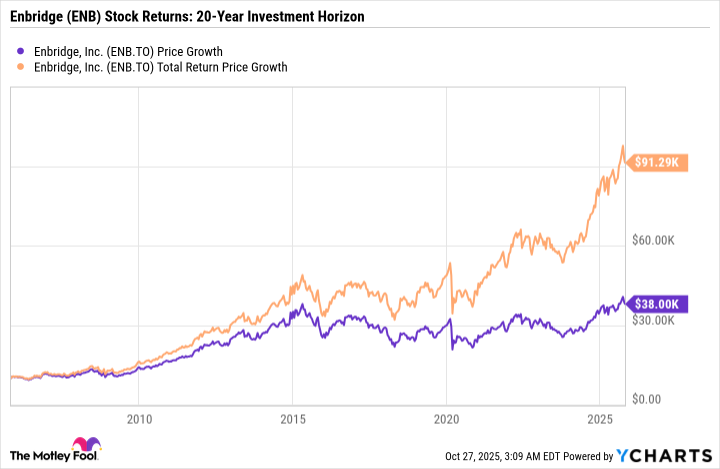

A $10,000 funding in Enbridge inventory 20 years in the past, with all dividends reinvested, might have grown to over $91,000. That’s a staggering complete return of 813%.

Even for those who had spent each single dividend cheque alongside the best way, your preliminary $10,000 capital would nonetheless have grown to $38,000, a 280% capital achieve.

Enbridge’s dividends have been a large and significant element of the long-term complete returns from proudly owning ENB inventory.

How will Enbridge fund future payouts

Previous efficiency is nice, however how will Enbridge preserve rewarding traders for the subsequent decade?

The corporate’s enterprise is constructed on a large, low-risk basis. Enbridge owns an intensive and irreplaceable community of midstream property, transporting about 30% of all crude oil produced in North America. It additionally operates Canada’s largest pure fuel distribution firm. It is a steadily rising enterprise producing over 98% of its earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) from regulated property or long-term contracts. Its income and earnings stay comparatively resistant to U.S. tariffs on Canadian vitality, and Enbridge’s enterprise mannequin insulates it from wild swings in commodity costs.

Enbridge is rising its footprint; its current quarterly outcomes show the expansion story is accelerating. The corporate delivered report second-quarter EBITDA. Extra importantly, Enbridge is actively funding its subsequent decade of dividends by sanctioning new tasks. It not too long ago green-lit the US$0.9 billion Clear Fork Photo voltaic challenge to assist Meta Platforms’s (NASDAQ:META) knowledge centre operations and new expansions to its fuel pipelines to serve rising industrial demand and the LNG export market.

The corporate is leveraging its income and money circulation stability to develop by a $32 billion secured capital program. This contains investing closely in its fuel transmission and renewables companies to serve the surging energy demand from new industries like synthetic intelligence (AI) knowledge centres. Administration expects funding packages to assist 5% annual progress in distributable money circulation (DCF) per share after 2026. DCF funds dividends, and a rising DCF helps sustainable dividend progress into the longer term.

Investor takeaway

Enbridge inventory is a defensive funding that gives a gorgeous bundle of excessive yield and regular progress. With a powerful steadiness sheet, an investment-grade credit standing, and a transparent plan for progress, this can be a dividend progress inventory that actually lets long-term traders sleep properly at night time.