After failing to hit a brand new all-time excessive (ATH) of $5,000 in August 2025, Ethereum (ETH) could lastly be able to breach the psychologically necessary worth degree. A decline in Binance open curiosity means that ETH is probably going near an area backside, prepared for its subsequent leg up.

Ethereum Open Curiosity Declines, Is Native Backside Shut?

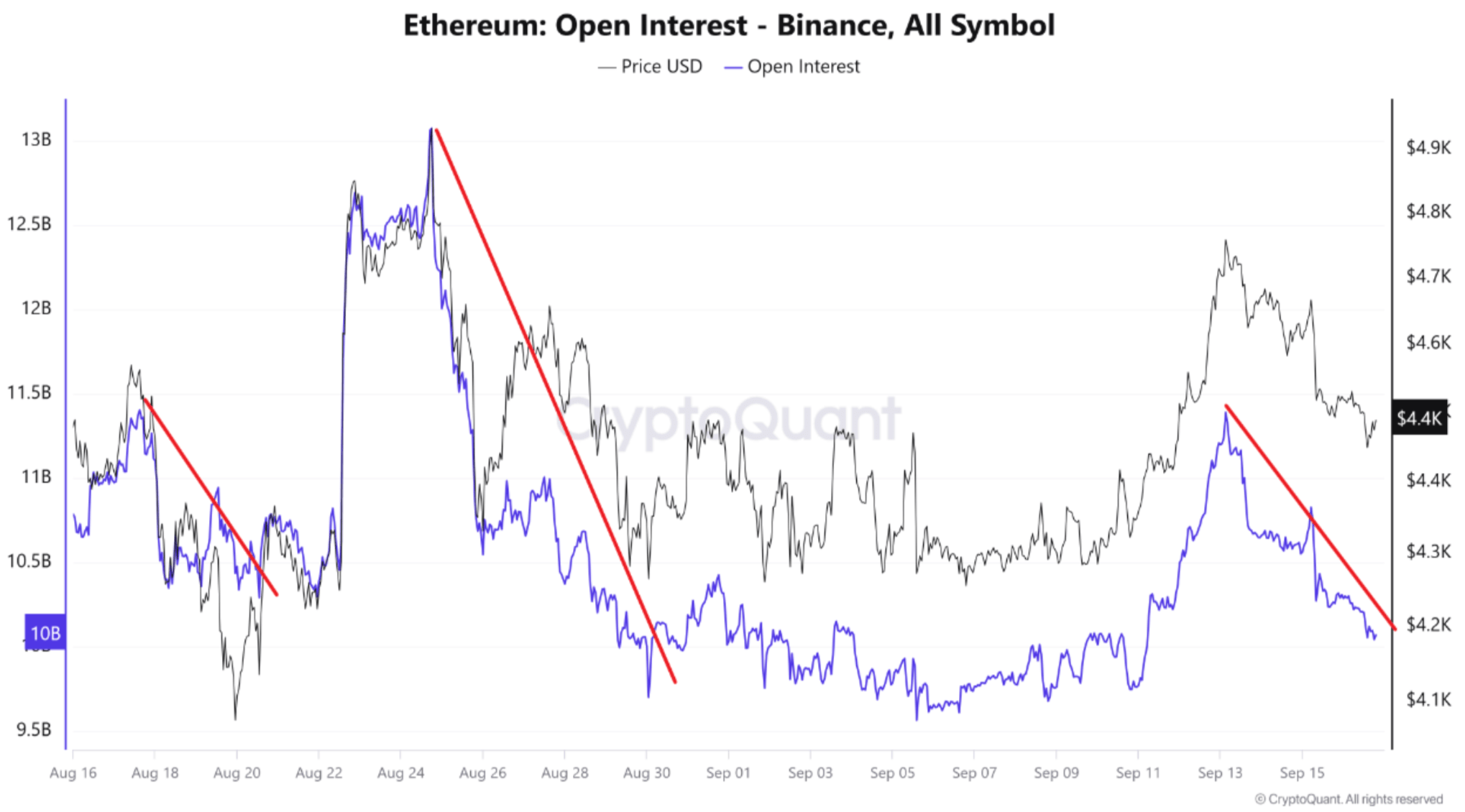

Based on a CryptoQuant Quicktake put up by contributor burakkesmeci, Ethereum could also be nearing an area backside. The analyst referred to the Binance ETH open curiosity (OI) hourly timeframe metric for his or her evaluation.

Associated Studying

Of their evaluation, burakkesmeci famous that in response to the Binance ETH OI metric, native bottoms have shaped with a median decline of 14.9% over the previous three months. On the spot market facet, these corrections have usually resulted in a median 10.7% decline.

The analyst stated that drops in ETH OI have often signaled spot worth corrections forward of time. For instance, on August 17, the Binance ETH OI decreased from $11.4 billion to $10.2 billion, representing a ten.52% drop.

Equally, on August 20, the Binance ETH OI tumbled from $13 billion to $9.7 billion, a correction of 25.38%. The newest main tumble in Binance ETH OI was noticed on September 13, when it crashed from $11.39 billion to $10.4 billion. The analyst concluded:

So, we are able to say this: when spot worth rallies are supported by the futures facet, the development progresses extra healthily – identical to a airplane flying with two wings. Within the reverse situation, OI alerts potential corrections. Binance ETH OI (measured on the highest-volume alternate, performing as a number one indicator) provides us an opportunity to catch native bottoms early.

The analyst added that based mostly on the latest traits, it may be speculated that the Binance ETH OI could dwindle to $9.69 billion. It additionally means that ETH is at the moment within the native backside zone. Nonetheless, the ETH worth could fall additional earlier than it finds its native backside.

Is ETH Eyeing $6,800?

In the meantime, fellow CryptoQuant analyst, PelinayPA, famous that Fund Market Premium (FMP) has remained principally impartial or optimistic between July and September 2025 – indicating renewed institutional demand. Over the identical interval, ETH has surged from $2,500 to $4,400.

Associated Studying

For the uninitiated, the FMP in Ethereum’s context measures the worth hole between futures contracts and the spot market. At present, with optimistic premiums dominating, the market is exhibiting sturdy institutional help for ETH. PelinayPA added:

This setting may assist Ethereum preserve stability above $4.4K and doubtlessly maintain additional upside momentum. Main goal $6,8K.

As well as, ETH alternate reserves proceed to deplete at a fast tempo. Latest evaluation by one other CryptoQuant contributor named Arab Chain forecasted ETH to the touch $5,500 in September.

That stated, the present pause in ETH’s rally stays a degree of concern. At press time, ETH trades at $4,491, up 0.8% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com