Delta Fusion Professional — Delta Profile and Internet Delta

On this first article, we focus solely on two core elements of Delta Fusion Professional: Internet Delta (the “internet” shopping for/promoting strain over time) and Delta Profile (the distribution of delta by value stage inside the session). The objective is to grasp what they measure, how the indicator calculates them, and the best way to interpret them on the chart.

Delta Fusion Professional is an MT4 indicator for order stream and intraday delta evaluation that features, amongst others, the next modules: NetDelta, Delta Profile, POC Delta, Imbalance, Infusion Quantity, VWAP Delta, and an on-chart management panel.

These options are listed within the description and configured by way of devoted enter parameters within the supply code.

1) What Is Internet Delta

Definition (how the indicator calculates it)

In the principle calculation cycle, the indicator estimates for every bar the “market” contribution on the Ask facet (aggressive buys) and the Bid facet (aggressive sells), aggregating them because the bar delta.

These contributions are smoothed utilizing an EMA (configurable interval) after which mixed as:

Internet Delta = EMA(Ask) − EMA(Bid) textual content{Internet Delta} = textual content{EMA(Ask)} – textual content{EMA(Bid)} Internet Delta=EMA(Ask)−EMA(Bid)

— saved within the NetDelta buffer.

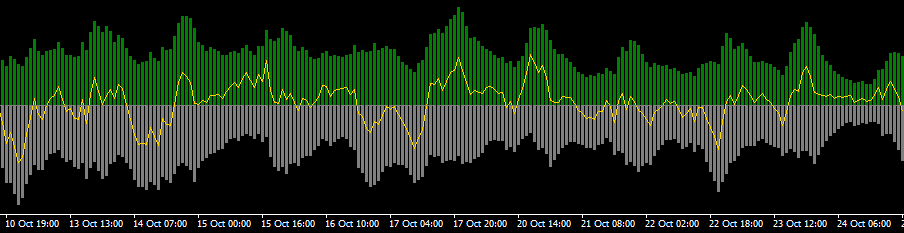

The 2 histograms within the subwindow show CumAsk (inexperienced, optimistic values) and CumBid (pink, plotted with a adverse signal for visible separation).

Intimately, the operate GetTickDeltaAskBid() allocates the candle’s tick_volume between Ask and Bid based mostly on the candle’s construction (physique and wicks):

-

if bullish (shut > open), extra weight is assigned to Ask;

-

if bearish, to Bid;

-

if doji, the break up is symmetric.

This estimate is then smoothed with SmoothEMA() earlier than reaching

NetDelta[i] = emaA[i] – emaB[i] .

The place to see it on the chart

In OnInit() , the buffers are outlined as follows: CumAsk and CumBid as histograms, NetDelta as a line; default colours are outlined within the indicator’s properties (inexperienced/grey/gold/blue/… relying on buffer index).

Key Parameters

Easy methods to interpret it (in apply)

-

Above zero → dominance of aggressive shopping for

-

Beneath zero → dominance of aggressive promoting

-

Will increase/squeezes in Internet Delta can anticipate or verify value accelerations;

decays can sign momentum exhaustion.

The CumAsk/CumBid histogram helps visualize when one facet is really dominant inside a time window (the panel additionally computes Purchase/Promote % because the share of |CumAsk| and |CumBid| within the session).

Be aware: Divergence logic and different sign modules (Imbalance, Infusion, Splash, and so on.) additionally use NetDelta, however they are going to be lined in devoted articles. [deltafusionpro]

2) What Is the Delta Profile

Primary thought

The Delta Profile distributes delta (internet or absolute) throughout value ranges inside the present session (outlined by a customizable reset hour).

The result’s a horizontal “map” highlighting at which costs extra optimistic delta (aggressive shopping for) or adverse delta (aggressive promoting) has amassed.

Primary Parameters (defaults from code)

-

EnableDeltaProfile = true → toggles profile on/off.

-

VP_ModeSel :

-

VP_AnchorSel : RIGHT (default) or LEFT → the place to anchor the profile rectangles on the chart.

When anchored proper, the code mechanically reserves margin area and maintains it on zoom/pan. -

VP_UpdateEveryN = 20 → refresh frequency (in bars) when the session stays the identical.

-

VP_MaxBins = 120 , VP_TopN = 30 → most granularity and variety of high ranges drawn (solely essentially the most related ones to keep away from muddle).

-

VP_BarsWidthMax = 10 , VP_RightPadBars = 3 , VP_KeepSpaceOnZoom = true → management most rectangle width (in “bars”), proper padding, and spacing on zoom.

-

VP_ColorPos = Lime , VP_ColorNeg = Tomato , VP_ShowZeroNodes = false → shade settings and visibility of zero nodes.

In ABS mode, a single optimistic shade is used. [deltafusionpro]

Computation Workflow (step-by-step from code)

Session detection

GetSessionStart() builds a each day timestamp utilizing ResetHourCustom/ResetMinuteCustom ; if the present time is earlier, it rolls again to the day gone by.

Every part after that processes solely bars ≥ session begin.

Session value vary and vertical step

The indicator estimates the session’s min/max (sesMin/sesMax) and defines a step measurement (peak of value bins).

If not already decided by an autotuning routine (additionally used for POC), the step is derived adaptively (based mostly on ATR/median current volatility) and aligned to tick measurement if required.

If the bin depend exceeds VP_MaxBins , the code applies a stride to cut back bins whereas preserving whole vary.

Delta accumulation per bin

For every bar within the session (excluding reside bar if configured), delta is computed as

dn = dA[i] − dB[i] (or |dn| in ABS mode) and distributed throughout all bins spanned between low[i] and excessive[i] (uniformly).

If the candle has zero vary, delta goes instantly into the shut’s bin.

Stage choice and drawing

VP_DrawProfile() selects the High-N bins by absolute magnitude, then attracts for every a horizontal rectangle with peak = step and width proportional to its weight vs. the utmost ( s/vmax * eff ).

-

Coloration: NET mode → inexperienced if ≥ 0, pink if < 0; ABS mode → single shade.

-

Anchor: proper or left; when anchored proper, EnsureRightMarginForProfile() at all times maintains enough visible area.

Environment friendly updating

The profile is recalculated when the session adjustments, when VP_UpdateEveryN bars have handed because the final construct, when chart/zoom triggers a redraw, or when whole bar depend adjustments.

Easy methods to learn it (in apply)

-

Inexperienced zones (NET) = value ranges dominated by aggressive shopping for

-

Pink zones = dominated by aggressive promoting

-

Extensive or repeated zones mark “scorching” value ranges the place stream was vital — helpful for figuring out flow-based help/resistance and commerce location.

-

In ABS mode, focus shifts to depth (no matter course), useful for recognizing stream confluence areas.

3) Internet Delta vs. Delta Profile: Why They’re Complementary

-

Internet Delta is a time sequence — it tells you when strain shifts.

-

Delta Profile is a value distribution — it tells you the place that strain concentrates.

Used collectively, they supply a time × value map of aggressive stream, extraordinarily helpful for filtering entries/exits and contextualizing intraday strikes.

4) Fast Platform Setup (from the indicator interface)

-

Toggle Delta Profile ON/OFF from the on-chart panel (“Delta Profile: ON/OFF”).

Anchor, colours, High-N, and granularity might be adjusted from the indicator inputs.

When anchored proper, margin area is managed mechanically so candles stay seen. -

Observe Internet Delta within the subwindow: Ask/Bid histograms + Internet Delta line.

The SmoothPeriod parameter controls sign responsiveness (increased = smoother, much less reactive).

Tip:

For intraday scalping, preserve VP_UpdateEveryN comparatively low to have a recent profile;

on slower timeframes, enhance it for effectivity.

(Scheduling and refresh logic are managed in OnCalculate and auxiliary capabilities.)

Conclusions

With Internet Delta, you perceive who’s pushing over time;

with Delta Profile, you see the place that push takes form in value.

Within the subsequent article, we’ll transfer on to different modules of the bundle — similar to POC Delta and VWAP Delta — to finish the stream studying framework.