Uniswap Labs, the developer of Uniswap–a decentralized change, has launched a brand new safety characteristic referred to as Permit2. Taking to X on January 18, the DEX developer stated this replace addresses the “infinite token allowances” vulnerability that hackers can exploit. This flaw risked consumer funds, and the brand new characteristic is supposed to resolve this concern.

Uniswap Sealing Infinite Token Allowance Dangers

In crypto, particularly amongst decentralized finance (DeFi) protocols, the “token allowance” is permission initiated by the consumer granting good contracts entry to tokens. From there, property will be moved.

With this permission, it turns into attainable for customers to work together with dapps, mainly protocols that make the most of consumer funds. A few of these dapps embody, as an example, decentralized exchanges like Uniswap or lending platforms like Aave or Maker.

Whereas helpful, “token allowance” will be exploited by hackers by way of “infinite token allowance,” the place hackers can infinitely entry and illegally withdraw funds from wallets, draining them consequently. As soon as a pockets has been compromised, it may be drained with out the consumer’s data for the reason that compromised code already permits the hacker to maneuver funds.

Conscious of this danger, Uniswap Labs is introducing the open-source Permit2 as an answer. The device, the DEX developer says, will give customers extra safety and, extra importantly, management over digital property.

A key characteristic of Permit2 is that customers can set closing dates on token approvals. Third events can solely entry funds inside a selected interval on this association.

Moreover, the device introduces a reusable token approval for simplicity. With this characteristic, finish customers don’t must repeatedly grant entry to their funds for every transaction. On the gas-saving fronts, Uniswap Labs say Permit2 additionally makes use of signature-based approvals and transfers. This implies the device can scale back gasoline charges when customers switch tokens.

Uniswap Constructing, UNI Stays Underneath Strain

This enhancement precedes the upcoming launch of Uniswap v4, which introduces Hooks. This new characteristic supplies builders with extra flexibility and management over their functions.

Analysts say the launch of Uniswap v4 and Uniswap Labs’ steady enhancement to enhance safety may cement the DEX’s place.

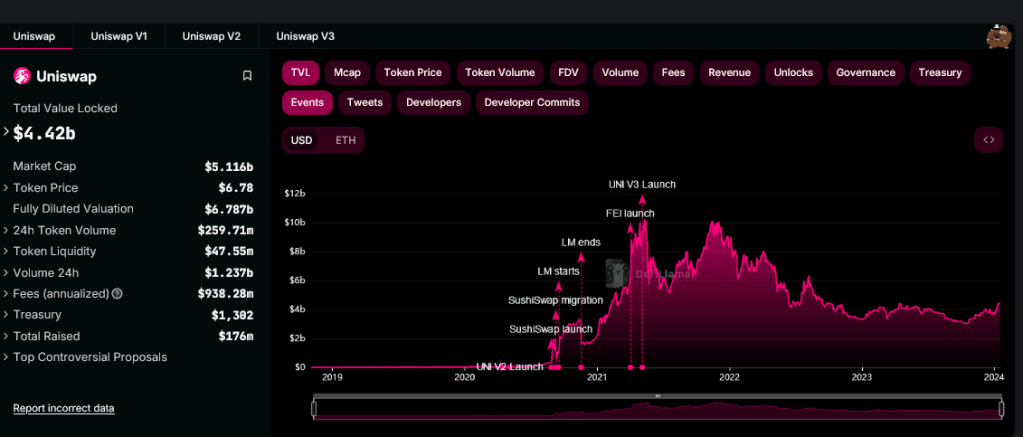

In accordance with DeFiLlama knowledge, Uniswap has managed over $4.4 billion value of property. Even so, UNI costs proceed to wrestle.

Wanting on the each day chart, UNI has resistance at round $8.1 and is at the moment down roughly 20% from December highs. Sharp losses under $6 may set off a sell-off, forcing the token in direction of $4.5 or decrease.

Function picture from Canva, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site fully at your personal danger.