Key Takeaways

- The mounting political turmoil, fueled by ‘no king’ protests, is pushing buyers to take a risk-averse place.

- The crypto ETFs have reported a internet outflow of $186.10 million on October 20.

- The highest crypto ETFs, equivalent to IBIT, weren’t spared from bleeding both.

- The delayed SEC ETF approvals have additional enhanced a risk-averse angle.

- In line with consultants, the institutional investor confidence can solely be restored by easing macro stress.

Institutional buyers are recalibrating their funding methods amid uncertainties, with no king protest sweeping throughout the U.S. Tens of millions are rallying on U.S. streets because the opposition occasion accuses the Trump administration of turning authoritarian.

The mounting political turmoil is pushing buyers to take a risk-averse place. The de-risking is taking a toll on the already fragile crypto market, with dominant tokens feeling the warmth.

The latest internet outflows from crypto exchange-traded funds are robust testimony to the waning investor curiosity and confidence.

Crypto ETFs Bleed Amid the Macro Strain

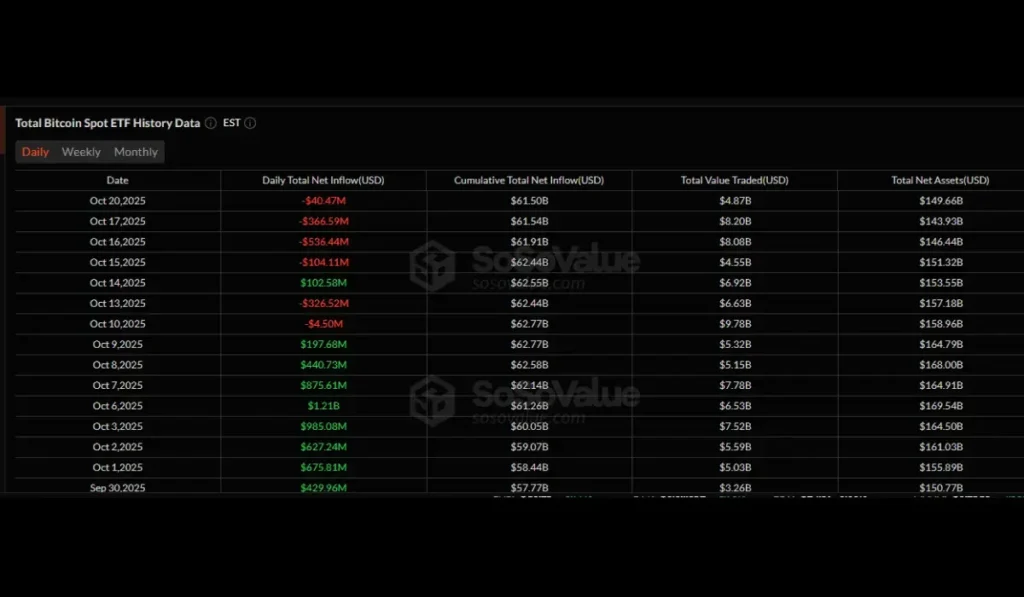

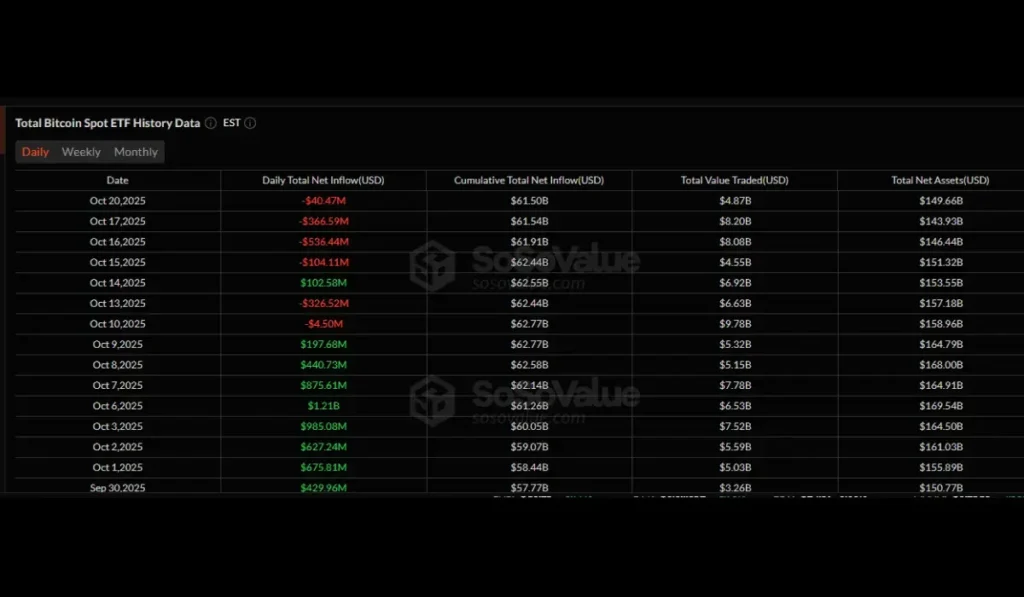

The crypto ETFs have reported a internet outflow of $186.10 million on October 20. The high crypto ETFs equivalent to IBIT, weren’t spared from bleeding. Each BTC and ETH ETFs have recorded losses amid the fading institutional curiosity. The BTC ETF marked 40.40 million internet outflows yesterday. Over the previous week, the BTC ETF noticed a internet outflow of $326.40 million.

Supply: SoSoValue

A large $145.70 million outflow was seen from Ethereum ETFs from yesterday solely. The weekly internet outflow from the identical quantities to $428.50 million. The opposite dominant cryptocurrencies are additionally seeing their ETFs log crimson. The ETF charts are suggesting that institutional confidence is thinning across the crypto market.

The latest market crash, which adopted heightened geopolitical tensions that resulted in 19 billion leveraged positions being worn out from the market, has overshadowed the early bullish sentiments in October. The continuing U.S authorities shutdown has weakened the notion of BTC being a safe-haven asset.

Moreover, the buyers are shifting in the direction of much less dangerous conventional funding avenues. The turbulent value actions additionally led to many short-term profit-taking by whales, including extra uncertainty to the crypto market.

| Ticker | Fund Title | Value | Quantity | Market Cap | Kind |

|---|---|---|---|---|---|

| IBITBTC | iShares Bitcoin Belief | $62.93 | $3.26B | $88.96B | Spot |

| FBTCBTC | Constancy Clever Origin Bitcoin Fund | $96.69 | $638.55M | $21.94B | Spot |

| GBTCBTC | Grayscale Bitcoin Belief ETF | $86.89 | $460.92M | $19.21B | Spot |

| ETHAETH | iShares Ethereum Belief ETF | $30.14 | $1.51B | $16B | Spot |

| ARKBBTC | ARK 21Shares Bitcoin ETF | $36.85 | $146.99M | $4.71B | Spot |

| BITBBTC | Bitwise Bitcoin ETF | $60.29 | $124.36M | $4.57B | Spot |

| BTCBTC | Grayscale Bitcoin Mini Belief ETF | $49.1 | $85.4M | $4.66B | Spot |

| ETHEETH | Grayscale Ethereum Belief ETF | $32.74 | $175.89M | $5.11B | Spot |

| BITOBTC | ProShares Bitcoin ETF | $18.27 | $456.21M | $1.99B |

What’s Forward for the Crypto Market Amid the Political Turmoil?

Political uncertainty is unhealthy information for a unstable and rising market such because the crypto market. At present, the crypto market cap has touched $3.6 trillion, and the 14-day Relative Energy Index (RSI) stands at a impartial place.

The delayed SEC approvals have added extra skepticism available in the market. The SEC approvals of the next ETFs are indefinitely delayed because of the ongoing authorities shutdown, additional rising the risk-averse stance from buyers.

Grayscale Litecoin Belief – 10/10/25

CoinShares Litecoin ETF – 10/23/25

Grayscale Solana Belief – 10/10/25

VanEck Solana Belief – 10/16/25

21Shares Core Solana ETF – 10/16/25

Canary Solana ETF – 10/16/25

Bitwise Solana ETF – 10/16/25

Grayscale Dogecoin Belief – 10/18/25

Grayscale XRP Belief – 10/18/25

21Shares Core XRP Belief – 10/19/25

Last Ideas

The continuing political protests are including extra uncertainty to the crypto market. The U.S. authorities shutdown and delayed SEC ETF approvals additional strengthened the risk-averse stance. Within the troubled occasions, Buyers are shifting in the direction of conventional property as a substitute of the high-risk crypto market. In line with crypto consultants, institutional investor confidence could be boosted solely by easing the macro stress.