Market reversals are sometimes tough to objectively anticipate particularly for newer merchants. Even seasoned merchants discover it as a hit-or-miss train at occasions. Nonetheless, the chance for enormous positive aspects that such market reversals current may be arduous to go up. The technique mentioned under could assist us enhance our odds of figuring out an accurate market reversal utilizing the Laguerre RSI and the traditional Double High and Double Backside sample.

Laguerre RSI with Laguerre Filter Indicator

The Laguerre RSI with Laguerre Filter is a momentum technical indicator that’s based mostly on the popularly recognized indicator, the Relative Energy Index (RSI). Simply as with the RSI, this indicator additionally presents pattern course and momentum as an oscillator, albeit with clear variations.

The traditional RSI indicator is a momentum indicator that detects momentum course or bias by measuring the magnitude of value actions by evaluating the variations between the present value and up to date historic value knowledge. It then presents an oscillator line that oscillates inside a particular vary, permitting merchants to derive their interpretation of developments, momentum, and potential market reversals based mostly on it.

The Laguerre RSI, developed by John Ehlers, is a modification of the traditional RSI which is geared in the direction of the discount of market noise and minimization of lag inside its presentation of the market’s momentum. Specifically, the Laguerre RSI applies an Exponential Shifting Common (EMA) inside its algorithm, which smoothens the oscillations of its strains.

This model of the Laguerre RSI line plots two strains, the primary oscillator line, which is stable, and a sign line, which is a dot-dot-dash line. It additionally has markers at ranges 0.15 and 0.85, in addition to a shaded space on its center zone.

The traditional thought is that the market could also be in a robust uptrend situation if the Laguerre RSI strains are persistently above 0.85 and in a robust downtrend situation if the strains are persistently under 0.15. Nonetheless, we will additionally interpret this as an oversold or overbought market which can have the potential to reverse. To substantiate this, we could use the crossing over of the primary line and the sign line past this space.

Double Tops and Double Bottoms

Technical analysts usually use value patterns as a way of figuring out the potential course of the market, whether or not it could be a market reversal or a pattern continuation, a market contraction or a market growth, or whether or not it’s about to maneuver up or transfer down.

Value patterns are principally recurring patterns which may be noticed by connective market swings, in addition to trendlines. It’s not a causative device however as an alternative an indicative method which permits merchants to interpret the market based mostly on such recurring and observable sample.

The Double Tops and Double Bottoms are two of essentially the most acquainted reversal value patterns that merchants usually use. Double Bottoms are bullish reversal patterns that are noticed as having a pair of swing lows with reversals at comparatively the identical value zones. This usually kinds as a result of merchants are taking a cue from the primary swing low what they might regard as low cost sufficient to purchase. Because of this, many merchants could also be inserting their pending orders at that very same value zone and these orders are sometimes met with merchants keen to make a purchase transaction on the similar value zone. This usually causes value to maneuver greater and reverse with a bullish momentum. The Double High then again is the inverse of the Double Backside mentioned above.

Buying and selling Technique Idea

Double Tops and Double Bottoms are wonderful commerce alternatives which merchants can exploit to seize enormous returns on a worthwhile commerce. Nonetheless, it’s usually tough to anticipate the place and when these patterns would kind.

This buying and selling technique makes use of the Laguerre RSI with Laguerre Filter indicator as a way to anticipate potential reversal zones the place such Double Tops and Double Bottoms could kind.

The Laguerre RSI with Laguerre Filter shall be used to determine oversold and overbought market circumstances and its preliminary reversal alerts. That is based mostly on the crossing over of its essential line and its sign line in an space which is both above 0.85 or under 0.15. Double Tops and Double Bottoms could then be actively noticed if these circumstances are met.

As an alternative of buying and selling the Double Tops and Double Bottoms after it’s confirmed, which is commonly on the break of its neckline, we are going to take an aggressive strategy, which might be the rejection of the reversal zone of its prior swing excessive or swing low.

Purchase Commerce Setup

Entry

- The Laguerre RSI strains ought to drop under 0.15.

- The principle line ought to cross above the sign line.

- The primary swing low of the Double Backside should be fashioned.

- Enable value to tug again to the congestion space of the prior swing low.

- Open a purchase order on a bullish reversal value motion indicating a value rejection of the prior swing low space.

Cease Loss

- Set the cease loss under the swing low.

Exit

- Set the take revenue goal on the following outstanding swing excessive space.

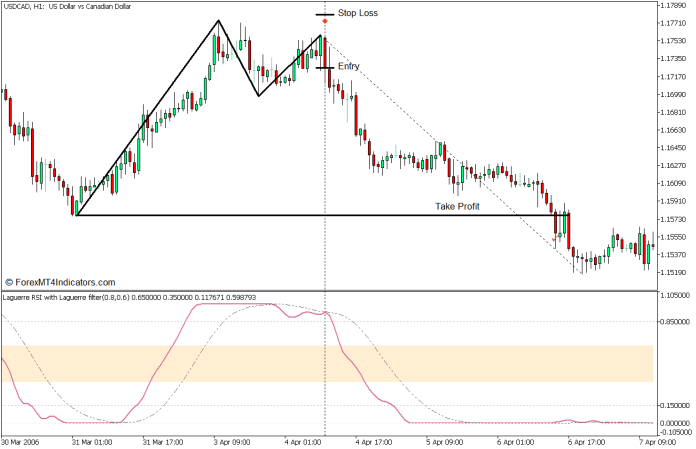

Promote Commerce Setup

Entry

- The Laguerre RSI strains ought to breach above 0.85.

- The principle line ought to cross under the sign line.

- The primary swing excessive of the Double High should be fashioned.

- Enable value to tug again to the congestion space of the prior swing excessive.

- Open a promote order on a bearish reversal value motion indicating a value rejection of the prior swing excessive space.

Cease Loss

- Set the cease loss above the swing excessive.

Exit

- Set the take revenue goal on the following outstanding swing low space.

Conclusion

This buying and selling technique may be an efficient reversal buying and selling technique. Though reversal buying and selling methods are sometimes tougher to anticipate particularly for brand spanking new merchants, this technique could assist. Using the Laguerre RSI strains permits us to anticipate if the market is oversold or overbought, that are prime circumstances for potential market reversals. Nonetheless, it could nonetheless be simpler if these reversal patterns are additionally cued off different value motion based mostly reversal zones.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mix of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the amassed historical past knowledge and buying and selling alerts.

This MT5 technique supplies a possibility to detect numerous peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this info, merchants can assume additional value motion and modify this technique accordingly.

Advisable Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The 12 months

>> Declare Your $50 Bonus Right here <<

How you can set up This MT5 Technique?

- Obtain the Zip file under

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you need to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out the MT5 technique

- You will notice technique setup is obtainable in your Chart

*Word: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here under to obtain: