Bitcoin is testing a crucial assist degree close to $110,000 after being rejected from the $116,000 provide zone, a degree that has now grow to be a serious level of rivalry between bulls and bears. The market stays fragile following the historic volatility from Friday’s crash, which erased billions in leveraged positions and triggered widespread uncertainty.

Associated Studying

Whereas the value has managed to stabilize above key shifting averages for now, momentum seems to be weakening as consumers battle to soak up continued promoting stress. Some analysts warn that if Bitcoin fails to carry this zone, a deeper correction towards the $105,000–$107,000 area may comply with, marking one other shakeout earlier than a possible restoration.

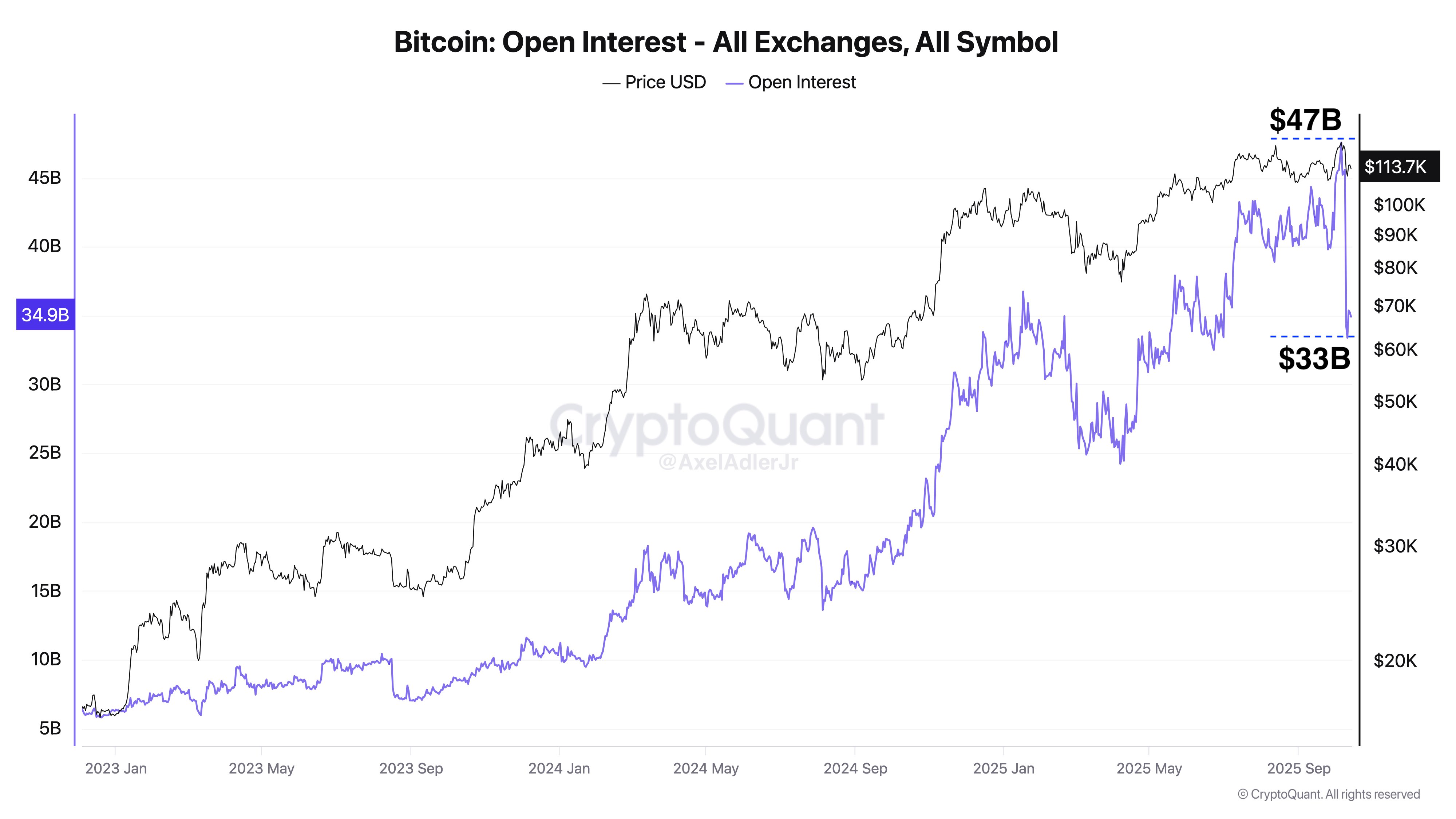

Prime analyst Axel Adler shared new knowledge shedding gentle on the magnitude of Friday’s occasion. In response to his evaluation, spot buying and selling quantity surged to $44 billion, nearing cycle highs, whereas futures quantity hit $128 billion. Extra notably, open curiosity declined by $14 billion, but solely $1 billion of that was from BTC lengthy liquidations. Adler explains this was a managed deleveraging occasion, not a liquidation cascade — suggesting that market contributors lowered threat manually slightly than being compelled out. Nonetheless, volatility stays elevated as Bitcoin fights to take care of structural assist.

A Managed Reset Amid Rising Concern

In response to Axel Adler, the current market crash revealed an necessary but underappreciated side of Bitcoin’s maturity. Information reveals that 93% of the $14 billion decline in open curiosity (OI) throughout Friday’s sell-off wasn’t compelled — that means it wasn’t the results of automated liquidations. As a substitute, merchants and establishments selected to scale back leverage manually, closing positions to guard capital. Adler describes this as a “managed deleveraging”, a stark distinction to earlier cycles the place comparable crashes usually triggered chaotic cascades of liquidations.

This conduct marks a turning level in Bitcoin’s market construction. It signifies that contributors — particularly institutional gamers — are managing threat extra prudently, reinforcing a extra secure and mature buying and selling atmosphere. In previous cycles, sharp liquidations usually induced excessive volatility, magnifying losses throughout the board. This time, nonetheless, the market dealt with unprecedented stress with relative self-discipline.

Nonetheless, regardless of this signal of structural maturity, the emotional panorama has shifted dramatically. As Bitcoin loses worth and hovers close to the $110,000–$112,000 assist zone, worry is spreading throughout the market. Many short-term merchants are exiting positions, whereas long-term holders are reassessing publicity amid rising uncertainty. Adler notes that this section — the place worry peaks and confidence wanes — usually defines the following market course.

If demand returns at these ranges, Bitcoin may affirm a wholesome reset earlier than the following rally. However failure to carry assist could check buyers’ conviction, doubtlessly pushing BTC right into a deeper corrective section earlier than broader accumulation resumes.

Associated Studying

Bitcoin Holds Key Help, However Momentum Weakens

Bitcoin is at present buying and selling round $110,300, sitting immediately on a key assist zone after one other spherical of promoting stress hit the market. The 4-hour chart reveals BTC struggling to take care of upward momentum after failing to interrupt above the $116,000–$117,500 resistance vary, a degree that beforehand acted as robust demand throughout earlier rallies.

The rejection from this space triggered a pointy pullback, pushing BTC under each the 50 EMA (blue line) and the 200 EMA (crimson line) — an indication of weakening short-term construction. The value is now testing horizontal assist round $110,000, which aligns with the late September consolidation vary. A clear breakdown under this degree may expose Bitcoin to additional draw back, with the following potential assist round $106,000–$107,000.

Associated Studying

Regardless of the bearish tone, oversold alerts are starting to seem on decrease timeframes, suggesting {that a} non permanent rebound is feasible if bulls defend this zone efficiently. For a sustainable restoration, Bitcoin should reclaim $114,000 and re-establish itself above the short-term shifting averages. Till then, the market stays in a fragile equilibrium — with bulls defending key assist and bears sustaining management of short-term momentum. The following few classes shall be decisive for BTC’s course.

Featured picture from ChatGPT, chart from TradingView.com