This 12 months has not began nicely for loanDepot.

We first heard the information two weeks in the past that the mortgage lender had suffered a cyber assault that shut down vital methods.

The incident remains to be ongoing and this morning we discovered that, along with a lot of their methods being down, the non-public info of 16.6 million individuals has been compromised.

Many shoppers had been unable to course of mortgage funds or start a mortgage utility. Some methods nonetheless look like down however the mortgage utility course of was working once more this morning.

The mortgage lending trade has had a tough time previously 18 months with rising rates of interest resulting in a dramatic decline in refinancing and new house loans.

That is the very last thing one of many main gamers wants proper now.

Featured

LoanDepot says 16.6 million prospects had ‘delicate private’ info stolen in cyberattack

By Zack Whittaker

About 16.6 million LoanDepot prospects had their “delicate private” info” stolen in a cyberattack earlier this month, which the mortgage and mortgage big has described as ransomware. The mortgage firm mentioned in a submitting with federal regulators on Monday that it might notify the affected prospects of the information breach.

From Fintech Nexus

> Actual-Time Pay-to-Card: Insights from the Visa Direct-Checkout.com webinar

By Fintech Nexus Workers

The webinar with Visa Direct and Checkout.com mentioned the rise of actual time funds and the way pay-to-card solves the ache factors for a lot of totally different verticals.

> Defend the home from fraud, not simply the entrance door

By Tony Zerucha

Whereas many safety firms could make a robust lock in your entrance door, DataVisor co-founder and CEO Yinglian Xie mentioned specializing in each space of the home is a way more efficient technique.

Podcast

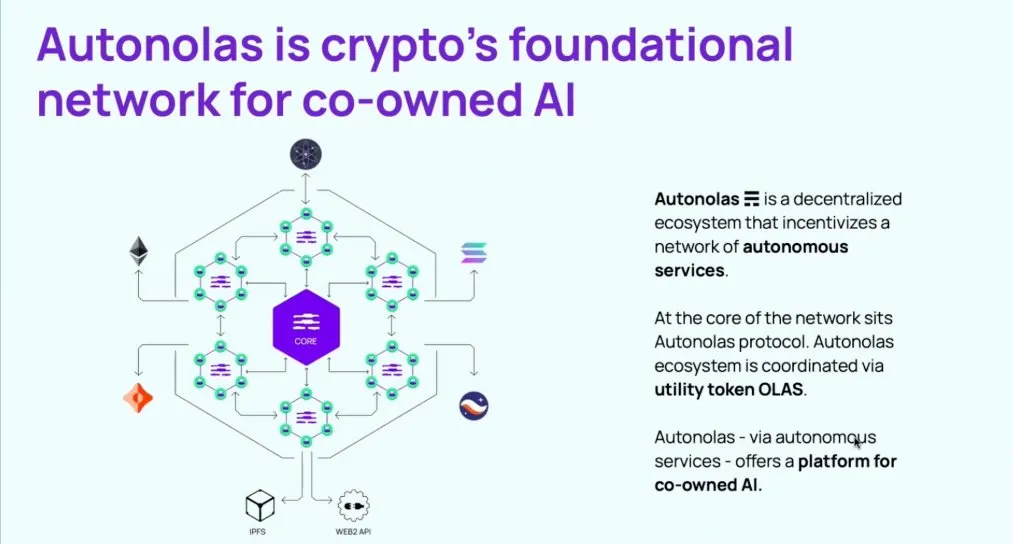

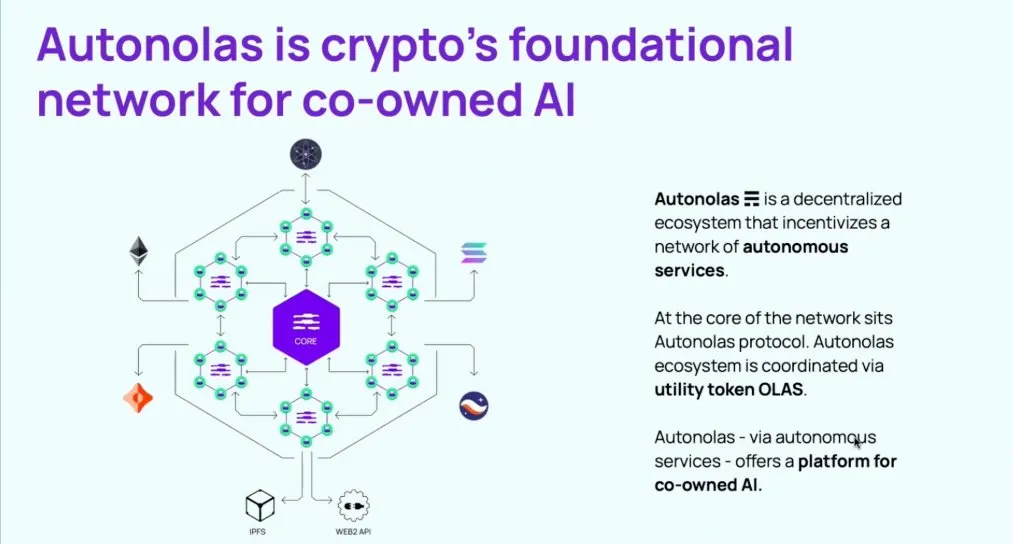

Podcast: Understanding Autonolas, the $2B autonomous agent community working on blockchain, with Valory CEO David Minarsch

Hello Fintech Architects, Welcome again to our podcast sequence! For people who wish to subscribe in your app of selection, you may…

Webinar

Constructing Belief: Scalable Methods for Shopper and Enterprise Onboarding

Jan 23, 2pm EST

Id verification is a key a part of monetary establishments’ and banks’ buyer journeys. Nonetheless, with ongoing compliance…

Additionally Making Information

- USA: Citi in Talks With Analytics Startup to Broaden Lending

Citigroup is in discussions with money move analytics startup Prism Information about incorporating the agency’s know-how in its client credit score underwriting, in response to individuals near the discussions between the 2 companies.

- International: Terraform Labs information for Chapter 11 chapter

Singapore-based Terraform Labs (TFL), the corporate behind digital belongings TerraUSD (UST) and Luna, filed for Chapter 11 chapter in Delaware following the collapse of its cryptocurrencies in 2022.

To sponsor our newsletters and attain 220,000 fintech lovers along with your message, contact us right here.