Key Factors

- The crypto market is having a troublesome time amid the rising macro uncertainties, whereas flagship tokens are exhibiting resilience.

- Robinhood listed Binance coin BNB immediately, and Coinbase confirmed the plans to listing BNB.

- The main Crypto change Kraken has launched its Q3 income report, exhibiting document income development.

- The Hong Kong Securities and Futures Fee (SFC) has given a inexperienced gentle to the primary Solana spot Change Traded Fund.

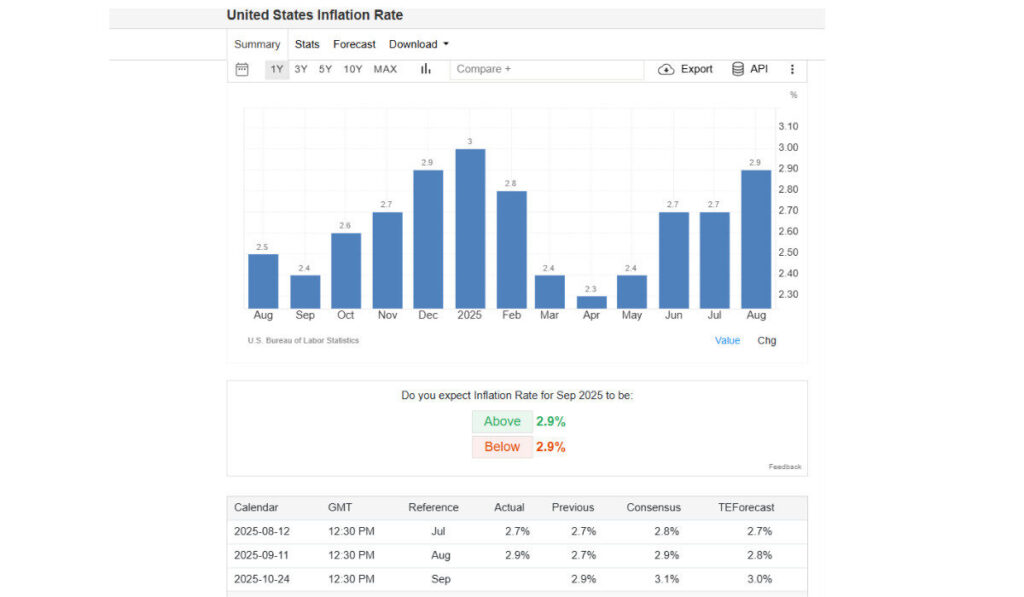

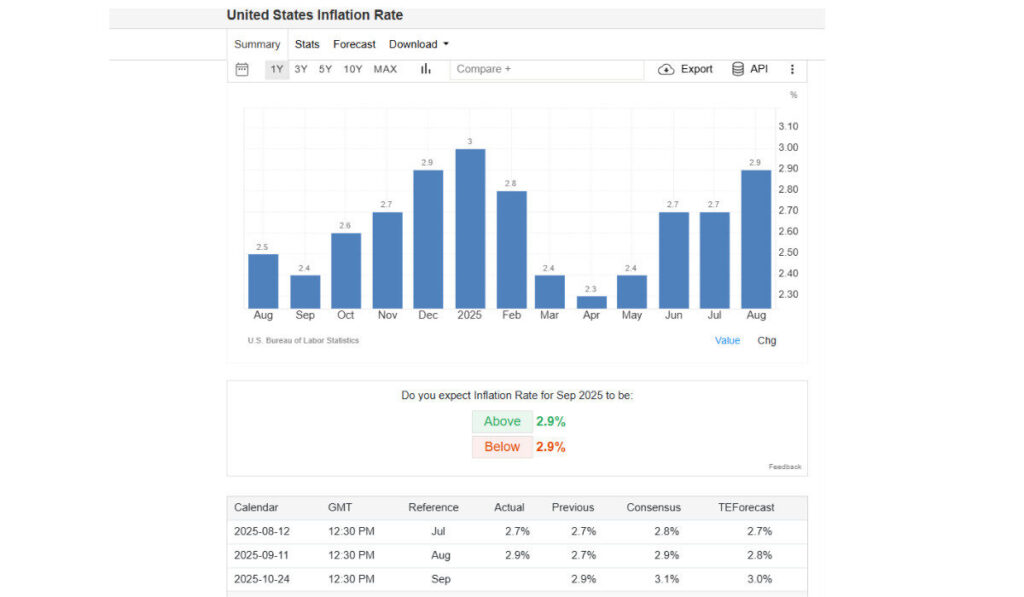

- The following greatest take a look at for the crypto market is the Shopper Worth Index (CPI) information launch by the U.S. Bureau of Labor Statistics (BLS) on Friday, October 24.

The crypto market is having a troublesome time amid the rising macro uncertainties. Regardless of the difficult occasions, the main cash are exhibiting appreciable resilience. The brand new partnerships and integrations inside the ecosystem are including a renewed vigor to the ecosystem, which had been battered by the latest macro headwinds starting from geopolitical tensions between the world’s two largest economies to political protests sweeping the united statesstreets amid the U.S. authorities shutdown.

What Occurred to Bitcoin In the present day?

At press time, the bitcoin value is round $111,074.02 (on the time of writing), and the value has elevated by 1.84% up to now 24 hours. The token efficiently held the Fibonacci assist ranges of 106K and 109K.

Regardless that the general momentum stays bearish, the token is buying and selling above the 10-day Exponential Shifting Common. With analysts having combined views on BTC’s rally, the buyers are taking a cautious strategy with the upcoming inflation information launch on the horizon.

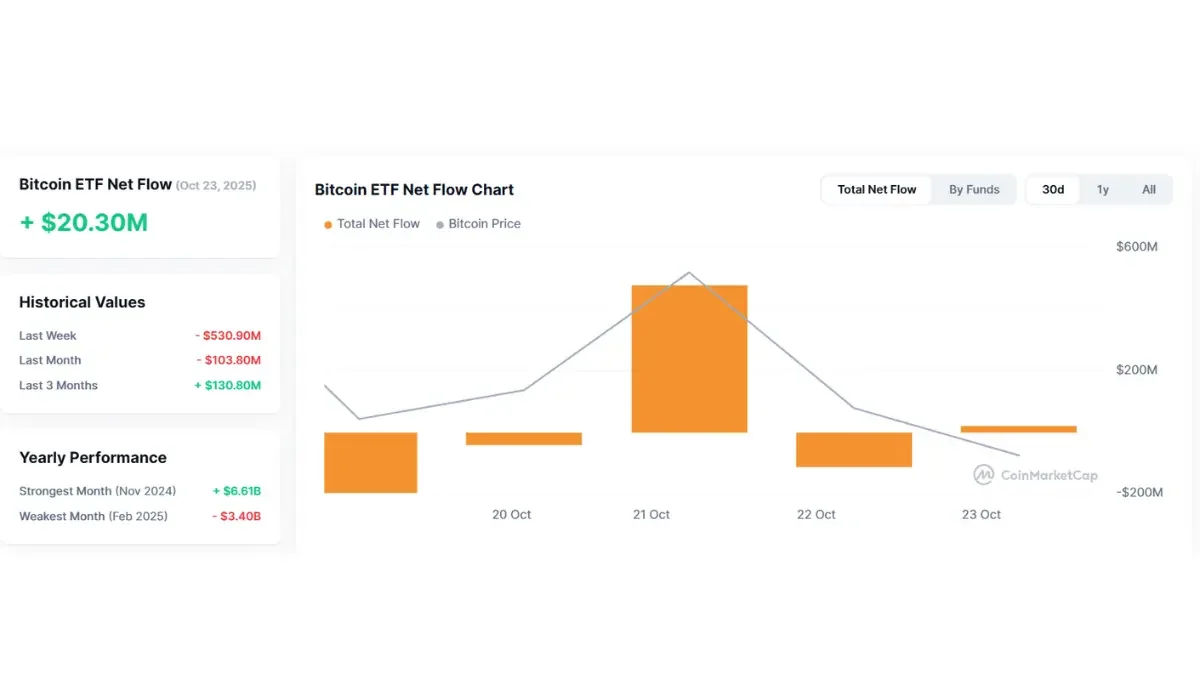

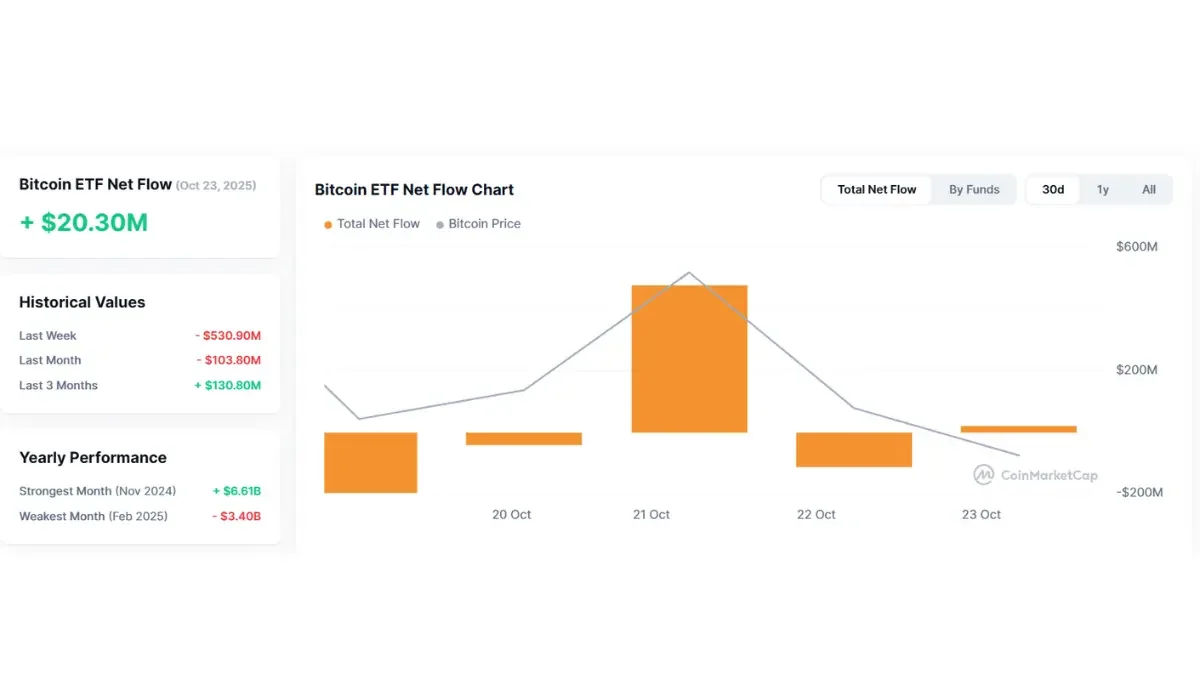

Furthermore, the BTC ETF recorded a web stream of $20.30 million on October 23.

Supply: CoinMarketCap

ETH and XRP are Sending Combined Indicators because the Broader Crypto Market is Nonetheless Below Macro Strain

On the time of writing the article, Ethereum (ETH) is priced at $3,977.7, and the market cap of the second-largest cryptocurrency has touched $468.55 billion.

The technical indicators are giving combined alerts, however are kind of inclined in direction of bearish sentiments. XRP, then again, is buying and selling round $2.40; the value marked a slight improve up to now 24 hours. The market cap reached $144.43 billion regardless of technical indicators sending bearish alerts.

The general crypto market touched 3.72 trillion, and the market stays cautious with Concern and Index worth of 32. The crypto market acquired bullish alerts following occasions akin to new partnerships and crypto ETF approvals in Hong Kong. The next are key occasions which can be shaping the crypto panorama immediately. The next are the important thing crypto market indicators and their worth.

|

Market Cap 9931_c730c0-dc> |

3.72Trillion 9931_24bd1e-4d> |

|---|---|

|

Concern and Greed Index 9931_d2a596-49> |

32 (Concern) 9931_411390-6f> |

|

Altcoin Season Index 9931_c0c9d4-45> |

24 ( Bitcoin season) 9931_a3ecff-0e> |

|

Common Crypto RSI 9931_6e3c75-c7> |

48.19 (Impartial) 9931_38ae3e-ec> |

Robinhood Lists BNB and Coinbase Verify the Itemizing

Robinhood listed Binance coin BNB, sending bullish alerts to the BNB. One other notable occasion is Coinbase confirming the plans to listing BNB. The transfer is notable as Binance is the previous’s largest competitor. The BNB has a market cap of $155.56, rating fourth among the many cryptocurrencies. The buyers at the moment are carefully watching whether or not the information relating to the itemizing can truly nullify the constructing macro strain.

Kraken Q3 Income Report Provides Confidence to the Crypto Ecosystem

The main Crypto change Kraken has launched its Q3 income report. The main highlights of the report embrace income reaching $648.0 million, a 50% rise from the earlier quarter. The Whole platform transaction quantity recorded a 23% quarterly enchancment.

The Kraken had earlier expanded its product choices in Q3 by including xStocks. The notable trade acquisition contains the Small Change, a CFTC-licensed Designated Contract Market (DCM) acquisition, marking Kraken’s increasing presence within the U.S. The outstanding income achievements are reinforcing confidence within the crypto ecosystem, because the unsure macroenvironment is placing the market below strain.

The Hong Kong SFC Approves First SOL ETF, Set to Begin Buying and selling on October 27

The Hong Kong regulator, Securities and Futures Fee (SFC), has given a inexperienced gentle to the primary Solana spot Change Traded Fund. ChinaAMC Solana ETF, issued by China Asset Administration (Hong Kong), is scheduled to go reside on the Hong Kong Inventory Change on October twenty seventh. It’s price noting that Hong Kong’s SFC’s approval transpired whereas the ETF approvals in the united statesare in limbo because of the ongoing U.S authorities shutdown.

The ETFs, akin to Grayscale Litecoin Belief, Grayscale Solana Belief, VanEck Solana Belief, and 21Shares Core Solana, are postponed indefinitely because the U.S. Securities and Change Fee(SEC) has but to renew working in full capability.

Crypto Market: What’s Forward because the Macro Warning Dominates With Upcoming CPI Report?

The following greatest take a look at for the crypto market is the Shopper Worth Index (CPI) information launch by the U.S. Bureau of Labor Statistics (BLS) immediately. The overall expectation is the next inflation charge, which isn’t excellent news for the crypto market.

Supply: Tradingeconomics

The inflation information can also be essential in deciding the long run path of financial coverage. If the inflation stays excessive, the buyers will transfer in direction of safer investments to hedge towards the inflationary strain. A powerful macro sign is what the crypto markets want now, however the unfolding macro situations aren’t serving to.