Canada’s major inventory market benchmark, the S&P/TSX Composite Index, has executed wonders to date this 12 months: it’s soared previous prior file ranges, rising over 21% 12 months so far to the touch 30,000. If you happen to’ve acquired some money on the sidelines, you could be feeling a mixture of pleasure and nervousness in October. It’s pure to surprise if placing new cash to work now could be like shopping for on the high. However what if I show to you that investing at all-time highs isn’t a lure? Actually, it’s typically probably the most rewarding path ahead for these with a long-term funding horizon.

The TSX is supposed to maintain rising

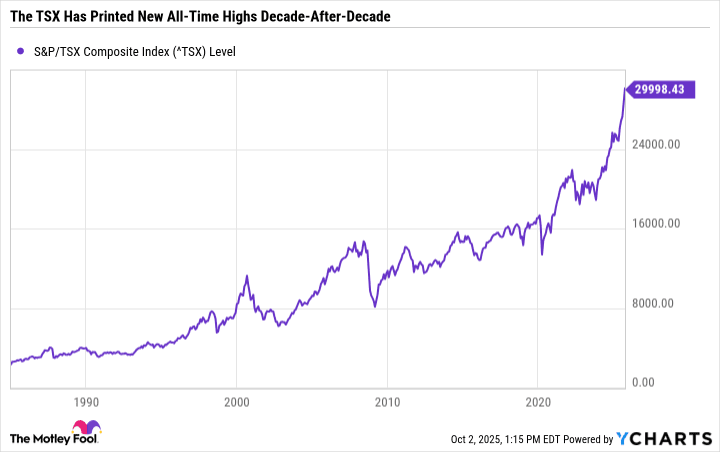

Let’s get one factor straight: markets are naturally designed to achieve new peaks. Because the TSX’s inception, it has persistently charted a path upward over the long term. This isn’t magic. It’s a results of financial progress, company income growth, and the collective enhance in Canada’s nationwide wealth.

A take a look at a 30-year chart of the TSX reveals a line that wobbles however finally traits definitively increased. Ready for a dip which will by no means arrive inside your funding time horizon is a traditional misstep.

By the point a big downturn happens, the market would possibly already be far above right this moment’s ranges, making your present “all-time excessive” appear like a discount in hindsight. The actual threat isn’t shopping for at market highs; it’s not shopping for in any respect and watching your capital’s buying energy get slowly eroded by persistent (and pure) inflation.

Hunt down the market’s bargains

How do you dive in with new capital when all the things appears to be like costly? The secret is to look beneath the floor. The TSX’s spectacular rally in 2025 has been closely fueled by the meteoric rise of metals and mining shares, with giants like Barrick Mining and Kinross Gold inventory posting staggering good points as gold costs hit data. The S&P/TSX Capped Gold Index has posted a 107% year-to-date acquire as gold (and silver) printed new highs this 12 months. Whereas these shares could also be dear now, different areas have been left within the mud. That is the place alternative lies.

Canadian actual property funding trusts (REITs), for example, have been relative laggards. Their distribution yields stay notably enticing for passive-income functions. Equally, the industrials sector has felt the sting of geopolitical headwinds and has underperformed the broader market. The S&P/TSX Capped Industrials Index is up 3.9% over the primary three quarters of 2025.

These sectors haven’t had their second within the solar this 12 months, however for forward-looking traders, that’s exactly what makes them fascinating right this moment. Their time to catch up will come. They could possibly be prepared for brand new cash.

Think about a tactical shift: Sector rotation

If you happen to’ve already ridden the wave with high-flying Canadian shares this 12 months, October could possibly be a wonderful time to consider a sector rotation. This merely means taking some income out of your winners and reinvesting them into areas that possess robust fundamentals however haven’t but participated totally within the rally.

For instance, the TSX communication companies sector continues to be down 13.8% over the previous 12 months, regardless of a modest acquire this 12 months. The capped actual property and industrials indices have additionally posted single-digit good points, lagging far behind the general market. By rotating into these underperformers, you place your portfolio for potential future good points when the market’s momentum finally shifts.

Go on a treasure hunt for hidden gems

Canadian traders with the time and inclination may go on probably the most rewarding technique: old style inventory selecting.

This technique entails digging into an organization’s financials, evaluating its price-to-earnings ratio, which compares its share value to its per-share income, or its earnings earlier than curiosity, taxes, depreciation, and amortization, a measure of core profitability, amongst different basic valuation metrics.

The aim is to seek out implausible companies whose present inventory costs don’t mirror their underlying energy and progress potential. Just lately, beaten-down progress shares like Constellation Software program and MDA Area have traditionally been examples of such long-term winners.

If you happen to lack the time for deep analysis, contemplate becoming a member of a group of like-minded traders. The precept stays the identical: concentrate on nice companies, not on guessing the market’s subsequent transfer. Because the legendary Warren Buffett advises, the aim isn’t to time the market, however to spend time out there.

The Silly backside line

The TSX at an all-time excessive isn’t a cease signal; it’s solely a milestone. By specializing in undervalued sectors, contemplating strategic rotations, and trying to find particular person shares with a disconnect between value and worth, you possibly can confidently proceed your investing journey.