Understanding Type W-4 is essential to managing how a lot federal earnings tax is withheld out of your paycheck. Whether or not you’re seeking to increase your take-home pay or plan for an even bigger tax refund, filling out your W-4 tax type appropriately will help you hit that candy spot.

At a look:

- Type W-4 tells your employer how a lot federal earnings tax to withhold out of your paycheck.

- You possibly can regulate your W-4 type anytime, but it surely’s particularly necessary to take action after main life adjustments.

- Reducing your tax withholding could lead to an even bigger month-to-month paycheck; withholding more cash every month could lead to an even bigger tax refund.

- As of 2020, Type W-4 not makes use of withholding allowances.

What’s Type W-4?

Type W-4, often known as the Worker’s Withholding Certificates, is utilized by employers to find out how a lot federal earnings tax to withhold out of your payroll. Primarily based on the small print you present, it helps your employer calculate your tax obligation for every pay interval. The objective is to match your tax withholding together with your precise tax legal responsibility, so that you don’t find yourself owing a big tax invoice or getting a big tax refund while you file your return.

Type W-4 updates

In 2020, the Inside Income Service (IRS) made vital adjustments to Type W-4 to simplify the method and supply extra correct federal earnings tax withholding for taxpayers. The brand new design eliminated the usage of allowances, which had been beforehand tied to non-public exemptions that had been eradicated by the Tax Cuts and Jobs Act (TCJA) in 2017.

Now, the W-4 type is extra simple, specializing in components like further earnings, deductions, and dependents. This variation was supposed to make the shape simpler to know and fill out, whereas additionally serving to workers keep away from over- or under-withholding. Correct withholding can forestall surprises for tax return filers — whether or not that’s an enormous tax invoice or a big refund.

Type W-4 instance

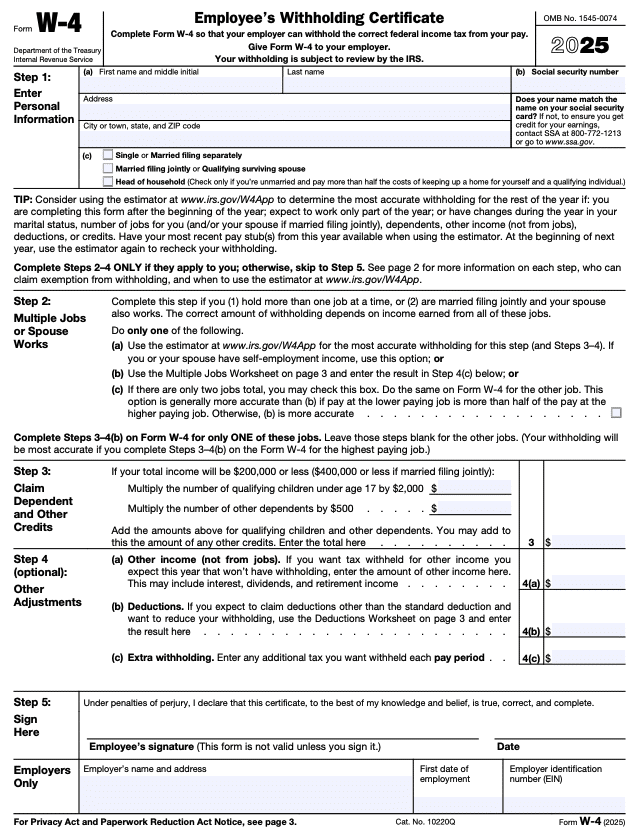

Type W-4 for the present yr seems like this:

This tax type consists of a number of necessary sections:

- Step 1 is on your fundamental data, akin to title, deal with, and Social Safety identification quantity.

- Step 2 applies in the event you maintain a number of jobs or have a partner who additionally works.

- Step 3 is the place you account on your qualifying dependents and different tax credit.

- Step 4 is for extra changes, together with another earnings, deductions, or additional quantities of tax you need withheld.

Every part is designed to account for varied components affecting your tax legal responsibility, like the usual deduction and Baby Tax Credit score, which might have an effect on your remaining tax invoice or tax refund quantity.

Type W-4 directions

How do I fill out a W-4 type?

It’s straightforward to finish Type W-4. Right here’s a step-by-step information to assist:

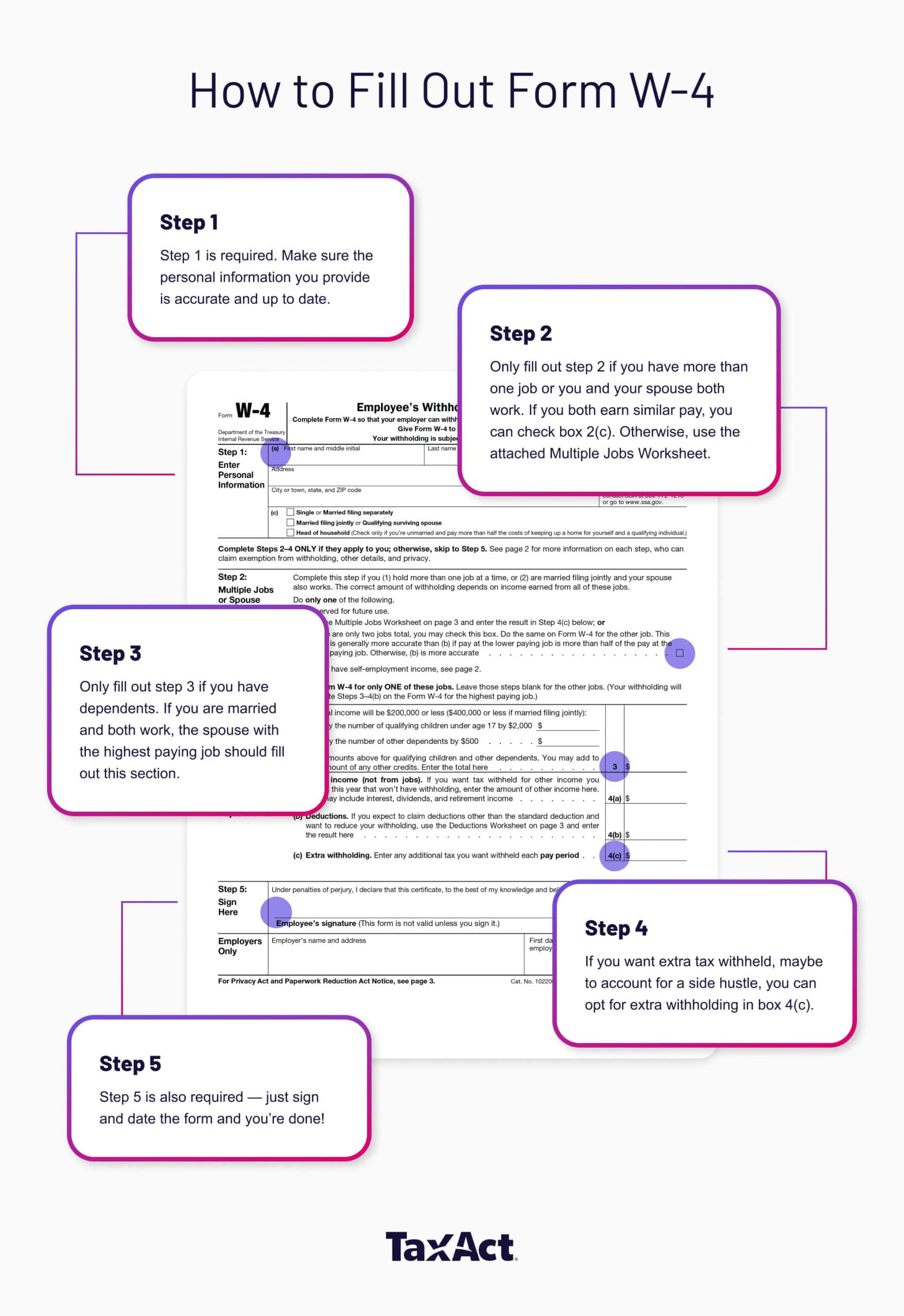

- Full Step 1 together with your private particulars, like your title, Social Safety quantity, and deal with. You’ll additionally choose your submitting standing right here, akin to married submitting collectively or head of family.

- Solely fill out Step 2 in case you have a second job or your partner works. This step ensures the correct quantity of tax is withheld primarily based on all earnings sources. When you and your partner each work and earn related pay, test field 2(c). In any other case, use the A number of Jobs Worksheet hooked up to Type W-4 that will help you fill out this part.

- In Step 3, declare the suitable variety of dependents to regulate your withholding primarily based on the Baby Tax Credit score or different credit. If you’re married and each work, solely the partner with the very best paying job ought to fill out this part. The opposite partner can go away Step 3 clean.

- Step 4 permits for changes, akin to reporting further earnings (like self-employment earnings), coming into tax deductions past the usual deduction, or specifying an extra quantity of tax you need withheld. If you’d like further tax withheld for any cause, you’ll be able to request additional withholding on line 4(c).

- Lastly, signal and date the shape in Step 5 earlier than submitting it to your employer.

FAQs about Type W-4

fill out a brand new Type W-4 with TaxAct

Talking of adjusting your Type W-4 withholding — we will help with that too. TaxAct’s Refund Booster software is a W-4 calculator designed that will help you fine-tune your tax withholding primarily based in your private targets. Whether or not you favor to get a smaller tax refund with extra take-home pay in every paycheck or a bigger refund at tax time, Refund Booster can information you thru filling out a brand new Type W-4 to match your preferences.

Right here’s the way it works:

- We’ll begin by asking you just a few questions on your tax state of affairs, like whether or not you acquired a refund or owed tax funds in the course of the prior yr, and the way a lot.

- Primarily based in your solutions, we’ll show you how to regulate your withholding to align together with your targets.

To verify your withholding is as correct as attainable, Refund Booster may even collect details about your submitting standing, what number of jobs you (and your partner, if relevant) have, and any 401(ok), HSA, FSA, or different pre-tax contributions you propose to make. We’ll additionally ask about any dependents you may have and issue that in for the Baby Tax Credit score, together with any further earnings you may earn from capital features or retirement funds.

After amassing this data, we’ll pre-fill your new Type W-4 for you. All it is advisable to do is evaluation, signal, and print it, then hand it off to your employer. Easy!

The underside line

Type W-4 is important for managing how a lot earnings tax is withheld out of your paycheck. Filling out the shape precisely can imply the distinction between a bigger paycheck now or a bigger refund later. When unsure, TaxAct is right here that will help you regulate your W-4 type simply as wanted, guaranteeing that your tax state of affairs is optimized on your particular person monetary targets.

* Refund Booster could not work for everybody or in all circumstances and by itself doesn’t represent authorized or tax recommendation. Your private tax state of affairs could range.

This text is for informational functions solely and never authorized or monetary recommendation.

All TaxAct presents, services and products are topic to relevant phrases and circumstances.