Information from the buying and selling analytics platform BitMEX Analysis reveals that Constancy’s Bitcoin spot ETF – FBTC – has now witnessed a complete influx of over $1 billion. This improvement comes as BTC makes an attempt to rebound from its latest dip during the last two weeks with a 1.56% achieve up to now day, based mostly on knowledge from CoinMarketCap.

Constancy Joins BlackRock On Unique $1-B Listing, As Grayscale’s ETF Continues To Bleed

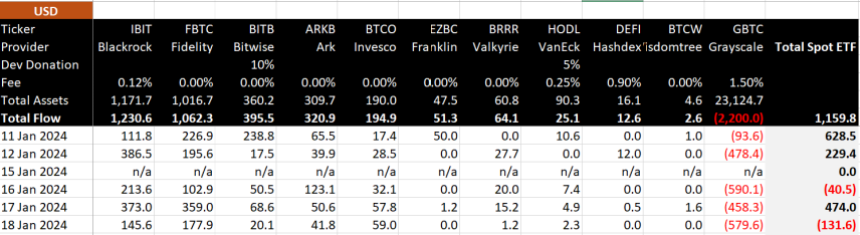

Following the official launch of Bitcoin spot ETF buying and selling on January 11, Constancy has now develop into the second asset supervisor, with its BTC spot ETF recording an accumulative influx of $1 billion. Based on BitMEX Analysis, Constancy’s FBTC skilled an influx of $177.9 million on January 18, bringing its complete inflows to $1.1 billion inside 5 days of buying and selling.

FBTC now sits on the identical desk as BlackRock’s IBIT, whose complete inflows are valued at $1.2 billion. Collectively, each funding funds by Constancy and BlackRock now account for over 67% of the $3.4 billion inflows recorded within the Bitcoin spot ETF market thus far.

Different Bitcoin spot ETFs with a notable optimistic efficiency embody Bitwise’s BITB, Ark Make investments’s ARKB, and Invesco’s BTCO, which have posted particular person complete inflows of $395.5 million, $320.9 million, and $194.8 million, respectively.

Bitcoin Spot ETF Movement knowledge – Day 5

Information out for all suppliers

Web outflow of $131.6m on day 5 for all spot ETFs, giant $579.6m GBTC outflow pic.twitter.com/McHZrRghtu

— BitMEX Analysis (@BitMEXResearch) January 19, 2024

Then again, Grayscale’s GBTC continues to expertise outflows on a large scale.

BitMEX Analysis reveals that GBTC recorded an outflow of $579.6 million on January 18, main the Bitcoin spot ETF market to witness a web outflow of $131.6 million. This represented the second day the BTC spot ETF market recorded a web outflow since its launch.

GBTC’s complete outflows are actually valued at $2.1 billion, leading to Bitcoin spot ETFs having a cumulative web influx of solely $1.3 billion regardless of the $1 billion standing of BlackRock and Constancy’s ETFs.

Supply: BitMEX Analysis

Bitcoin’s Worth Overview

In opposition to standard predictions, Bitcoin has witnessed a value decline within the final two weeks following the approval of the much-anticipated BTC spot ETF on January 10. Many analysts have attributed this sudden improvement to the huge promoting strain generated by GBTC’s outflows.

On the time of writing, Bitcoin trades at $41,536, with a decline of two.55% and 5.50% within the final seven and 14 days, respectively. As earlier said, the premier cryptocurrency has garnered some positive factors of 1.56% within the final day, which can be indicative of a restoration, nevertheless, it’s too early to name.

BTC buying and selling at $41,561 on the day by day chart | Supply: BTCUSDT chart on Tradingview.com

Featured picture from Investopedia, chart from Tradingview

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal danger.