Bitcoin’s newest pullback has little to do with crypto-native flows and every little thing to do with the greenback, in accordance with chief crypto analyst at Actual Imaginative and prescient Jamie Coutts.

Sharing two charts on X, Coutts argued {that a} rebound within the US Greenback Index (DXY) is briefly tightening international liquidity and pressuring danger property throughout the board. “Bitcoin’s dip isn’t mysterious — it’s macro,” he wrote.

Why Is Bitcoin Down?

“The greenback’s rebound is tightening international liquidity. DXY is retesting 100–101 — a key resistance and pure mean-reversion zone after one of many sharpest declines in many years in 1H25. Positioning had turn out to be crowded on the brief aspect, so a bounce was all the time possible. The actual query: is that this the beginning of a brand new greenback cycle or simply the setup for the subsequent leg decrease? Base case: liquidity tailwinds and an bettering enterprise cycle maintain the outlook for danger property bullish into mid-2026,” he added.

Associated Studying

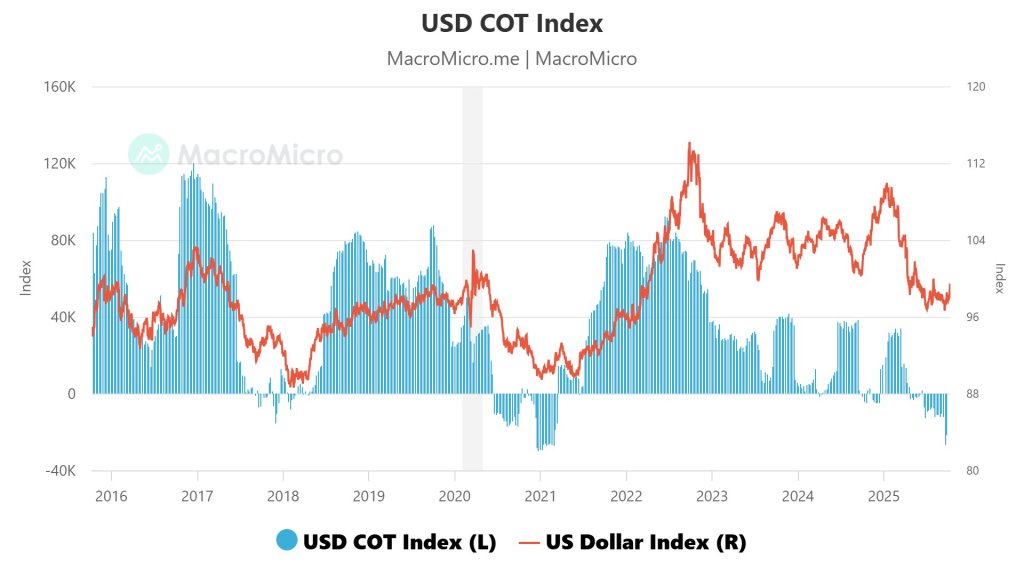

The primary chart he shared juxtaposes the USD COT Index with the US Greenback Index. After a chronic slide in 1H25, speculative positioning flipped aggressively towards the greenback, with the COT index sinking into detrimental territory in mid-2025.

That capitulative stance created fertile situations for a counter-trend squeeze. The value panel exhibits DXY clawing again towards the 100-101 space—a zone that traces up with prior congestion and the underside of this 12 months’s breakdown—whereas the COT bars stay beneath zero, in line with short-covering dynamics slightly than a completely rebuilt long-dollar consensus.

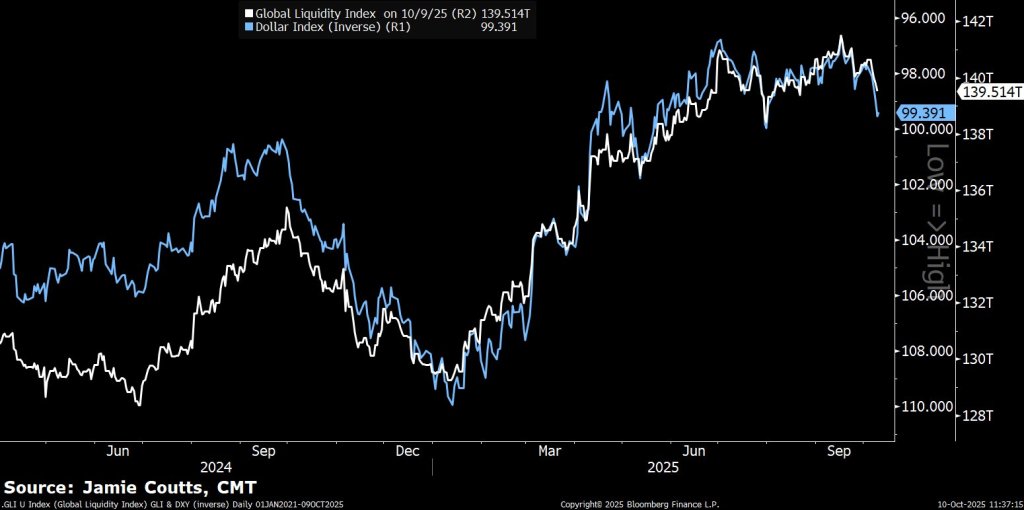

Coutts’ second chart overlays the World Liquidity Index with the inverse of DXY. The sequence monitor one another carefully: when the greenback weakens (inverse DXY rises), the worldwide liquidity proxy rises too, traditionally coinciding with stronger efficiency for duration-sensitive danger property akin to equities and crypto.

Associated Studying

Over latest weeks, the white liquidity line has rolled over modestly because the blue inverse-DXY line has achieved the identical, illustrating the transmission mechanism Coutts highlights: a firmer greenback equals tighter international greenback liquidity on the margin, which in flip dents danger urge for food and crypto beta.

What This Means For BTC Worth

Framed this manner, Bitcoin’s slip is an easy perform of FX imply reversion and futures positioning, not a breakdown in crypto’s structural flows. The “crowded brief” in greenback futures telegraphed vulnerability to a bounce, and the mean-reversion goal round 100–101 supplied a logical waypoint for that transfer.

If DXY stalls and resumes decrease from that band—in line with the broader 2025 downtrend—liquidity situations would possible ease once more, restoring the bid below high-beta property. If, as a substitute, the index pushes via and holds above that zone, Bitcoin can be contending with a extra sturdy greenback impulse and a slower return of optimistic liquidity momentum.

Coutts’ “base case” stays constructive regardless of the near-term headwind: an bettering international enterprise cycle and continued liquidity tailwinds into mid-2026. In that framework, Bitcoin’s drawdowns on greenback power look cyclical, not secular. The instant pivot level sits in plain view on his charts: the DXY’s 100–101 retest, born from stretched speculative shorts and traditional imply reversion, is dictating BTC’s temperature for now.

At press time, Bitcoin traded at $121,703.

Featured picture created with DALL.E, chart from TradingView.com