As Bitcoin (BTC) tries to get better from its weekend sell-off that noticed it virtually crash to $100,000, some crypto analysts assume that the BTC market possible “misplaced its pulse.” In consequence, the main cryptocurrency could also be on the cusp of shedding its bullish momentum.

Bitcoin At The Danger Of Dropping Momentum?

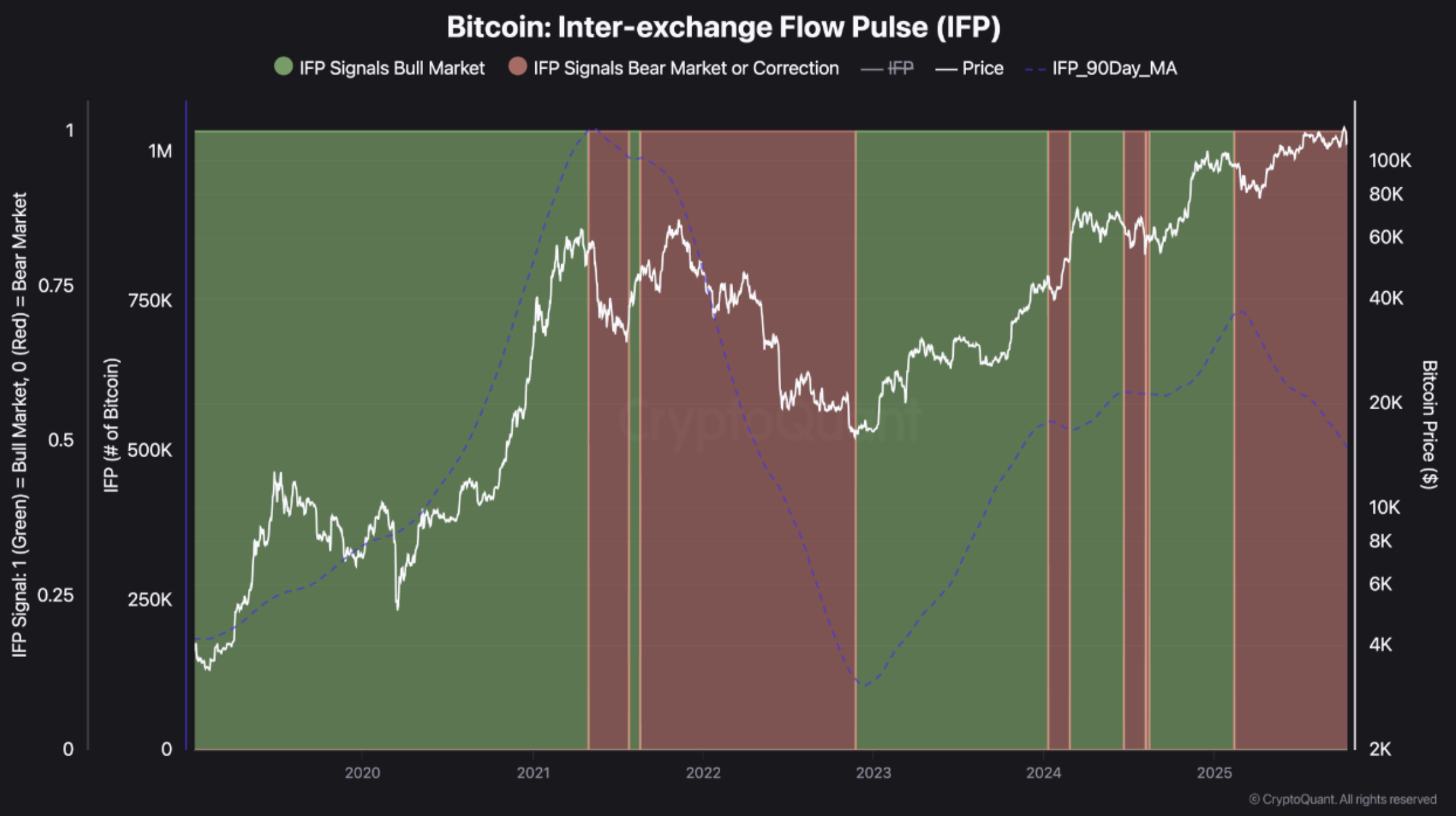

In keeping with a CryptoQuant Quicktake submit by contributor TeddyVision, Bitcoin’s Inter-Change Circulation Pulse (IFP) has been trending decrease, confirming that inter-exchange exercise is slowly fading.

Associated Studying

For the uninitiated, the IFP measures liquidity because it strikes between crypto exchanges. In essence, it may be thought-about a proxy to find out how lively arbitrage and market-making actually are.

To clarify, arbitrage refers back to the follow of shopping for an asset for a cheaper price on one platform and promoting it at the next worth on one other, thus benefiting from the value differential. In easy phrases, arbitrage refers to making the most of inefficiencies.

When such inefficiencies exist out there and are literally executable, liquidity tends to begin transferring quick. On the similar time, buying and selling bots start shuttling funds throughout platforms, market spreads start to realign once more, and the market begins to really feel “alive.”

That is when the IFP rises. Though there may be better market volatility attributable to a rising IFP, it’s typically thought-about wholesome for the market because it confirms that BTC is probably going experiencing a bullish momentum.

Nevertheless, for the reason that IFP studying has turned decrease in current weeks, merchants are discovering it tougher to arbitrage worth discrepancies though they may nonetheless be showing. TeddyVision famous:

Worth discrepancies nonetheless seem, however they’re tougher to arbitrage – liquidity is thinner, latency is larger, and risk-adjusted alternatives are drying up. Merchants discover fewer setups value taking, and fewer capital circulates between venues.

The analyst emphasised that liquidity will not be leaving the market, it’s simply not circulating like earlier. Whereas such a slowdown in liquidity doesn’t crash the market, it does drain the power out of it.

To conclude, the market will not be collapsing, it’s simply “too environment friendly” for the time being for merchants to search out any significant arbitrage alternatives that they will profit from. When inefficiencies depart the market, the underlying asset is probably going susceptible to shedding its momentum.

A Wholesome Correction For BTC?

The market crash on October 9 led to the most important single-day liquidation ever within the historical past of the crypto business, totalling a mammoth $19 billion. Whereas the general optimism has receded, some analysts are nonetheless hopeful of a fast sentiment turnaround.

Associated Studying

Fellow crypto analyst EtherNasyonaL said that BTC has maintained its upward trajectory regardless of the current market crash, and {that a} transfer to a brand new all-time excessive (ATH) could also be on the horizon. At press time, BTC trades at $111,731, down 2.3% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com