Sir Tim Berners-Lee, laptop scientist, inventor of the net and an all-round good man, wrote some phrases in “The Night Normal” earlier this week, arguing that polarization, conspiracy and psychological well being crises on-line stem from design flaws that should be corrected — even when that requires regulation.

The piece attracts instantly from chapter 13, “Design Points,” of his lately launched guide “This Is for Everybody: The Unfinished Story of the World Large Internet,” which I encourage everybody to learn.

I agree with Berners-Lee’s analysis. However regulation will not be the treatment. The online’s decline will not be merely a design failure; it’s also an financial one. Design selections observe incentives, and people incentives have been distorted by fiat cash and the promoting mannequin it props up. Low cost credit score from the fiat-fuelled enterprise capital system pushed Silicon Valley away from hacker-led engineering and towards surveillance-driven revenue extraction.

To repair the net, we’d like open supply protocols and open supply cash.

The web could be fastened with out regulation. However we can not engineer an answer whereas ignoring the financial headwinds that form design. The financial system — quarterly shareholder primacy and fiat inflation — pressures corporations to prioritize engagement, outrage and surveillance promoting. Bitcoin adjustments this equation. It removes inflationary strain, probably breaks the advert mannequin by enabling new types of monetization that align with consumer pursuits slightly than exploit them. Mixed with open protocols, Bitcoin is the enabler of a freer, extra moral net.

What Went Incorrect With World Large Internet

Berners-Lee highlights two major signs: polarization and psychological well being injury. He’s proper.

1. Polarization and Collapse of Shared Actuality

Berners-Lee says:

“Probably the most egregious symptom is polarisation. Social media, as at present constructed, leads customers to take excessive political positions and demonise the opposing facet. This makes constructive engagement tough, permits outlandish conspiracy theories to flourish, and promotes demagoguery over deliberation.”

Polarization is actual. However amplification cuts each methods. The identical algorithms that floor conspiracy theories additionally amplify truths that the mainstream media suppresses. In an age of censorship and propaganda, this amplification has typically been the one approach reality surfaces.

The deeper subject is that folks not share the identical actuality. A breaking story fractures into irreconcilable narratives relying on whether or not it spreads through Twitter, TikTok, Bluesky or Reddit; whether or not filtered by way of left-leaning fact-checkers or right-leaning commentators; whether or not summarized by Grok or ChatGPT. Every tribe outsources “reality formation” to its personal authorities, who’re incentivized to ship emotionally handy information. LLMs also can generate artificial personalities to disrupt discourse at scale. Regulation is not going to restore belief right here — as a result of the issue is not only what flows, however how belief is established within the first place.

That mentioned, algorithms are optimized for outrage as a result of outrage is worthwhile. Regulation is not going to change this, because it’s as a lot an financial downside as it’s a technical one.

As Neal Howe and William Strauss describe in “The Fourth Turning,” we’re in a disaster period: Consensus frays, energy realigns and outdated preparations give approach. In follow, which means extra friction on-line — tribal feeds, narrative knife fights and rising coordination prices. In different phrases, we should always count on to see a few of the carnage we’re seeing right now, and we are able to do one thing about it.

2. Psychological Well being and Addictive Algorithms

Berners-Lee says:

“Many social media customers report struggling psychological well being points after extended utilization. {The catalogue} of ills associated to social media is alarming: nervousness, melancholy, jealousy, inadequacy, emotions of isolation, physique picture points.”

I agree, social media is liberating and harmful in equal measure. Search queries for nervousness rise in parallel with utilization, and {the catalogue} of harms is lengthy: melancholy, inadequacy, physique picture points, isolation. That is definitely one thing that wants fixing.

Berners-Lee says:

“Social media corporations are utilizing machine-learning methods to make customers hooked on their platforms. These techniques are designed to be addictive, feeding individuals an increasing number of excessive content material, making them alternately indignant and unhappy.”

This isn’t unintended. Twenty-plus years in the past, Silicon Valley execs and engineers have been taught how one can design addictive techniques at BJ Fogg’s Persuasive Know-how Lab at Stanford (his guide, for anybody , is known as “Persuasive Know-how”), with some even attending retreats at his house the place these concepts have been explored additional. The *Like* button, infinite scroll and pink notification badges all got here from his teachings and have been engineered to hijack dopamine pathways.

Jack Dorsey, talking on the Oslo Freedom Discussion board in 2024, spoke concerning the injury attributable to the algorithms designed by these corporations:

“The actual debate must be about free will. We’re being programmed primarily based on what we are saying we’re curious about, and we’re instructed by way of these discovery mechanisms what’s fascinating — and as we have interaction and work together with this content material, the algorithm continues to construct an increasing number of of this bias.”

Dorsey has beforehand spoken about how Twitter started as a protocol imaginative and prescient earlier than enterprise capital steered it towards development, management and advert monetization. Having seen the corruption of that imaginative and prescient, it’s no coincidence that Dorsey now backs open supply protocols like Nostr, Bitchat and beforehand Bluesky. His investments are a affirmation that platforms can’t be reformed from inside. Solely protocols, open by design, can defend free will from algorithmic seize.

Berners-Lee has steered that algorithms might be rebuilt to maximise pleasure slightly than outrage. It’s a noble imaginative and prescient, one I want have been life like — however underneath present incentives, it isn’t. Analysis exhibits that high-arousal feelings, particularly anger, unfold sooner than calm or constructive feelings.

Makes an attempt to pivot have confirmed pricey earlier than. As an illustration, when Fb adjusted its Information Feed in 2018 to scale back dangerous content material, customers spent 50 million fewer hours per day on the location and publishers noticed visitors collapse. Newer audits verify the identical sample: Platforms that downrank divisive content material see measurable drops in engagement and income. (You’ll find associated research right here, right here, right here and right here.)

So long as corporations are sure by their fiduciary obligation to maximise shareholder worth, regulators can not drive them to intentionally make much less cash as long as outrage stays extra worthwhile than pleasure.

Regulation of the Web

Berners-Lee has lengthy been one of many net’s strongest defenders. He fought for internet neutrality, encryption and decentralization. He warned of surveillance lengthy earlier than it was modern. He has stood on the facet of open participation and consumer empowerment.

So it comes as considerably of a shock when Berners-Lee concedes that regulation is perhaps essential. He even quotes bad-faith actor Yuval Noah Harari to help this case:

“If a social media algorithm recommends to individuals a hate-filled conspiracy concept, that is the fault not of the one that produced the conspiracy concept, it’s the fault of the individuals who designed and let free the algorithm.”

Whereas I begrudgingly agree with Harari on this occasion, let’s not lose sight of who we’re coping with. He’s a World Financial Discussion board favourite, a constant advocate of technocratic options and somebody who has described bitcoin as a foreign money of mistrust. His worldview defaults to centralization, surveillance and state energy. His arguments are wearing motive however advance much less autonomy and extra management.

Berners-Lee admits: “Whereas I usually oppose the regulation of the net, on this occasion I agree.” I’m sorry, however regulation is a slippery slope that we should always do our utmost to keep away from.

It’s as a result of Berners-Lee has been such a defender of the web that his concession to regulation feels somewhat defeatist. Has the relentless rise of algorithmic seize, misinformation and addictive design worn him down? Maybe. However regulation will not be the reply.

One other phrase on regulation… When governments regulate, they entrench incumbents and weaponize “security” to justify censorship. They’re additionally hopelessly incompetent — the EU’s cookie legislation is an ideal instance: It protected no one, achieved nothing and left customers coping with annoying pop-ups.

True democracy on-line must be crowdsourced and constructed with open protocols — guidelines with out rulers.

The Financial Headwind of a Free and Flourishing Web

Now let’s get to the crux of the matter. The largest subject is fiat cash. Its full implementation in 1971 marked a fork within the highway: productiveness saved climbing, however wages stagnated in actual phrases. WTF Occurred in 1971? exhibits the divergence clearly — inequality, debt, housing prices and social decay all accelerating after Nixon severed the ultimate tie to gold.

Earlier than 1971, costs and wages remained comparatively steady. For hundreds of years, underneath laborious cash, there was equilibrium. Through the short-lived classical gold normal, the Belle Époque delivered a golden age of invention and relative prosperity. Costs stayed steady, and by most accounts, life flourished. That stability vanished as soon as fiat cash grew to become the norm.

Since then, and at an accelerating tempo, individuals have needed to work tougher for much less. Corporations have been compelled to extract extra productiveness whereas turning into much less moral. Keep in mind Google’s “Don’t be evil” motto? That is possible the malevolent drive that induced Sergey, Larry and Eric to lose their innocence.

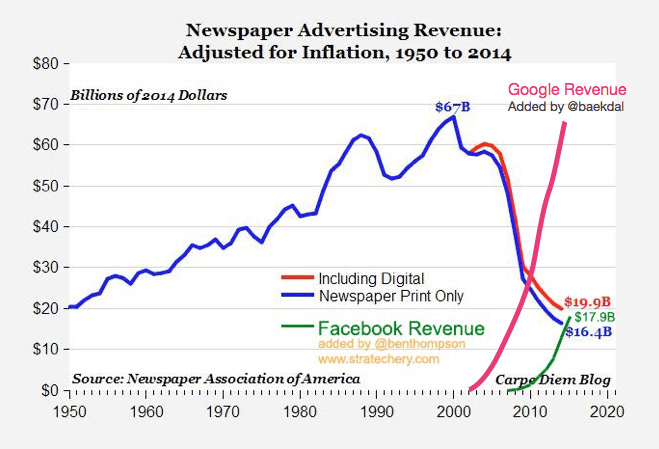

Talking of Google, its advert mannequin killed conventional media’s enterprise mannequin, leaving it depending on state subsidies and company sponsorships. Governments now use media as PR machines, which is a big a part of the polarization downside we’re witnessing on-line.

The enterprise capital mannequin, fuelled by low-cost fiat credit score, warped Silicon Valley incentives from hacker-led engineering to surveillance-led revenue extraction. Centralization and monopolization are hallmarks of simple credit score and the Cantillon impact.

Jeff Sales space estimates expertise applies a pure deflationary drive of ~5% per 12 months, whereas Saifedean Ammous argues that actual inflation — not CPI, however financial growth — runs nearer to 15-16%. Governments offset deflation with cash printing; corporations reply by extracting extra from customers in an ever-increasing race to the underside.

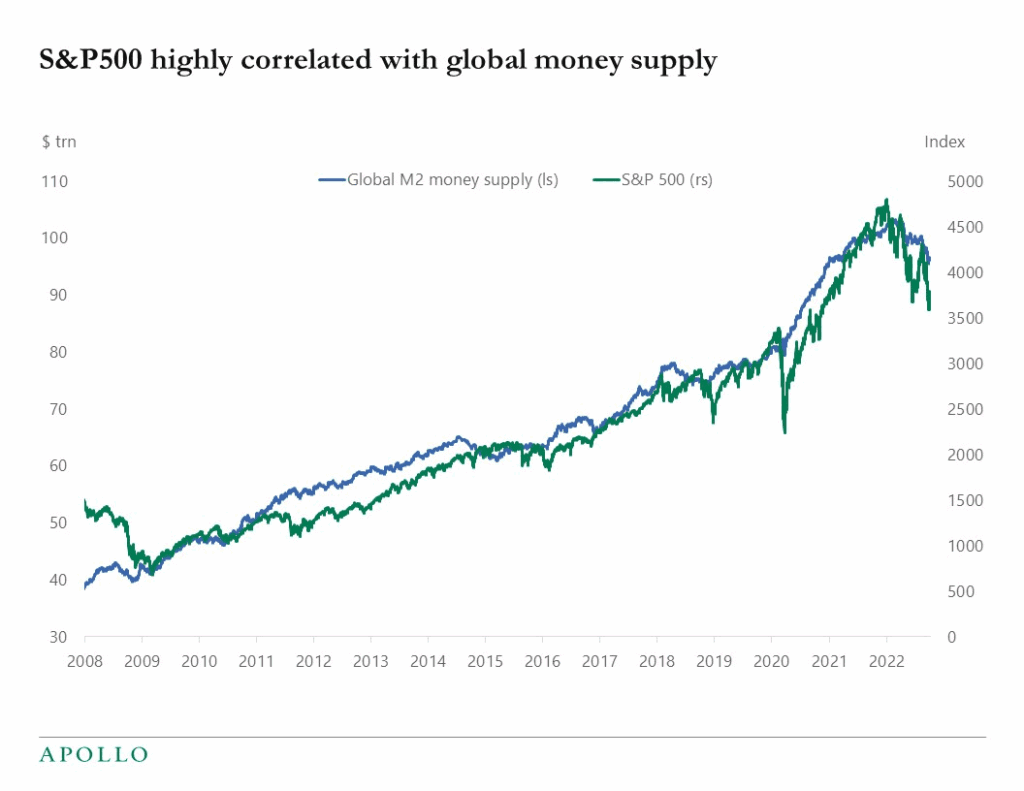

The end result is seen in fairness markets: the Mediocre 493 companies listed on the S&P 500 are structurally failing, and the S&P, powered by the Magnificent 7, principally mirrors the cash provide.

And layered on high of fiat, fiduciary obligation and quarterly reporting locked corporations right into a head-on battle with inflation. Fiduciary obligation, codified in Nineteenth-century U.S. legislation, merely required administrators to behave in shareholders’ finest pursuits. However the SEC’s 1970 mandate for quarterly 10-Q reporting — mixed with Milton Friedman’s 1970 essay within the New York Instances proclaiming that the only real duty of enterprise is to extend earnings — hardened the tradition of “quarterly capitalism.”

| 12 months | Occasion | Impression on Company Governance / Incentives |

| Nineteenth century | Fiduciary duties codified in U.S. company legislation. | CEOs and administrators should act in one of the best pursuits of shareholders. |

| 1934 | U.S. Securities Change Act | Gave SEC authority to require periodic reporting from public corporations. |

| 1970 | SEC mandates quarterly 10-Q reporting | Begins the tradition of Wall Road earnings seasons, with common short-term efficiency checks. |

| 1970 | Milton Friedman publishes “The Social Duty of Enterprise is to Improve Its Earnings” (NYT). | Popularizes shareholder primacy as company goal. |

| 1971 | Nixon suspends gold convertibility — fiat period begins. | Rising inflation means corporations should beat not simply development expectations, however inflationary strain too. |

| Eighties | Wall Road’s leveraged buyouts + stock-based CEO pay. | Locks in short-term earnings focus: Lacking 1 / 4 turns into harmful for CEOs. |

| 2000s–current | “Quarterly capitalism” dominates. | CEOs are pressured by markets, and shareholders to hit quarterly EPS targets. |

This convergence — fiat cash, shareholder primacy, quarterly reporting and venture-funded adtech — created the right storm. Corporations are structurally incentivized to gasoline outrage, dependancy, and mine consumer knowledge. Regulation can not change this as long as the underlying cash system is damaged. Till we modify course and return to sound cash, design fixes will at all times fail underneath financial strain.

Tim Berners-Lee, Bitcoin is the Panacea!

Bitcoin is each a treatment for damaged cash and a basis for brand spanking new enterprise fashions on-line. It’s not an app or an organization — it’s a financial base layer that resets incentives on the root.

I don’t know the place Berners-Lee stands on Bitcoin particularly. Publicly, he’s dismissed crypto as a speculative on line casino. On that, I agree. Bitcoin is completely different: no insiders, no enterprise fund, no basis, no mutable guidelines. If he sees that distinction, good; if not but, possibly quickly.

Fixing cash

Bitcoin combines one of the best properties of gold — sturdiness, shortage, uniformity, unforgeable costliness — with one of the best properties of fiat — divisibility, portability. The result’s unequivocally one of the best cash ever designed: It’s additionally borderless, censorship-resistant, decentralized, overtly programmable, sure by thermodynamics and internet-native.

In distinction to Bitcoin, it’s turning into clearer with every passing 12 months that the fiat system is crumbling beneath our toes, as bitcoin monetizes in its shadow. Bitcoin provides a technique to diffuse the worldwide debt bubble slightly than let it implode, correcting the course of financial historical past by inserting international a refund on a sound footing.

The implications are monumental, if/when bitcoin turns into fiat’s successor. For the primary time in dwelling reminiscence, society would not should swim towards the tide simply to remain nonetheless. With sound cash, the pure deflationary advantages of technological progress can accrue to all, not be siphoned away by these closest to the spigot.

Jeff Sales space, in “The Worth of Tomorrow,” makes the purpose that expertise is inherently deflationary, i.e., it delivers extra for much less. However underneath fiat cash, this deflation is papered over with inflation, debt and development targets. Bitcoin harmonizes cash with expertise. Its fastened provide means the beneficial properties of technological deflation accrue to everybody, slightly than being siphoned away.

Fixing incentives on-line

“For those who contemplate the web to be the equal to a nation state, it should have a foreign money native to itself, and there’s not going to be anyone get together or establishment that makes this occur, and there’s not going to be anyone get together or establishment that may cease it from taking place.” – (Jack Dorsey, Quartz)

Now that we have now an web native foreign money, the query is… what can it allow?

Properly, to start with, bitcoin can reshape incentives on-line. It could do that by enabling micropayments, streaming sats and peer-to-peer monetization, that means customers can help creators instantly. Platforms can earn cash with out promoting their customers’ knowledge to advertisers. This might reduce the impact and even eliminate an ad-driven, knowledge mining mannequin that forces platforms to optimize for outrage.

It’s going to additionally upend the enterprise capital mannequin, as presently those that are closest to the cash spigot profit in larger proportion. As Bitcoin has no central financial institution to create more cash, everybody has a comparatively equal footing, and thus funding ought to change into extra decentralized, as soon as once more.

From there, completely new dynamics can emerge. Protocols and functions received’t be beholden to growth-at-all-costs fashions dictated by enterprise funds; they will scale organically, funded by the very customers who depend on them. Worth turns into the metric, not quarterly development or advert impressions. Builders can ship merchandise that clear up actual issues, and be rewarded instantly in sats. Communities can pool capital with out intermediaries, seeding initiatives from the underside up slightly than ready for approval from the highest down.

On this atmosphere, the web can lastly align with its unique ethos — open, interoperable and user-driven — as a result of the financial layer itself is open, interoperable and user-driven. Bitcoin clears the bottom for that alignment.

Bitcoin will not be restricted to fixing the net — it’s upstream of it. With out sound cash, design fixes will at all times be bent again towards exploitation. With sound cash, platforms can undertake fashions which can be moral by default. With internet-native cash, creators could be paid instantly. Bitcoin is the fulcrum the place damaged incentives give technique to more healthy techniques — on-line and off.

“The web, our best instrument of emancipation, has been reworked into probably the most harmful facilitator of totalitarianism we have now ever seen.” – Julian Assange

Fixing this doesn’t require authorities regulation. It requires realigning incentives — with open protocols and Sound Cash.

Open Supply Options

Berners-Lee factors to open supply instruments like Polis, Mastodon and Fora as promising experiments in more healthy on-line discourse. Constructing on these efforts, a brand new wave of protocols combines the identical open ethos with a local web cash, aligning incentives in ways in which advertising-driven fashions by no means may.

With Bitcoin because the financial base, protocols can deal with the design layer. These techniques are stay, early and want broader adoption and a killer utility — however they already present how one can realign incentives with out regulation.

Mastodon demonstrates what’s doable with open supply federation and timelines constructed from individuals you select to observe, slightly than engagement-driven algorithms. And whereas its refusal to depend on promoting is a energy, the absence of a local funds system is a limitation.

Enter Nostr

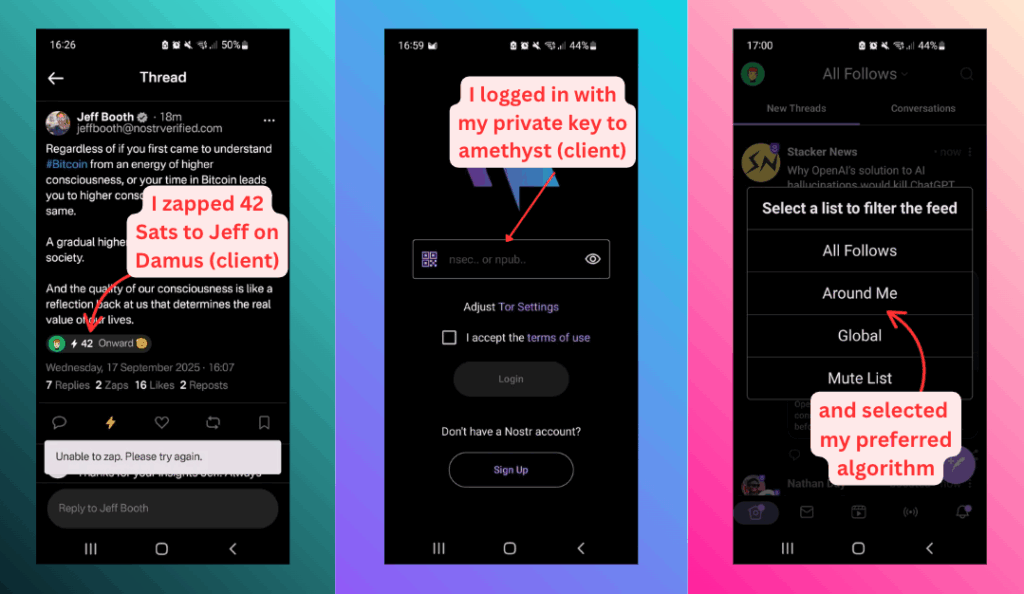

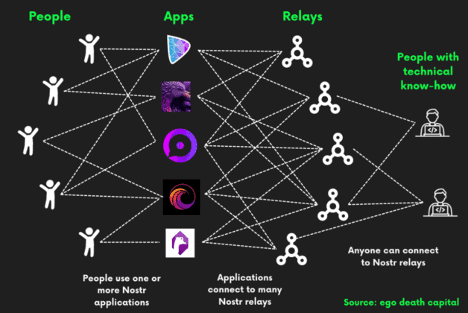

Launched in late 2019 by Fiatjaf, Nostr (“Notes and Different Stuff Transmitted by Relays”) is an easy protocol that decouples identification and content material from any single app. Keys establish customers; relays transmit signed occasions. A number of purchasers (Damus, Amethyst, Primal, Iris, Alby) learn and write to the identical social graph, delivering actual interoperability — the sort of cross-client, cross-app portability Berners-Lee requires.

Customers decide relays and form their very own feeds, placing algorithmic selection firmly of their palms. This echoes the concept Harvard professor Jonathan Zittrain proposed — and which Berners-Lee spotlights in his guide — for fine-tuned controls to steer content material away from conspiracy rabbit holes. In contrast to that platform-driven imaginative and prescient, Nostr empowers customers instantly, with its algorithmic flexibility restricted solely by the protocol’s younger age.

Whereas funds aren’t a part of the bottom design, Lightning “zaps” at the moment are frequent — native, on the spot tipping and funds tied to posts and profiles. That pairing — open communication plus open cash — permits bottom-up coordination and speedy iteration with out gatekeepers. Deletion is advisory (purchasers/relays could honor it), so there’s sensible permanence and accountability throughout the community.

Learn extra: Nostr: censorship-resistant communication

Protocols, Infused with Bitcoin

Chaumian Mints

Cashu by Calle brings Chaumian eCash to Bitcoin — personal, bearer-style tokens that may run alongside Nostr or standalone. It permits quick, personal micro-flows; Calle additionally co-founded BitChat with Jack Dorsey, taking these concepts right into a user-facing chat context.

Repute Methods

Neighborhood Notes proves cross-faction context can gradual misinformation. Add clear weighting, DIDs and Internet-of-Belief primitives and also you get a sturdy, moveable fame. Put sats as skin-in-the-game (bonds/slashing for dishonest alerts) and the mechanism strengthens with out central censors.

Spam Resistance

Spam isn’t new, and it isn’t purely on-line. Usenet has dealt with floods for many years as a decentralized, user-run community with no central regulator. Adam Again’s Hashcash confirmed the core precept: connect a small proof-of-work price and abuse drops. The identical economics apply now with bitcoin — sats-priced frictions through Lightning (or Ark Protocol) make bot farms and propaganda costly whereas holding sincere participation low-cost.

Spam is principally a numbers recreation: When it’s free, it scales; add price and also you restore the sign. Suppose refundable per-post/per-DM deposits, PoW stamps or charge limits priced in sats— good-faith interplay stays sustainable whereas mass manipulation turns into uneconomic.

In Conclusion

Sir Tim Berners-Lee is true concerning the signs. Our opinions differ concerning the treatment. Regulation can not reverse centralization engineered by states and firms; it merely entrenches governments into the issue it partly created.

The drift didn’t begin with dangerous UX. It began with damaged cash (and all the issues therein) and the top of sound cash (1971), along with shareholder-primacy dogma, bent incentives towards short-term nominal beneficial properties and surveillance promoting. From there, outrage paid the payments, whereas integrity fell by the way in which.

The treatment is Bitcoin returning the world to sound cash, which is able to allow open protocols to higher energy the net.

Screw the regulators.

Repair the cash, repair the world.