Bitcoin (BTC) is displaying renewed energy, reclaiming the $115,000 degree after weeks of volatility and uncertainty. Bulls try to construct momentum for a possible impulse transfer greater, aiming to substantiate a sustained bullish construction after the latest consolidation section.

Associated Studying

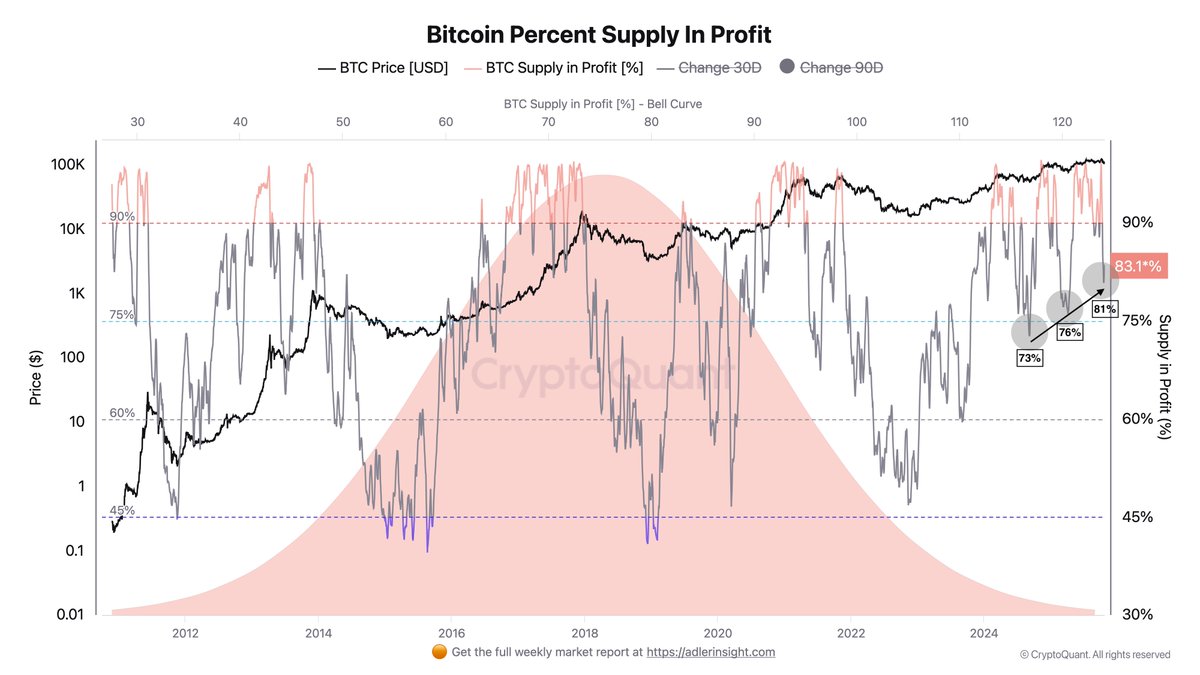

On-chain information continues to disclose a transparent and repeating sample tied to investor conduct and market cycles. Traditionally, when the proportion of Bitcoin provide in revenue climbs above 95%, the market tends to enter an overheated section, typically resulting in sharp corrections. These pullbacks function pure cooling durations, resetting sentiment and liquidity earlier than the subsequent main leg up.

Apparently, every correction cycle has proven constant bottoming zones across the 75% threshold, the place long-term holders reaccumulate and market confidence begins to rebuild. Extra particularly, information highlights revenue provide lows of 73% in September 2024, 76% in April 2024, and a latest rebound from 81%, signaling a possible mid-cycle restoration section.

Bitcoin Provide in Revenue Rises to 83.6% — Momentum Rebuilds Forward of Key Threshold

In accordance with prime analyst Darkfost, the proportion of Bitcoin provide in revenue has began to climb once more, at the moment standing at 83.6%. This regular rise signifies {that a} rising share of Bitcoin holders are as soon as once more sitting on unrealized beneficial properties — a pattern that always displays bettering sentiment and renewed market confidence.

Darkfost notes that this degree might be interpreted as encouraging, suggesting that buyers are prepared to carry their BTC as an alternative of realizing income, anticipating additional upside within the close to time period. Traditionally, such conduct has been attribute of mid-cycle restoration phases, when concern begins to fade and accumulation resumes throughout each retail and institutional segments.

This stage of the cycle is taken into account wholesome for rebuilding momentum, because it permits the market to stabilize after giant corrections. Holders who beforehand capitulated typically reenter at this stage, whereas long-term individuals strengthen their positions, making a extra resilient market construction.

Nonetheless, Darkfost cautions that when the availability in revenue surpasses 95%, it usually indicators overheated market circumstances — a degree the place euphoria tends to interchange rational conviction. In such phases, Bitcoin traditionally faces elevated volatility and sharp corrections as overleveraged merchants and short-term speculators take income.

Associated Studying

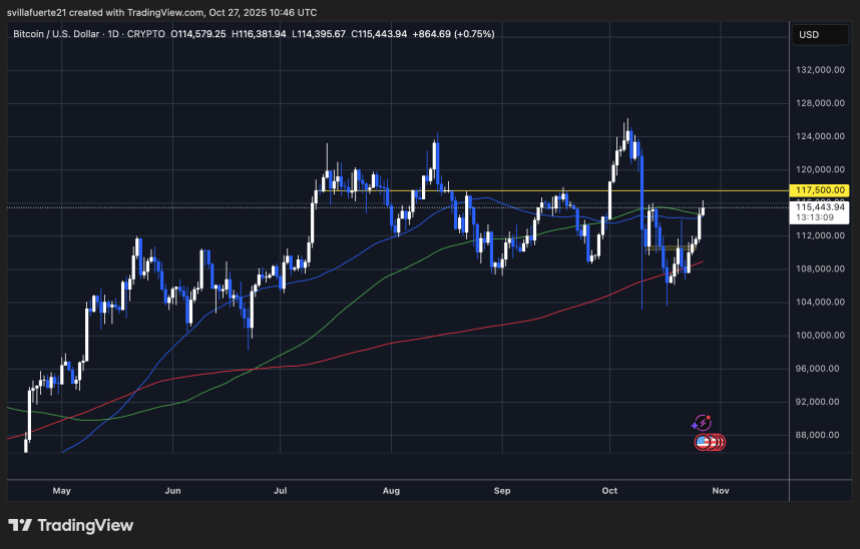

BTC Retests $115K Resistance: Bulls Regain Momentum

Bitcoin (BTC) is displaying renewed bullish momentum, buying and selling round $115,443 and efficiently reclaiming key short-term assist ranges after weeks of consolidation. The day by day chart highlights a robust restoration construction, with BTC breaking above each the 50-day and 100-day transferring averages, signaling a shift in short-term market sentiment.

The subsequent crucial take a look at lies at $117,500, a historic resistance zone that beforehand rejected a number of makes an attempt in September and early October. A transparent breakout and day by day shut above this degree would possible verify an impulse continuation towards $120K–$125K, opening the door for a extra sustained uptrend.

Associated Studying

Momentum indicators recommend strengthening shopping for strain, whereas the latest bounce from the 200-day transferring common close to $107K underscores the market’s resilience. This degree acted as a springboard for the present rally, aligning with the broader sample of accumulation seen on-chain, the place investor profitability is rising steadily.

Nonetheless, BTC stays inside a range-bound construction, and rejection at $117.5K may set off short-term consolidation again towards $111K–$112K. General, Bitcoin’s technical outlook seems constructive — if the bulls can maintain above $115K and make sure energy above $117.5K, the market may transition into a brand new bullish leg, supported by bettering investor sentiment and on-chain well being.

Featured picture from ChatGPT, chart from TradingView.com