Presently buying and selling at $2.90, XRP skilled a notable dip of three.32%, extending its shedding streak as traders continued to lock in earnings from its preliminary surge from final week. Whatever the preliminary value withdrawal and BTC’s affect, the token is anticipated to expertise a rebound, as tailwinds are gathering for XRP.

XRP’s mainstream demand was brought on by the approval of Cboe, Nasdaq, and NYSE’s Generic Itemizing Requirements (GLS) for commodity-based belief shares, permitting customers to listing crypto-spot ETFs below the GLS framework with out the necessity for a SEC evaluate. Nate Gearci, the NovaDius Wealth Administration president, shared a chart from the Chief Funding Officer at Bitwise Asset Administration, displaying the dramatic improve in ETF issuances after the ETF rule was handed by the SEC in 2019.

In response to the Bitwise CIO, approval of the GLS for crypto ETFs might be the important thing to ETF market growth. Nate Geraci said that the crypto ETF floodgates might open quickly, anticipating an avalanche of latest filings and launches. He additionally added that cryptocurrency is anticipated to go mainstream via the ETF wrapper, with ETFs serving because the bridge between TradFi and DeFi.

Why XRP’s Value is Down At this time?

In response to latest studies, XRP skilled a fall of three.32% within the final 24 hours. Allow us to see why XRP skilled this value dip:

- Technical Breakdown: As per studies, XRP fell beneath its 30-day SMA ($2.95) and its important psychological assist of $3.00, inflicting stop-loss orders. Experiencing a lower from its July 2025 excessive of $3.66, the value is now hovering close to the Fibonacci retracement stage ($2.90).

- Regulatory Delays: Choices on the seven-spot XRP ETF software have been delayed by the SEC to October 18-November 14, 2025. The costs have been initially pushed by the latest launch of leveraged ETFs, reminiscent of ProShares Extremely XRP, however did not maintain the momentum.

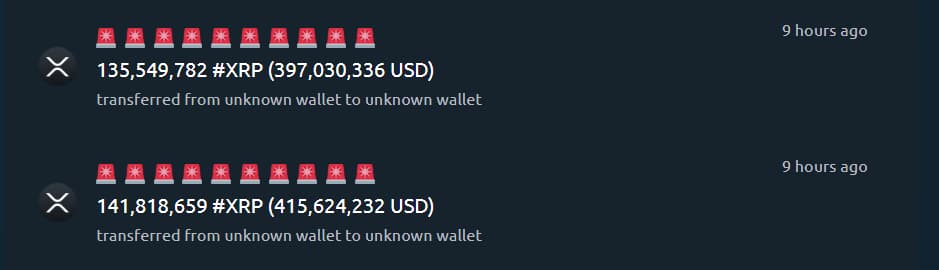

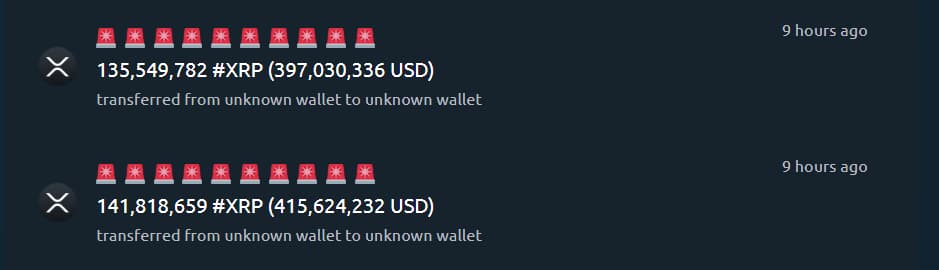

- Whale Exercise and Market Sentiment: As per Whale Alert information, in September 2025, massive holders moved 236 million XRP (approx. $679 million). Nonetheless, XRP famous institutional curiosity, because the REX-Osprey XRP ETF noticed $37 million inflows on September 18, 2025.

Current Value Motion and Technical Evaluation

XRP skilled a value lower on September 21, 2025, reaching $2.97. Though XRP is continuous its shedding streak, the preliminary value dip meant it outperformed the crypto market and hovered close to the important thing resistance stage of $3. In response to studies, these are the next technical ranges:

- Assist: $2.8 and $2.5

- Resistance: $3, $3.3, and $3.6.

The important thing value catalysts that might drive the value motion are:

- ETF move traits

- Spot ETFs: Approval or delay of XRP-spot ETFs and BlackRock’s plans for an iShares XRP Belief submitting.

- XRP getting built-in as a treasury reserve asset by Blue-chip corporations.

- Regulatory milestones: The worth for XRP might be additional influenced by elements reminiscent of Ripple’s US-chartered financial institution license software, the Market Construction Invoice, and SWIFT information.

Catalysts and Eventualities

XRP testing the decrease assist or breaking the upper resistance will probably be decided by institutional adoption, regulatory progress, and the steadiness of inflows.

Now, allow us to take a look at the elements that may trigger a bearish market state of affairs for XRP:

- BlackRock downplays planning an iShares XRP Belief submitting, and the BITW, XRPR, and GDLC report weak demand.

- SEC, declining XRP-spot ETF software.

- Setbacks to the crypto-friendly laws

- Blue-chip corporations determine to not combine XRP as a treasury reserve asset.

- OCC, delaying or rejecting Ripple’s US chartered financial institution license.

- SWIFT, capping Ripple’s market entry by sustaining international dominance.

If the XRP experiences a bearish market pattern, the costs are anticipated to spiral right down to $2.8, opening the brand new key assist stage at $2.5.

Now, allow us to take a look at the elements that might trigger a Bullish pattern for XRP:

- Studies of robust inflows by BITW, GDLC, and XRPR

- BlackRock decides to file an iShares XRP Belief, and the approval of the XRP-spot ETF by the SEC.

- Adoption of XRP as a treasury reserve asset by Blue-chip corporations.

- The Senate passes the Market Construction Invoice, and Ripple secures the US-chartered financial institution license.

- SWIFT loses its market dominance to Ripple.

Ultimate Ideas

Though XRP is experiencing a slight value dip, spot ETF approvals and the passing of the Market Construction Invoice might considerably improve its worth within the coming days. Nonetheless, if the market pattern turns bearish, the value might attain $2.8, exposing the brand new key assist stage of $2.5.

Earlier than your funding, maintain a detailed watch on the regulatory and financial dangers that might affect XRP’s trajectory within the coming weeks. It’s essential to do the required diligence earlier than you spend money on XRP to keep away from monetary harm.