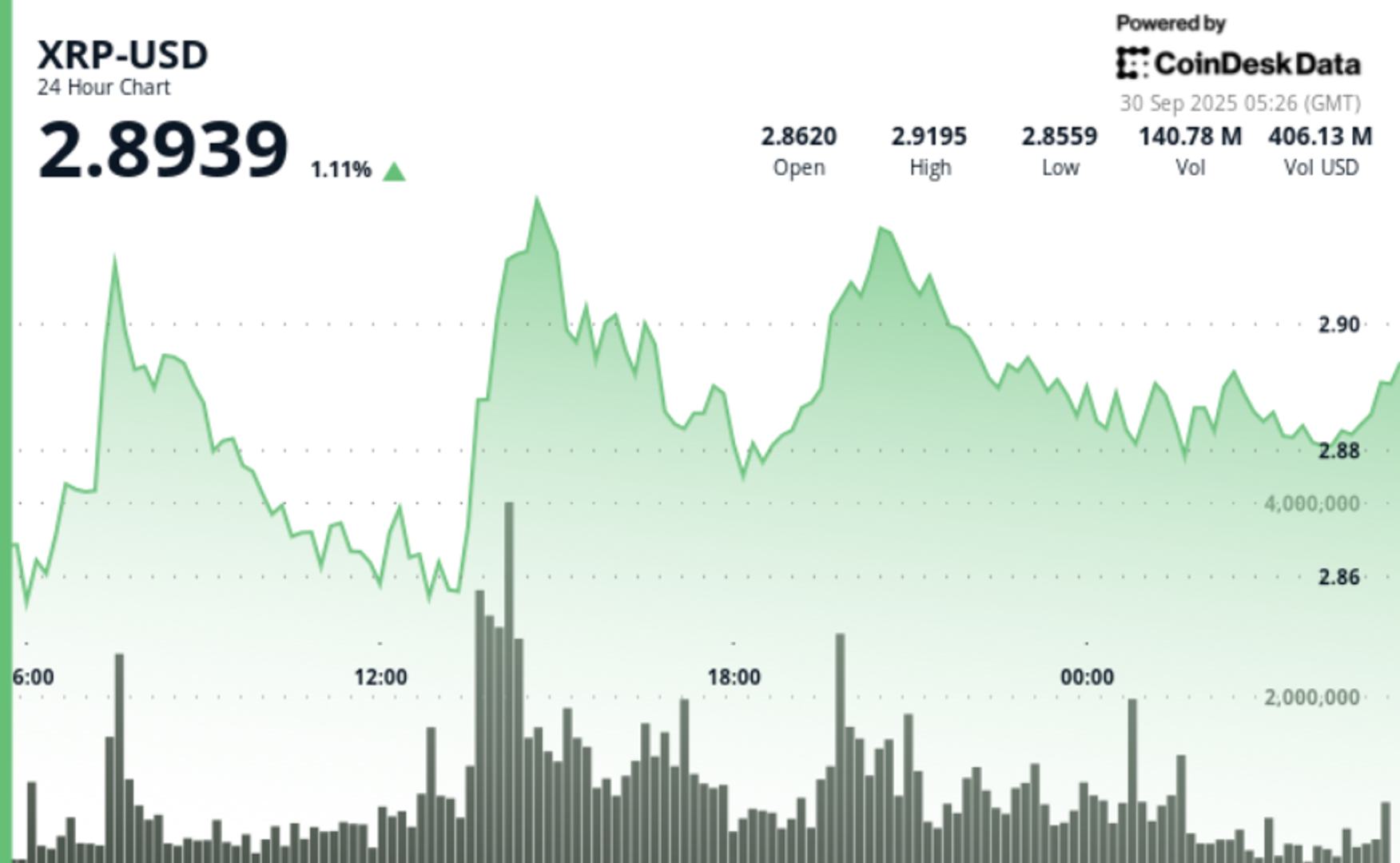

XRP gained 2.1% in the course of the 24-hour buying and selling session from September 28 at 21:00 to September 29 at 20:00, climbing from $2.84 to $2.90 whereas transferring inside a $0.10 vary that represented 3.47% of the opening value.

Information Background

• Giant institutional addresses holding between 10–100 million XRP tokens amassed over 120 million cash throughout the final 72 hours.

• Seven XRP spot ETF functions stay pending earlier than the U.S. Securities and Alternate Fee. Grayscale’s submission is scheduled for October 18, with others queued by means of November 14, making a concentrated window of regulatory catalysts that would reshape near-term flows.

• Market sentiment has been buoyed by anticipation of elevated company portfolio publicity. Analysts body ETF approvals as a structural driver that would speed up XRP’s adoption inside institutional allocation methods.

Value Motion Abstract

• XRP traded inside a $0.10 hall, fluctuating between a low of $2.84 and a excessive of $2.93, reflecting 3.5% volatility in the course of the interval. Value capped out close to $2.93 the place promoting stress intensified, significantly in the course of the September 29 14:00 session.

• Essentially the most vital upward strikes got here at 02:00 and 07:00 GMT on September 29, the place quantity spiked to over 97 million items. These surges considerably outpaced the each day common of 57.4 million, confirming institutional participation throughout rally phases.

• The ultimate hour of buying and selling prolonged the advance, as value moved from $2.88 to $2.90 for a 0.7% late acquire. The breach of the $2.90 psychological barrier was confirmed by a 4.8 million unit quantity burst, taking the session to its highs earlier than settling round $2.9045.

Technical Evaluation

• Resistance is clustered between $2.92 and $2.93, the place value repeatedly stalled on increased quantity. This zone marks the following hurdle for continuation, with breakout affirmation doubtless requiring an in depth above $2.93 on increasing participation.

• Assist has consolidated between $2.85 and $2.86, the place patrons constantly defended bids throughout retracements. A number of profitable retests of this band all through the session spotlight its significance as an accumulation zone.

• The $2.90 psychological degree has shifted right into a near-term pivot. Value reclaimed it within the late session, and merchants will monitor whether or not this may maintain as help heading into the weekend.

• Volatility over the 24-hour window reached 3.47%, in line with elevated institutional repositioning round key regulatory catalysts.

What Merchants Are Watching

• Whether or not XRP can maintain closes above $2.90 and flip this into help, which might validate continuation makes an attempt towards $3.00 and past.

• The SEC’s October–November ETF assessment window, with Grayscale’s October 18 date seen as the primary main structural catalyst for institutional inflows.

• Whale pockets exercise, with 120 million tokens amassed over three days suggesting additional upside if this tempo continues.

• Broader macro circumstances, with Treasury yield volatility and Fed coverage alerts influencing danger urge for food throughout each equities and digital property.