Buying and selling the markets is mainly a chances recreation. It’s about stacking the chances in your favor as a way to have a comparatively excessive probability of getting a successful commerce. The most effective methods to “stack the chances in your favor” is by in search of confluences.

These are eventualities whereby multiple indication is pointing in the identical commerce path, which is usually a reversal sign or a affirmation of a pattern path. The technique that we’re about to debate is an instance of how confluences can be utilized as a foundation for recognizing and figuring out potential commerce setups.

Elder Impulse System Indicator

The Elder Impulse Indicator is a momentum technical indicator that derives its alerts from two underlying technical indicators, specifically the Shifting Common Convergence and Divergence (MACD) and the Exponential Shifting Common (EMA) indicators.

Shifting Common Traces are sometimes used as a pattern or momentum path indicator. One of many methods merchants use transferring common strains is by observing the place worth motion typically is in relation to its transferring common line.

Markets with worth actions which can be typically above the transferring common line are thought-about as bullish trending markets, whereas markets with worth actions which can be under the transferring common line are thought-about as bearish trending markets.

This similar idea is utilized by the Elder Impulse System indicator to objectively filter momentum based mostly on pattern path bias. Nevertheless, it makes use of an Exponential Shifting Common methodology for calculating its transferring common as a way to arrive at a extra responsive identification of the pattern.

The Elder Impulse Indicator additionally makes use of the MACD as talked about above. The MACD is a well-liked oscillator which additionally makes use of two underlying transferring common strains to determine momentum. It does this by calculating the distinction between the sooner and slower strains. This worth turns into the primary MACD line.

Other than this, the MACD additionally calculates the typical of the MACD line, which turns into its sign line. Momentum path is then based mostly on the connection between the MACD line and its sign line. The momentum is bullish each time the MACD line has a better worth than its sign line, and bearish if the MACD line has a decrease worth than its sign line.

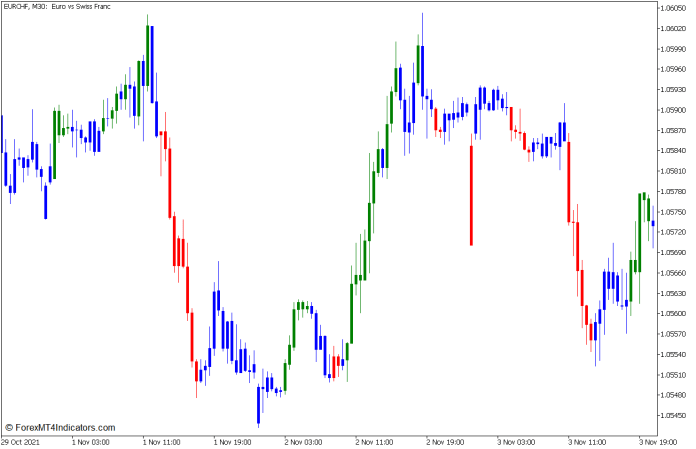

The Elder Impulse Indicator makes use of the confluence of the 2 underlying indicators to determine and make sure momentum. It then shades the bars to point the path of the momentum.

It plots inexperienced bars each time the EMA and MACD alerts are bullish, and purple bars each time the EMA and MACD bars are bearish. Nevertheless, if the 2 alerts diverge, the indicator would plot blue bars which can be interpreted as a weak or unclear momentum path.

Relative Energy Index

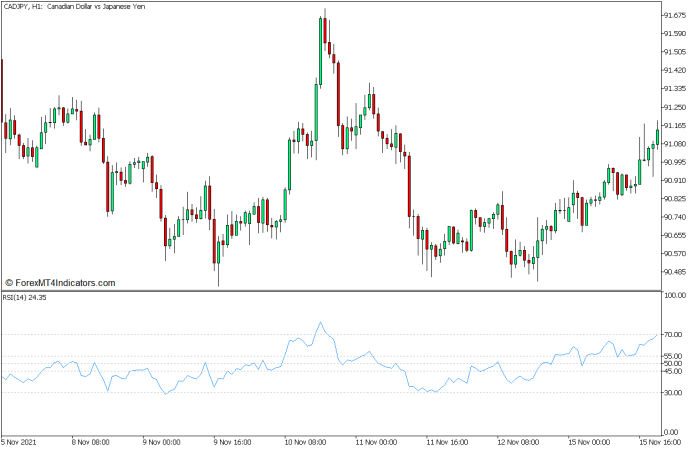

The Relative Energy Index (RSI) can be one other extensively used oscillator sort of momentum indicator. This indicator identifies momentum path by calculating the magnitude of worth actions based mostly on latest historic worth information.

The RSI plots its values as an RSI line which oscillates throughout the vary of 0 to 100. This vary usually has markers at ranges 30 and 70, which demarcates the oversold and overbought ranges. A market with an RSI line dropping under 30 is indicative of an oversold market. Then again, an RSI line breaching above 70 signifies an overbought market. Each these eventualities are prime situations for potential market reversals, which is commonly thought-about as a imply reversal.

Some merchants can also add extra RSI degree markers to assist them determine and make sure market pattern path and bias.

Buying and selling Technique Idea

The technique that’s about to be described right here is an easy imply reversal buying and selling technique which can be utilized to substantiate a possible market reversal. It makes use of the confluence of the RSI and the Elder Impulse System indicators to assist merchants objectively determine potential commerce setups.

The RSI indicator is especially used to assist merchants spot oversold and overbought markets. That is based mostly on the RSI line dropping under 30 or breaching above 70.

As soon as an oversold or overbought market is recognized, we will then begin to observe for a possible market reversal sign based mostly on the Elder Impulse System indicator. That is based mostly on the altering of the colour of the bars in confluence with the imply reversal market path as indicated by the RSI indicator.

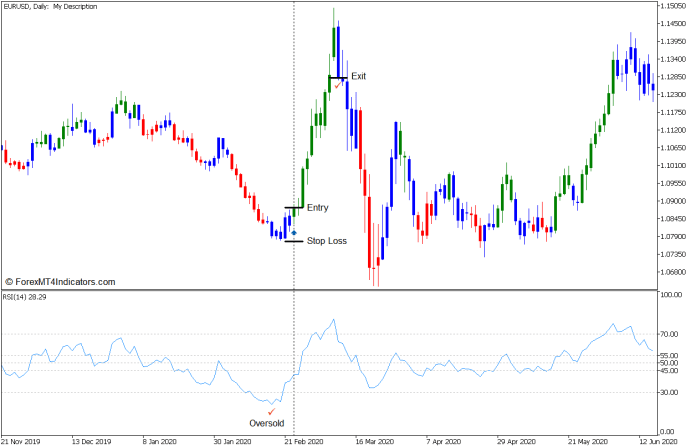

Purchase Commerce Setup

Entry

- The RSI line ought to drop under 30 indicating an oversold market.

- Open a purchase order as quickly because the Elder Impulse System indicator plots a inexperienced bar confirming a bullish momentum reversal.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Enable worth to run with robust momentum, then shut the commerce as quickly because the bars change to blue.

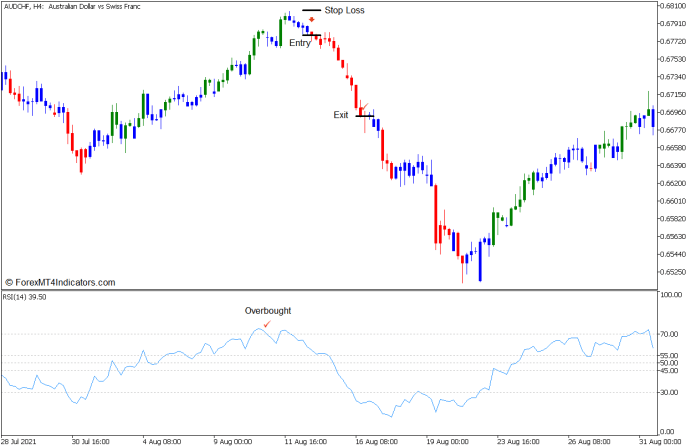

Promote Commerce Setup

Entry

- The RSI line ought to breach above 70 indicating an overbought market.

- Open a promote order as quickly because the Elder Impulse System indicator plots a purple bar confirming a bearish momentum reversal.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Enable worth to run with robust momentum, then shut the commerce as quickly because the bars change to blue.

Conclusion

This imply reversal commerce setup is usually a dependable commerce entry sign. Nevertheless, this commerce setup shouldn’t be used as a standalone commerce sign. It’s best to make use of this buying and selling technique at the side of a better timeframe commerce setup.

This could possibly be a reversal from a key help or resistance space, a pullback entry coming from a better timeframe pattern, a reversal from a market spike that can’t push by a key degree, and so forth. Regardless of the larger timeframe cause could also be, this setup might be a superb praise as an entry sign.

Since this technique is predicated on confluences, the alerts that it produces are usually high-probability alerts. Nevertheless, it might additionally incur some lag. As such, it is usually finest to look at worth motion as a way to verify whether it is nonetheless a viable commerce setup based mostly on a risk-reward standpoint.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the accrued historical past information and buying and selling alerts.

This MT5 technique offers a possibility to detect varied peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional worth motion and regulate this technique accordingly.

Beneficial Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

The best way to set up This MT5 Technique?

- Obtain the Zip file under

- *Copy mq5 and ex5 recordsdata to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you need to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out the MT5 technique

- You will notice technique setup is out there in your Chart

*Observe: Not all foreign exchange methods include mq5/ex5 recordsdata. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here under to obtain: