The best way to know when to simply accept shoppers and when to terminate the connection.

Highlights

- Audit corporations should comply with PCAOB pointers, notably the upcoming QC 1000 customary, which mandates a proper, risk-based high quality management system for shopper acceptance and continuance.

- Efficient due diligence includes evaluating administration integrity and monetary well being, making certain agency independence underneath stricter AICPA ethics interpretations, and speaking with predecessor auditors to determine pink flags.

- Corporations should internally assess their capability and competence, making certain enough business experience and associate bandwidth for high quality supervision.

An audit agency’s resolution to simply accept and proceed a shopper carries vital weight — and for good cause.

Accepting engagements past a agency’s skilled competence violates Public Firm Accounting Oversight Board (PCAOB) requirements and will increase danger and reputational hurt. That’s why having risk-based audit shopper acceptance procedures in place is important.

To assist corporations navigate the nuances, this text peels again the layers to handle how corporations can determine dangers when accepting new shoppers, when it’s time to finish a shopper relationship, how corporations can higher handle audit shopper engagements with ease, and extra.

Soar to ↓

What are the PCAOB pointers for audit shopper acceptance procedures?

Figuring out dangers when accepting new shoppers

Due diligence pink flags for auditors

How audit leaders can deal with shopper capability

Consumer continuance and understanding when to finish the connection

The best way to handle audit shopper engagements with ease

What are the PCAOB pointers for audit shopper acceptance procedures?

The PCAOB establishes necessities that auditors should comply with when figuring out whether or not to simply accept or proceed an engagement.

The pointers, at their core, give attention to making certain that an engagement is simply accepted when a agency can moderately count on to finish it with skilled competence, after acceptable due diligence and danger evaluation.

With the latest adoption of the QC 1000, A Agency’s System of High quality Management, the PCAOB is making it crystal clear that shopper acceptance and continuation are crucial parts of a agency’s whole high quality administration system.

QC 1000, which has been postponed by one yr to December 15, 2026, expands on PCAOB’s present pointers to supply audit corporations with a extra risk-based high quality management framework when they’re deciding whether or not to simply accept or proceed shopper engagements.

Reasonably than being merely a regular process, QC 1000 formalizes and elevates shopper acceptance and continuance procedures by embedding them right into a extra rigorous, documented, and constantly monitored high quality management framework throughout the agency.

Corporations could have an additional yr earlier than QC 1000 goes into impact, however early preparation is essential to making sure compliance and sustaining audit high quality. That includes conducting a niche evaluation of present high quality management methods, implementing enhanced shopper acceptance and continuance audit procedures, and leveraging the appropriate instruments and applied sciences.

PPC’s Information to PCAOB Audits

A time-tested, confirmed audit method designed to carry out a public firm audit underneath PCAOB requirements

Figuring out dangers when accepting new shoppers

Not each engagement is the appropriate match. Having the ability to determine and assess dangers upfront allows corporations to make knowledgeable acceptance choices and higher safeguard audit high quality and agency fame. That’s why taking a disciplined, risk-based method is essential.

“I believe one of many first issues they [audit firms] have to do is a few inner evaluation on their very own independence and capability, and ensure they’ll do the work earlier than they get too far … after which they should do due diligence on the shopper,” stated Alison Stephens, Government Editor of PPC merchandise for Thomson Reuters. “It is advisable be sure that that is anyone you need to be in enterprise with. There’s a complete host of issues; a few of them come from the [PCAOB and AICPA] auditing requirements and the standard administration requirements, and a few of them are simply frequent sense.”

To additional break it down, corporations should think about the next earlier than taking over a brand new shopper:

Independence

Assess agency independence earlier than accepting a brand new engagement. That features reviewing any monetary pursuits, prior companies, or relationships that would impair agency independence, and figuring out if the shopper’s enterprise may create a battle of curiosity.

It is very important be aware that the AICPA lately sharpened and expanded its ethics interpretations to supply additional readability on guidelines and thresholds.

Stephens defined, “One thing else to think about is the familiarity menace. Actually, you simply know the shopper too properly to train acceptable skilled skepticism. … Additionally, payment issues in proportion to your complete monetary well-being. So, is one job paying for half of your agency’s existence? That’s a reasonably new AICPA ethics interpretation. Are the charges disproportionate such that you just’re probably not impartial?”

Integrity

Consider the integrity of the chief group. This entails performing background checks, on the lookout for previous authorized or regulatory points, and their historical past of monetary statements. Does the shopper have a fame for being clear and compliant with legal guidelines and rules?

Monetary well being

Analyze the corporate’s monetary stability and money circulate. Are they underneath monetary pressure? Have they got a posh income mannequin? Is it an business with greater inherent danger, like monetary companies or healthcare?

Predecessor auditor communications

If the shopper had a earlier auditor, auditing requirements require successor auditors to speak with the predecessor auditor (topic to shopper consent) earlier than accepting a brand new engagement. Doing so helps the agency assess engagement danger. Inquiries to ask embody: Does the predecessor auditor know of or suspect any fraud? Did they’ve disagreements with the shopper? Why is the corporate altering auditors? How lengthy did they function the shopper’s auditor?

Due diligence pink flags for auditors

Correct due diligence allows corporations to determine dangers as beforehand famous, and there are a number of pink flags to not be ignored. These embody:

- Opinion purchasing: This system prioritizes the shopper’s administration’s most popular consequence, not solely eroding belief and audit high quality but in addition putting the agency at elevated danger.

- Litigation: Is the corporate dealing with any authorized proceedings, and on the flip facet, is the corporate litigious? Corporations could not need to do enterprise with an organization that’s identified to sue its distributors or different associates.

- Fraud allegations and prison exercise: If an organization or its administration has any previous or current situations of fraud allegations or prison exercise, corporations should tread rigorously. The corporate could have new administration in place to resolve any points associated to fraud and misconduct and restore integrity; nevertheless, if the prior administration group stays in place, that’s particularly regarding.

- Monetary instability: Corporations need to guarantee they are going to make an inexpensive return on an engagement. If a possible shopper is in monetary misery, they could not have the flexibility to pay the audit agency for its companies. Unpaid charges may also result in independence points for future engagements.

How audit leaders can deal with shopper capability

The PCAOB Code of Ethics requires that auditors not solely be impartial and goal, however they have to even have the capability and competence to carry out a high-quality audit.

“You need to take a look at the business itself. Do you’ve got the business experience in-house? Is that this a extremely specialised space, and do you’ve got folks in-house who’re going to have the ability to do that, or are there sure features of the enterprise the place you will have to rent a specialist? Which is okay if the engagement price range can bear that,” Stephens stated.

Making certain that the agency has the time to carry out an audit correctly can also be important, as auditing requirements emphasize that engagement companions be concerned and assume final accountability for audit high quality. That features planning, supervision, and overview of the engagement.

“The standard administration requirements are actually particular about engagement associate duties, and auditors get in hassle with peer overview, they get in hassle in PCAOB inspections when there’s not sufficient supervision; when there’s not sufficient associate involvement,” stated Stephens. “So, it is advisable be sure that your engagement companions have the bandwidth to do the work as properly.”

A great way to gauge how lengthy an engagement could take to finish is to discuss with related engagements the agency has completed previously, Stephens steered.

Additionally, take into account that first-year audits typically require extra time and work, and an organization present process its first-ever audit may even require extra time and sure be labor-intensive.

Issues for smaller audit corporations

Smaller corporations with fewer assets and strained bandwidth could also be particularly involved about audit capability, in addition to competency. That stated, there are measures they’ll take to assist guarantee success.

“If you wish to develop your agency, you’re going to perhaps need to step outdoors of your consolation zone. And you are able to do that. You’ll be able to go into an business that you just’ve perhaps by no means labored in earlier than; you’ve simply bought to just be sure you have assets and coaching obtainable, specialists obtainable to make that transition. That’s the way you develop,” Stephens stated.

Smaller audit corporations which can be involved about capability could need to think about implementing a “scorecard” system. Because the PCAOB highlighted in a latest version of its Audit Focus, right here’s the way it works: factors are assigned to a associate primarily based on the quantity and kind of audits already served. The upper the factors, the upper the workload.

“The purpose is to maintain every associate’s workload at a degree the place they’re under a sure factors threshold and are due to this fact in a position to serve a brand new or present engagement. Companions exceeding the purpose purpose are required to debate associate project with management to find out their capability to tackle one other engagement,” PCAOB defined within the July 2025 version of Audit Focus: Engagement Acceptance.

Consumer continuance and understanding when to finish the connection

Auditing and high quality administration requirements require that corporations reassess continuance a minimum of yearly, usually earlier than planning begins for the subsequent audit cycle. That allows corporations to judge whether or not any situations could have modified that may impair their skill to carry out the engagement with independence, competence, and integrity.

That stated, auditors additionally have to know when it’s time to finish a shopper relationship ought to issues or pink flags come up. As Stephens outlined, such situations could embody:

- Administration’s integrity turns into questionable. For instance, the auditor finds proof of fraud, misrepresentation, or the shopper demonstrates an unwillingness to supply data.

- The shopper is unable or unwilling to pay the charges owed to the agency.

- There’s been a change inside the shopper or the audit agency that impairs independence.

The best way to handle audit shopper engagements with ease

Staying forward in shopper acceptance and continuance doesn’t need to be an uphill battle. By combining a risk-based audit method with the appropriate expertise, corporations can streamline processes, mitigate danger, and confidently ship a high-quality audit for engagements of all sizes.

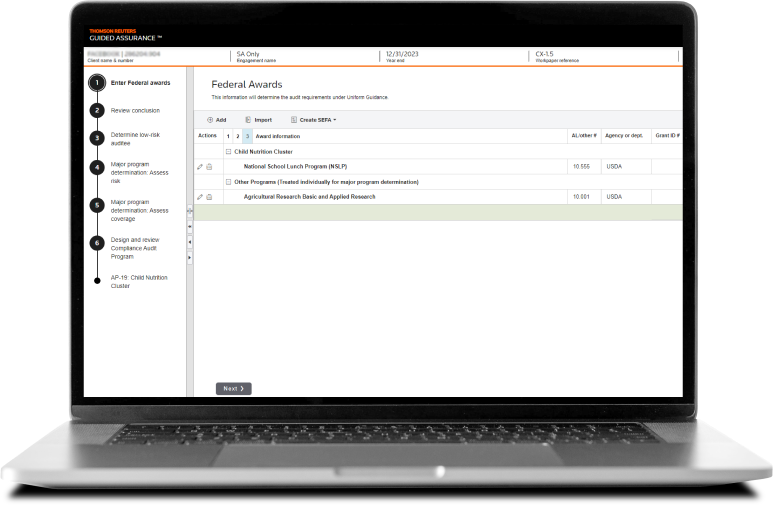

Thomson Reuters is right here to assist with the expertise and instruments your audit agency must carry out environment friendly and worthwhile audits that adjust to skilled requirements and move peer overview.

Equip your agency for fulfillment and uncover what’s shaping the way forward for audit management by exploring our new digital information, “The three pillars powering the subsequent era of audit leaders.”