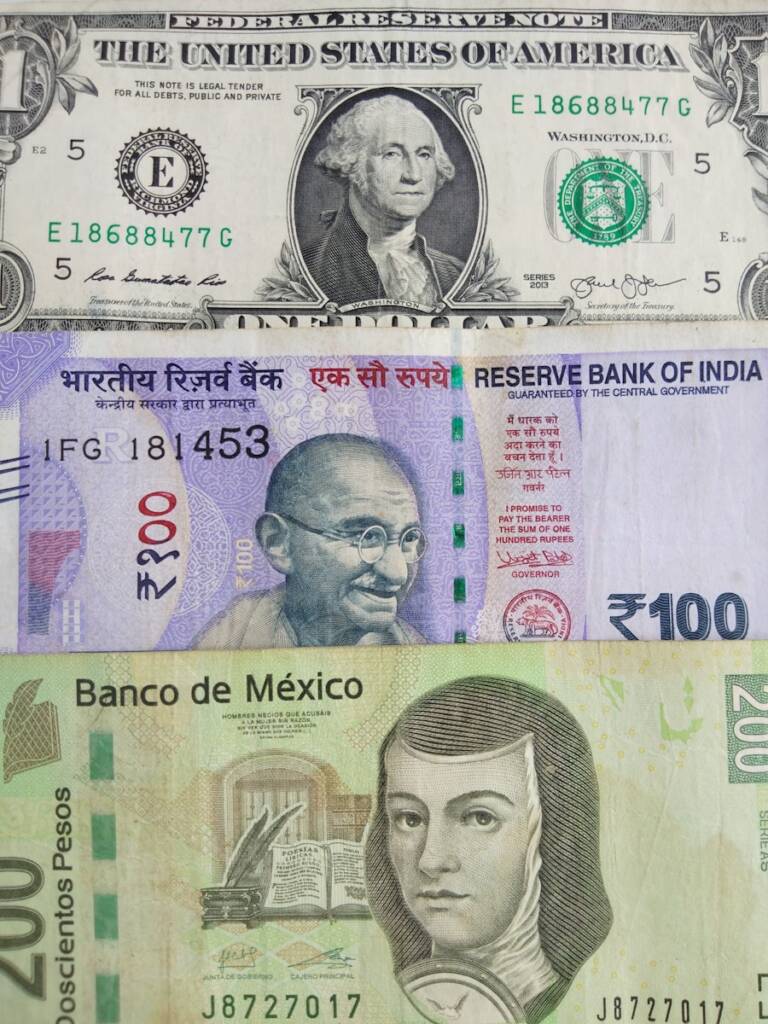

As extra firms promote and rent throughout borders, demand for quick and low-cost forex companies is rising. Companies buying and selling in {dollars}, euros, yuan, and different currencies want higher methods to pay suppliers, receives a commission by prospects, and handle money. Suppliers comparable to Clever, Airwallex, and Payoneer are stepping in to deal with these wants, providing multi-currency accounts, faster settlement, and clearer charges.

The shift is reshaping how small and mid-sized companies transfer cash. It additionally places strain on banks which have lengthy dominated cross-border transfers. With e-commerce and distant work increasing, the timing is pressing. Delays or excessive charges can erase margins or stall progress.

Why Multicurrency Issues Now

Even modest exporters now face forex danger. A fee delayed by every week can swing in worth and wipe out revenue. Conventional financial institution wires could be sluggish and opaque, with charges unfold between sending and receiving banks. Newer companies say they minimize each time and uncertainty.

“Worldwide cash switch companies like Clever, Airwallex and Payoneer are necessary instruments for companies that usually deal with a number of currencies.”

That view displays day by day ache factors for finance groups. Multi-currency balances let companies accumulate in native currencies and pay out with out fixed conversion. Clearer mid-market pricing helps managers forecast money circulation and set costs with much less guesswork.

How Suppliers Compete: Pace, Value, Transparency

Clever constructed its model on low charges, mid-market trade charges, and monitoring just like parcel transport. It pairs native financial institution particulars in dozens of nations with a single account. Airwallex focuses on international retailers and platforms, providing APIs, digital playing cards, and treasury instruments geared toward scaling firms. Payoneer serves marketplaces and freelancers, linking payouts to sellers and repair suppliers worldwide.

Widespread promoting factors embody:

- Sooner supply in contrast with conventional wires on widespread routes.

- Upfront, line-item charges and mid-market FX charges.

- Multi-currency accounts to carry and convert funds when wanted.

- APIs that plug into storefronts and finance methods.

For a lot of companies, the selection comes right down to hall protection, FX spreads on key currencies, integration with accounting instruments, and buyer help of their time zone.

Dangers, Guidelines, and Financial institution Partnerships

Behind the user-friendly apps sit advanced obligations. Suppliers should meet anti-money laundering guidelines, sanctions checks, and know-your-customer requirements in every market. In addition they depend on networks of native banks to maneuver funds domestically. Meaning service high quality can range by nation pair.

Regulators have tightened expectations on fraud and screening. Some markets license e-money establishments or fee companies fairly than full banks. This will restrict deposit protections or the power to supply credit score. Companies ought to test the place funds are safeguarded and the way float is held.

Foreign money danger is one other issue. Holding balances throughout a number of currencies spreads publicity however doesn’t take away it. Finance groups usually set conversion triggers and hedge massive invoices when charges transfer.

Business Affect and What Comes Subsequent

Strain from specialists is forcing incumbents to reply. Many banks now supply improved FX portals for enterprise shoppers. Card networks are increasing cross-border instruments. Central banks are advancing real-time rails that assist with home legs of world funds.

A number of developments are price monitoring:

- Extra native payout choices in Asia, Africa, and Latin America.

- Tighter fraud controls as scams and account takeovers rise.

- Deeper integrations with marketplaces, payroll, and ERP methods.

- Clearer disclosures on charges and supply instances as guidelines evolve.

Analysts anticipate continued progress as e-commerce, digital companies, and distant staffing develop. The winners will probably be companies that stability pace with sturdy compliance and dependable protection.

For finance leaders, the takeaway is sensible. Map main forex flows, choose suppliers that cowl key routes, and check supply instances with small funds. Monitor FX prices, reconciliation effort, and help high quality. The market is aggressive, and switching prices are decrease than they had been a couple of years in the past.

The core want is regular: transfer cash quick, at honest charges, with clear monitoring. Companies like Clever, Airwallex, and Payoneer have made that less complicated for a lot of firms. The following section will probably be determined by who can keep low prices whereas assembly harder guidelines and serving extra corridors.