As Bitcoin (BTC) takes a short breather after creating a brand new all-time excessive (ATH) above $125,000, on-chain knowledge reveals that three key indicators performed a serious function within the digital asset’s newest rally to new highs.

These Three Indicators Counsel Extra Room For Bitcoin

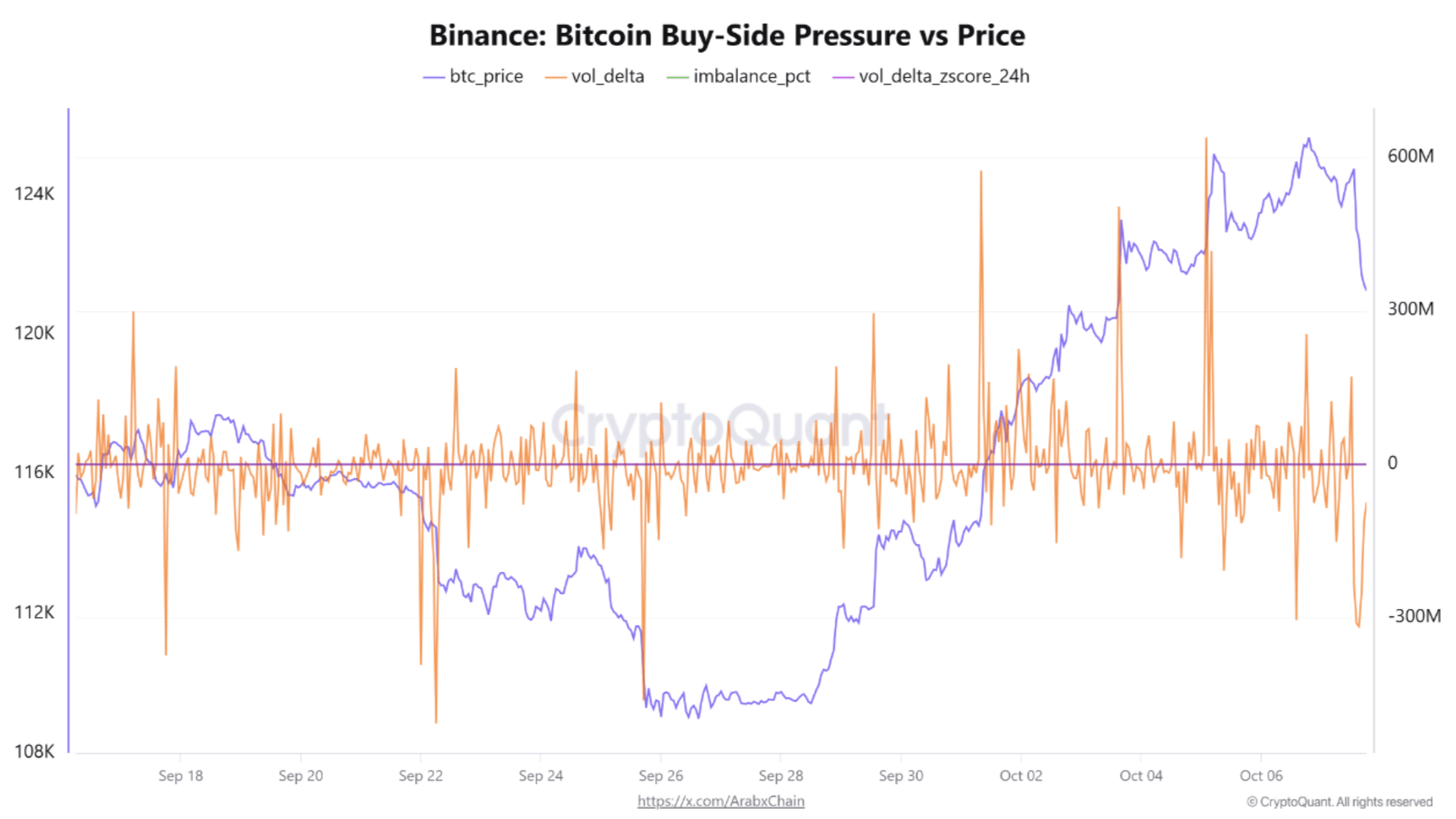

In line with a CryptoQuant Quicktake submit by contributor Arab Chain, recent knowledge from Binance means that BTC is witnessing one among its most vital shopping for phases since mid-year. Notably, BTC’s value has surged from round $117,000 to $124,000 because the starting of October.

Associated Studying

Arab Chain emphasised three key indicators that recommend the return of whales into the Bitcoin market. First, the online shopping for stress (vol_delta) surged previous $500 million on some days, indicating that purchasing stress outweighed promoting stress from this quantity.

Equally, the imbalance ratio (imbalance_pct) just lately hit a excessive of 0.23, suggesting that BTC purchase orders on Binance had been roughly 23% increased than promote orders. Greater purchase orders than promote orders normally point out robust demand and potential upward stress on the asset’s value.

Lastly, the Z-score recorded a price of 0.79, reflecting above-average shopping for exercise. For the uninitiated, a Z-score measures what number of commonplace deviations an information level is from the imply.

The CryptoQuant analyst remarked that these indicators verify that institutional consumers and whales have returned to the Bitcoin market in pressure. Arab Chain added:

This exercise coincides with a transparent improve in every day buying and selling volumes, which have reached their highest ranges since final July, suggesting that the rally is being supported by actual liquidity somewhat than short-term hypothesis.

Latest buying and selling periods have proven a couple of of those indicators – particularly vol_delta – barely declining in worth, and quickly transferring to damaging territory. That mentioned, the broader indicators nonetheless favor a continued upward pattern for the highest cryptocurrency.

Notably, the common every day volatility has remained low, confirming robust market confidence and steady demand. That is in stark distinction to the market habits proven in September, when BTC was struggling within the $100,000 vary.

To conclude, each technical and behavioral indicators help BTC’s continued rise to $125,000 – $130,000 within the close to time period. Until a powerful wave of sell-off emerges, any value correction ought to be seen as a possibility to build up BTC, Arab Chain famous.

What’s Subsequent For BTC?

Whereas it’s usually a problem to foretell BTC’s future, some analysts should not shying away from giving predictions in regards to the flagship digital asset’s upcoming value trajectory. For example, BTC’s pricing bands recommend a transfer towards $140,000 is probably going.

Associated Studying

Equally, quickly dwindling BTC reserves on crypto exchanges might propel the cryptocurrency’s value to even higher highs, probably to $150,000 and past. At press time, BTC trades at $122,373, up 0.3% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com