As Bitcoin (BTC) continues to stay range-bound between $110,000 – $115,000, information from crypto exchanges appears divided towards the main cryptocurrency. Whereas Binance merchants are exhibiting a bullish stance, merchants from different exchanges are nonetheless displaying a level of hesitation.

Binance Merchants Anticipating Bitcoin Worth Surge

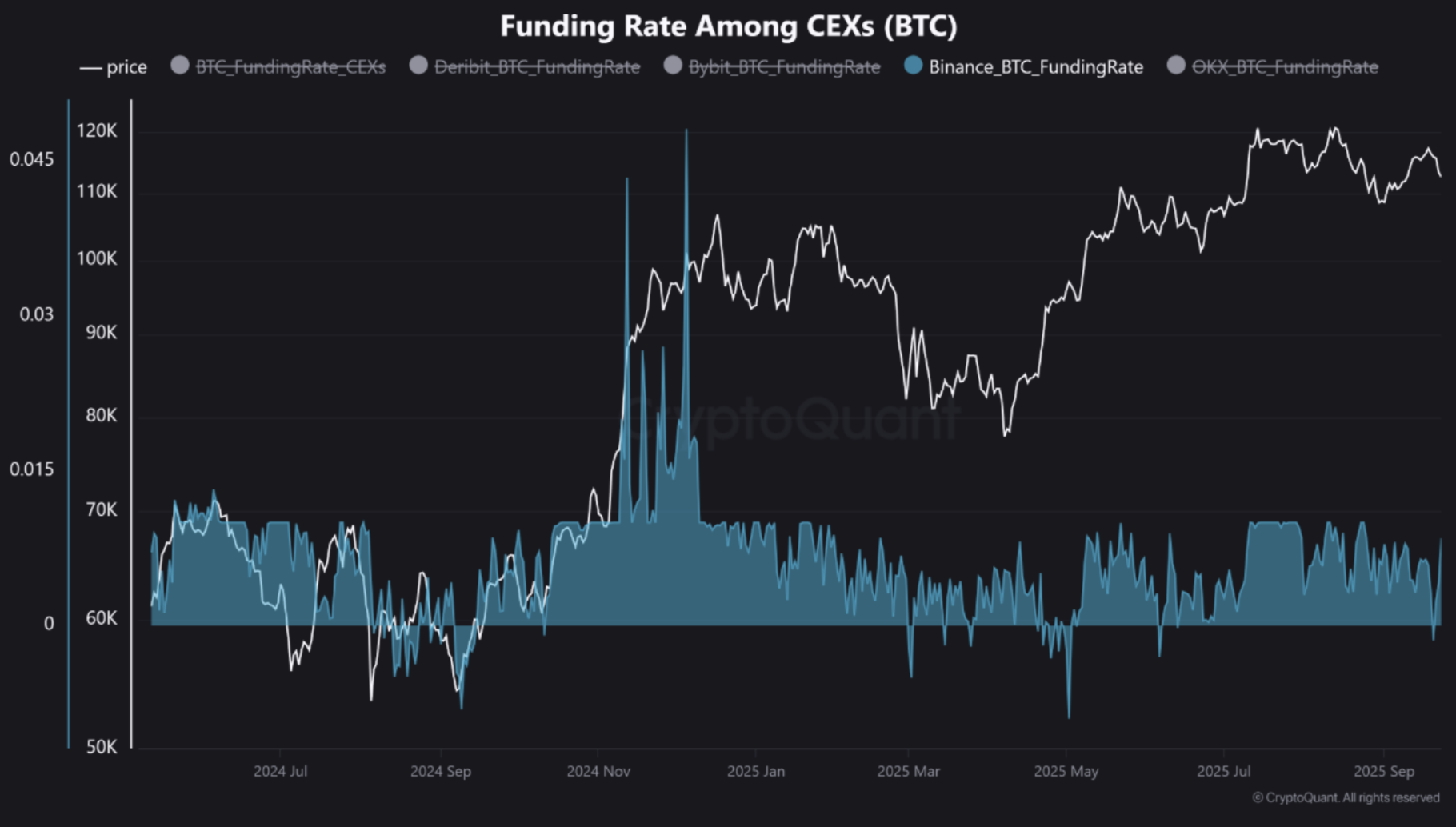

In response to a CryptoQuant Quicktake publish by contributor Crazzyblockk, recent derivatives information from Binance is signaling shifting market dynamics – particularly, the latest BTC funding fee on Binance factors towards merchants taking a bullish stance.

Associated Studying

Quite the opposite, the BTC funding fee from different exchanges, equivalent to OKX, Bybit, and Deribit, means that merchants on these platforms are nonetheless unsure about taking any directional guess.

As of September 23, the BTC perpetual funding fee on Binance climbed to +0.0084%, suggesting that the lengthy positions are dominant and merchants are keen to pay a premium to keep up their bullish bets.

It’s price highlighting that the rise in funding fee shouldn’t be an remoted occasion, because it suggests a constructive seven-day change, indicating strengthening conviction amongst Binance merchants.

For comparability, the BTC funding fee on OKX is presently hovering at -0.0001%, whereas on Bybit it sits at 0.0015%. Lastly, Deribit exhibits a funding fee of 0.0019%. The analyst added:

This isn’t only a distinction in numbers; it’s a distinction in narrative. Whereas funding charges on OKX and Bybit have really decreased during the last seven days, Binance’s fee has climbed.

For the uninitiated, funding charges might be considered as a real-time gauge of dealer sentiment within the perpetual swaps market. A powerful constructive fee like that of Binance, which diverges from the remainder of the market, factors towards aggressive bullish hypothesis.

Is BTC About To Make A Transfer?

In a separate CryptoQuant publish, contributor XWIN Analysis Japan famous that Bitcoin’s implied volatility has dropped to its lowest stage since 2023. Again then, the lull available in the market was adopted by an explosive rally of 325%, which propelled BTC from $29,000 to $124,000.

Associated Studying

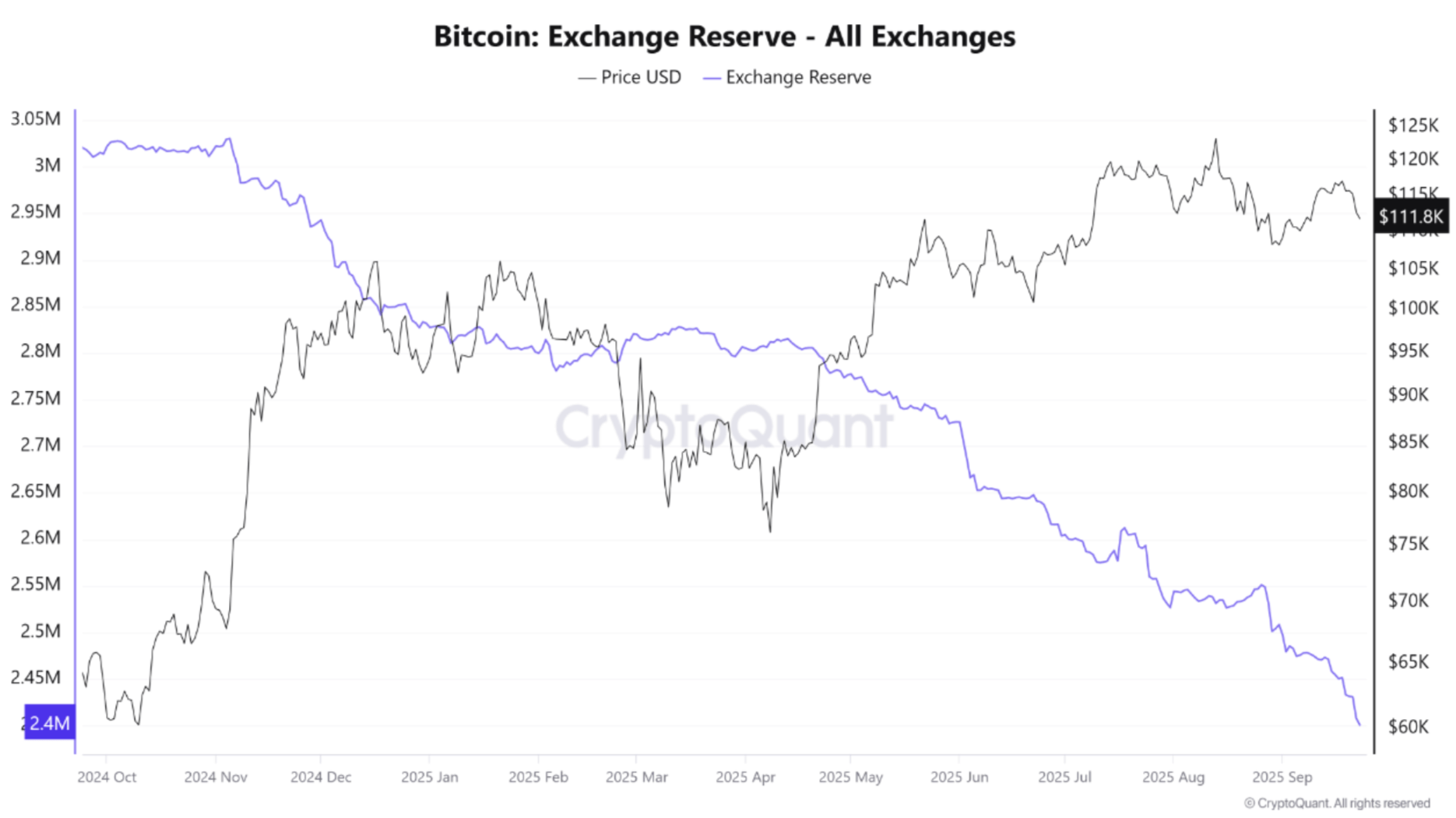

The analyst added that the whole Bitcoin alternate reserves proceed to deplete at a speedy tempo, hitting new multi-year lows. Traditionally, such a fall in BTC alternate reserves has preceded provide squeezes, resulting in a dramatic rise in demand.

That mentioned, the general sentiment towards BTC seems to be chilly at current. The Bitcoin Concern & Greed Index suggests that buyers are terrified of getting into the market, which can supply an excellent alternative to build up BTC at present market costs.

Nonetheless, recent information from BTC wallets confirms that new wallets – these which are lower than a month previous – are beginning to purchase the highest digital asset. At press time, BTC trades at $113,796, up 1% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com