If Type 1099-SA confirmed up in your mailbox or inbox this yr, don’t let it scare you. On this information, we’ll break down what a 1099-SA kind is, why you bought it, and what you’ll want to do subsequent. By the tip, you’ll know precisely methods to report it in your revenue tax return and have one much less factor to fret about on Tax Day.

At a look:

- Type 1099-SA reviews distributions from well being financial savings accounts and medical financial savings accounts.

- Withdrawals from these accounts are tax-free if used for certified bills.

- Nonqualified bills are topic to revenue tax plus extra tax.

What’s a 1099-SA kind?

The Inner Income Service (IRS) formally calls Type 1099-SA Distributions From an HSA, Archer MSA, or Medicare Benefit MSA. Principally, the company makes use of this type to trace distributions created from your well being financial savings account (HSA), Archer Medical Financial savings Account (Archer MSA), or Medicare Benefit Medical Financial savings Account (MA MSA).

HSAs and MSAs defined

HSAs and MSAs are tax-advantaged accounts designed to assist People lined below a Excessive Deductible Well being Plan (HDHP) pay for certified medical bills. Contributions to those accounts are tax-deductible and might be invested, however there are contribution limits to how a lot cash you may add annually. Unspent contributions roll over from yr to yr till you want them. Typically, your employer could contribute to those accounts as effectively. Whenever you pull cash out of your HSA or MSA to cowl healthcare bills, the IRS needs to find out about it.

Right here’s why it issues: For those who used the distribution cash for certified medical bills, you’re within the clear — no taxes, no penalties. However in the event you used it for a nonqualified expense, that cash is topic to revenue taxes plus a further penalty.

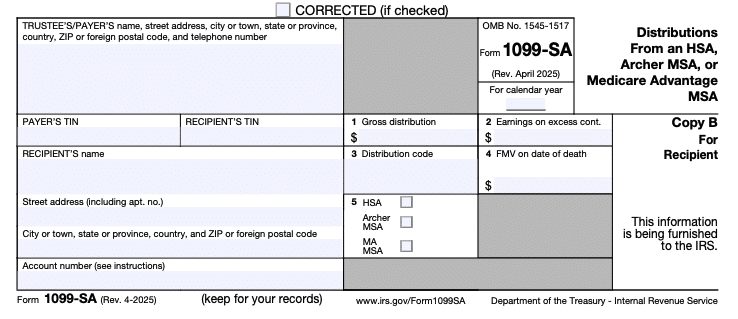

IRS Type 1099-SA instance

Type 1099-SA seems like this:

On the left of the shape, you’ll discover the contact info of the monetary establishment (payer) and their taxpayer identification quantity (TIN). Because the account holder, you’ll additionally see your information, account quantity, and TIN.

Now, let’s break down the important thing elements of this type and what every field means:

- Field 1: Gross distribution – That is the overall distribution quantity you took out of your HSA or MSA through the yr. All distributions are reported right here, even in the event you used the funds for certified medical bills.

- Field 2: Earnings on extra contributions – For those who contributed greater than the allowable restrict to your HSA or MSA, any earnings on these extra contributions are reported right here.

- Field 3: Distribution code – This quantity signifies the kind of distribution — whether or not it was for a certified medical expense, a non-medical expense, or another excuse solely (retirement, loss of life, incapacity, and many others.). You’ll be able to view the complete listing of codes on the IRS web site. The code tells the IRS methods to tax your distributions (if in any respect).

- Field 4: FMV on date of loss of life – This field solely applies if you’re a beneficiary of the HSA or MSA account and is generally for informational functions. It reveals the truthful market worth (FMV) of your account on the day the account holder died.

- Field 5: Kind of account – This checkbox tells you whether or not the distribution got here from an HSA, Archer MSA, or Medicare Benefit MSA.

Type 1099-SA directions

Okay, so now what’s on the shape. However what do you really do with it?

First, take a deep breath. For those who withdrew cash for certified medical bills, you shouldn’t need to pay taxes on it — however you do must report it. Right here’s methods to deal with it:

- Verify your information: Examine the quantity in Field 1 with your individual information. Be certain the distribution matches what you took out. For those who discover an error, contact your plan administrator instantly to get it corrected.

- Report the distribution in your tax return: Taxable HSA distributions are reported on Type 8889, whereas taxable MSA distributions are reported on Type 8853. You must report distributions from these accounts even when they aren’t taxable. Whenever you e-file with TaxAct®, we assist you to fill out these kinds by asking questions on your 1099-SA.

- Non-qualified distributions: For those who used the funds for non-medical bills, the distribution will probably be taxed, and also you’ll owe a further 20% penalty. Our software program may also help calculate this, too, if wanted.

- E-file your return: When you’ve crammed out the right kinds, TaxAct may also help you e-file all the things electronically with our tax preparation software program. E-filing is quick, safe, and ensures the IRS will get your information rapidly.

FAQs about Type 1099-SA

The way to file Type 1099-SA with TaxAct

TaxAct’s intuitive software program takes the guesswork out of tax submitting, so you may confidently report your 1099-SA with ease. Relying on the kind of account you may have, you may report your 1099-SA distributions in 3 ways:

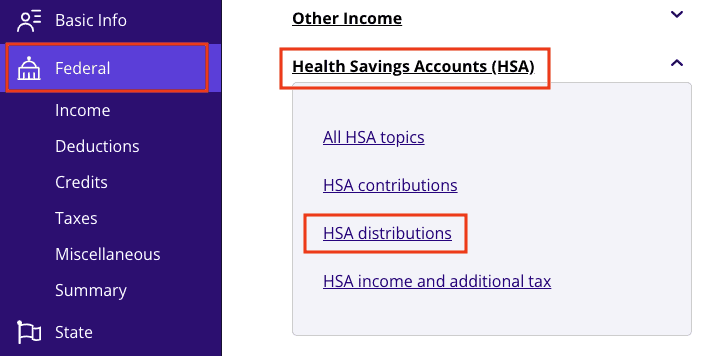

HSA distributions

- From inside your TaxAct return (On-line or Desktop), click on Federal. (On smaller units, click on within the prime left nook of your display, then click on Federal).

- Click on the Well being Financial savings Accounts (HSA) dropdown as proven beneath, then click on HSA distributions.

3. Proceed with the interview course of till you attain the display titled Type 1099-SA – Kind of Account, then click on the circle subsequent to HSA.

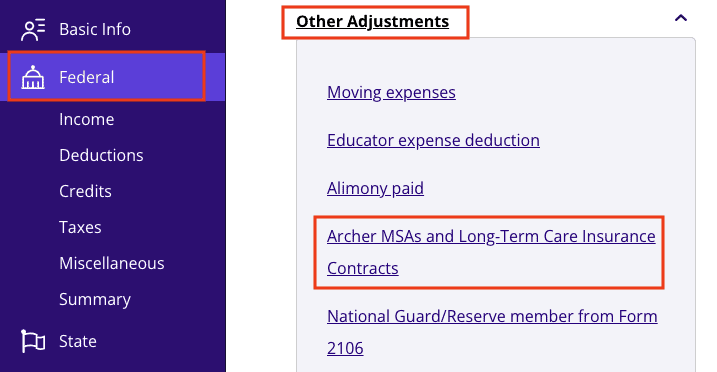

Archer MSA distributions

- From inside your TaxAct return (On-line or Desktop), click on Federal. (On smaller units, click on within the prime left nook of your display, then click on Federal).

- Click on the Different Changes dropdown as proven beneath, then click on Archer MSAs and Lengthy-Time period Care Insurance coverage Contracts.

3. Click on MSA Distributions and proceed with the interview course of to enter your info.

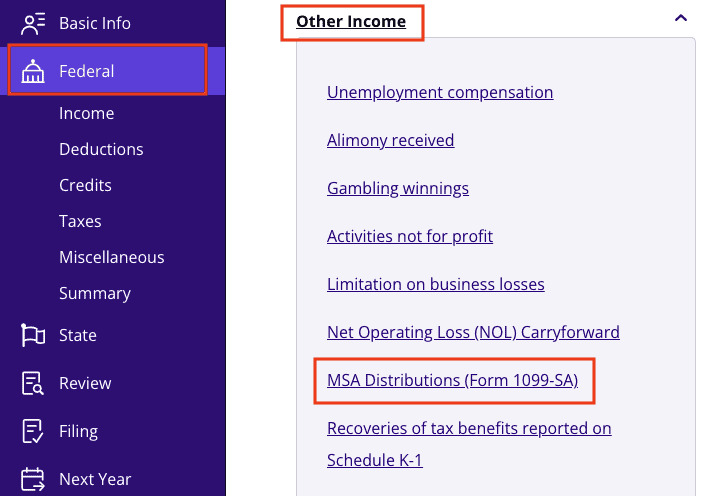

Medicare Benefit MSA distributions

- From inside your TaxAct return (On-line or Desktop), click on Federal. (On smaller units, click on within the prime left nook of your display, then click on Federal).

- Click on the Different Revenue dropdown as proven beneath, then click on MSA Distributions (Type 1099-SA).

3. Click on + Add Type 1099-SA to create a brand new copy of the shape or click on Edit to edit a kind already created. (Desktop program: click on Evaluate as an alternative of Edit).

4. Proceed with the interview course of to enter your info.

The underside line

For those who took distributions from an HSA or MSA through the tax yr, count on to obtain Type 1099-SA this season. Whether or not you used your distribution for certified medical bills or non-medical functions, TaxAct will assist you to report it correctly so you may relaxation simple understanding your taxes are squared away. Let TaxAct deal with the small print, and your taxes will probably be over with earlier than it!

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct gives, services are topic to relevant phrases and circumstances.

All logos not owned by TaxAct, Inc. that seem on this web site are the property of their respective homeowners, who should not affiliated with, related to, sponsored by, or sponsors of TaxAct, Inc.