Hyperliquid (HYPE) has had a turbulent week because the broader altcoin market faces intense promoting stress. After weeks of regular development, the token is now testing key help ranges, with bulls struggling to regain management. Regardless of the continuing correction throughout the crypto panorama, sentiment round Hyperliquid stays combined — whereas merchants brace for extra draw back, some optimistic analysts see potential for restoration within the coming weeks.

Associated Studying

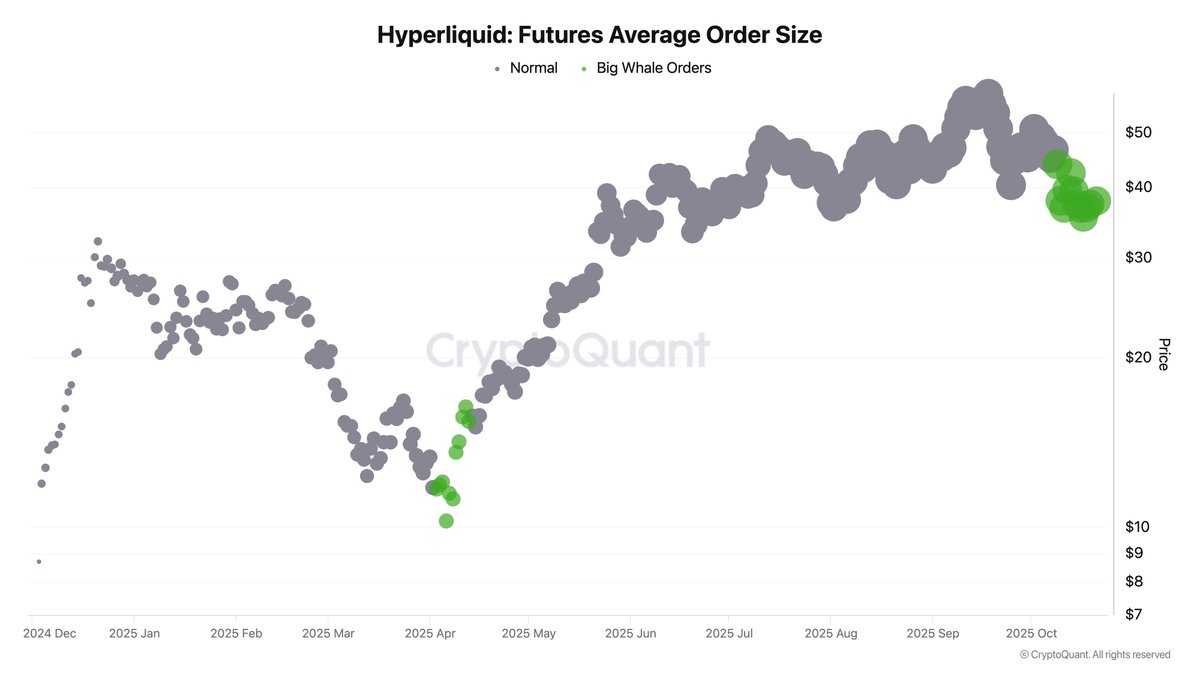

In response to recent knowledge from CryptoQuant, whales are going lengthy on HYPE, signaling renewed confidence amongst giant buyers whilst retail sentiment weakens. These whale strikes usually mark the early levels of a rebound, particularly after they happen throughout heightened volatility. Analysts notice that such positioning can point out that good cash is getting ready for a possible market reversal, or at the very least for a reduction rally as soon as promoting stress cools off.

Nonetheless, the short-term outlook stays unsure. With the market setting dominated by worry and liquidity scaling down, Hyperliquid’s value motion within the coming days can be crucial in figuring out whether or not it will probably maintain its present help zone or if one other leg down awaits. For now, all eyes are on whale conduct — and what it is perhaps signaling subsequent.

Huge Gamers Wager on a Hyperliquid Rebound

Altcoin knowledge analyst Kate Younger Ju shared recent insights into Hyperliquid’s futures market, revealing that the typical order dimension has considerably elevated, signaling that enormous buyers — or “large gamers” — are positioning for a possible value surge. In response to the info, institutional-scale orders have turn into extra frequent over the previous week, a transparent indication that market contributors with deep capital are beginning to take calculated lengthy positions regardless of the continuing volatility.

This comes after a exceptional 12 months for Hyperliquid, which has quickly emerged as some of the revolutionary decentralized perpetual exchanges available in the market. Constructed by itself high-performance Layer 1, Hyperliquid has attracted each merchants and liquidity suppliers by options like zero fuel charges, quick settlement, and native HYPE staking rewards. Since its early 2025 rally, the protocol has seen exponential development in buying and selling volumes and neighborhood engagement, solidifying its place amongst high DeFi derivatives platforms.

The rise in futures order dimension displays rising confidence that HYPE could get better from its current drawdown. Traditionally, such exercise usually precedes a reversal, as whales and complicated merchants are likely to accumulate throughout market uncertainty. This accumulation section suggests a possible shift in momentum — the place good cash is getting ready for the subsequent leg up whereas retail sentiment stays cautious.

If Hyperliquid’s value motion stabilizes and macro circumstances enhance, this whale-driven accumulation might act as the inspiration for a powerful rebound section. Nonetheless, analysts warn {that a} lack of follow-through from retail merchants or a broader crypto selloff might nonetheless dampen short-term momentum. For now, the info paints a compelling image: large gamers are quietly betting that Hyperliquid’s story isn’t over — it would simply be coming into its subsequent main chapter.

Associated Studying

HYPE Evaluation: Testing Key Assist After Weeks of Volatility

Hyperliquid (HYPE) is at present buying and selling round $35.6, down greater than 6% on the day, because the token continues to face heavy promoting stress. The every day chart reveals that HYPE has entered a crucial help zone close to the 200-day shifting common (pink line), which sits round $34–$35. This stage has acted as a powerful base throughout earlier corrections, significantly throughout April and July, when comparable pullbacks led to renewed bullish momentum.

Associated Studying

Nonetheless, value motion has weakened notably after failing to reclaim the 50-day shifting common (blue line) close to $42, turning it into short-term resistance. The sequence of decrease highs and sharp rejections from this zone spotlight a market struggling to regain confidence.

On a broader view, HYPE stays in an uptrend, however the construction is underneath stress. If the token manages to consolidate above $35, it might entice patrons aiming for a rebound towards the $40–$42 space. Conversely, a breakdown under $34 might speed up losses towards $28, the subsequent vital help stage.

Featured picture from ChatGPT, chart from TradingView.com