In my quest to search out the very best answer for Cake Pockets to supply user-friendly, non-custodial Lightning to our customers, I’ve gone deep down the rabbit gap of each Spark and Ark. Each are fairly novel approaches to Bitcoin layer two networks, and are designed at their core to be interoperable with the broader Bitcoin community for funds through the Lightning Community. Whereas each can be utilized “simply” for Lightning funds, each networks are positioned to quickly broaden and be used for way over that over the approaching months and years.

One factor to bear in mind is that whereas Spark and Ark on their face appear somewhat comparable, in observe and in implementation they’re fairly distinct.

Why do we want new layer twos?

Bitcoin at its core is an unbelievable software for freedom, however resulting from block measurement constraints, we all know that almost all of the world won’t ever be capable to make transactions on-chain. Enter Lightning, an answer that permits one on-chain transaction to permit for basically infinite off-chain transactions, increasing the usefulness of Bitcoin’s base layer and making it potential for extra individuals to transact.

Whereas Lightning supplied a promising method to scaling Bitcoin funds, in the end the conclusion that its greatest function is as an interoperability layer and never as a software for end-users to run themselves has change into clear. On-chain necessities, liquidity administration, liveness necessities, and different core hurdles make the implementation of user-friendly, self-custodial Lightning subsequent to unimaginable. This has change into obvious as most Lightning wallets and use-cases have opted to make use of custodial or federated fashions out of a must simplify the person expertise and the implementation issue.

The most important win that Spark and Ark present to the Bitcoin area out of the gate is offering a a lot easier and simpler approach for the typical developer to offer Lightning to their customers, whereas permitting for tremendously expanded performance down the road past Lightning funds.

Ark, simplified

Historical past

The idea of Ark was created in Might of 2023 by Burak, a Lightning advocate and developer. The driving pressure behind its creation was the conclusion that the Lightning community as constructed was not efficient as an onboarding software for the typical particular person resulting from inbound liquidity necessities amongst many different issues, and that privateness was typically missing. Whereas Burak invented the protocol itself, two firms – Ark Labs and Second – have stepped in to construct the Ark protocol into an end-to-end layer-two community for Bitcoin.

Whereas each firms are constructing across the similar open-source Ark protocol, their implementations and targets are somewhat dissimilar. In consequence, I’ll do my greatest to distill each beneath the place potential.

Terminology

Ark: Ark is a protocol for transferring Bitcoin transactions off-chain by leveraging multisig and pre-signed transactions between customers and the Ark Operator. Something you are able to do on Bitcoin, you are able to do on Ark however quicker and with decrease charges.

Ark Operator: The entity working the centralized Ark server infrastructure and accountable for offering liquidity for person’s VTXOs earlier than expiry.

Lightning Gateway: The entity that gives the power for Ark customers to ship or obtain Lightning funds utilizing trustless atomic swaps of Ark VTXOs. This perform will be supplied by the identical entity because the Ark Operator, however is usually distinct to unfold out counter-party threat.

Digital Transaction Outputs: Additionally known as “VTXOs”, these are similar to on-chain UTXOs in nature, however are digital as they aren’t represented as distinctive UTXOs on-chain and stay totally off-chain. Customers ship and obtain VTXOs inside Ark.

Rounds: As a way to achieve true finality and/or refresh VTXOs, Ark customers might want to be a part of rounds, the place they work along with different Ark customers and the Ark Operator to get new VTXOs in trade for a charge.

Making transactions

Ark capabilities very equally to on-chain Bitcoin transactions, and inherits most of the similar mannerisms whereas permitting transactions to be near-instant and trust-minimized between Ark individuals. The sender works with the Ark Operator to signal the VTXO over to the recipient, or within the case of Ark Labs to create a brand new, chained VTXO for the recipient. This enables a user-experience comparable in some ways to on-chain funds, however with far decrease charges and much quicker transaction occasions. When the person desires to ship or obtain Lightning funds, they will work with a Lightning Gateway to atomically swap VTXOs for Lightning funds as-needed. For the time being no offline obtain for Lightning funds in Ark is feasible, however it’s seemingly this can be solved in a equally trust-minimized approach inside Ark as it’s in Spark.

If the person needs finality (i.e. they’ve acquired a big cost), they will select to affix a spherical to finalize the cost and achieve the identical finality assumptions as on-chain Bitcoin. The frequency of this spherical course of will range by Ark Operator – with estimates starting from each 10min to each hour – and requires a comparatively prolonged coordinated signing course of between all customers searching for to affix the spherical with the Ark Operator. The spherical frequency may even range primarily based on demand, and isn’t one thing that must be set in stone to a single frequency in contrast to Bitcoin block occasions.

As Ark inherits Bitcoin scripting and the UTXO mannequin straight from on-chain Bitcoin, Ark will seemingly be prolonged to assist token protocols like Taproot Belongings sooner or later.

Belief tradeoffs

Ark targets a really trust-minimized method to scaling Bitcoin, hanging one thing of a middle-ground by way of usability and tradeoffs between Lightning and Spark. Word that Ark as a protocol is quickly growing, and a few of these tradeoffs will hopefully be solved via using novel off-chain strategies or after the implementation of covenants in Bitcoin.

Lack of out-of-round finality

Whereas Spark lacks provable finality, Ark strikes one thing of a center floor. For small funds, customers can depend on the Ark Operator and former senders to not collude for safety, permitting for immediate transfers without having for collaborative signing rounds. Word that by default, funds inside Ark can be “out-of-round” funds that lack true finality, a tradeoff that permits Ark to ship an excellent person expertise out of the field.

That being mentioned, customers who do want or need true finality can have it by becoming a member of a spherical and receiving a brand new VTXO from the Ark Operator. Receivers are basically in command of their most well-liked belief mannequin.

VTXO expiration

Because of the liquidity necessities to function an Ark occasion, Ark Operators want a technique to reclaim liquidity repeatedly. To permit this liquidity reclamation, Ark VTXOs will expire repeatedly (i.e. after 30d, with the VTXO expiry being set by every Ark Operator), requiring their house owners to both be a part of a spherical to refresh the VTXO or threat giving up management of their funds totally to the Ark Operator. Whereas the Ark Operator has robust incentives to merely situation a brand new VTXO to the proprietor of the expired one after they come again on-line, each the Ark Operator and the person can have the power to spend funds till a brand new VTXO is issued to the person.

To keep away from funds expiring, customers can be required to refresh their VTXOs inside that window both straight or by offloading refresh to a delegate. Alternatively, atomic swaps of an expiring VTXO for one with an extended lifecycle might be completed with an entity like Boltz for a charge, however that’s not but carried out.

Advanced spherical person expertise

In case you’ve ever used Coinjoin on Bitcoin, you understand how tedious and unreliable collaboratively signing a transaction with different Bitcoiners will be. In Ark, these searching for true finality for his or her VTXOs will must be accessible all through a spherical signing course of till its completion, one thing that can rely closely on different individuals correctly finishing the signing course of. Whereas that is fairly trivial to perform for a pockets working on an always-online server, it’s somewhat complicated to reliably carry out on cellular platforms, particularly iOS the place no background execution (and thus no capability to be on-line on the proper time for signing) will be assured for any app.

Because of this complicated person expertise, Ark Labs have give you a system that leverages delegated third events performing the refresh in a trust-minimized approach for customers, offloading the liveliness requirement to a 3rd occasion. Whereas this third occasion has no capability to steal funds, if they’re offline for any motive or refuse to refresh a given VTXO, the person can be pressured to affix a spherical themselves earlier than the expiry interval. To mitigate this threat, customers can designate a number of delegates, shifting the belief assumptions for expiry to a 1-of-N assumption, the place if any delegate is sincere their VTXO can be refreshed correctly.

Second even have a equally designed system that permits trustless, non-interactive rounds for customers, permitting any variety of events to signal for a person throughout a spherical (i.e. the pockets supplier and a third-party delegate) the place if any of these events indicators correctly, the customers VTXO is correctly refreshed.

Word that whereas these two options can refresh expiring VTXOs, they can’t give customers true finality with out the person actively collaborating within the spherical themselves.

Lastly, it’s necessary to name out that the overwhelming majority of complexity with the spherical course of will be totally mitigated if a easy covenant is deployed in an improve to Bitcoin, one thing that may unlock a vastly improved person expertise for Ark.

Privateness tradeoffs

At its core, Ark inherits Bitcoin’s poor privateness and doesn’t present any notable privateness enhancements as a protocol. That being mentioned, its capability to dump execution off-chain and broaden Bitcoin’s performance permits current and novel privateness protocols to be constructed on high of it sooner or later, with covenants totally unlocking issues like non-public rounds inside Ark.

Within the short-term, Ark Labs have deliberate to make use of WabiSabi-like blinded credentials to enhance privateness from the operator when customers take part in rounds.

Transaction visibility

Whereas all transactions inside Ark don’t must be printed on-chain, offering some free ephemerality, all transaction particulars are seen to the Ark Operator and shouldn’t be thought of non-public within the truest sense. As an alternative, viewing the ephemeral privateness supplied by Ark as analogous to the VPN mannequin (offloading visibility into transactions from the Bitcoin blockchain to a trusted third-party) is a helpful psychological mannequin.

It’s unclear right now if Ark Labs and Second will preserve transaction knowledge non-public or publish it publicly, however as with a VPN customers shouldn’t rely totally on a promise to not log for his or her privateness.

Be taught extra

Spark, simplified

Historical past

The Spark community was launched earlier this yr by the parents at Lightspark, a Bitcoin-adjacent firm with an attention-grabbing historical past. From UMA (a username system with natively built-in compliance options for his or her banking companions) to connections with the failed Libra foreign money, they’ve an odd observe report of constructing instruments that aren’t fairly as much as par with Bitcoin’s extra cypherpunk roots. However, once I put apart their odd observe report and targeted purely on what Spark the protocol really is, it presents a somewhat helpful, pragmatic, and highly effective software total.

Spark at its core takes lots of the helpful options of statechains, a novel method to layer twos on Bitcoin created by Ruben Somsen in 2018. Spark particularly extends statechains with the concept of “leaves”, permitting customers to ship any quantity in a transaction as an alternative of being solely in a position to transact with complete UTXOs, one of many largest points with statechains up thus far.

Terminology

Spark Entity: the entity working a given Spark occasion, i.e. Lightspark, made up of a set of Spark Operators. As Spark is an open-source protocol, anybody can begin their very own Spark Entity, however every Spark Entity controls which Spark Operators can be a part of.

Spark Operator: every Spark Entity consists of a number of Spark Operators, every of that are accountable for validating and signing operations of customers throughout the Spark occasion, together with transfers of funds and tokens, issuance of latest tokens, and so forth. These will be the identical entity because the Spark Entity, or (hopefully) distinct in relationship and jurisdiction from the Spark Entity. Presently the 2 Operators for Spark are Lightspark themselves and Flashnet, however extra are slated to be added within the close to future.

Spark Service Supplier: an entity that gives numerous providers to Spark customers, together with utilizing atomic swaps to trustlessly ship and obtain Lightning funds on the customers behalf.

Spark leaves: Spark solves the problems round whole-coin switch necessities in statechains with the introduction of leaves. These will be considered equally to UTXOs inside Bitcoin, as they are often freely damaged up into any measurement essential.

Making transactions

At its core, Spark capabilities by permitting customers to simply transfer Bitcoin across the Spark community near-instantly by working in a trust-minimized approach with Spark Operators to switch possession of particular person leaves to a different particular person. There isn’t a want for a blockchain, confirmations, or liveness between sender and receiver, making funds easy and really quick. When a person desires to make a cost on Lightning, they atomically swap a leaf or leaves from their pockets with a Spark Service Supplier who then sends the cost trustlessly on their behalf for a charge.

To switch a Spark leaf, the sender co-signs possession of the leaf over from themselves + Spark Operators to the brand new proprietor + Spark Operators. That is completed in such a approach that if any of the Spark Operators or earlier proprietor truthfully deletes their keyshare used within the co-signing operation, the leaf is then solely owned by the recipient and no double-spend is feasible. As this operation solely requires collaboration between the Spark Operators and sender and never some other Spark customers, these signing rounds are very quick and immune to DoS assaults.

Spark additionally features a comparable 1-of-N belief mannequin to do offline obtain for Lightning funds, a key user-experience enchancment over customary Lightning pockets utilization. That is particularly necessary when utilizing Spark on a cellular pockets, as cellular platforms can’t assure background execution or good community entry 24/7.

Along with common funds, Spark has prolonged the concept to incorporate native token assist, with the core focus being on stablecoins like USDT and USDC in a position to be issued and transferred seamlessly throughout the Spark community. Tokens transfers themselves share an analogous belief mannequin to plain transactions on Spark, and retain the power to unilaterally exit on-chain.

Lastly, customers in Spark can unilaterally exit on-chain at any time by publishing a pre-signed exit transaction on-chain. Whereas the price of exiting can range extensively resulting from variables like leaf depth and on-chain charge charges, seemingly pricing out smaller quantities, it’s a important software to make sure that funds will be retrieved within the occasion of a malicious or unavailable Spark Entity.

Belief tradeoffs

Spark makes a really pragmatic set of tradeoffs that flatter the present points befalling Lightning and Bitcoin utilization right now. That being mentioned, there are some main variations with Spark in comparison with on-chain Bitcoin or Lightning utilization. I choose to make use of the time period “trust-minimized” when speaking about Spark (and most different layer two networks) as solely self-custody of Bitcoin on-chain can actually be seen as “trustless”.

Lack of true finality

The core threat to self-sovereignty in Spark is the dearth of true finality, the place customers can by no means know for positive that their funds can’t be double-spent via collusion between the Spark Operators and a earlier spender. Inside Spark, finality (realizing that your funds can solely be moved together with your keys) exists – however shouldn’t be provable – on the situation that any single Spark Operator deletes their keyshare after signing off on a Spark transaction. On the flip facet, if all Spark Operators are malicious and refuse to delete their keyshare and collude with a earlier sender of a leaf you personal they will double-spend that leaf and successfully steal funds.

Whereas in observe I feel this 1-of-N belief assumption is cheap, it clearly falls far wanting the common, on-chain Bitcoin belief assumptions the place true finality is a default. It’s additionally necessary to notice that as a result of pseudonymous nature of Spark transactions, the earlier sender might be the identical entity because the Spark Entity.

Probably centralized token management

Whereas transfers of tokens themselves share the 1-of-N belief assumption of normal Spark funds, the tokens themselves will be frozen at any time if the issuer decides to allow this performance. Whereas that is just like many centrally managed stablecoins like USDT (who freeze and confiscate Tether very often for authorized causes), it’s necessary to callout and can seemingly be enabled in lots of regulated stablecoins like USDC and USDT.

1-of-N offline Lightning obtain safety

Whereas offline Lightning receives will not be trust-minimized in the identical approach customary Lightning funds are, theft of funds would require all Spark Operators to collude to steal a single Lightning cost, one thing that’s disincentivized as a result of small measurement of Lightning funds and the large reputational threat if caught stealing from customers, one thing that’s simple to detect as a result of inherent proof of cost within the Lightning community.

Privateness tradeoffs

Spark itself shouldn’t be seen as a privateness software, because it inherits core privateness issues from Bitcoin’s base layer and has made some poor design selections initially relating to privateness. That being mentioned, Spark’s core expertise might be prolonged to have improbable privateness with the introduction of blind signing for all transactions, confidential quantities for token transfers, and different privateness applied sciences that aren’t usually potential throughout the Bitcoin ecosystem.

Transaction visibility

Whereas transactions inside Spark aren’t printed all the time to a blockchain like on-chain transactions, all Spark Operators do get full visibility into transactions. In concept this might present ephemerality if Spark Operators had a non-logging coverage, however in observe all transaction knowledge is presently being printed to an explorer by Flashnet, one of many Spark Operators. Because of this outdoors observers can trivially search for Spark addresses and see all transaction particulars, token balances, and even hyperlink Lightning funds to addresses utilizing timing and quantity evaluation.

Word that Spark is working so as to add the power for pockets builders to opt-out of this knowledge publishing by marking transactions as non-public, which then falls again to the identical VPN-like belief mannequin as beforehand described for Ark. If a pockets developer opts to allow this (as I hope all of them will!), the Spark Operators will promise to not publish this transaction knowledge publicly, however in fact nonetheless have the power to retailer this knowledge domestically in the event that they so select.

Lack of handle rotation

In its present type, Spark doesn’t assist spending funds from a number of distinct Spark addresses in a single transaction. Whereas that is slated to be fastened and already acknowledged as a key shortcoming of Spark, at current it signifies that most Spark implementations will depend on a single, static handle for all transactions, making Spark’s privateness in the mean time worse than even on-chain Bitcoin. Combining this handle re-use with all quantities being seen signifies that it might be trivial for an attacker to carry out timing + quantity heuristics on funds to determine which Lightning funds pertain to which Spark addresses.

Spark handle leaks

To finish the trifecta of present privateness issues in Spark, the core SDKs supplied by Spark (and utilized by the most typical implementation of Spark in Pockets of Satoshi) by default embrace the person’s Spark handle unnecessarily in BOLT 11 Lightning invoices. Because of this anybody can simply decode a supplied BOLT 11 bill and study each transaction from that person in Spark, due to using static addresses and all particulars being printed to an explorer as detailed above.

Word that this isn’t completely essential, can simply be disabled by pockets builders, and is already eliminated within the Breez Nodeless SDK that makes use of Spark and is quickly gaining adoption however is necessary to callout nonetheless.

Be taught extra

Conclusion

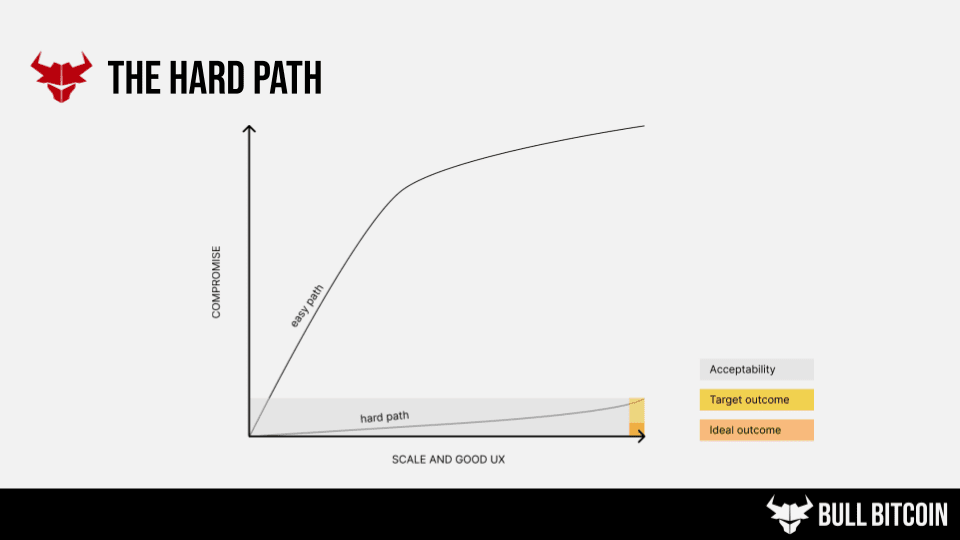

Whereas each Spark and Ark current an thrilling new time on the planet of Bitcoin usability and scalability, as with all issues they arrive with their very own distinctive units of tradeoffs. Whereas neither is an ideal answer, it’s thrilling that pockets builders lastly have two competing and attention-grabbing choices to unravel the implementation of Lightning, native tokens, and different performance into their wallets and software program with out the complexity historically related to Lightning. Each Spark and Ark current a realistic end result for scaling Bitcoin, representing a tough however sane path to do issues in a approach that balances trust-minimization with user-experience and scaling.

As each are quickly evolving protocols, the hope is that the tradeoffs offered by each options can be quickly improved upon and minimized within the coming months and years, offering an excellent higher choice that will get non-custodial Bitcoin into the fingers of many extra individuals whereas extending the issues that we will construct on high of Bitcoin.

A particular thanks to the parents at Spark, Ark Labs, Second, Breez, Spiral, and Bitcoin QnA for taking the time to offer suggestions on this text! It takes a tribe to work out the entire belief assumptions and tradeoffs of those novel methods, and I’m extraordinarily grateful to every for taking out a few of their helpful time to assist right here.

This can be a visitor submit by Seth For Privateness Opinions expressed are totally their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.