As a mum or dad or guardian submitting taxes, you’ve possible claimed the Little one Tax Credit score (CTC). However what occurs if the CTC reduces your tax invoice to zero, and there’s nonetheless some credit score left unused? That’s the place the Extra Little one Tax Credit score, or ACTC, is available in.

Let’s break down how the ACTC works, who qualifies, and what that you must know for the 2024 and 2025 tax years.

At a look:

- The ACTC is the refundable portion of the Little one Tax Credit score.

- Making a part of the CTC refundable ensures low-income filers can nonetheless reap the benefits of the credit score, even when they don’t make sufficient to owe federal revenue tax.

- After the One Huge Lovely Invoice Act, the ACTC is now price as much as $1,700 per qualifying little one for tax yr 2025, with this most listed for inflation every year going ahead.

How the ACTC works

Is the Extra Little one Tax Credit score refundable?

Sure! The Extra Little one Tax Credit score refers back to the refundable portion of the Little one Tax Credit score. Primarily, it’s a refundable tax credit score that permits qualifying taxpayers to nonetheless get a full or partial refund even when they don’t owe any tax.

Not like the nonrefundable credit score portion of the CTC, which might solely scale back your tax invoice to $0, the ACTC means that you can obtain a refund even when the credit score is greater than the tax you owe. This ensures that households with decrease tax obligations can nonetheless profit from the credit score.

So, for those who don’t owe sufficient taxes to make use of up the total Little one Tax Credit score, the ACTC could make up the distinction by providing you with a refund verify.

Who qualifies for the Extra Little one Tax Credit score?

Eligibility for the ACTC is decided by way of the identical standards because the CTC, and you will have to finish Schedule 8812 to use.

Not each household will qualify for the ACTC, however many do. To qualify for the ACTC, you could earn greater than $2,500 from work (together with wages, ideas, or web self-employment revenue). That $2,500 is the minimal revenue required to be eligible — it’s referred to as the refundability threshold.

Right here’s a more in-depth have a look at the fundamental necessities:

- Your little one should meet the CTC eligibility guidelines. A qualifying little one should:

- Be below age 17 on the finish of the tax yr.

- Be your son, daughter, stepchild, foster little one, sibling, stepsibling, grandchild, niece, or nephew.

- Be claimed as your dependent.

- Have lived with you for greater than half the yr, and also you offered not less than half of their monetary help.

- Be a U.S. citizen, nationwide, or U.S. resident alien.

- You could have earned revenue of not less than $2,500 for the tax yr. That is key! In case your earned revenue is under that threshold, you’ll be able to’t declare the ACTC (even when you’ve got a qualifying dependent).

- You (OR your partner, if submitting collectively) and the kid will need to have a Social Safety quantity. It is a new provision below the One Huge Lovely Invoice Act handed in July 2025.

- You (and your partner, if married submitting collectively) can’t declare the CTC for those who file Kind 2555 or Kind 255-EZ, excluding international earned revenue.

- You could file Kind 1040 or 1040-SR and fasten Schedule 8812 to calculate and declare the credit score.

If that sounds sophisticated, don’t fear. TaxAct® does these calculations and pulls the mandatory tax kinds for you if you e-file your federal revenue tax return with us.

How a lot is the Extra Little one Tax Credit score for 2024 and 2025?

Tax yr 2024

For the 2024 tax yr, the utmost ACTC was as much as $1,700 per qualifying little one (the total CTC was price $2,000).

Tax yr 2025 modifications

The passage of the One Huge Lovely Invoice included some modifications to the ACTC beginning in 2025:

- Now, the utmost ACTC remains to be price as much as $1,700 per qualifying little one, whereas the total CTC is price $2,200.

- Nevertheless, this most shall be listed for inflation every year going ahead, that means the max ACTC will improve barely every year to maintain tempo with rising prices.

This quantity relies on any unused portion of the Little one Tax Credit score after it’s utilized to your tax legal responsibility.

Each the CTC and ACTC credit start to section out as soon as your modified adjusted gross revenue (AGI) reaches:

- $200,000 for single filers

- $400,000 for married {couples} submitting a joint return

Instance ACTC calculation

When you earn above $2,500, the IRS provides you 15 cents again for each greenback you earn over that quantity, as much as a most of $1,700 per qualifying little one (for the 2024 and 2025 tax years).

Right here’s a fast instance:

- You earn $10,000 from a job.

- Subtract the $2,500 threshold: $10,000 – $2,500 = $7,500.

- Take 15% of that: $7,500 × 0.15 = $1,125.

- So, on this instance, you would qualify for as much as $1,125 of the ACTC, assuming you will have not less than one little one who meets the principles.

The extra you earn (previous $2,500), the upper your ACTC shall be till you hit the max per little one ($1,700 in 2025). Keep in mind, for those who earn lower than $2,500 in the course of the yr, you don’t qualify for the ACTC.

As you’ll be able to see, the precise calculation will get a bit sophisticated, however don’t fear — that’s what tax preparation software program like TaxAct is for. We’ll provide help to crunch the numbers and declare the ACTC with out stress.

The best way to declare the Extra Little one Tax Credit score

TaxAct makes it simple to assert the ACTC for those who qualify. You don’t must memorize IRS guidelines or do any sophisticated math. We’ll do the heavy lifting — you simply must reply some simple questions on your children, earned revenue, and submitting standing to find out whether or not you meet all of the eligibility necessities.

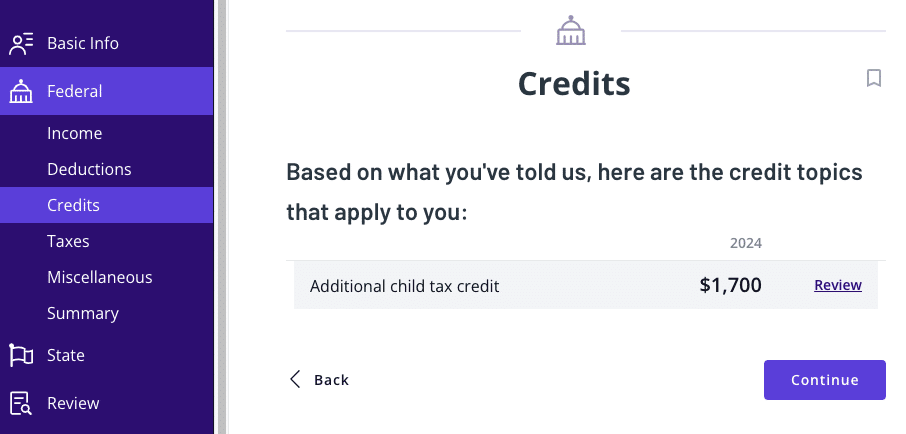

If all seems to be good, you’ll see a display just like the one under:

In the event you qualify for the ACTC, TaxAct will routinely apply it to your return — it’s that simple!

Extra Little one Tax Credit score FAQs

The underside line

The Extra Little one Tax Credit score is a beneficial tax profit for households with decrease tax payments. In the event you didn’t get the total Little one Tax Credit score as a result of your tax owed was too low, the ACTC might make up the distinction.

Simply keep in mind: It’s solely obtainable for those who meet the revenue threshold, and it could delay your tax refund till mid-February or later. Use that information to plan forward and let TaxAct provide help to declare it with out the headache.

Able to file your particular person revenue tax return and declare your ACTC? Begin your return with TaxAct, and we’ll provide help to get each greenback and tax break you deserve.