Key Takeaways

- Basic evaluation (FA) in crypto is a standard technique of analyzing and evaluating the financial and monetary components that influence the intrinsic worth of a crypto.

- Basic evaluation permits buyers to establish undervalued property.

- FA makes use of components just like the undertaking’s know-how, use circumstances, improvement crew, and tokenomics.

- Basic evaluation is subjective and a time-consuming course of.

Introduction

The final word purpose of varied analyses is to achieve a complete understanding of the actual factor we talk about. Within the cryptocurrency sector, there isn’t a precise science or idea; all you’ve is a few knowledge and a few instruments to research it. Basic Evaluation (FA) in crypto is without doubt one of the two methods used to review and perceive the best way the crypto market capabilities.

Basic evaluation is vital in crypto as a result of it lets you decide a crypto undertaking’s worth, long-term potential, and sustainability. FA consists of checking varied components, together with the cryptocurrency’s utility, market cap, progress potential, and the developer crew behind the undertaking and so on. This text comprehensively discusses the concept of basic evaluation in crypto.

What’s Basic Evaluation in Crypto?

Basic evaluation in crypto refers back to the complete analysis technique used to search out out the intrinsic worth of a crypto asset by inspecting the components affecting its potential and sustainability. The final word purpose of basic evaluation is to find out whether or not the cryptocurrency is undervalued or overpriced so buyers could make knowledgeable long-term funding selections and test if the undertaking has sufficient potential for substantial progress.

Conducting a basic evaluation, the buyers ought to perceive that the method isn’t just analyzing the undertaking’s future or potential of an asset by its prior efficiency and up to date market momentum. The elemental evaluation takes under consideration each micro and macroeconomic circumstances that may make a huge impact available on the market and the way forward for that specific asset.

Whereas conducting a basic evaluation of a cryptocurrency, buyers ought to take into account components just like the undertaking’s developmental crew, ecosystem progress, know-how used, use case, tokenomics, group help, and on-chain metrics, and so on. The idea of FA is totally different from technical evaluation (TA), which solely makes use of historic worth knowledge to foretell the short-term and long-term worth of a crypto asset.

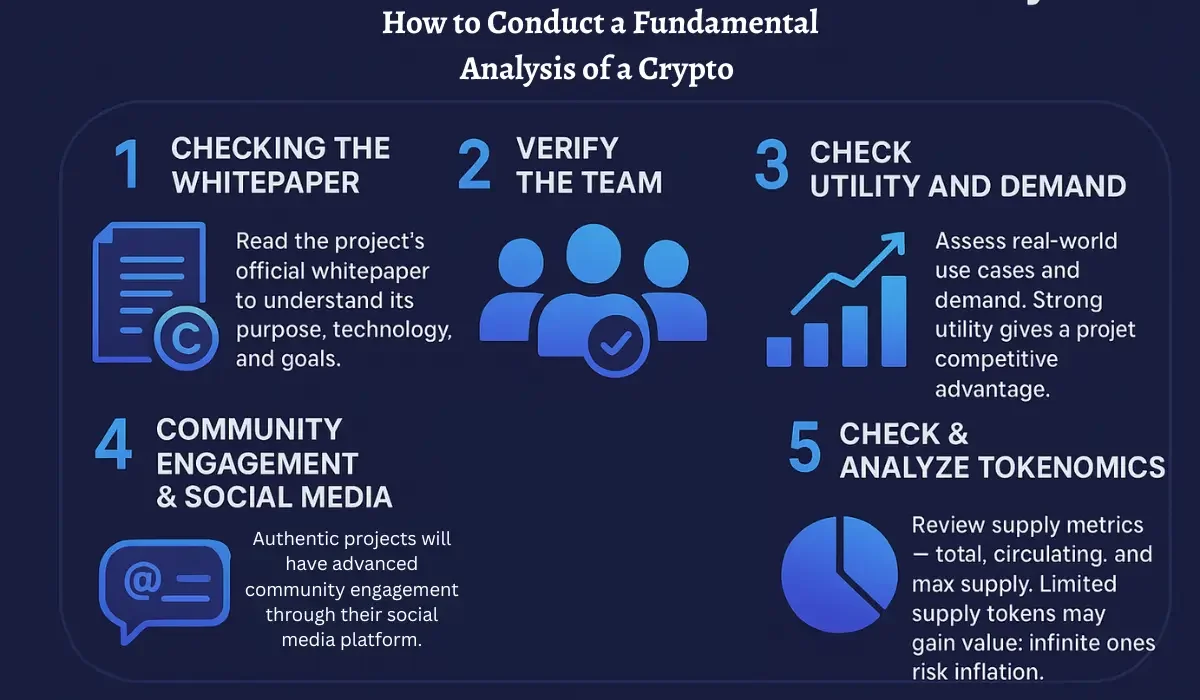

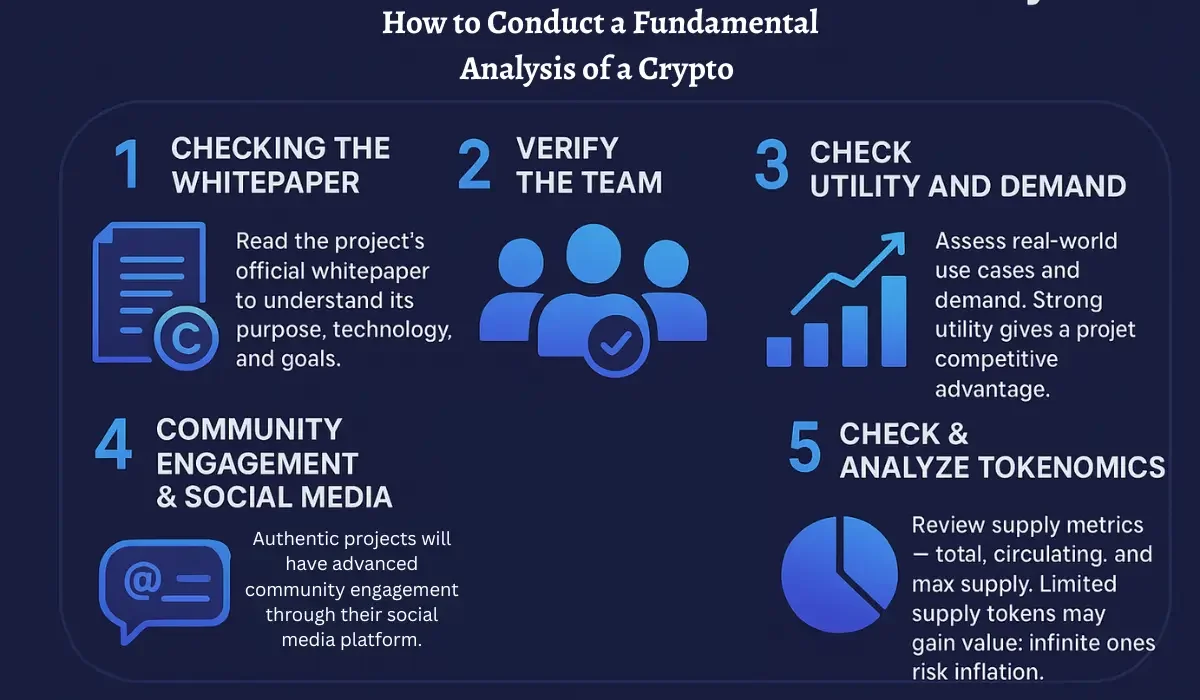

Easy methods to Conduct a Basic Evaluation of a Crypto

Cryptocurrencies are decentralized, which implies there isn’t a centralized authority to supervise their functioning, making it tough to test whether or not a crypto undertaking is genuine or not. Some frequent metrics that buyers can use for crypto basic evaluation are whitepaper, know-how crew, and use circumstances.

1. Checking Whitepaper

A cryptocurrency whitepaper is a foundational doc of a crypto undertaking that explains each element of the undertaking, together with its goal, know-how, objectives, and roadmap. This doc can be genuine and launched by the builders of the actual crypto undertaking. In a crypto white paper, buyers will get clear and concise data on the actual drawback the undertaking offers with and the way it will likely be solved. Checking the whitepaper is step one whereas conducting a basic evaluation of a crypto undertaking. For those who can’t discover the official whitepaper wherever, the undertaking is likely to be a fraudulent one or much less credible.

2. Confirm the Group

Checking and verifying the credibility of the crew is the subsequent step whereas conducting a basic evaluation. Analysis concerning the earlier file and expertise of the event crew, founders, and advisors of the undertaking. A robust and dependable improvement crew is the primary signal of an genuine crypto undertaking. If the crew is concerned in any earlier fraudulent or malicious actions, you’ll be higher off staying away from the undertaking.

3. Examine the Utility and Demand of the Undertaking

A crypto undertaking or cryptocurrency must have a utility worth and a number of use circumstances. Consider the real-world utility and demand of the undertaking. By evaluating it, you may evaluate the undertaking’s worth towards the direct rivals and in the end perceive the aggressive benefit of that specific undertaking. Whereas conducting a basic evaluation, Traders ought to take into account the undertaking’s technical facet in addition to its utility.

4. Neighborhood Engagement & Social Media Presence

Genuine tasks could have superior group engagement by way of their social media platform. Whereas conducting a basic evaluation of a crypto undertaking, look at whether or not the undertaking has an official web site and accounts on distinguished social media platforms like X, Discord, and Telegram. A vibrant group is a constructive sign and may show help and resilience.

5. Examine & Analyze the Tokenomics

Understanding the tokenomics has a key position within the crypto basic evaluation. Whereas checking the tokenomics, consider the overall provide, circulating provide, and most provide of the actual cryptocurrency. A token with a restricted most provide can be deflationary and topic to worth enhance over time; in the meantime, a undertaking with an infinite token provide could face inflationary pressures sooner or later.

These are a number of the strategies you should utilize to conduct a basic evaluation of a crypto. Basic evaluation in crypto is a mix of each qualitative and quantitative evaluation; you could test components just like the developer crew and tokenomics on the similar time. Folks usually confuse basic evaluation and technical evaluation. Right here is the distinction between these two.

What’s the Distinction Between Basic Evaluation(FA) and Technical Evaluation(TA) in Crypto?

| Characteristic | Basic Evaluation (FA) | Technical Evaluation (TA) |

| Definition | Researching and learning a crypto undertaking by analyzing components past the value chart. | Evaluating a crypto undertaking by analyzing historic market knowledge (worth, quantity) to foretell future actions. |

| Major Focus | Inspecting the intrinsic worth of a crypto. | Inspecting the crypto utilizing technical indicators and patterns. |

| Key Components/Instruments | Undertaking’s know-how, use circumstances, improvement crew, tokenomics, and so on. | RSI (Relative Energy Index), MACD (Shifting Common Convergence Divergence), transferring averages, help/resistance ranges. |

| Primary Goal | To seek out whether or not the undertaking is undervalued or overvalued. | To establish entry and exit factors for a commerce. |

| Foundation of Analysis | Components that decide the undertaking’s long-term potential and real-world utility. | Market psychology mirrored in worth motion and quantity. |

| Time Horizon | Sometimes used for long-term funding selections. | Primarily used for short- to medium-term buying and selling selections. |

Basic and Technical evaluation are two totally different however complementary ideas. Basic evaluation could be outlined as researching and learning a selected crypto undertaking by analyzing components past the value chart. On the similar time, technical evaluation evaluates a crypto undertaking by analyzing historic market knowledge, reminiscent of worth and quantity, and predicts its attainable future actions.

Basic evaluation primarily focuses on inspecting the intrinsic worth of a crypto by contemplating components such because the undertaking’s know-how, use circumstances, improvement crew, and tokenomics, and so on. Technical evaluation examines the crypto utilizing technical indicators like RSI (Relative Energy Index), MACD (Shifting Common Convergence Divergence), transferring averages, and help/resistance ranges to forecast the worth. FA goals to search out whether or not the undertaking is undervalued or overvalued, however the goal of TA is to establish entry and exit factors of a crypto.

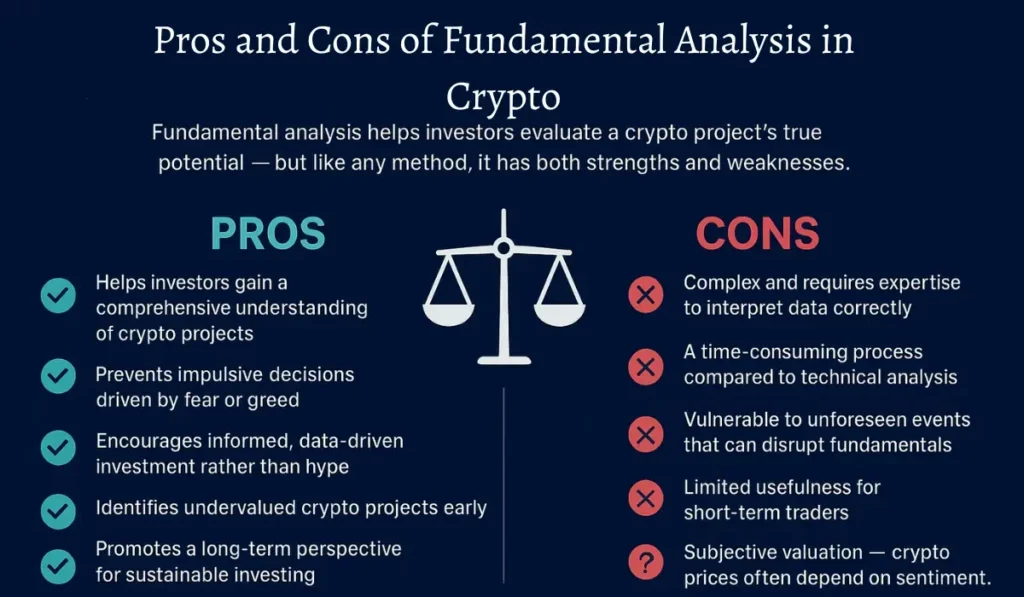

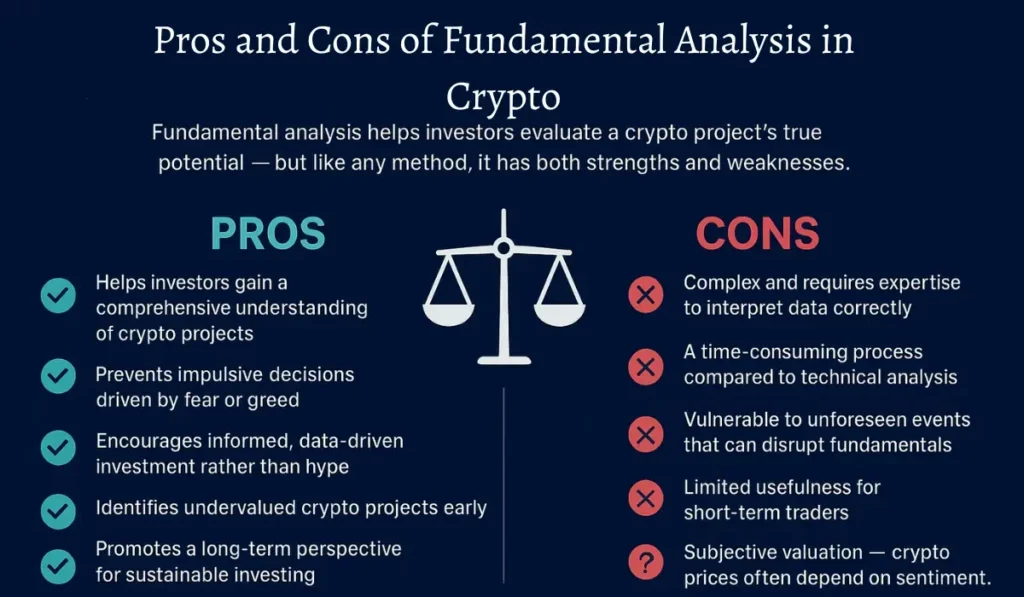

Professionals and Cons of Basic Evaluation in Crypto

Basic evaluation is a extensively accepted and used technique in crypto, but it has a number of benefits and downsides. Listed here are some main professionals and cons of basic evaluation in crypto.

Professionals

- Assist buyers get a complete understanding of the crypto undertaking

- Traders can keep away from impulsive or fear-and-greed-based selections

- Assist buyers make knowledgeable funding selections as an alternative of following false market hype.

- Basic evaluation helps buyers establish undervalued crypto tasks

- FA encourages a long-term perspective on a crypto undertaking.

Cons

- Basic evaluation is complicated and usually calls for knowledgeable people

- It’s a time-consuming course of

- Basic evaluation is susceptible to unexpected occasions

- FA has restricted relevance for short-term buying and selling

- Problem with goal valuation, since crypto valuation is extremely subjective.

These are a number of the vital benefits and downsides of basic evaluation in crypto. The method all the time helps long-term buyers, and the cons are primarily as a result of crypto market’s distinctive traits.

The Backside Line

Basic evaluation in crypto is a technique of evaluating a digital asset’s intrinsic worth by analyzing its fundamentals just like the undertaking’s crew, know-how, tokenomics, and group and so on. Basic evaluation in crypto is important as a result of it might probably assist buyers get a complete understanding of a selected crypto undertaking offers with and decide if the crypto is undervalued. Traders ought to pay attention to the intrinsic worth of a crypto past its short-term market hype and volatility. Basic evaluation helps them get an thought of a crypto’s intrinsic worth.