EUR/USD: Causes Behind the Greenback’s Strengthening

● The previous week was notably sparse by way of macroeconomic statistics. Consequently, the market members’ sentiment largely trusted the statements made on the World Financial Discussion board in Davos (WEF). It is price noting that this occasion, held yearly at a ski resort in Switzerland, gathers representatives of the worldwide elite from over 120 nations. There, amidst the glowing, crystal-clear snow glistening within the daylight, the world’s energy gamers focus on financial points and worldwide politics. This 12 months, the 54th version of the discussion board happened from January 15 to 19.

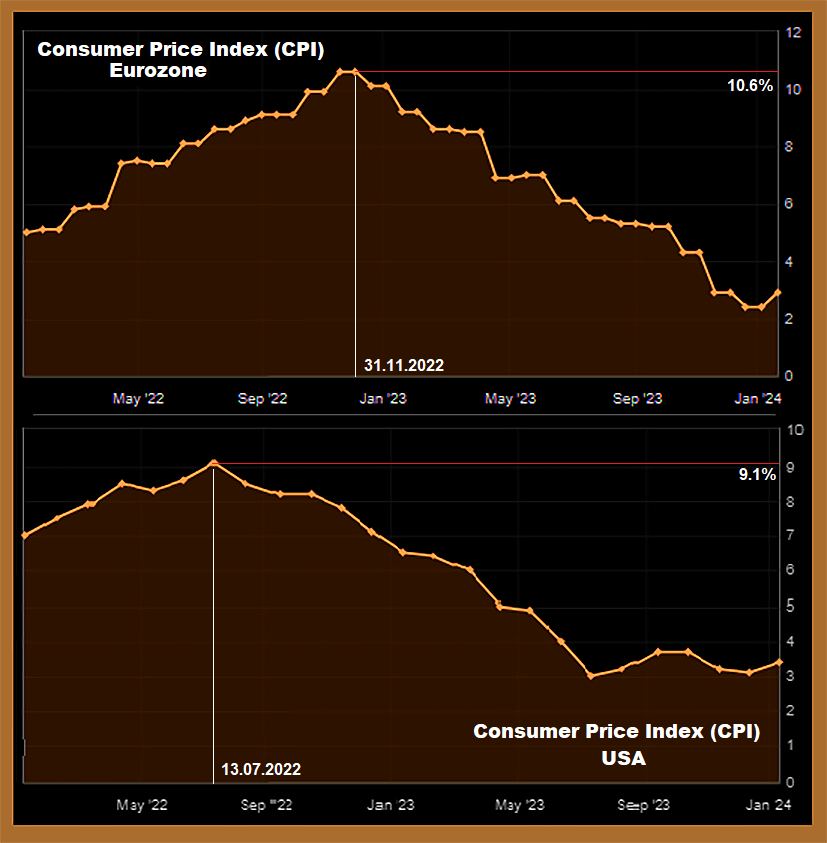

● Talking on the World Financial Discussion board on January 16, the President of the European Central Financial institution, Christine Lagarde, expressed her confidence that inflation would attain the goal degree of two.0%. This assertion didn’t increase any doubts, because the Shopper Value Index (CPI) within the Eurozone exhibits a gradual decline. From a degree of 10.6% on the finish of 2022, the CPI has now fallen to 2.9%. Isabel Schnabel, a member of the ECB’s Govt Board, didn’t rule out the potential for a smooth touchdown for the European economic system and a return to the goal inflation degree by the tip of 2024.

In accordance with a Reuters survey of main economists on the long run financial coverage of the ECB, the bulk anticipate the regulator to decrease rates of interest as early because the second quarter, with 45% of respondents believing that this resolution shall be made on the June assembly.

● Then again, inflation in the US has been unable to surpass the three.0% mark since July 2023. The figures revealed on January eleventh confirmed that the annual Shopper Value Index (CPI) elevated by 3.4%, which was above the consensus forecast of three.2% and the earlier worth of three.1%. In month-to-month phrases, shopper inflation additionally rose, registering at 0.3% towards a forecast of 0.2% and a earlier worth of 0.1%.

In mild of this, and contemplating that the U.S. economic system seems fairly steady, the chance of the Federal Reserve decreasing rates of interest in March began to decrease. This shift in sentiment led to a slight strengthening of the greenback, transferring EUR/USD from the 1.0900-1.1000 vary to the 1.0845-1.0900 zone. Moreover, the weak efficiency of the Asian inventory markets exerted some stress on the European forex.

● In accordance with economists on the Dutch Rabobank, lengthy positions on the euro could face additional challenges. This might occur if Donald Trump continues his motion in the direction of a possible second time period within the White Home. “Though President Biden’s Inflation Discount Act meant that the previous 4 years weren’t all the time simple for Europe, Trump’s stance on NATO, Ukraine, and presumably local weather change may show pricey for Europe and improve the attraction of the U.S. greenback as a protected asset,” the Rabobank specialists write. “Primarily based on this, we see a risk of EUR/USD falling to 1.0500 in a three-month perspective.”

● EUR/USD closed final week at 1.0897. Presently, nearly all of specialists predict an increase within the U.S. greenback within the close to future. 60% voted in favour of the greenback’s strengthening, 20% sided with the euro, and the remaining 20% took a impartial stance. Oscillator readings on the D1 chart affirm the analysts’ forecast: 80% are colored purple, indicating a bearish pattern, and 20% are in impartial gray. Among the many pattern indicators, there’s a 50/50 cut up between purple (bearish) and inexperienced (bullish) alerts.

The closest help ranges for the pair are situated within the zones of 1.0845-1.0865, adopted by 1.0725-1.0740, 1.0620-1.0640, 1.0500-1.0515, and 1.0450. On the upside, the bulls will face resistance at 1.0905-1.0925, 1.0985-1.1015, 1.1110-1.1140, 1.1230-1.1275, 1.1350, and 1.1475.

● Not like the previous week, the upcoming week guarantees to be extra eventful. On Tuesday, January 23, we are going to see the publication of the Eurozone Financial institution Lending Survey. Wednesday, January 24, will deliver a deluge of preliminary statistics on enterprise exercise (PPI) in numerous sectors of the German, Eurozone, and U.S. economies. The primary occasion on Thursday, January 25, will undoubtedly be the European Central Financial institution’s assembly, the place a choice on the rate of interest shall be made. It’s anticipated to stay on the present degree of 4.50%. Traders will due to this fact be paying shut consideration to what the ECB leaders say on the subsequent press convention. For reference, the FOMC assembly of the Federal Reserve is scheduled for January 31. Moreover, on January 25, we are going to be taught concerning the GDP and unemployment information in the US, and the next day, information on private consumption expenditures of residents of this nation shall be launched.

GBP/USD: Excessive Inflation Results in Excessive Charges and a Stronger Pound

● Not like the US and the Eurozone, there was a major quantity of essential statistics launched final week regarding the state of the British economic system. On Wednesday, January 17, merchants have been targeted on the December inflation information. The information revealed that the Shopper Value Index (CPI) in the UK rose from -0.2% to 0.4% month-on-month (towards a consensus forecast of 0.2%) and reached 4.0% year-on-year (in comparison with the earlier worth of three.9% and expectations of three.8%). The core CPI remained on the earlier degree of 5.1% year-on-year.

Following the discharge of the report displaying inflation development, UK Prime Minister Rishi Sunak moved shortly to reassure the markets. He acknowledged that the federal government’s financial plan stays right and continues to work, having diminished inflation from 11% to 4%. Sunak additionally famous that wages within the nation have been rising sooner than costs for 5 months, suggesting that the pattern of weakening inflationary stress will proceed.

● Regardless of this optimistic assertion, many market members consider that the Financial institution of England (BoE) will postpone the beginning of easing its financial coverage till the tip of the 12 months. “Considerations that the disinflation course of would possibly decelerate have seemingly intensified because of the newest inflation information,” economists at Commerzbank write. “The market will in all probability guess on the Financial institution of England responding accordingly and, due to this fact, being extra cautious relating to the primary rate of interest reduce.”

Clearly, if the BoE doesn’t rush to ease financial coverage, this can create perfect circumstances for the long-term strengthening of the British pound. This prospect already allowed the GBP/USD pair to bounce off the decrease boundary of its five-week channel at 1.2596 on January seventeenth, rising to the channel’s midpoint at 1.2714.

● It’s fairly attainable that GBP/USD would have continued its upward trajectory, nevertheless it was hindered by weak retail gross sales information in the UK, which have been revealed on the finish of the workweek on Friday, January nineteenth. The information confirmed a decline on this indicator by 4.6%, from +1.4% in November to -3.2% in December (towards a forecast of -0.5%). If the upcoming Buying Managers’ Indexes and enterprise exercise indicators, because of be launched on January twenty fourth, paint the same image, it may exert much more stress on the pound. The Financial institution of England would possibly worry {that a} stringent financial coverage may overly decelerate the economic system and would possibly contemplate easing it. In accordance with analysts at ING (Internationale Nederlanden Groep), a discount in the important thing rate of interest by 100 foundation factors may result in GBP/USD falling to the 1.2300 zone over a one to three-month horizon.

ING analysts additionally consider that the UK price range announcement on March 6 will considerably affect the pound, with tax cuts on the agenda. “Not like in September 2022,” the specialists write, “we consider this shall be an actual tax reduce, financed by the diminished value of debt servicing. This might add 0.2-0.3% to the UK’s GDP this 12 months and result in the Financial institution of England sustaining larger charges for an extended interval.”

● GBP/USD ended the final week at 1.2703. Looking forward to the approaching days, 65% voted for the pair’s decline, 25% have been in favour of its rise, and 10% most well-liked to stay impartial. Opposite to the specialists’ opinions, the pattern indicators on D1 present a desire for the British forex: 75% point out an increase within the pair, whereas 25% level to a decline. Among the many oscillators, 25% are in favor of the pound, the identical proportion (25%) for the greenback, and 50% maintain a impartial place. If the pair strikes southward, it should encounter help ranges and zones at 1.2650, 1.2595-1.2610, 1.2500-1.2515, 1.2450, 1.2330, 1.2210, 1.2070-1.2085. In case of an upward motion, the pair will meet resistance at 1.2720, 1.2785-1.2820, 1.2940, 1.3000, and 1.3140-1.3150.

● No vital occasions associated to the UK’s economic system are anticipated for the upcoming week, apart from the beforehand talked about occasions. The Financial institution of England’s subsequent assembly is scheduled for Thursday, February 1.

USD/JPY: The ‘Moon Mission’ Continues

● In accordance with information revealed by the Japanese Statistics Bureau on Friday, January 19, Japan’s Nationwide Shopper Value Index (CPI) for December was 2.6% year-on-year, in comparison with 2.8% in November. The Nationwide CPI, excluding contemporary meals, was 2.3% year-on-year in December, down from 2.5% the earlier month.

On condition that inflation is already reducing, the query arises: why increase the rate of interest? The logical reply: there is no such thing as a want. Because of this the market’s consensus forecast means that the Financial institution of Japan (BoJ) will go away the speed unchanged at its assembly on Tuesday, January twenty third, sustaining it on the damaging degree of -0.1%. (It’s price remembering that the final time the regulator modified the speed was eight years in the past, in January 2016, when it was lowered by 200 foundation factors.).

● As standard, Japan’s Finance Minister Shunichi Suzuki made one other spherical of verbal interventions on Friday, and as standard, he mentioned nothing new. “We’re carefully monitoring forex actions,” “Foreign exchange market actions are decided by numerous components,” “it is essential for the forex to maneuver stably, reflecting basic indicators”: these are statements that market members have heard numerous occasions. They not consider that the nation’s monetary authorities will transfer from persuasion to actual motion. In consequence, the yen continued to weaken, and USD/JPY continued its upward motion. (Apparently, this aligns exactly with the wave evaluation we supplied two weeks in the past.)

● The previous week’s excessive for USD/JPY was recorded at 148.80, with the week closing close to that degree at 148.14. Within the close to future, 50% of specialists anticipate additional strengthening of the greenback, 30% are siding with the yen, and 20% maintain a impartial place. As for the pattern indicators and oscillators on D1, all 100% level north, although 1 / 4 of the latter are within the overbought zone. The closest help degree is situated within the 147.65 space, adopted by 146.90-147.15, 146.00, 145.30, 143.40-143.65, 142.20, 141.50, and 140.25-140.60. Resistance ranges are set within the following areas and zones: 148.50-148.80, 149.85-150.00, 150.80, and 151.70-151.90.

● Along with the Financial institution of Japan’s assembly, one other vital occasion associated to the Japanese economic system to notice for the upcoming week is the publication of the Shopper Value Index (CPI) information for the Tokyo area, which is scheduled for Friday, January 26.

CRYPTOCURRENCIES: Quite a few Predictions, Unsure Consequence

● Final week, the long-awaited regulatory saga lastly concluded: as anticipated, on January tenth, the U.S. Securities and Trade Fee (SEC) accepted a batch of all 11 functions from funding corporations to launch spot exchange-traded funds (ETFs) primarily based on bitcoin. This information initially triggered a spike in bitcoin’s value to round $49,000. Nevertheless, the cryptocurrency then depreciated by about 15%, falling to $41,400. Consultants cite overbought circumstances or what is named “market overheating” as the primary purpose for this decline. As Cointelegraph reviews, the SEC’s optimistic resolution was already factored into the market value. In 2023, bitcoin had grown 2.5 occasions, with a major a part of this development occurring within the fall when the approval of the ETFs grew to become nearly inevitable. Many merchants and buyers, particularly short-term speculators, determined to lock in income reasonably than purchase the now costlier asset. This can be a basic instance of the market adage, “Purchase on rumors (expectations), promote on details.”

● It can’t be mentioned that this value collapse was surprising. Within the lead-up to the SEC’s resolution, some analysts had predicted a downturn. As an example, specialists at CryptoQuant talked a few potential drop in costs to $32,000. Different forecasts talked about help ranges at $42,000 and $40,000. “Bitcoin failed to interrupt by way of the $50,000 degree,” analysts at Swissblock wrote. “The query arises whether or not the main cryptocurrency can regain the momentum it has misplaced.”

● Our earlier overview was titled “D-Day Has Arrived. What Subsequent?”. Greater than every week has handed for the reason that approval of the Bitcoin ETF, however judging by the BTC/USD chart, the market nonetheless hasn’t selected a solution to this query. In accordance with Michael Van De Poppe, head of MN Buying and selling Consultancy, the worth is caught between a number of ranges. He believes that resistance lies at $46,000, however bitcoin may take a look at help within the vary between $37,000 and $40,000. In actuality, for nearly your complete previous week, the first cryptocurrency moved in a slim sideways channel: between $42,000 and $43,500. Nevertheless, on January 18-19, bitcoin skilled one other bear assault, recording a neighborhood minimal at $40,280.

● Evaluating the affect of the launch of spot bitcoin ETFs would require a while. Appropriate information for evaluation is anticipated to build up round mid-February. Nevertheless, as famous by Cointelegraph, these funds have already attracted over $1.25 billion. On the primary day alone, the buying and selling quantity of those new monetary market devices reached $4.6 billion.

Andrew Peel, Head of Digital Property at funding financial institution Morgan Stanley, factors out that the weekly influx of funds into these new merchandise already exceeds billions of {dollars}. He believes that the launch of spot bitcoin ETFs may considerably speed up the method of de-dollarization of the worldwide economic system. He’s quoted as saying, “Though these improvements are nonetheless of their infancy, they open up alternatives for difficult the hegemony of the greenback. Macro buyers ought to contemplate how these digital belongings, with their distinctive traits and rising adoption, can change the long run dynamics of the greenback.” Andrew Peel reminds us that the recognition of BTC has been rising steadily over the past 15 years, with over 106 million individuals worldwide now proudly owning the primary cryptocurrency. In the meantime, Michael Van De Poppe notes that the occasions of January 10 will change the lives of many individuals around the globe. Nevertheless, he warns that “this would be the final ‘simple’ cycle for bitcoin and cryptocurrencies” and that it “will take longer than earlier than.”

● The affect of the newly launched bitcoin ETFs on the worldwide order has additionally been a subject of debate amongst many influencers on the prime of the facility pyramid, underscoring the importance of this occasion. As an example, Elizabeth Warren, a member of the U.S. Senate Banking Committee, criticized the SEC’s resolution, expressing issues that it may hurt the prevailing monetary system and buyers. In distinction, Kristalina Georgieva, the Managing Director of the Worldwide Financial Fund (IMF), holds a special view. She believes that cryptocurrencies are a category of belongings, not cash, and it is essential to make this distinction. Subsequently, she argues, bitcoin won’t be able to interchange the U.S. greenback. Moreover, the IMF head disagrees with those that anticipate that bitcoin ETFs will contribute to the mass adoption of the primary cryptocurrency.

● Bitcoin’s value is projected to succeed in $100,000 – $150,000 by the tip of 2024 and $500,000 throughout the subsequent 5 years, in response to Tom Lee, co-founder of the analytics agency Fundstrat, in an interview with CNBC. “Within the subsequent 5 years, provide shall be restricted, however with the approval of spot bitcoin ETFs, now we have doubtlessly big demand, so I believe one thing round $500,000 is kind of achievable inside 5 years,” the knowledgeable acknowledged. He additionally highlighted the upcoming halving within the spring of 2024 as an extra development issue.

ARK Make investments CEO Cathy Wooden, additionally talking on CNBC, predicted a bullish situation the place the primary cryptocurrency may attain $1.5 million by 2030. Her agency’s analysts calculated that even beneath a bearish situation, the worth of the digital gold would develop to at the least $258,500.

One other forecast was given by Anthony Scaramucci, founding father of SkyBridge Capital and former White Home Communications Director. “If bitcoin is at $45,000 throughout the halving, then by mid-to-late 2025, will probably be price $170,000. Regardless of the value of bitcoin is on the day of the halving in April, multiply it by 4, and it’ll attain that determine throughout the subsequent 18 months,” mentioned the SkyBridge founder in Davos, forward of the World Financial Discussion board.

● It is fascinating to see how totally different AI chatbots have supplied diversified predictions for the worth of bitcoin by December 31, 2024. Claude On the spot from Anthropic predicted $85,000, whereas Pi from Inflection expects an increase to $75,000. Bard from Gemini forecasts that the worth of BTC will exceed $90,000 by that date, although it cautions that unexpected financial obstacles may restrict the height to round $70,000. ChatGPT-3.5 from OpenAI sees a value vary of $75,000 to $85,000 as believable however not assured. A extra conservative estimate from ChatGPT-4 suggests a variety of $40,000 to $60,000, factoring in potential market fluctuations and investor warning, however would not rule out an increase to $80,000. Lastly, Bing AI from Co-Pilot artistic predicts a value round $75,000, primarily based on the data it has gathered.

These various predictions from AI programs replicate the inherent uncertainty and complexity in forecasting cryptocurrency costs, highlighting a variety of things that might affect market dynamics over the subsequent few years.

● As of the night of January 19, BTC/USD was buying and selling round $41,625. The whole market capitalization of the cryptocurrency market stood at $1.64 trillion, down from $1.70 trillion every week earlier. The Bitcoin Worry & Greed Index, a measure of market sentiment, has dropped from 71 to 51 factors over the week, transferring from the ‘Greed’ zone to the ‘Impartial’ zone. This shift signifies a change in investor sentiment, reflecting a extra cautious strategy within the cryptocurrency market.

● In conclusion relating to the rising market hypothesis concerning the imminent launch of spot ETFs on Ethereum, in our earlier overview, we cited a press release by SEC Chairman Gary Gensler, who clarified that the regulator’s optimistic resolution applies completely to exchange-traded merchandise primarily based on bitcoin. In accordance with Gensler, this resolution “doesn’t sign readiness to approve itemizing requirements for crypto belongings which can be thought-about securities.” It is essential to notice that the regulator nonetheless classifies solely bitcoin as a commodity, whereas “the overwhelming majority of crypto belongings are seen as funding contracts (i.e., securities).”

Now, analysts from the funding financial institution TD Cowen have confirmed pessimism relating to ETH-ETFs. Primarily based on the data they’ve; it appears unlikely that the SEC will start reviewing functions for this funding instrument within the first half of 2024. “Earlier than approving ETH-ETFs, the SEC will wish to acquire sensible expertise with related funding devices in bitcoin,” commented Jaret Seiberg, head of TD Cowen Washington Analysis Group. TD Cowen believes that the SEC will revisit the dialogue of Ethereum ETFs solely after the U.S. presidential elections in November 2024.

Nikolaos Panagirtzoglou, a senior analyst at JP Morgan, additionally doesn’t anticipate a fast approval of spot ETH-ETFs. He opines that for the SEC to decide, it must classify Ethereum as a commodity reasonably than a safety. Nevertheless, JP Morgan considers such a improvement unlikely within the close to future.

NordFX Analytical Group

Discover: These supplies will not be funding suggestions or tips for working in monetary markets and are supposed for informational functions solely. Buying and selling in monetary markets is dangerous and may end up in a whole lack of deposited funds.

#eurusd #gbpusd #usdjpy #Foreign exchange #forex_forecast #signals_forex #cryptocurrency #bitcoin #nordfx