On-chain analytics agency Glassnode has defined how the newest Bitcoin selloff is completely different from the LUNA and FTX crashes of 2022.

Bitcoin Provide In Revenue Pattern Is Structurally Completely different For The Newest Crash

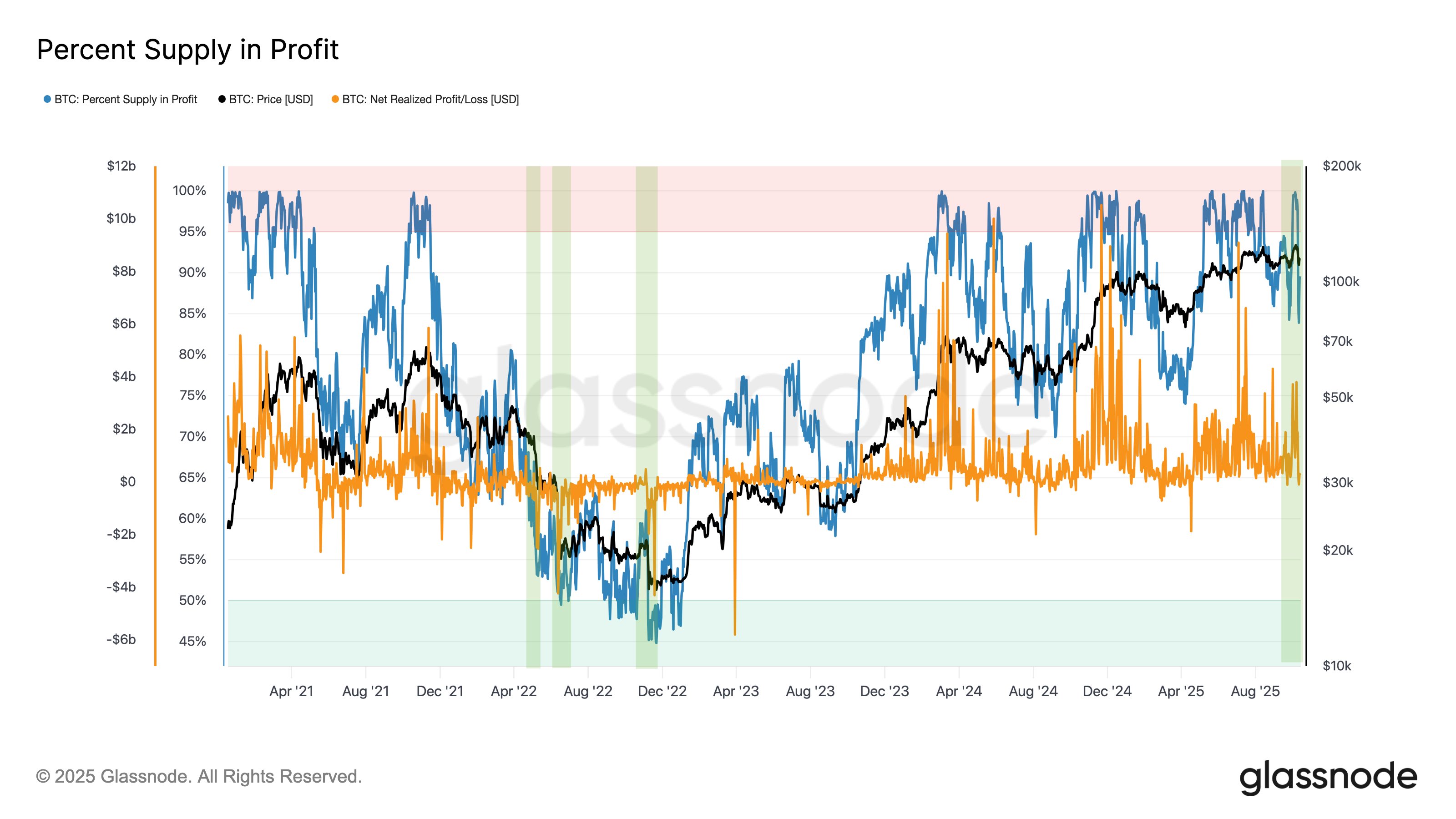

In a brand new submit on X, Glassnode has mentioned how the latest bearish motion in BTC compares towards a number of the previous crashes. The analytics agency has used the % Provide in Revenue to make the comparability. This on-chain indicator measures, as its title suggests, the share of the overall Bitcoin circulating provide that’s sitting on some internet unrealized acquire proper now.

The metric works by going by way of the transaction historical past of every token in circulation to see what worth it was final transferred or bought at. If this earlier transaction worth was lower than the newest spot worth for any token, then it could be thought-about to be at present sitting on some revenue.

The % Provide in Revenue provides up all cash of this sort and determines what proportion of the provision they make up. One other indicator known as the % Provide in Loss tracks the tokens of the alternative kind. If certainly one of these indicators is understood, the opposite can merely be calculated by subtracting it from 100, because the whole BTC provide should add as much as 100%.

Now, right here is the chart shared by Glassnode that reveals the pattern within the Bitcoin % Provide in Revenue over the previous few years:

As is seen within the above graph, the Bitcoin % Provide in Revenue hit the 100% mark earlier within the month when the cryptocurrency’s worth set its new all-time excessive (ATH). When the sharp selloff on the finish of final week began, the indicator’s worth was nonetheless properly over the 90% mark, that means the overwhelming majority of traders had been within the inexperienced. As such, the crash was extra profit-driven, with losses principally coming from the highest consumers.

Throughout a number of the large crashes of the 2022 bear market, nevertheless, the market situations had been fairly completely different. Within the LUNA and FTX collapses, the % Provide in Revenue sat below 65%.

Within the chart, Glassnode has additionally highlighted the info of one other metric: the Internet Realized Revenue/Loss, measuring whether or not profit-taking or loss-taking is dominant on the BTC community. From this indicator, it’s obvious that the aforementioned crashes noticed deep adverse values, implying a broad capitulation occasion befell.

The 3AC collapse occurred alongside the next % Provide in Revenue, nevertheless it additionally witnessed a notable spike in loss-taking. Primarily based on this, Glassnode concludes that the newest Bitcoin crash was “a structurally completely different, leverage-driven occasion.”

BTC Worth

On the time of writing, Bitcoin is buying and selling round $110,400, down greater than 11% during the last week.