As Bitcoin (BTC) continues to commerce within the excessive $100,000 vary following the October 9 crypto market crash, some bullish indicators are beginning to emerge. Notably, stablecoin reserves on main crypto exchanges like Binance are coming into all-time excessive (ATH) territory, hinting at a possible rally for BTC.

Stablecoin Reserves Rise – Will Bitcoin Profit?

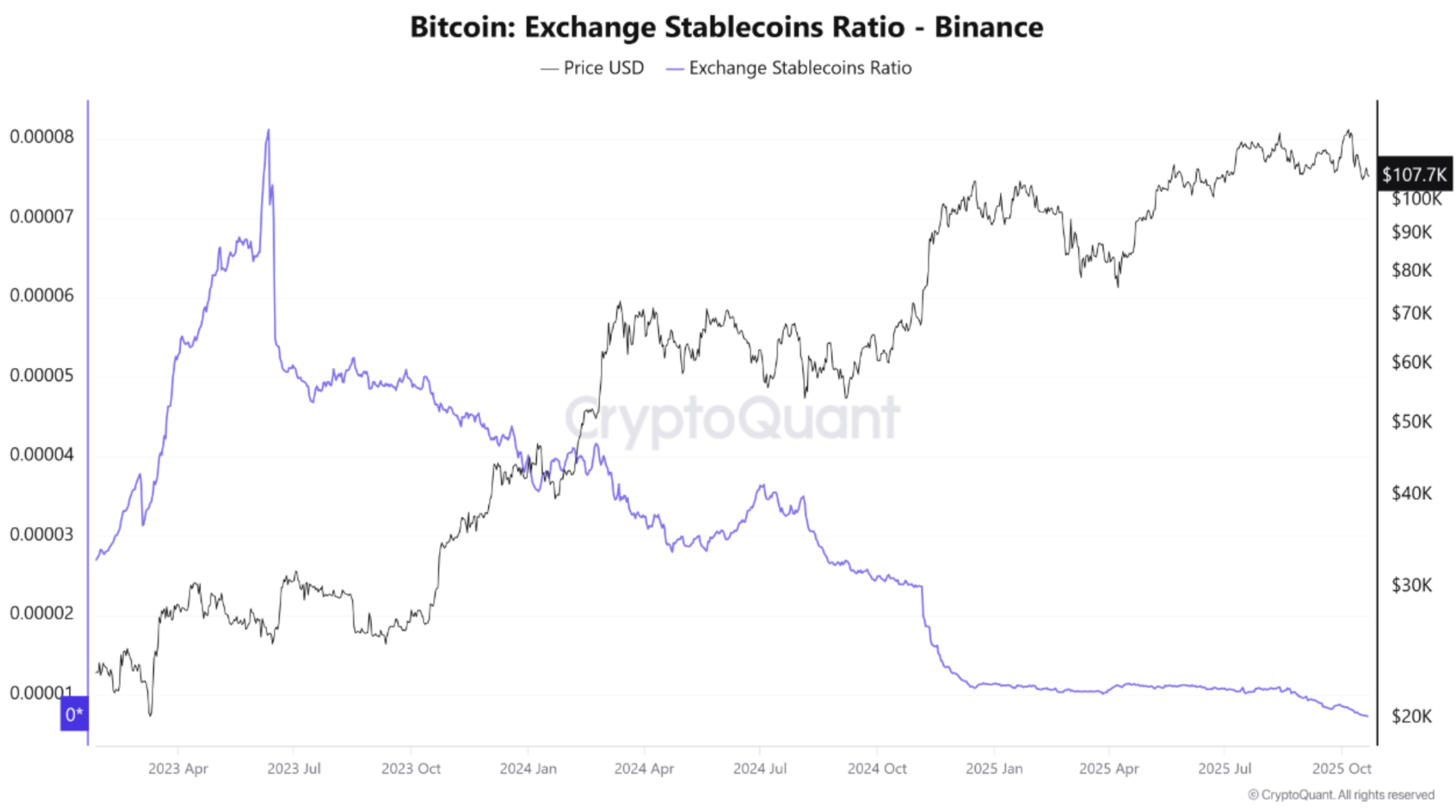

In keeping with a CryptoQuant Quicktake put up by contributor PelinayPA, Binance stablecoin reserves are approaching ATH ranges, indicating that buyers are able to deploy funds to build up BTC at present or decrease ranges.

Associated Studying

The CryptoQuant analyst highlighted the quickly falling Bitcoin-Stablecoin Ratio (ESR). For the uninitiated, the ESR measures the proportion of Bitcoin reserves to stablecoin reserves on exchanges like Binance.

The ratio additionally offers hints concerning the market’s potential shopping for energy and promoting strain. Previous knowledge exhibits that at any time when the ESR falls sharply throughout market volatility, BTC’s value tends to surge.

Primarily, a declining ESR implies that stablecoin reserves are rising compared to BTC reserves on exchanges. This exhibits a rise in accessible “dry powder” on exchanges, which might rapidly be used to purchase extra BTC and provoke one other bull rally.

Conversely, when the ESR rises, it implies that stablecoin reserves are falling whereas BTC provide on exchanges is rising. This factors towards a rise in short-term promoting strain as merchants deposit BTC to exchanges to promote.

At present, the ESR has fallen to traditionally low ranges, implying that Binance holds comparatively massive stablecoin reserves in comparison with BTC reserves. In keeping with PelinayPA, such a setup can have two interpretations:

In a constructive state of affairs, the abundance of stablecoins suggests vital latent shopping for energy. If market confidence returns, this might set off a powerful wave of shopping for strain and mark the beginning of a brand new bullish section.

In the meantime, the adverse state of affairs assumes that this liquidity would stay inactive, reflecting investor hesitation and a market in standby mode after the latest massacre that resulted in liquidations price $19 billion.

Will The Gold Rotation Assist BTC?

Following the crypto market crash earlier this month, which despatched BTC from an ATH of greater than $126,000 all the best way right down to $102,000, a number of whales confronted liquidations. Regardless of the crash, some analysts are assured that the BTC prime just isn’t in but.

Associated Studying

One of many elements that may considerably profit BTC within the close to time period is the capital rotation from gold to the digital asset. In a brand new report, Bitwise predicted that capital rotation from gold into BTC might propel it to $242,000.

That stated, veteran dealer Peter Brandt lately forecasted that BTC might crash 50% from present value ranges. At press time, BTC trades at $108,268, down 0.3% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com