Introduction

Understanding the essential ideas and main terminologies is important for fulfillment in each space. Cryptocurrency is not any totally different; everyone knows that crypto is a posh sphere to cope with and a troublesome space to wander in. So, navigating there with out understanding the essential ideas and terminologies could be like delving right into a deep sea with no security jacket and an oxygen cylinder. In case you are a crypto fanatic or dealer, you could have heard the time period ‘liquidity’. Within the cryptocurrency sphere, liquidity is essential

The time period liquidity refers to how simply a digital asset like cryptocurrency could be purchased or offered with out considerably affecting its value. This text will likely be solely concerning the idea of ‘liquidity’, and it discusses all of the essential issues it’s essential learn about.

What’s liquidity in crypto?

The power to effectively purchase and promote a selected asset is all the time essential in any sort of funding. Liquidity within the crypto market is the convenience with which a digital asset, together with cryptocurrency or a token, could be purchased or offered with out making a big distinction in its value or affecting its value. Liquidity, in easier phrases, is how shortly you’ll be able to convert a crypto asset into fiat cash or one other crypto asset.

In a extremely liquid crypto market, the commerce will likely be simpler, and however, in a market with low liquidity, traders will discover problem find the potential consumers and sellers on the value they need. In easy phrases, excessive liquidity means there will likely be a big quantity of energetic merchants and a secure value, whereas low liquidity includes fewer market contributors and an unstable value. Distinguished cryptocurrencies like Bitcoin and Ethereum are examples of extremely liquid belongings, and newer or much less common next-gen altcoins are examples of cryptocurrencies with low liquidity.

The foremost traits of excessive liquidity cryptocurrencies are straightforward conversion, lowered slippage, secure costs, and excessive buying and selling quantity. Issue exiting, fixed value volatility, and important slippage are among the traits of low liquidity cryptocurrencies.

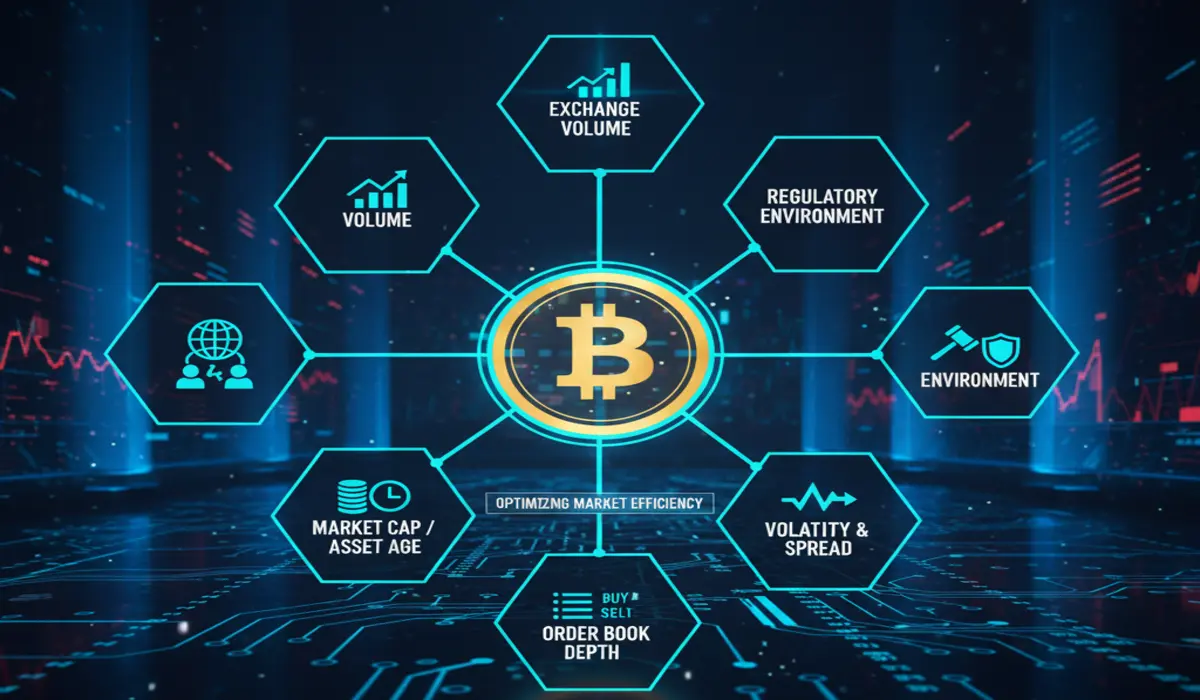

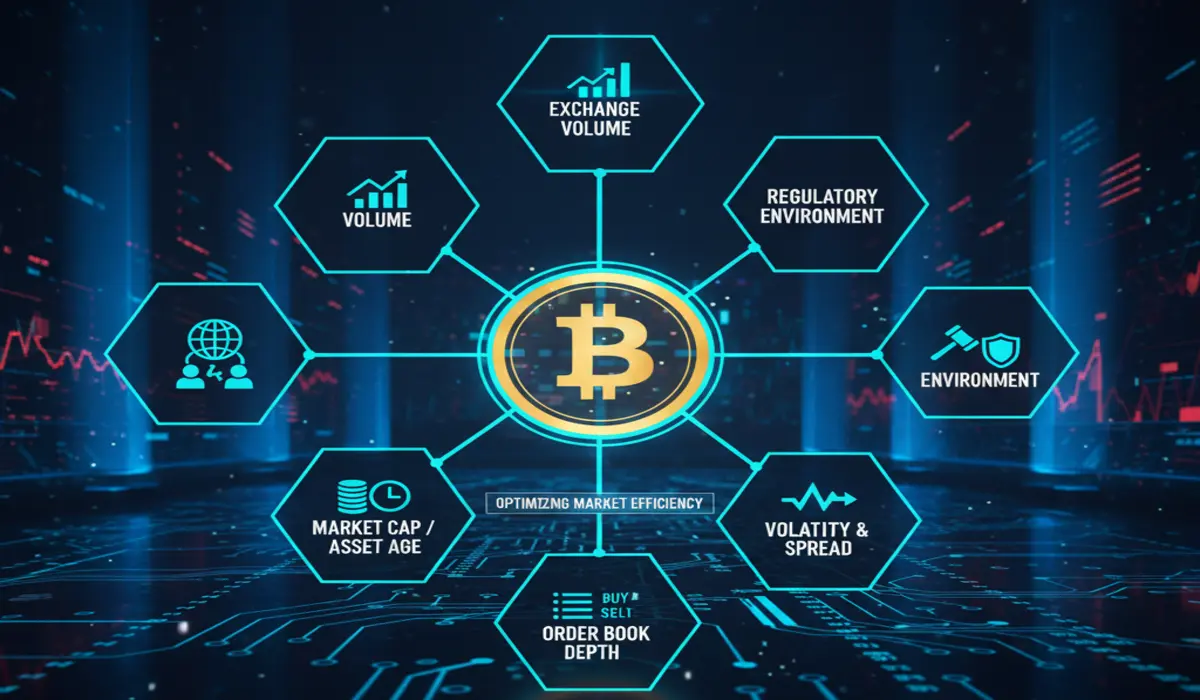

What are the Elements Influencing Crypto Liquidity?

Crypto liquidity is an idea that’s influenced by numerous different elements, like buying and selling quantity, market sentiment, alternate exercise, the regulatory atmosphere, macroeconomic circumstances, and the technological improvement and broader adoption of the crypto mission.

Buying and selling quantity has an enormous affect on crypto liquidity. Greater buying and selling quantity signifies extra consumers and sellers, in the end resulting in larger ease of transaction. Market sentiment is one other issue that has a strong affect on crypto liquidity. Constructive market sentiment typically will increase liquidity by attracting extra customers, whereas damaging sentiment can result in low liquidity because it drives individuals away from the crypto mission.

The regulatory atmosphere of a selected crypto mission influences the crypto liquidity by fueling traders’ confidence, market stability, accessibility and institutional participation. Macroeconomic elements or circumstances affect crypto liquidity by affecting the general market danger urge for food and international capital flows, and on the similar time, technological developments of the crypto mission drive crypto liquidity by enhancing its market effectivity, accessibility and safety.

How you can Test the Liquidity of a Crypto

Calculating the liquidity of a crypto mission is a crucial course of when you’re within the crypto enviornment. To examine the liquidity of a selected crypto, you’ll be able to depend on numerous strategies. Listed below are some methods you could undertake.

- Analyse Buying and selling Quantity: To examine the liquidity of a crypto, you need to use its 24-hour buying and selling quantity on dependable platforms like CoinMarketCap or CoinGecko. Excessive buying and selling quantity on these platforms signifies excessive liquidity. Bitcoin’s each day buying and selling quantity is round $20 billion, which signifies excessive liquidity.

- Bid-Ask Unfold: Checking the distinction between the best purchase order (bid) and the bottom promote order (ask) on a crypto alternate’s order e book will enable you analyse the liquidity of a selected crypto. Bid-Ask spreads of lower than 0.1 are typically thought-about excessive for outstanding cryptocurrencies.

- Alternate Listings: You’ll be able to examine if the cryptocurrency is listed on a number of respected greatest crypto exchanges. Crypto cash obtainable on extra platforms typically have larger accessibility and liquidity.

- Analyse Market Capitalisation : Cryptocurrencies with larger market capitalisation (Market Cap) typically appeal to extra merchants and liquidity suppliers, and this may result in higher liquidity. So, to establish the liquidity of a crypto utilizing market capitalisation, examine that the coin has a excessive market cap.

What does 100% Liquidity Imply in Crypto?

100% liquidity is a theoretical or hypothetical idea, which is virtually unimaginable in any market, together with crypto. It’s not a real-world market state as a result of there won’t be any state of affairs the place merchants can convert their belongings to money or one other type of belongings with none value change. Cryptocurrency is a particularly risky asset that continuously undergoes modifications, so any sort of best switch that resembles 100% liquidity will not be doable on this specific area.

It’ll all the time keep as a theoretical idea, as a result of all markets have some friction each time. No asset, whether or not a conventional inventory or crypto, operates with 100% liquidity, as a result of in any commerce, there will likely be a marginal provide or demand change.

Liquidity vs Market Cap in Crypto

Liquidity and market cap are two intently associated however totally different ideas within the crypto area. These two market parts are essential and play a serious function in the best way we perceive and execute crypto trades. The foremost distinction between these two ideas is that market cap focuses on the worth of a selected token, whereas liquidity focuses on the convenience of buying and selling it.

Market cap is the whole worth of all circulating cash or tokens. This worth is calculated by multiplying the present value of 1 token by the whole variety of cash in circulation.

Market Cap = Present Worth Per Coin × Circulating Provide of Cash

Liquidity in crypto is the convenience of a digital asset transaction (Promoting or shopping for) with out considerably affecting its value.

Listed below are the important thing variations between liquidity and market cap.

| Market Cap | Liquidity |

| Focuses on the token’s worth | Focuses on the convenience of buying and selling it |

| It’s calculated primarily based on the share value and token circulation. | Liquidity is measured by elements like buying and selling quantity and the bid-ask unfold. |

| It’s used to match the general measurement of two totally different crypto tasks | It’s used to evaluate the chance of buying and selling an asset and the potential for big value actions from trades. |

The Backside Line

To grasp a selected space, it’s essential comprehensively perceive all the idea in that area. Liquidity in crypto is one thing that each one crypto merchants and lovers ought to pay attention to. Liquidity is an element when you’re initiating a selected transaction utilizing crypto. The outstanding belongings like Bitcoin and Ethereum could have larger liquidity, whereas new tasks and fewer well-known tasks have comparatively decrease liquidity, so all the time select crypto with larger liquidity when you’re into it. This text lined all of the essential information associated to liquidity in crypto. perceive the market parts earlier than diving deeply into it.

Disclaimer: The data supplied right here is for informational and academic functions solely and shouldn’t be thought-about monetary, funding, authorized, or tax recommendation. We’re not monetary advisors, and you need to seek the advice of a certified monetary skilled earlier than making any funding choices